When paying taxes, investors in cryptocurrencies must record capital gains and extra income. However, if you have an extensive portfolio with several assets across multiple exchanges, doing it manually is difficult.

Thankfully, software such as Koinly automates the calculation of crypto taxes and the generation of tax returns. Koinly is unquestionably one of the best alternatives for complete crypto tax software that may save you time and hassle.

However, it is essential to understand what features Koinly provides and how it compares to other tax software. My review of Koinly covers all you need to know about this industry-leading tax software to determine whether it’s appropriate for you.

What Is Koinly?

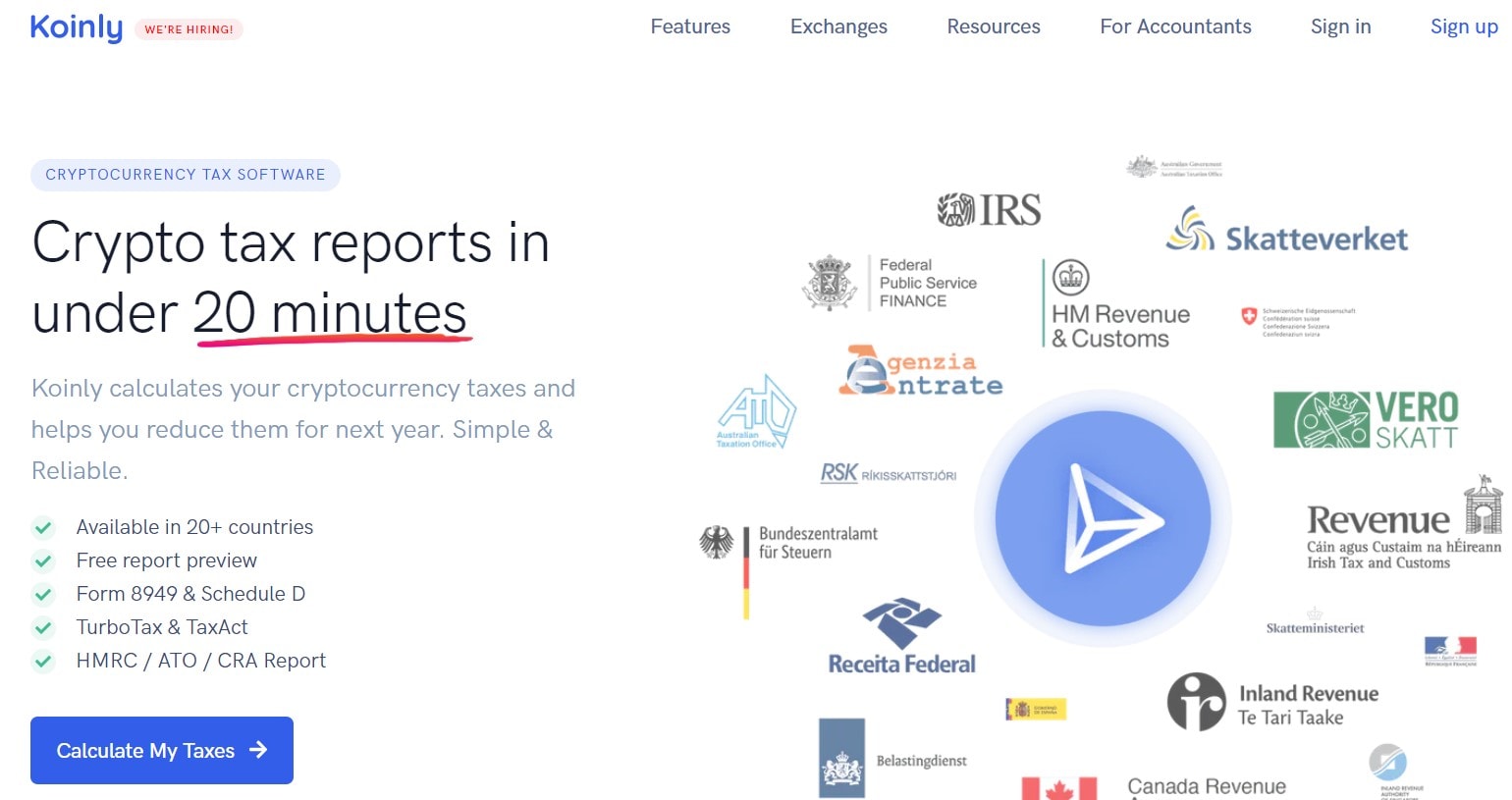

Koinly is one of the largest and most popular online platforms for crypto tax accounting. The Koinly platform enables customers to monitor all bitcoin transactions and activity, automatically gathering and categorizing data and providing regulatory compliance tax reports.

