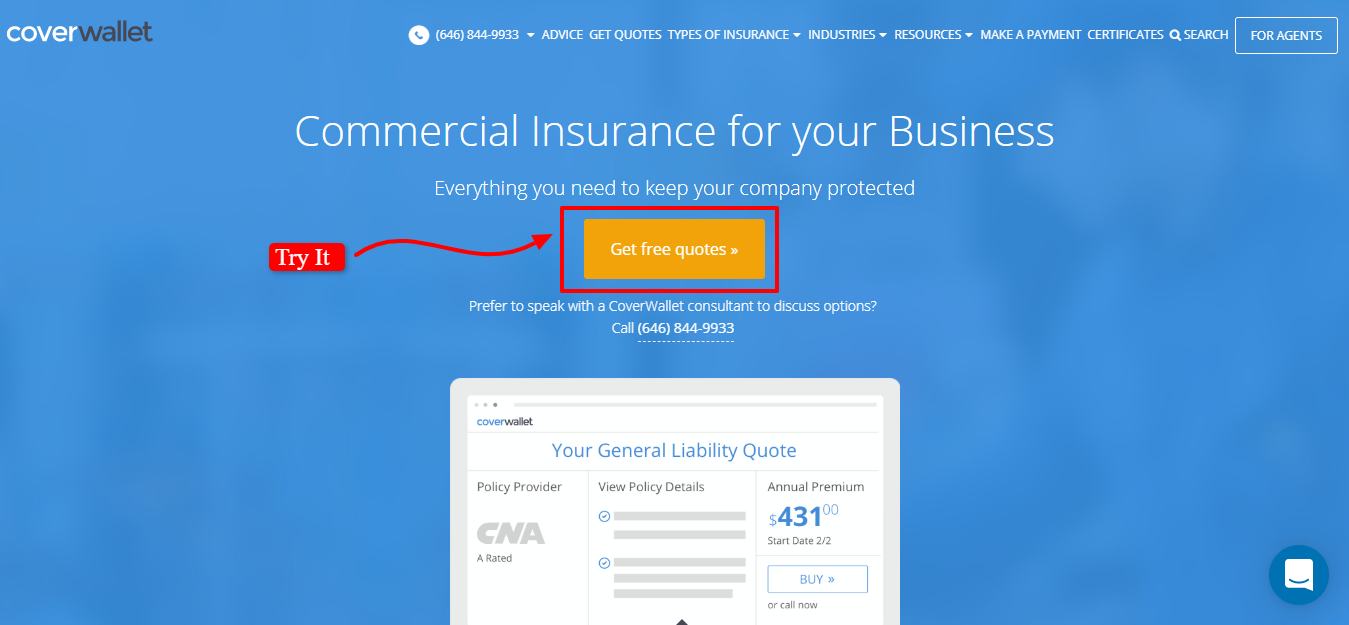

CoverWallet is a web-based insurance management solution. Help your users by simplifying the administration of your company’s insurance policies. The service offers high functionality in an easy-to-understand interface. Everything is simple and transparent. With CoverWallet you can see all your sources in one place.

