Opening a business in Hong Kong or Singapore is easy. But you’ll have to deal with the banks to open your account, and that can be an enormous hassle.

Banks are notoriously slow to respond to applicants, and some don’t even respond at all. I’ll show you a workaround for this problem.

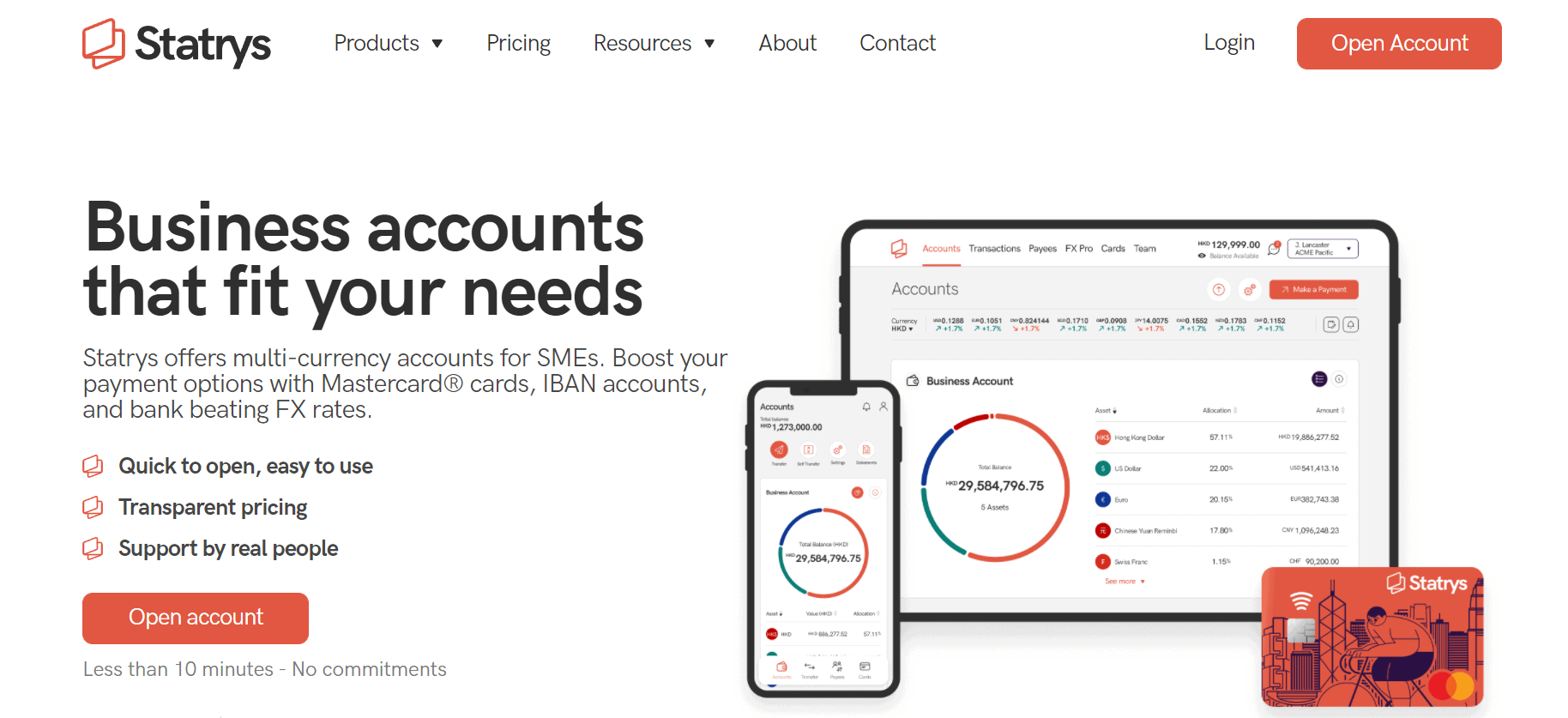

Good business accounts are designed to make running your company as easy and efficient as possible. And Statrys is perfect for doing just that: It’s one of the best options for Hong Kong, Singapore, or BVI businesses.

Compared to other digital-only banks, it offers a greater variety of features, with a simple application process and transparent pricing, but still lacks some features like shared accounts and loans that traditional banks still have.

Let us check it out in a little more detail.

What Does Statrys Offer?

Statrys is a global payment platform that reimagines payments for small and medium-sized businesses. It’s part of the Fintech wave that’s currently taking place in the Asia Pacific.