Koinly was founded in 2018 and is headquartered in Palo Alto, California. However, it offers country-specific features for Australian crypto traders and investors.

Koinly may be connected to various cryptocurrency wallets and exchanges to monitor crypto-related activities that may have tax implications, such as airdrops, DeFi applications, lending, staking, trading, and mining.

How Does Koinly Work?

Koinly is a digital asset monitoring and tax reporting software that integrates with some of the industry’s most prominent exchanges and wallets. This enables customers to see their whole bitcoin portfolio in a single location and produce correct tax returns with a single click

In addition to a real-time capital gains tracker, cost-basis tracker, and more, Koinly offers a variety of tools to assist consumers in keeping on top of their taxes.

Koinly Best Features

1. Customer Support:

The team has a Support area and a Frequently Asked Questions website that strives to answer the most frequent questions. In addition to email and live chat, they have a Facebook profile and a Twitter account.

2. Comprehensive Resources:

Koinly offers a range of valuable tools to keep its users informed, including Regional Tax Guidelines, a Crypto Tax Calculator, a list of Tax Accountants, and a Blog.

3. Free Account Option:

The tool may be used at no cost to monitor up to 10,000 transactions and create capital gains tax estimates. The free account may be used forever to monitor your bitcoin transactions and activity.

4. Easy Data Import:

Koinly enables you to import essential data and connect to various services through API. Manual CSV file imports, xPub/yPub/zPub imports, and data migrations from CoinTracking, Deribit, Bitmex, BlockFi, and Nexo are also supported.

5. Extensive Service Integration:

Koinly is compatible with more than 6,000 blockchains and offers automated NEO, Litecoin, Ethereum, and Bitcoin imports. It also interfaces with 350 exchanges, including Kraken, Coinbase, and Binance, portfolio applications such as Delta, Blockfolio,, and 75 wallets, and makes it simple to monitor mining, staking, and other DeFi operations.

6. Multi-Country Support:

Over 20 nations in Europe, Asia, Oceania, and the Americas have access to the platform. Koinly enables customers to prepare localized Form 8949 and Schedule D, K4, Rf1159, and Sheet 9A tax reports.

Koinly Pricing Plans: How Much Does It Cost?

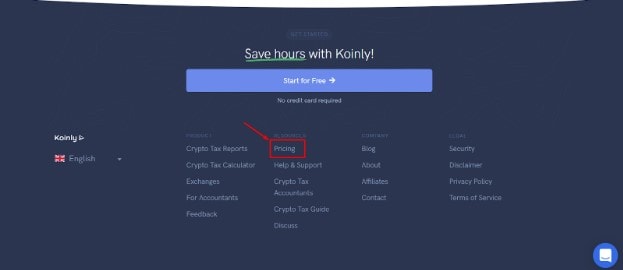

Step – 1: Go to the official website of Koinly, scroll down, and click on ‘Pricing.’

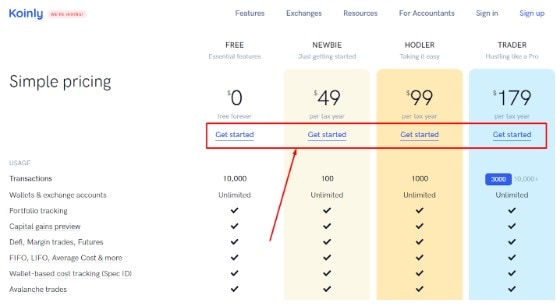

Step – 2: Choose a plan of your choice, and click on ‘Get started below the plan of your choice.