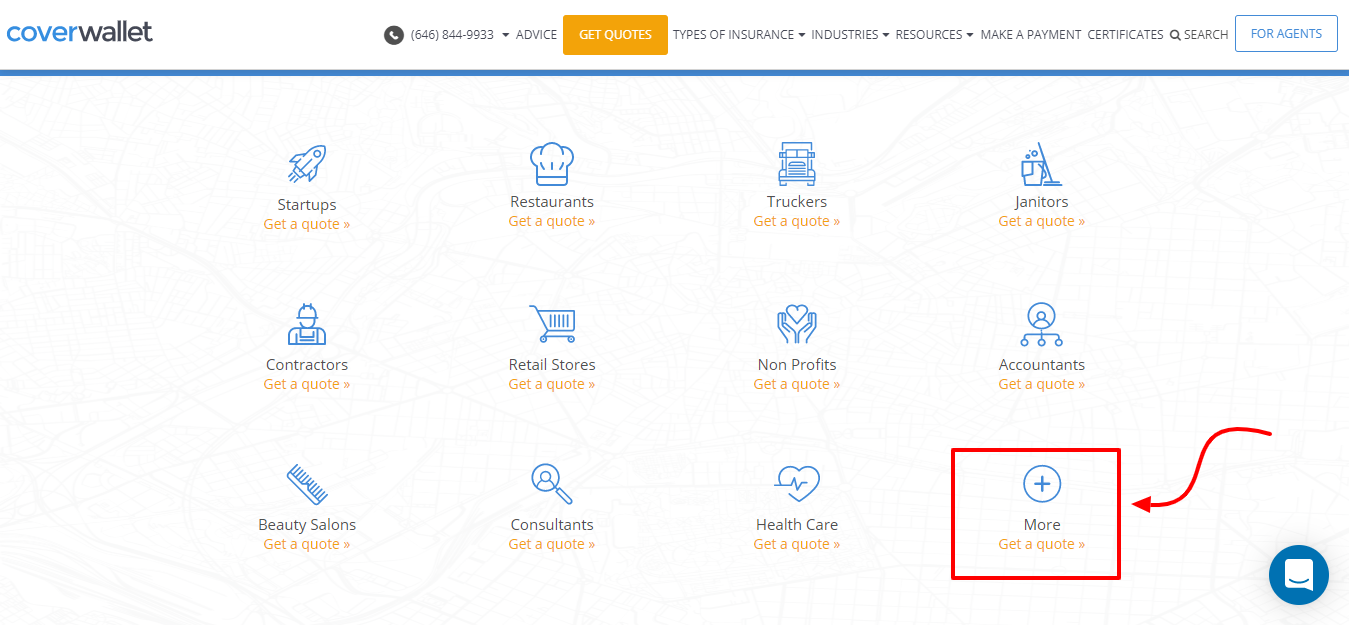

CoverWallet supports various types of insurance, such as Employee compensation, business owner agreements, misconduct, civil liability, etc.

This is also used in many sectors such as education, retail, construction, and finance. If your business needs a simple solution to easily manage all your sources, CoverWallet may be right for you.

A free trial period will be offered so you can try the program. In this post, we are sharing about CoverWallet review. Read full CoverWallet review in below section.

{Updated} CoverWallet Review 2024: Is It Legit ? (Pros & Cons)

Detailed About CoverWallet Review

CoverWallet is an online business insurance management platform designed to simplify the management of corporate policies.

The service is a product of entrepreneurs with experience in software technology who want to create a fully online, transparent and easy insurance management service. In summary, CoverWallet puts all your insurance policies in one central location for easy management and access.

