Summary: We conduct a detailed review of TransferWise vs Western Union and discuss its features, characteristics, pricing, policies, and all the important things you need to know before making the final decision. Read the section about the TransferWise vs Western Union in the following section.

It is a better to send money internationally online. If you have to pay in cash or the recipient has to pay in cash, TransferWise has not been completed yet, do not offer this option. International money transfers become so easy with these two services.

Transferwise is an online service that allows you to send money between two different currencies means you can send international money to anywhere. They demand very competitive exchange rates, but what’s unusual about TransferWise is that they have no margin in the exchange rate.

WesternUnion is one of the world’s largest and most recognized money transfer companies in the industry, known for its payment and cash payment options. They have more than 550,000 branches in 200 countries and territories around the world. They also offer money transfers online.

Both money transfer companies are excellent options, but Transferwise is generally cheaper due to its zero exchange rate margins (while the exchange rates of Western Union are above the average market price) or “real”. However, if you need to send money to collect money or pay in cash, Western Union will offer this service, but TransferWise will not. Sending money internationally has never been easy but Western Union made life much easier.

Western Union Overview

WesternUnion is probably the oldest surviving company of its kind and certainly the largest international remittance company in the world. This company has been sending money since 1851. Although there are other trading companies, it is known as a society that bridges the gap between developed and developing countries and enables thousands of people to send money to other countries. wherever you are

Western Union is headquartered in the US, but has offices and agents around the world, and handles more currencies in more countries than any other. Send international money within a few clicks to anywhere with an awesome transfer speed.

Western Union features

- 550,000 branches and agent locations

- 150,000 ATMs and kiosks worldwide

- Operation in more than 130 currencies

- You receive cash, a bank account, a wallet or a prepaid card

- Online security center that connects directly in the event of fraud and suspicious activity

- Founded in 1851 in New York.

- Reward system based on points that lead to monetary reductions

- Awesome customer support contactable via Facebook, Twitter, Pinterest, LinkedIn, email or phone

- The Western Union Foundation promotes economic development and financial inclusion

- Regional headquarters in 19 countries.

TransferWise Overview

Transferwise is part of the new School of Digital Money Transfer Companies and was established in 2011 with the aim of ending high bank interest rates associated with international payments and to be completely transparent in all aspects of your business, including payments, prices, and exchange rates.

Transferwise has become one of the industry’s most recent success stories and has received regular awards for business success and digital innovation. The company has attracted significant investment from outside sources and uses a method of transferring funds between peers as the main basis for its operations.

TransferWise features

- Peer-to-peer platform

- Nominal transfer fees

- Transfers within 1 to 4 business days , transfer speed is amazing.

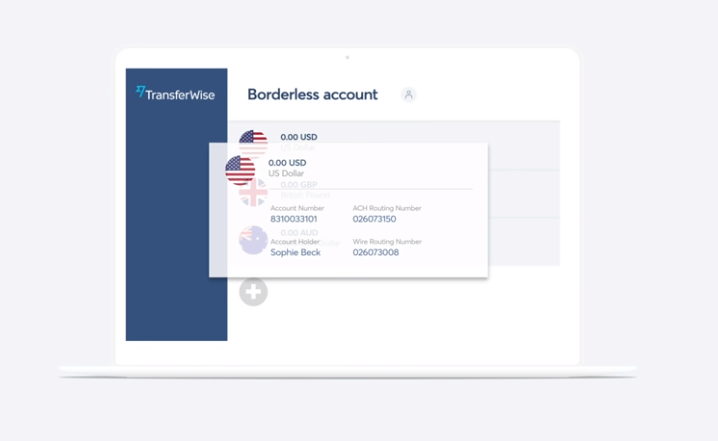

- Accounts without borders without residence abroad

- Four currencies are offered: AUD, EUR, GBP or USD

- One-time payment or repeated payment

- Find out about fees and tariffs before sending money through an online calculator

- Payments with a debit card, Apple Pay, SWIFT transfers and bank transfers

- Secure payment feature available via the TransferWise feature in Facebook Messenger

- 5 Star Trustpilot rating of more than 40,000 ratings

- Use the average rate provided by Reuters

- Customer support is amazing too.