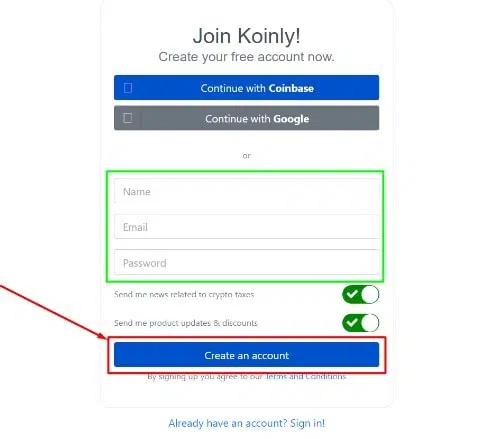

Step – 3: Fill up the details asked for and click on ‘Create an account. You can also choose to sign by Google or Coinbase.

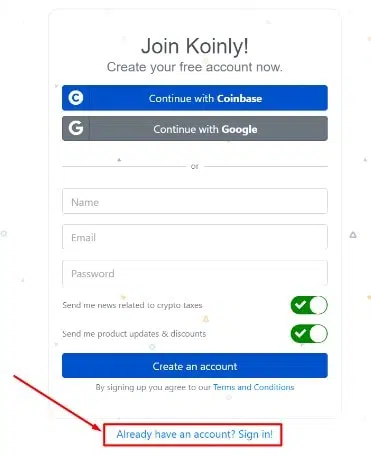

Step – 4:When done, click on ‘Already have an account? Sign in.

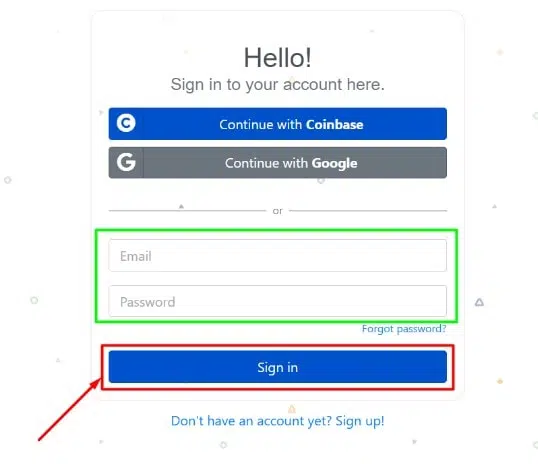

Step – 5: Fill up your login details and click on ‘Sign in.’

That’s it. Start using Koinly.

FAQs On Koinly Review

What happens if you don't report cryptocurrency on taxes?

You may be subject to harsh fines if you fail to record your bitcoin revenues on your tax return. The IRS has said that those who fail to declare their bitcoin profits may face criminal prosecution. Therefore, you may be taking on significant risks if you do not record your cryptocurrency profits. And if you're having difficulties keeping track of your cryptocurrency profits, several excellent tools are available to assist you. Koinly is one of these programs, and as you can see from my Koinly review, it has all the functionality you need to remain on top of your taxes.

Do you have to pay for Koinly?

Koinly offers a free plan, so if you do not want any premium features or integrations, you will not be required to pay anything. Koinly offers three premium programs for individuals that want more: Trader, Holder, and Newbie. In addition, individuals with more extensive portfolios have access to bespoke solutions and may request a price from the Koinly team.

Does Koinly share information with HMRC?

No, Koinly does not disclose user information. It is only a tool that requires information from you to create your tax reports automatically.

Is Koinly worth paying for?

Yes, Koinly is worth the money you pay since it automates most of the tax labor you must do when filing with tax authorities in your nation.

Quick Links:

- How To Sell Safemoon on Trust Wallet: The Easiest Way To Exchange Crypto For USD

- CryptoHero Review: Everything you should know about it

- Cryptocurrencies Advertising: How To Target Cryptocurrency Users

- Basics of Cryptocurrency: What Is Cryptocurrency How It Works?

Conclusion: Koinly Review 2024

Koinly is fantastic for foreign traders and users who do not engage in astronomical trading volumes. Its free version helps you gain an overview of your taxes, but it will not create reports unless you pay for the software.

It offers automated importation of NFT transactions for EVM-based blockchains like ETH, Polygon, BSC, Chronos, etc., and is compatible with all standard DeFi protocols. Solana and other less popular chains do not currently have automated support, although NFT transactions may be added manually.

Overall, it is superior to most of its rivals in terms of assistance for other nations, but it falls short in tax-loss harvesting