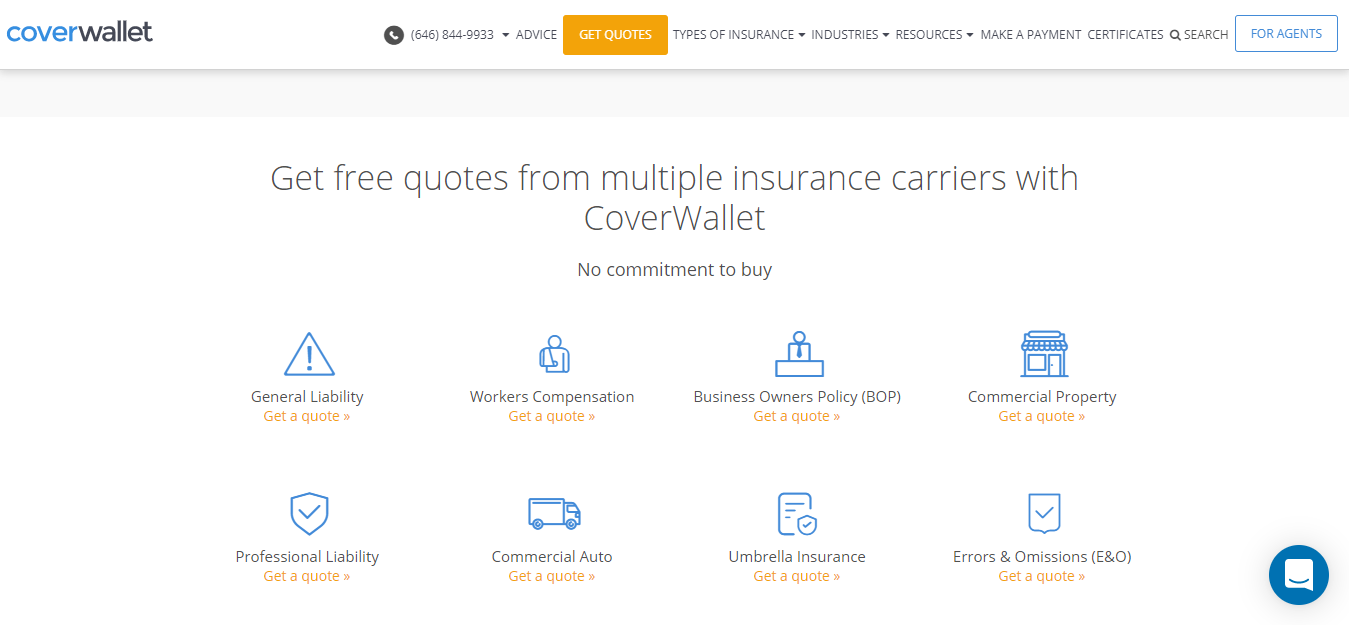

CoverWallet is suitable for many types of insurance. These include General Liability, Labor Remuneration, Industrial Property, Business Ownership Policy (BOP), Professional Indemnity, Errors and Omissions (E & O), Medical Misconduct, etc.

Service is widely used in various areas such as rental, real estate, construction, finance, education, and retail, to name just a few.

- Our mission at CoverWallet is to provide our customers with easy, fast and convenient commercial insurance. Voluntarily motivated, we will continue to develop our business in 2018 in every imaginable way. Today, we have three main platforms, all dedicated to simplifying business insurance using data, design, and technology.

- Our direct consumer business (D2C) continues to grow exponentially and we now serve tens of thousands of small businesses to help them understand, buy and manage their insurance online.

- On the B2B side, we work with operators and their affinities to provide a fluid way to buy insurance online. You can use our platform to easily and conveniently offer your insurance products and provide an effective solution for working with smaller accounts.

- CoverWallet for Agents, launched in December, expands our distribution to millions of insurance-buying insurance companies. This helps agents to effectively quote, link and serve their customers.

GENERAL BENEFITS

The key benefits of CoverWallet are time savings, partnering with insurance companies, and providing personal assistance.

Different insurance policies with different operators and payment plans can be quite overwhelming. With CoverWallet you save time and energy by checking hard copies, digital documents, and emails. All of this can be entered and managed with a single program. The organization becomes more comfortable and many steps are automated. Earn more time, earn more money.

CoverWallet also maintains partnerships with insurers. This means that the information in your policy and calendar will be synchronized with your suppliers’ information. Operators like Berkshire Hathaway Guard, Atlas, Markel, Liberty Mutual and Hamilton have partnered with CoverWallet.

With the help of the administrative solution, you can find the best insurance policy for you. You do not even have to be blind in this area, because CoverWallet offers an intelligent rating system that will help you find the best solution for your needs and budget.

CoverWallet is not just an application in itself. If you subscribe, you have a personal adviser to help you manage your business insurance. With a free trial period, it would not hurt to give it a try.

Which commercial motor insurance coverage does CoverWallet offer?

CoverWallet provides organizations with a variety of policies, including customizable add-ons:

- Responsibility Protect your company from financial losses due to personal injury or property damage to vehicles in a car accident.

- Collision Cover the physical damage caused by a collision with another vehicle or object.

- Complete Be sure to repair or replace a professional vehicle after it has been damaged by anything other than a collision.

- Specific causes of damage. This alternative to full coverage applies only to accidents caused by specific causes.

- Uninsured or underinsured drivers. Protect yourself from medical expenses that are not covered by the insurance of the other driver.

- Medical Payments Pay medical bills from employees who are not covered by employee compensation.

- Upload and download Protect yourself from damage that can occur when loading or unloading professional tools, goods or equipment.

- Towing and working. Cover for the costs of the illness including the associated labor costs.

- Roadside Assistance Get help for minor repairs while traveling.

- Charge. Protect lost or damaged goods transported by truckers.

- Shortened tail Cover truck employees when they are in business but do not carry cargo.

- Car rented and not owned. Protect a professional vehicle and its passengers, even when you rent it.

Where can I get CoverWallet car insurance?

CoverWallet puts you in touch with multiple partners to find the insurance you need. Their associations cover all 50 states. You will probably find an option near you.

CoverWallet’s insurance partners include Progressive, Geico, Liberty Mutual, Chubb, Markel, and AmTrust.

What features does CoverWallet provide for businesses?

CoverWallet offers several types of supplementary insurance available from its partners.

- Employee compensation Ensure that injuries to employees are taken into account in your work.

- Change Trailer Protect an unused trailer of your fleet from physical damage.