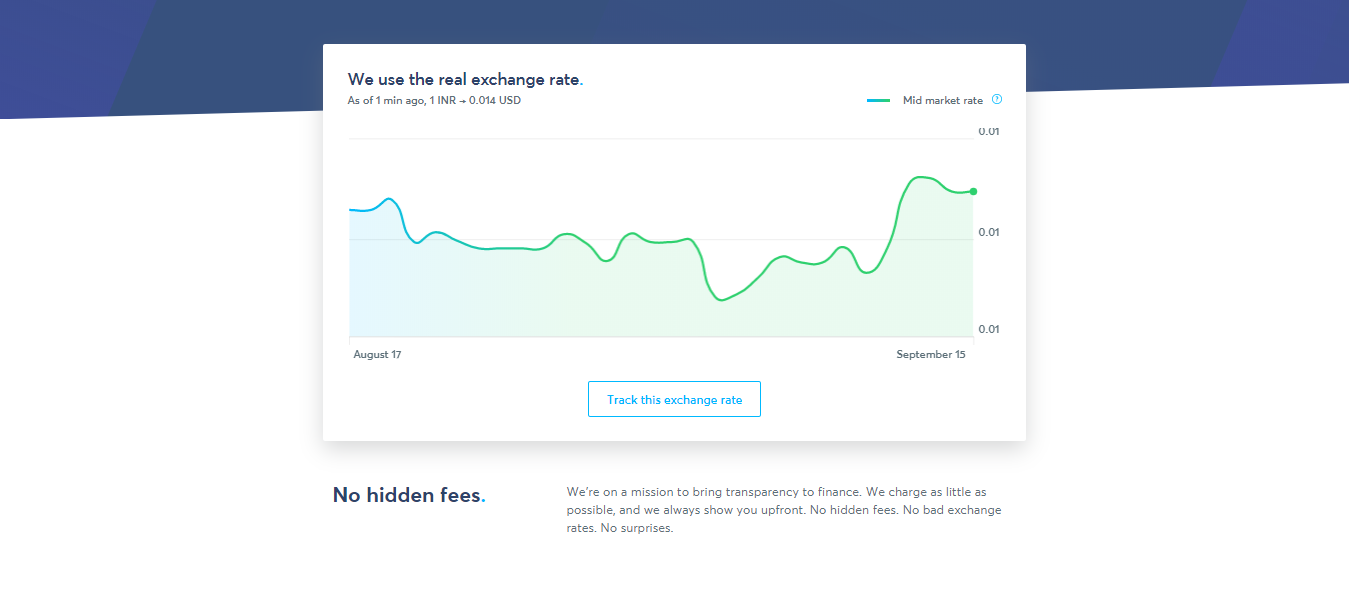

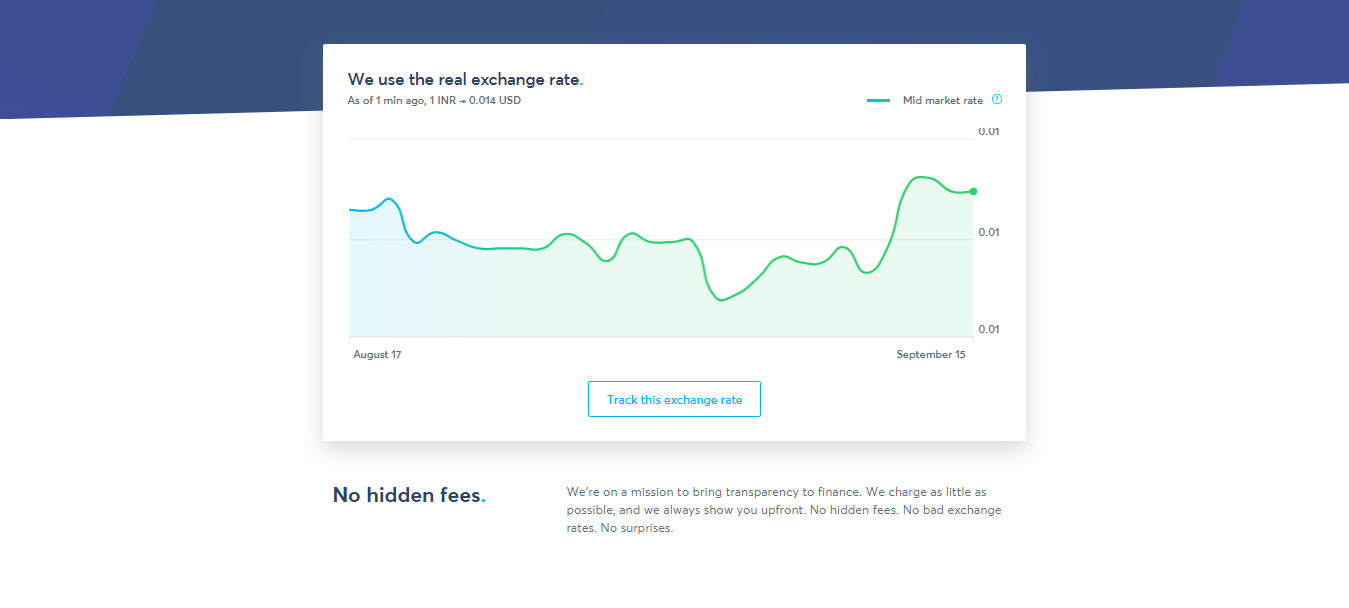

Exchange rate

The comparison between Transferwise and Western Union does not clearly indicate the favorite in this section due to the volatility of the foreign exchange market. The best solution is to compare the rates of the two companies just before a transfer.

TransferWise

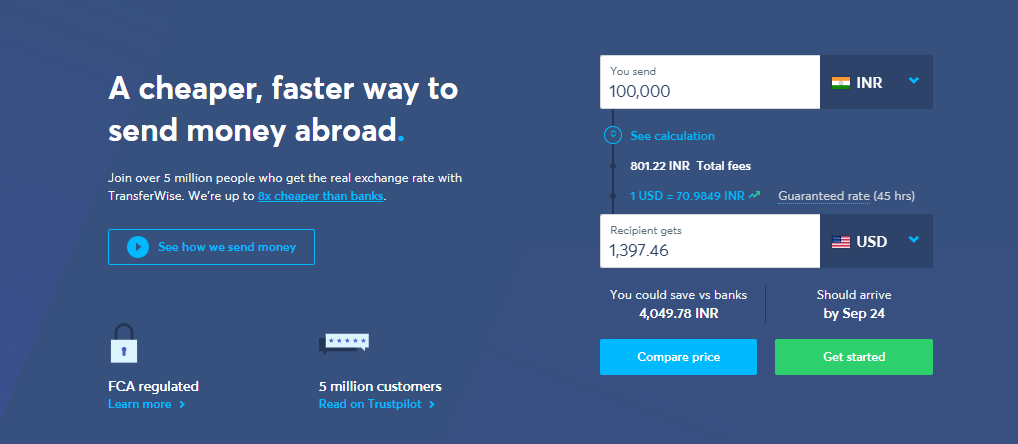

- Use the calculator on the TransferWise website to review existing exchange rates.

- TransferWise offers close to market prices.

- Discover the guaranteed exchange rate before you make a transfer.

- If you want to track exchange rates between two currencies processed by TransferWise, you can do so on their website.

- It’s free to register to receive rate notifications.

Western Union

- With Western Union Price Estimators, you can easily check current exchange rates.

- For some destinations, the exchange rate may depend on the method of transfer required.

International transfer fees

Regardless of whether you choose Transferwise Vs Western Union, cost reduction is virtually assured compared to banks.

TransferWise

- You can view the pricing structure followed by TransferWise on the website.

