PayoneerLearn More |

PaypalLearn More |

|---|---|

| $ Pricing | Upto 2.5% Transfer Fees | 2.7%-2.9% plus 30 cents per transaction |

| Best for |

Payoneer has risen nicely in the past years with substantial funding from Carmel Ventures, PingAn, Nyca Partners, Greylock, Crossbar Capital and other |

It is the first and the payment processor I have been associated with since I started digital marketing. |

| Features |

|

|

| Pros | |

|

|

| Cons | |

|

|

| Ease of Use | |

|

Payoneer is much smoother and faster easy to use |

It helps to easily manage and move your cash via PayPal |

| Customer Support | |

|

Payoneer is the winner for real-life support and stellar customer service |

Multilingual customer support is available 24/7 through phone, chat, or email. |

Note: Clear computer system cache/cookies before creating an account; otherwise you may be redirected to the Payoneer credit card signup page, which is NOT available in India.

realize the added advantages of relatively newer platforms like Payoneer.

In the current economic times, cross-border transactions have evolved from being large B2B or government transactions to millions of small transactions occurring every day between individuals and firms.

The internet has converted the world into a global marketplace where people from one part of the globe can indulge in the products and services of another part. This has spawned the era of secure online transactions that are not limited by national boundaries.

When it comes to online payments the most used services are those of global payment processors. These firms take responsibility for allowing you to give and receive payments from abroad. They provide a secure framework for the same and also charge a certain fee based on the transaction sizes and volumes.

Payoneer vs Paypal: Detailed Comparison

The first obvious name which comes to mind is PayPal. It is the first and the payment processor I have been associated with since I started digital marketing. Founded in 2005 by innovators including Elon Musk, it has grown into the most popular channel for global payment processes.

The other name which comes to mind because of its recent big launch in India and my direct involvement with it as a marketer is Payoneer.

Founded in 2005 by Yuval Tal, Payoneer has risen nicely in the past years with substantial funding from Carmel Ventures, PingAn, Nyca Partners, Greylock, Crossbar Capital, and others.

It has become a popular PayPal alternative for many and is currently operational in 200 countries with over 100 currencies. It had earlier started its services in India but was discontinued by the RBI according to some guidelines.

Well, now it has launched its services with some hand-crafted features ideally suitable for Indian freelancers and online business owners.

But how should one decide to go for Payoneer or PayPal?

What are the pros and cons when it comes to these Payment Processes?

Well, here I will showcase an Infographic which features a showdown of Payoneer vs. PayPal:

Sign Up For Payoneer To Get 25$

Note: Clear computer system cache/cookies before creating an account; otherwise you may be redirected to the Payoneer credit card signup page, which is NOT available in India.

Now let’s look into the details:

1. Payoneer is definitely more profitable than PayPal

The costliest average charges per transaction are $14.88 while the cheapest is $1.55. This shows that the variance is inclined to the costlier side i.e. loss of valuable money is almost inevitable.

With Payoneer, you save an average of $5 per transaction of $100 which is INR300. With PayPal this is not the case as Payoneer offers:

- Higher Conversion Rates

- Higher Exchange Rates

PayPal charges a straight fee of $5 per $100 and then there are the added transaction charges which result in heavy money-erosion.

With Payoneer, the entire cost before the money is in your account is almost $3. Huge Savings!

2. Payoneer is smoother than PayPal when it comes to global pay-outs and withdrawals

With a PayPal account, you have to manually initiate a withdrawal process every time you need cash in your bank account. The entire process is lengthy too!