Why do I recommend Statrys?

For any business looking to save on time, money, and frustration, the Statrys virtual business accounts are a must-have.

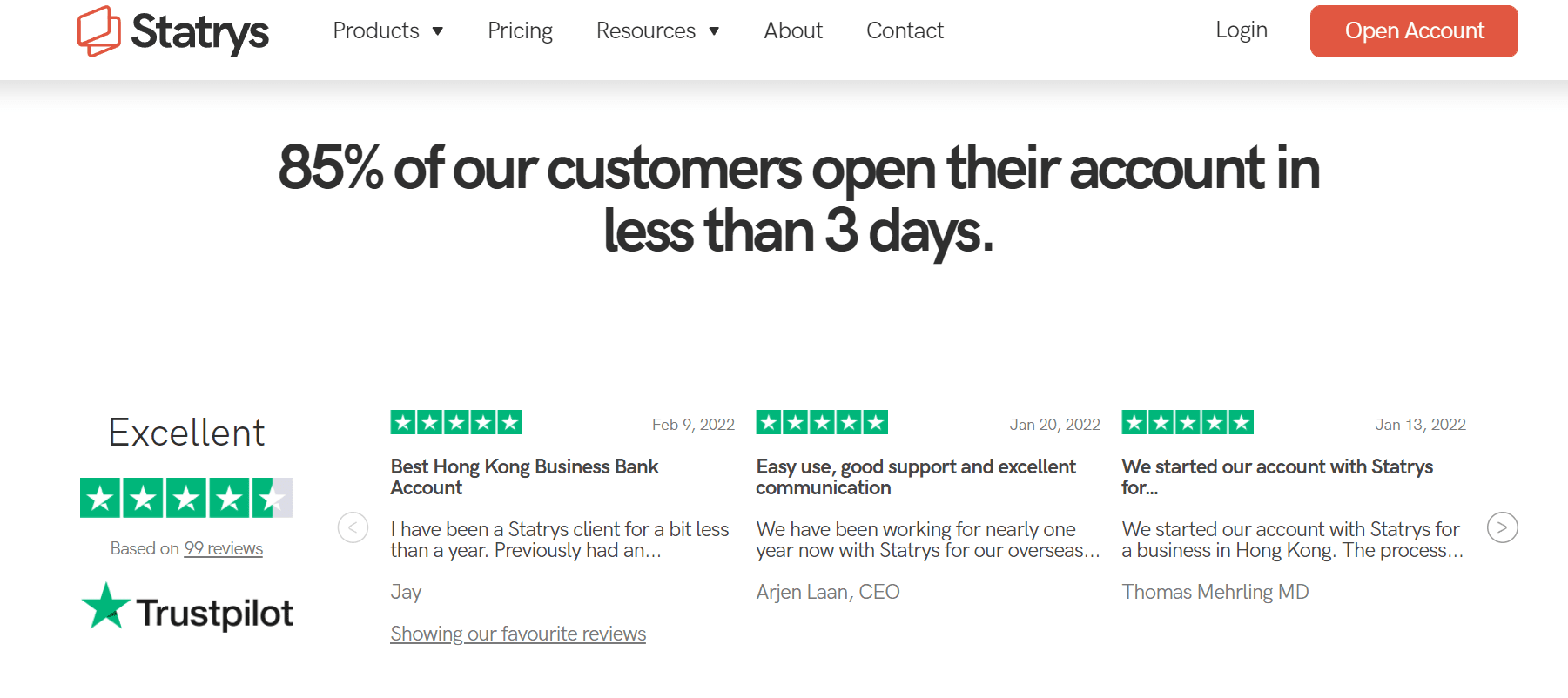

1. It’s a simple and easy Application

- The application process is simple and straightforward as everything is done online. Meaning you don’t need to move from your seat.

- It only takes 10 minutes to apply- you can be prepared and grab your company documents as well as shareholders’ and directors’ IDs copy – otherwise, you can still upload the necessary documents ulteriorly

- The review process is short as well- once you’ve applied you can expect an answer within 24 hours. After the first screen, they’ll schedule a zoom call and if everything is okay you can expect the account to be opened within a few days

2. Get Actual Human Customer Support

- They do not just believe in human-to-human assistance. They put it into practice. There will be no more robotic reactions. Statrys support teams are vigilant in their monitoring of your account.

