If You want Information on HubSpot Stock Price, then read this till the end for better help.

The HubSpot (NYSE:HUBS) CRM SaaS platform is a global business management software provider. Companies flocked to COVID to better manage their remote workforces, which caused the stock to soar during COVID.

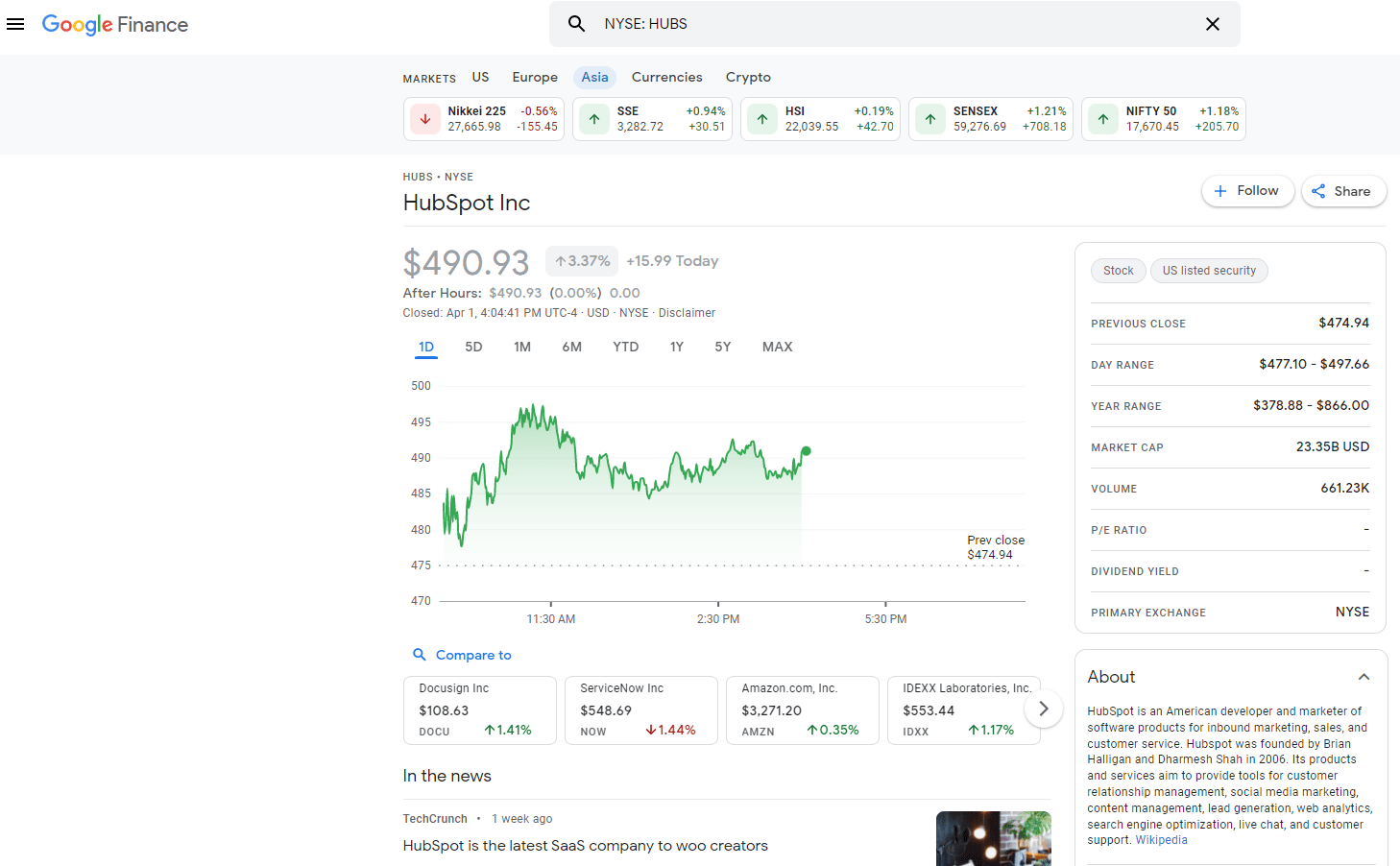

During the March market sell-off in 2020, COVID shares fell to around $90 per share, then skyrocketed to $866 per share by October 2021. After falling from its highs, the Hubspot stock is now trading at $467 through the beginning of 2022.

HubSpot, Inc. provides companies with a CRM platform that allows them to attract and engage users. With the CRM Platform, users can access software-as-a-service via a web browser or a mobile application.

CRM platforms provide companies with marketing, sales, customer service, content management systems (CMS), operations, and other tools and integrations that help them grow and engage with customers over the life of the customer relationship.

In addition to search engine, blogging, Website content management, messaging, chatbots, social media, marketing automation, email, and predictive lead scoring, its CRM platform also includes tools for ticketing and helpdesk, customer NPS surveys, and analytics.

Customer onboarding and training are two of its professional services. Its CRM platform is sold on a subscription basis to mid-market business-to-business (B2B) companies.

In 2022, HubSpot Inc’s market capitalization was $22.1 billion, compared to $1401.7 billion for the Software sector. HubSpot Inc’s stock is down 20.5%, up 8.8% in the previous five trading days, and up 16.2% for the year. The current price-earnings ratio of HubSpot Inc is.

In the last 12 months, HubSpot has generated $1.3 billion in revenue with a 6.0% profit margin. The company’s quarterly sales increased 46.5% year over year. According to analysts, adjusted earnings will be $2.404 per share for this fiscal year. There is no dividend paid by HubSpot Inc.

Quick Links:

- How To Invest In Stock Market In India With Little Money (100% Working)

- Social Stock Case Study: How I Made 500+ Sales in 1 Year

- 40 Best Free Stock Photos Sites To Find Awesome Images

Conclusion: Information on HubSpot Stock Price

HubSpot remains a far too rich company for me despite the recent sell-off. With constant dilution, no evidence of profitability, and rising interest rates, future shareholder returns will be an uphill battle.

In fact, if shares rise further, I would consider taking a short position. One risk of shorting HubSpot would be a short squeeze, a downward trend in Fed rate hikes, and either a large increase in revenue or a large decrease in costs.

It is unlikely that any of these risks will arise, but anyone thinking of shorting a stock should be aware of them.