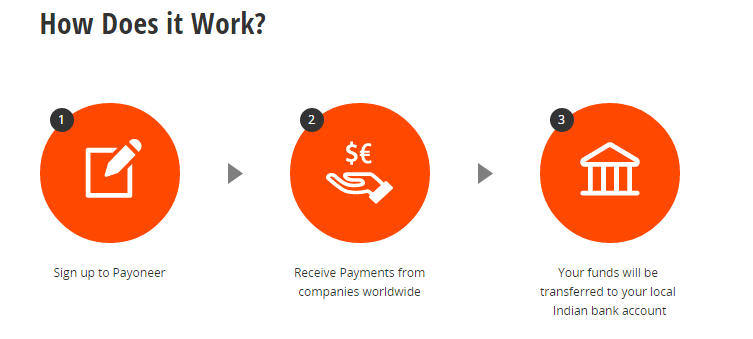

Payoneer eliminates such hassles by automatically converting funds into Rupees and then transferring them to your bank account.

The daily withdrawal limit is also higher with Payoneer at INR 500,000 which is approximately $9500. I guess that is good enough for any Indian freelancer or marketer!

Every time an automated withdrawal happens you will receive an email alert of the transaction.

It does not end here. The turnaround time with Payoneer is better than that for PayPal! The latter takes about 3 to 5 business days for transferring funds to your account while Payoneer guarantees account transfers within 24 hours. Everybody loves speedier transactions!

3. Added “Indian” Benefits

Payoneer has a very unique service for Indian customers. After the sign-up, you receive a separate UK and US collections account.

This means you will have a virtual bank account in that region with complete details like account number, and router number coupled with complete privacy and control. You can use this account to collect from those clients who desire to pay to local banks due to their own reasons!

Thus, Payoneer can help you amplify your reach and use your market potential to the maximum.

Once the collection has been deposited the rest of the process is the same. You will receive the money in your account within the next 24 hours.

If you ask me, there are certain added benefits with Payoneer which make it a compelling choice for Indian freelancers. If asked which one to use, I would choose both. Why?

Well, the sign-up is free for both! As a marketer, I have to think about all my options and all my current and prospective clients. Both platforms are popular but PayPal is still the premier choice for many people. This trend is slowly changing as more and more people realize the added advantages of relatively newer platforms like Payoneer.

Payoneer vs Paypal: Safety and Security

As we know security is one of the main factors, which users are concerned with in order to transfer or receive cash internationally. Before selecting a service, users are required to take some measures to make sure that their money transfer is safe and secure.

In addition, there are several options are available in the virtual market, which allow users to do transactions conveniently. But are they safe enough to protect your fund? Well, according to recent hacking cases, it is better to choose PayPal because it is one of the independent and publically trading online companies.

Also, you can select Payoneer, which is an exclusive global payment method for users to utilize easily.

Supported Countries

PayPal and Payoneer are both companies that are able to offer services to over 199+ countries easily. So, there is no need to be troubled about transferring your funds from one account to another. Just use one of them and gain success without making too much effort.

Quick Links:

- How To Open A PayPal Account In India And Verify It

- Payoneer Review: My Honest Review

- Steps To Cancel a Paypal Payment

Speed: Payoneer vs Paypal

It is fact that when it comes to huge amount transfers, Payoneer is much smoother and faster compared to PayPal. In PayPal, you have to follow some steps manually and then it takes a few minutes to complete the process. In other words, its method is somewhat lengthy and bothersome, which makes users face tons of hurdles.

On another side, Payoneer eradicates these sorts of complications and allows paying in your local currency to a bank account with ease. Overall, the procedure of sharing funds is automated and people can easily receive the money in their account normally within 24 hours.

Conversely, PayPal takes 2-4 working days to share your funds to your bank account once you commence the procedure. Due to this, it is a very daunting task and creates problems at critical times. So, it is advisable to choose your payment method wisely and gain success respectively.

|

Payoneer vs PayPal Elements |

|

|

|

FAQs On Payoneer vs Paypal:

Which one is better PayPal or Payoneer?

Which one is better PayPal or Payoneer? Unfortunately, they'll be affected by PayPal's high exchange rate and any other applicable charges when they send payment. WINNER: Payoneer has better currency exchange rates than PayPal, but not by much

Is Payoneer trustworthy?