- The customer support is responsive, with a turnaround time averaging 15 minutes. (Turnaround times vary depending on your time zone, but you can expect an answer within 24 hours). So compared to other solutions you don’t need to wait days to get an answer.

- Another plus is that the customer support team is international and speaks up to 8 different languages: English, French, Spanish, Chinese Mandarin, Chinese Cantonese, Thai, Hindi and Tagalog. So whatever your background, you’re served.

3. They’re Safe as Safe can be

- They safeguard access to your virtual business account using cutting-edge technology to encrypt data, manage various security permissions, and avoid inadvertent security breaches.

- Your money is always kept in segregated accounts with reputable Asian and European banks. You alone have access to your money; they are not permitted to utilize or lend customer assets.

- Statrys is fully licensed and regulated in Hong Kong as a Money Service Operator by the Customs & Excise Authority, and in the United Kingdom as a Small Payment Institution by the Financial Conduct Authority.

- Within 2 years only, Statrys has already reached USD2 Billion in transaction volume– reflecting the high level of adoption by users, as well as its popularity and competitive position in the market.

And the wide range of features:

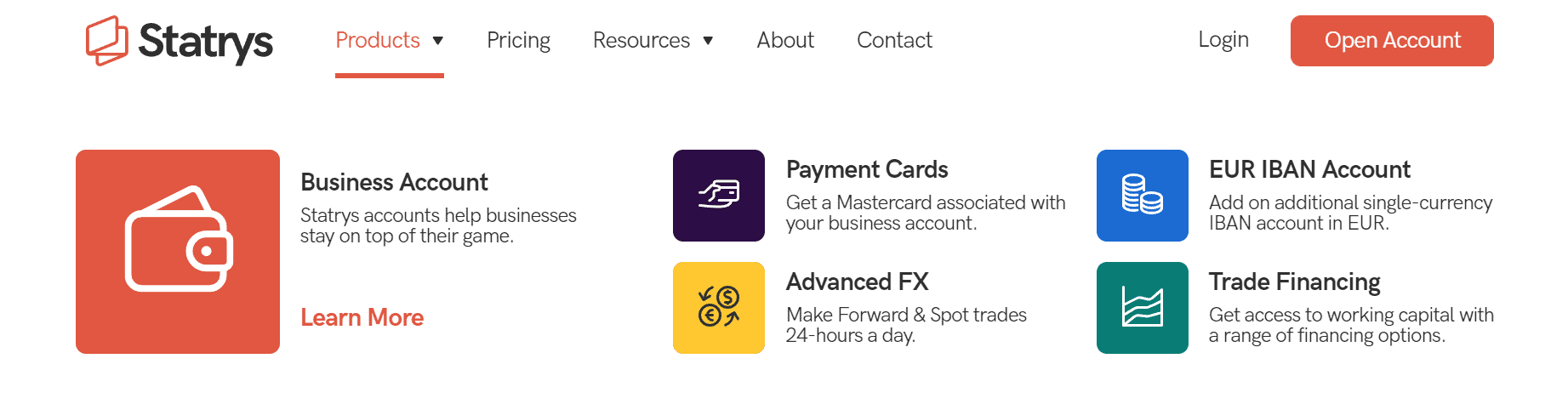

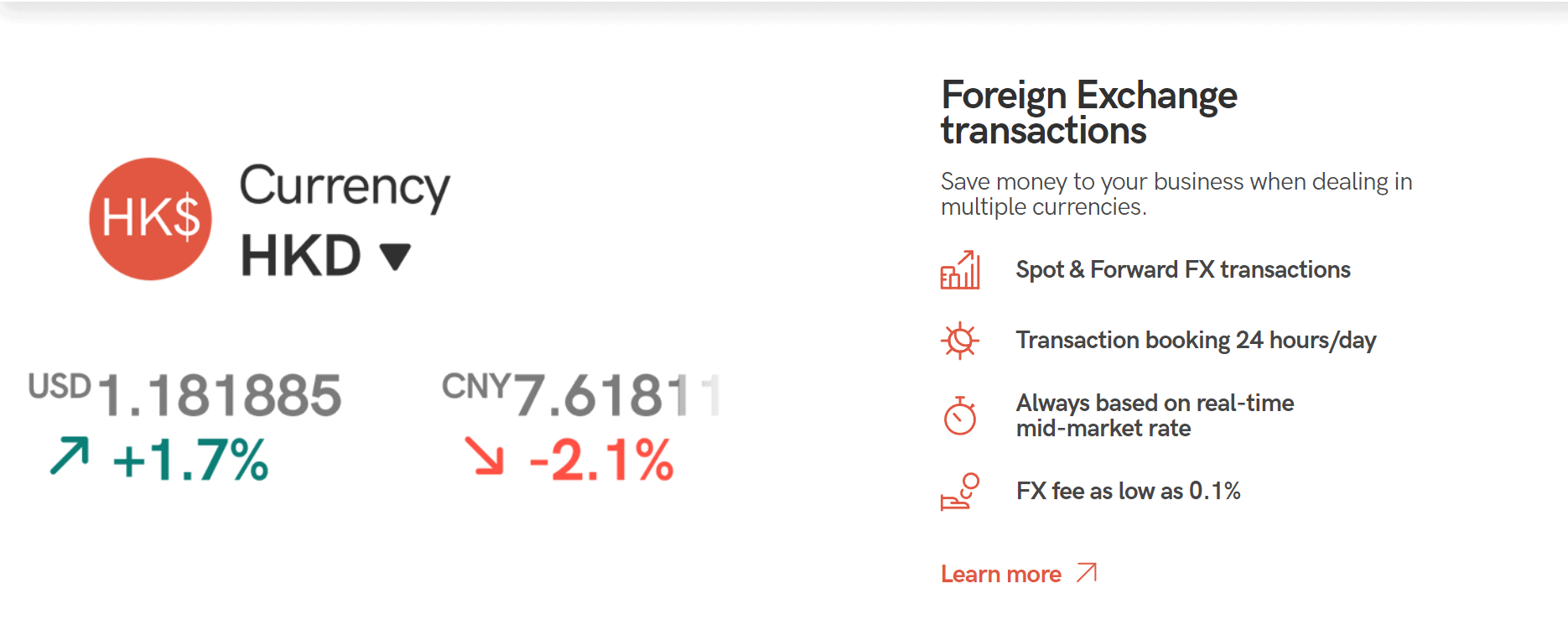

1. Excellent FX services

- The foreign exchange market is very volatile. You’ll be protected against swings and volatility with Statrys FX products– FX Forward, Spots and Swap.

- Their trade desk is accessible to help you in booking preferential exchange rates or in executing Spot orders at the best available rate.

- They give real-time currency conversion rates, allowing you to choose the optimal moment to ride the current or book at the best price for you. Their FX solutions are one of the cheapest in the market.

2. Additional Payment Cards

- Distribute and maintain cards for additional essential individuals or workers within your companies.

- Withdraw cash from participating ATMs whenever and wherever you need it.

- Manage payment cards from their Statrys App.