- Liability not in connection with trucks. Get liability insurance if you use your semi for non-commercial reasons.

- Contamination Special cover for damage in connection with the pollution of your vehicles. Environmental policy may also include cleaning.

CoverWallet Review | How reliable is CoverWallet?

You will not find much information about CoverWallet in our customer reviews. However, CoverWallet is up to date with the Bloggersideas. It is considered an advantage to help businesses buy car insurance. CoverWallet is not responsible for his financial status with A.M. Meilleur

CoverWallet was honored in 2016 by Entrepreneur Magazine as one of the leading entrepreneurship companies. The award was based on the company’s simple yet innovative insurance process.

Compare the opinions and financial position of the company you are with, as claims are not settled through this broker, but through the insurer of your choice.

CoverWallet Features

Check out the list below of some of CoverWallet’s features:

- Business Owners Policy (BOP)

- Workers compensation

- Employment Practices Liability Insurance (EPLI)

- Commercial property

- Directors and Officers (D&O)

- Professional liability

- Commercial auto

- Umbrella insurance

- General liability

- Errors and Omissions (E&O)

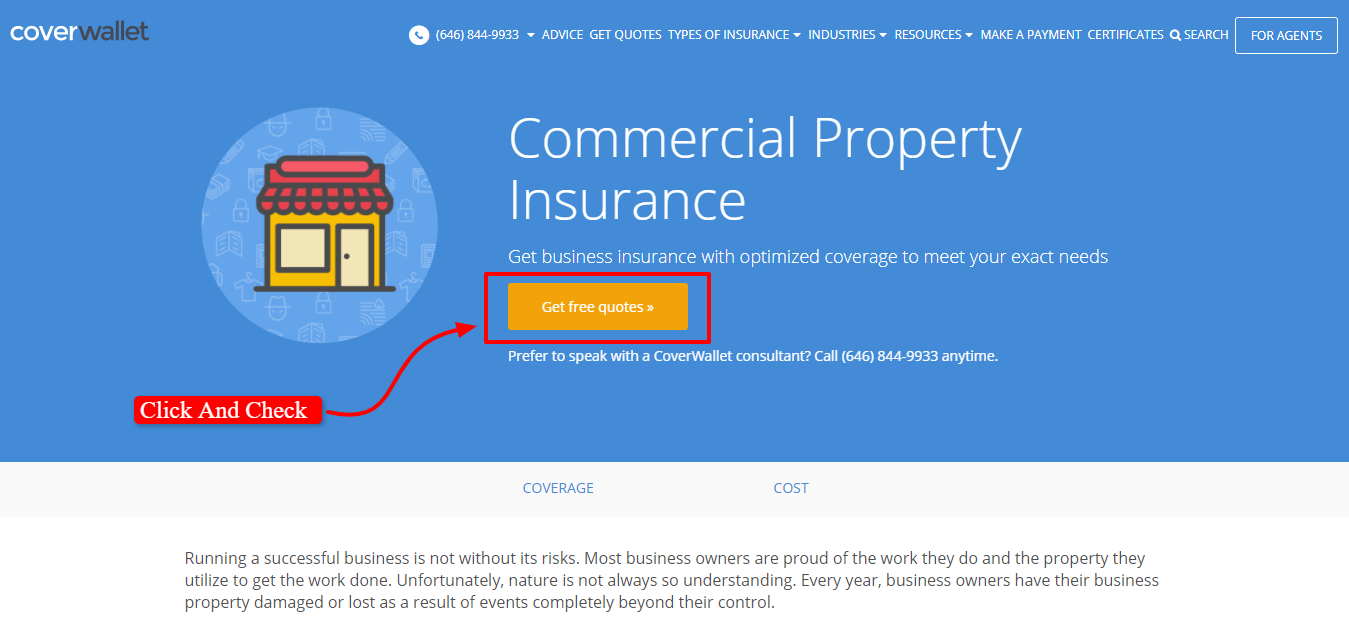

CoverWallet-Insurance

Business insurance is a set of covers that protects companies against losses from their normal business activities, including claims for damages. Different coverages cover different risks that may extend to property damage, legal liability and personal problems related to employee issues. These are some of commercial insurance policies offered by CoverWallet:

General liability insurance: The liability insurance covers all damages such as personal injury, defamation and defamation as well as legal costs. Since your business is different from other companies, you should contact CoverWallet insurance agent to discuss potential add-ons.