Payoneer is a legit, fully regulated US company registered as a US Money Service Business (MSB). They have also been in operation since 2005, and are certified at a PCI Level 1 Data Security Standard which means they need to uphold a high standard of security on their network and systems

Can Payoneer be used instead of PayPal?

Can Payoneer be used instead of PayPal? Payoneer is a financial services company with one core purpose: to enable businesses to pay each other — and get paid — both domestically and internationally. Unlike PayPal or similar platforms (such as Square or Stripe), Payoneer is not an all-in-one payment service provider, nor is it a merchant account provider

Does Payoneer require bank account?

Payoneer accounts are FREE and you can link any Security Bank checking or savings account to your Payoneer account.

Online Usage: Payoneer vs Paypal

You might be familiar with several websites, which allow users to pay money via PayPal. If you haven’t heard about them, then go to your dashboard and gather information about it to start shopping easily.

Most importantly, the best thing about PayPal is that there is no need to worry about having cash in your PayPal account. As we know, it is linked to your bank account, which means it will pay automatically from your connected bank account or credit card.

Don’t worry, there will be no charges deducted unless your transactions have other countries.

Furthermore, in the case of Payoneer, they will issue and provide a plastic card to your address. Also, Payoneer allows users to do any sort of transaction without getting charged.

However, in some places, potential people are unable to locate PayPal, which creates hassles for them. So, it is better to choose the right payment method in order to shop without worrying about anything.

To conclude I will come forward and say that I am inclined towards using Payoneer more. This is because as per my research it is more profitable and creates a more sustainable monetary framework for me.

Here is a video to let you know more about how to receive Payments on Payoneer:

Video Credits: Payoneer

Very useful information PayPal is the most secure and widely accepted payment gateway but charges are very high as 5% on each transaction including fixed fee I think Payoneer can provide the same value as Paypal alternative.

very nice information really like it.

Yes, Payoneer is the best method to get money.

Payoneer is truly the best alternative and for many of us, the best payment solution than PayPal.

I have been using Payoneer for the last few years and it works for me very well.

Literally, the also offer Affiliate Program too which lets everyone earn $50 per referral.

Yasar,

Thank you so much for this incredible Comparison.

Great Post here @Jitendra,

Payoneer is simply the best as of now compared to PayPal. Payoneer is simply the best.

Especially when it allows me receive payments in three currencies: USD, GBP, EURO.

Thanks for sharing this with your readers.

Payooner is now accepted worldwide. Very easy in transactions RIP Paypal hahaha

how much are the charges deducted to the payments I will receive thru payoneer?

Amazing Post!

Keep Sharing….

Alex,

Hi Jitendra ,

Thanks for the great payonner review, Yes payoneer helps you to get money easily. In some point of view payoneer is far better than paypal.

Time to try Payoneer. Paypal eats up a lot 😀

I think Payoneer is the best option (unless you live in the USA). The problem is that PayPal is more widely accepted, we probably have to work with both

hey, when schema plugin launch, i use WordPress so i am waiting for it.

thanks

Hi mate

Can you please confirm that the comparison which is there on site, have got it published by simply adding a plugin or it has been developed by you.

If you have purchased the plugin please let me know from where you had.

I want it at a lowest cost and better benefit.

Hey this is a plugin I am using. I am creating my own Schema plugin if you want then you can PM me anytime I will give you review copy.

I really wondering Payoneer!!!! FOR STRATEGIC BETTER BUSINESS. AND I CAN DO MY BUSINESS

Thanks a lot for the comparison, mate. I’ve been tired of using Paypal, with all their nonsense policies and lowest exchange rate possible. I’ve finally made the switch to Payoneer and signed up through your link. Thanks a lot once again 🙂

Regards,

Daniel

First of all, I’d like to thank you for providing a clear cut comparison between Payoneer and Paypal. I was a bit hesitant to use Payoneer at first due to its service fees. But with the comparisons you’ve mentioned, it made me look twice on getting my account reactivated.