Statrys Pricing

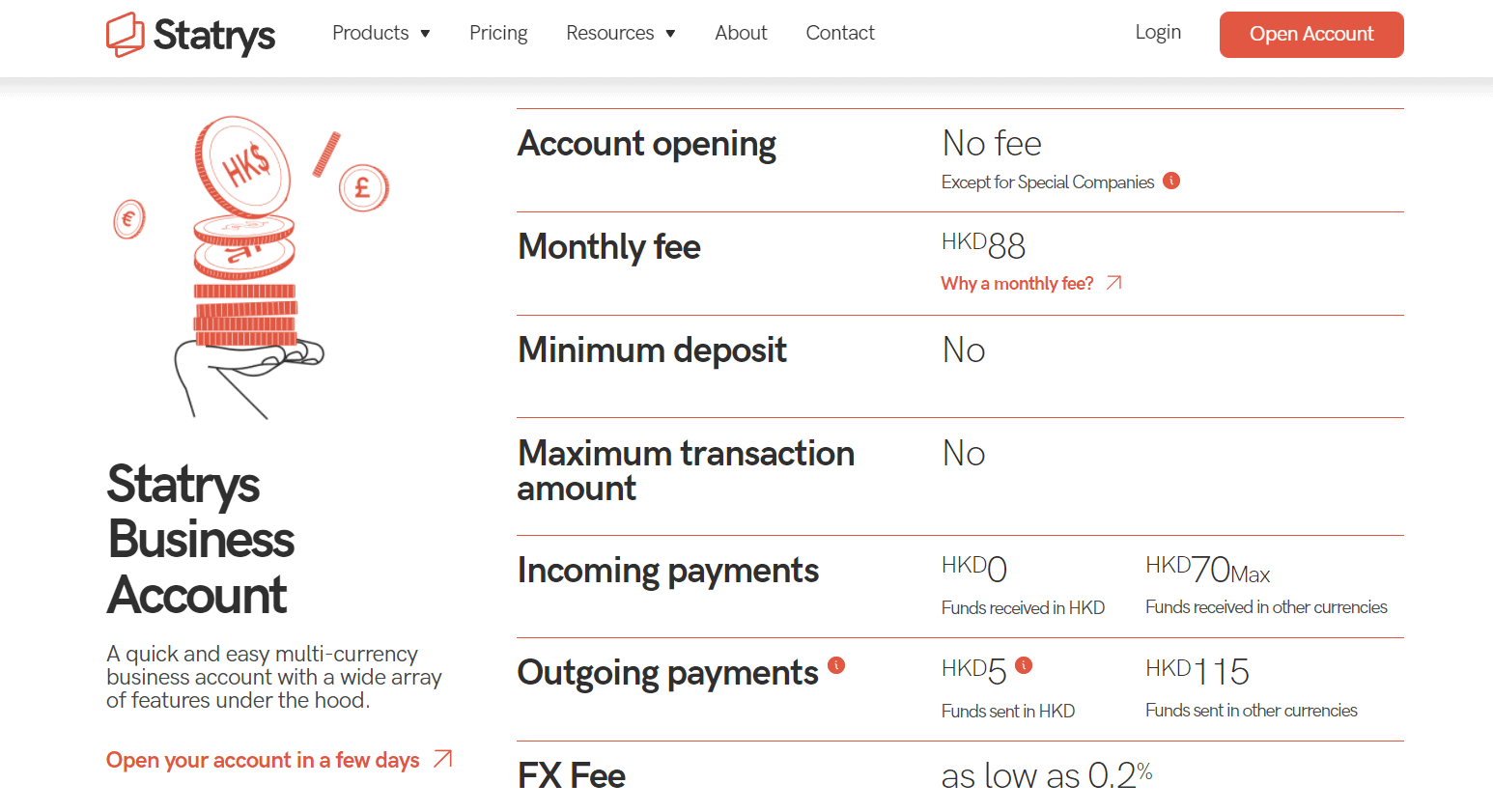

1. Statrys Virtual Business Account

First of all, for account opening, there is no fee. However, for special companies i.e. for companies not incorporated in Singapore or Hong Kong, companies with a certain business profile, and companies with complex structures, they may charge a fee.

Their monthly fee is HKD 88. The best part is, there is no minimum deposit or maximum transaction amount at all. For incoming payments in HKD, there is no charge.

However, for funds received in other currencies, they may charge a fee up to HKD 70 at the maximum.

For outgoing payments in HKD currency, you will be charged as follows:

- 5 HKD for outgoing payments between HKD 0 to HKD 1 M.

- 25 HKD for outgoing payments between HKD 1 M to HKD 10 M.

- 55 HKD for outgoing payments of more than 10 M.

This is because the payment is made through FPS meaning the payment shall arrive on the same day of the transaction on your account.

And for other currencies, the charges would be HKD 115.

2. EUR IBAN Account

On top of the virtual business account monthly fee of HKD88, expect to pay an additional HKD 148 for the EUR IBAN Account.

The incoming and outgoing payments in the SEPA zones are completely free while in the international or SWIFT zones will cost you EUR 35.

If you wish to transfer EUR between your EUR IBAN account and virtual business account, it’s possible and will cost you HKD 95.

3. FX Fees

Their FX fee is as low as 0.2 %, making them among the lowest in the industry.

4. Payment Cards

A physical card will be included with your Virtual Business account. The first payment card is free. For any additional physical card, they will charge you HKD 48 per month. For daily management, there is no fee for a top-up fee, activation fee, and POS usage fee as well.

They charge 1.99 % on ATM withdrawals with a minimum withdrawal limit of HKD 31. Also, for foreign currency conversion, they will charge you 1.5 %.

What I loved about their pricing is that it is completely transparent. As well as being super affordable.