Possible additions are the protection of commercial real estate, even if they are not under your roof during the damage period. Ratings by CoverWallet are correct.

Business Owner Policy (BOP): A business owner policy combines all the coverage required for a business owner. The BOP often includes property insurance, liability insurance, business interruption, and crime insurance. You can tailor the package to the specific needs of your business. The police are usually cheaper than buying the blanket separately.

Professional responsibility: Consider this responsibility for service companies. This is one way to protect yourself from the mistakes you make in customer service.

Commercial Property: Property insurance covers various losses, including:

Buildings: Cover is required if you own the building used by your company. In the event that the premises are rented, the owner provides the cover.

Corporate Property: Cover for tables, desks, chairs, and appliances. In addition, you want to incorporate the improvements made by the renter into the leased premises.

You are affected by mistakes, omissions or negligence. For example, suppose you are a professional wedding photographer and know that device failure can be a disastrous experience. If the ravaged couple takes legal action, their professional liability insurance covers the incident. CoverWallet revisions are not visible.

Product Liability: Product liability insurance is essential for companies selling products instead of services. If the products you sell are a problem, this can lead to expensive and time-consuming queries. The product liability insurance protects you against any possible medical and legal costs.

Workers compensation: This insurance is compulsory for most non-self-employed companies and protects their employees if they are injured while working. It covers the loss of earnings of a worker as well as the sickness or occupational accident costs. In addition, it protects your company from claims for working conditions that cause injury or illness.

Commercial vehicles: If the vehicles are being used by your company for running of the business like for employee transportation, or some equipment or products, these are protected by a company car insurance against damage and accidents. Non-owner car liability insurance may also be considered to protect the company if employees drive their own car on behalf of the company.

Cyber responsibility: A data breach can harm your business. When you store sensitive information with respect to personal details of your clients or employees, it is your responsibility to protect that personal information. In addition, in the event of a data breach, you must inform your employees or clients regarding the same. This prcoess can be rather expensive and tedious too. Your cyber liability insurance covers the costs incurred. CoverWallet notes are good.

If a member of your management team is involved in litigation directly attributable to his or her actions at work, the D & O insurance may help to cover the costs of a lawsuit. It may even cover fines or penalties imposed on a government investigation.

Ocean Marine: When importing or exporting goods on behalf of a company, it is important to protect them from damage, destruction or theft when traveling with Ocean Marine insurance from one port or country to another. Your cargo is protected regardless of your final destination.

Directors and Officers (D & O): The D & O insurance policy is intended to support good corporate governance by providing its directors and officers with liability insurance.

Health insurance: Unlike companies with more than 50 full-time equivalents, companies with fewer than 50 full-time equivalents are not required by law to take out health insurance. However, it makes sense to offer companies health insurance. Health benefits for their employees include a higher perceived value of employee benefits, tax benefits and credits, and more productive employees.

Crime insurance: The crime insurance protects a company from loss of crime. It covers certain losses that are not covered by commercial property insurance. For example, several companies offering property insurance exclude theft insurance policies from employees of companies. They also do not cover losses or damages in the form of cash, money, securities, food stamps or similar items.

Linkage: The purpose of the linkage is to make sure that the contractor you hire does the work for which you hired him. For example, if you hire a renovator and Renovator does not perform its duties under your contract or if you fail to comply with state laws and regulations, you may be entitled to a loan. and get compensation.

Fidelity Bond: As an entrepreneur, you need to make decisions every day that can directly impact the success of your business. You need to hire valuable staff, but what happens if the background of your ideal candidate is questionable> What happens if you hire a specialist with significant fiduciary responsibilities?

Business Interruption: If your company is forced to suspend operations due to an insured event, this coverage can provide you with a steady income that allows you to pay employees and their bills and monthly expenses.

CoverWallet application process

A 24-hour complaint service is available at CoverWallet. The moments the first report has been submitted, you should wait for the consultant to connect with you and complete the application process. This includes obtaining a cost estimate and, where appropriate, a written statement on the application.

Purchasing and Administrative Guidelines

CoverWallet simplifies the purchase of insurance for small businesses. Its platform makes it easier to understand your needs and purchase digital reporting. CoverWallet has licensed insurance experts who offer free consultations.

Managing multiple insurance contracts for your business can be very tedious, especially if you have contracts with multiple operators.

Traditional insurance management practices involve storing and storing tons of documents in filing cabinets. This can be difficult if you have access to them and find that they are not well organized. With CoverWallet, it’s easy to online manage your policies.