FAQs related to Statrys Review

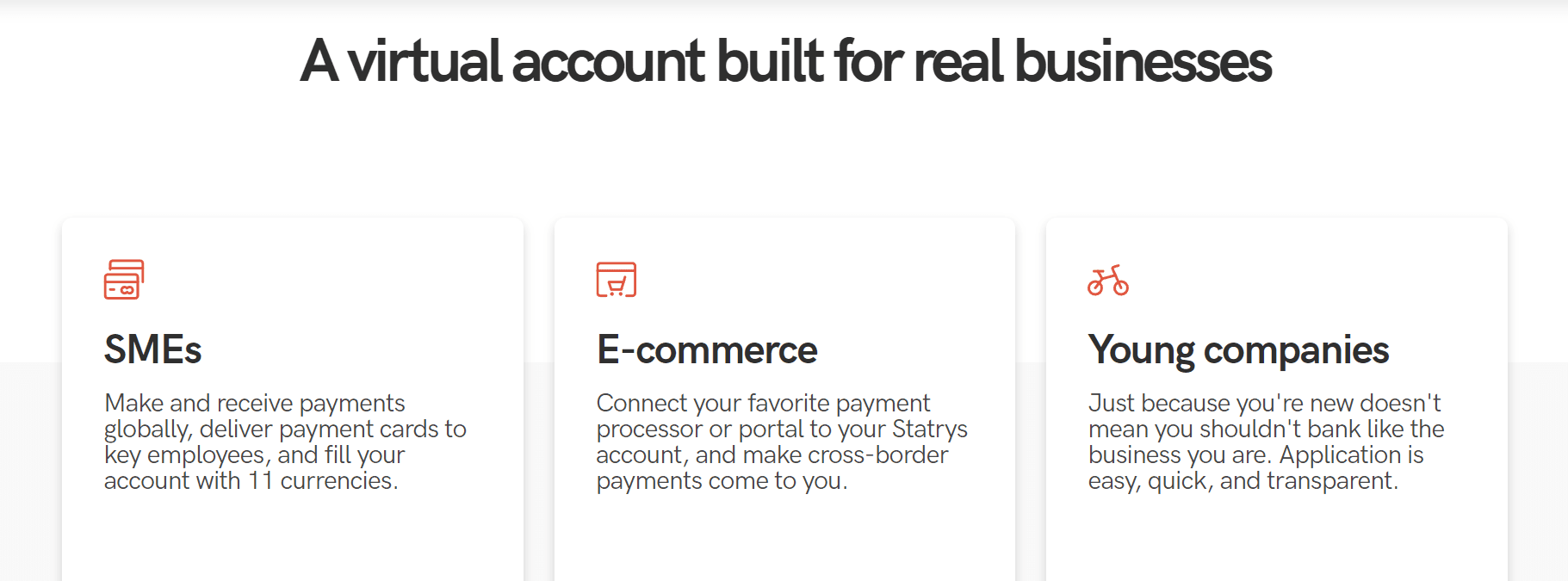

✌️ Which companies can apply for a Statrys Business Account?

Statrys Business Accounts are available to companies registered in Hong Kong, Singapore, and the British Virgin Islands.

💁♂️ What is the difference between opening a bank account with a traditional bank and Statrys?

To begin, their account opening process is entirely digital. There will be no paperwork, branch waits, or weeks of waiting! Second, you have complete control over your business's money through their platform. Pay online, add beneficiaries, see balances, and add and manage users from any location!

🙅 Is my money safe with Statrys?

They would not be in business if their customers' money was not secure. Your money is housed at a fully licensed custodian bank in Hong Kong. To ensure the safety of client money, customer accounts are kept securely separate from their business accounts at all times.

🙋♀️ Is Statrys a bank?

Statrys is not a bank; rather, they are a financial institution that has a Hong Kong Money Service Operator license (19-02-02726) and a United Kingdom Small Payment Institution license (12031334). They are controlled by the Hong Kong Customs and Excise Department and the Financial Conduct Authority in the United Kingdom.

🤷♂️ How long will it take to open an account with Statrys?

If your application is complete (i.e. all required papers are submitted on time), it will take just a few days to examine it and set up your account. Most times, an account is opened within a week.

Quick Links

Conclusion- Statrys Review 2024

For small businesses incorporated in Hong Kong, Singapore, or the BVI, Statrys offers a virtual business account with all the features you need.

It’s easy and straightforward to apply for an account – it can be done in as little as ten minutes. The review process can take less than a week – which is pretty quick when we look at the average time in the market.

The Statrys payment platform is user-friendly, updated regularly, and cheaply priced. You can access it from both desktop and mobile devices.

Statrys virtual business account comes with an array of innovative features, including FX solutions and payment cards, to help small businesses to expand.

So if you’re ready to take your business account to the next level, Statrys is the software for you.