Customer service and support

There are many ways to connect with CoverWallet employees. In different areas of the site, you can talk to real representatives via email, phone or chat. The chat feature allows users to talk to people during business hours (calls that are sent after 18:00 (Eastern Time) will be answered the next business day).

One of the useful features is the ability to schedule an appointment with a CoverWallet representative to remind you that you can not call someone at this time. Users value the available support resources, but some complaint about slow response times and lack of communication.

Reputation and reliability of the company.

CoverWallet is highly praised for its user-friendly interface and the goal of simplifying business insurance processes. The startup is new and evolving. They have now launched a platform that offers their customers more agents and insurance options by building a larger bridge between suppliers and business owners. As the company grows and learns, the first comments on CoverWallet’s services are solid.

Company-specific size

Companies of all shapes and sizes with different insurance needs could use an interface such as CoverWallet to meet their insurance and compliance requirements. CoverWallet is ideal for small business owners who want to save money by comparing the insurance policies of multiple operators.

Large companies or small businesses with multiple contracts can also benefit from centralizing all insurance information on the CoverWallet platform. If necessary, you can add multiple users to your CoverWallet account online.

CoverWallet Pricing | Check CoverWallet Pricing Review Here

Prices for CoverWallet depend mainly on the type of insurance and the specifics of the company requesting them. For example, your general liability insurance can cost between $ 15 and $ 75 per month, employee compensation between $ 19 and $ 286 per month, and business owners between $ 16 and $ 87 per month.

| Insurance Types | Pricing

($/Month) |

| Professional Liability | $29 to $150 |

| Workers Compensation | $19 to $286 |

| Commercial Property | $25 to $94 |

| Business Owners Policy (BOP) | $16 to $87 |

| General Liability | $15 to $74 |

They also offer many other types of insurance, such as general insurance, errors and omissions, product liability, special events, health insurance, maritime insurance, health insurance, and car hire. and third-party cars, business interruption, equipment failure, civil liability, disability insurance, civil liability for contamination, crime, trust, surety, fidelity certificate, and trade package.

READ ALSO

- SimpleTuition Review 2019: Does It Really Help With Students Loans?

- [Updated ]Top 10 Small Business Loans Platform 2018: With Pros & Cons

- SimpleTuition Coupons & Discounts April 2024: Get Up To 50% Off

- [Latest] Everything Breaks Review {Discount Coupon 2019: Upto 15% Off

Pros and Cons of the CoverWallet Review

Pros

- Personal Advisor CoverWallet includes an insurance checklist on its website that describes the types of insurance coverage based on your company’s information. You also have free access to a personal insurance advisor.

- One-Stop-Shop It is well known that the company covers many insurance needs, not just cars.

- Specific dates for the industry. Get an online quote based on your industry or business type.

- Wide commercial coverage. CoverWallet focuses exclusively on commercial insurance. It offers many coverage options that are not available at some car insurance companies.

- Online account management. Unlike many insurance brokers, you can create a CoverWallet account to manage all of your business policies in one place.

Cons

- No branches The customer service is limited to the phone or online.

- Some customer comments. Only a few consumer sites rated CoverWallet. However, the company claims to have committed to the quick and easy handling of the business insurance process.

Conclusion: Is CoverWallet worth it? | CoverWallet Review

With a complete list of standard insurance items, CoverWallet offers good protection against unexpected losses and costs. By choosing many Level A insurance companies, small businesses can be sure to work with insurance companies that can deliver on their promises.

If you own a business of any size, try CoverWallet. Gone are the days when managers had to keep an eye on every detail of corporate insurance. CoverWallet can do that for you now. If you are looking for a more organized and efficient solution for your business, this service is the answer. Request a quote today for more information.

I hope this post suits your purpose well and helped you in getting a detailed Coverwallet Review. And if you liked the post then you can easily share it on various social media platforms like Facebook, Twitter, and LinkedIn.

CoverWallet FAQs

🤔What kind of insurance do I need for my small business?

General Liability insurance and Professional Liability insurance are the primarily important insurance covers for any business. While the first one helps for the lawsuits that claim physical injury or property damages, the latter covers lawsuits against errors in the services provided by your business.

🤞Do I need a Public liability insurance for a limited company?

Public liability insurance certainly protects you against the claims which incur if someone gets injured or hi/her property gets damaged because of your business.