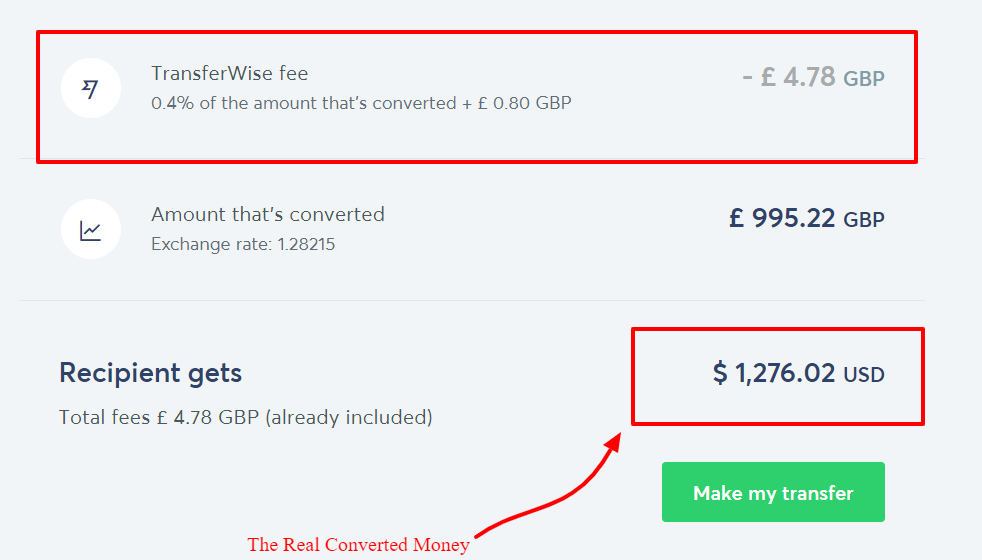

- TransferWise calculates a fixed percentage of the transfer amount, which is quite low.

- The prices to be paid may depend on the country of destination.

- The TransferWise cost breakdown table contains additional information.

Western Union

- Factors such as the method of transfer, the method of payment and the country of destination may affect the cost of your transfer.

- Transferring funds to a foreign bank account usually cost less than sending funds to a money collection agency.

- When paying by electronic transfer, rates are generally lower than those charged by debit or credit card.

- Use the estimated Western Union rate to find out how much your bank transfer will cost.

User-friendliness

Although both companies are well-rated in this section of the comparison between Western Union and Transferwise, one with the proposed transfer methods is better than the other. You can register online at both companies.

TransferWise

- With TransferWise you can use your website in English, German, Spanish, French, Italian, Hungarian, Polish, Portuguese, Russian and Japanese.

- You can use your Facebook or Google Account to sign up for TransferWise, saving you time and effort.

- The company offers services to individuals, businesses, and suppliers online.

- It allows you to pay with your debit or credit card and make electronic transfers.

- You can use TransferWise applications with Android and iOS devices.

Western Union

- You can access the Western Union website in several languages, including Spanish, Italian, French, Russian, German, and Japanese.

- You can register as an individual or as a business.

- The payment methods may vary depending on the place of residence. Your options include cash, debit cards, credit cards, and bank transfers.

- With Western Union, you can arrange your transfer online, in person or by phone.

- The transfer methods to the destination include the transfer of funds to accounts and fundraising centers as well as the replenishment of mobile wallets.

- Western Union offers you the option of transferring funds to inmates in US prisons.

Security

The comparison between TransferWise and Western Union gives both companies a good rating in this section. You do not have to worry about the security of the information you provide online because the websites of both companies depend on a high level of encryption. Both companies keep client funds in separate bank accounts.

TransferWise

- The Financial Conduct Authority (FCA) governs the activities of this UK-based company.

- A two-factor authentication system adds security to people who sign in with their Google Account.

- The new two-step TransferWise connection feature enhances the security of your personal or professional TransferWise account. If

- this feature is enabled, you will need to enter an SMS code to be sent to your mobile phone.

Western Union

- Regulators in the various US states. Western Union has been approved as an international money transfer company.

- Western Union International Bank GmbH, licensed by the Austrian Financial Markets Authority, offers online money transfer services to UK residents.

Regular foreign payments

It is not possible to plan transfers abroad in advance, regardless of whether you use TransferWise or Western Union. If you want to set up scheduled transfers, you can contact other reputable money transfer companies such as OFX, TorFX, HiFX, World First or Currency Direct.

Vouchers

Both companies offer their customers the opportunity to save money through promotional offers.

- Sign up for TransferWise and use your free coupon for up to £ 3000.

- The Western Union My WU reward program gives you loyalty points for every qualifying transfer.

Comparison of Western Union vs Transferwise services, rates, and exchange rates

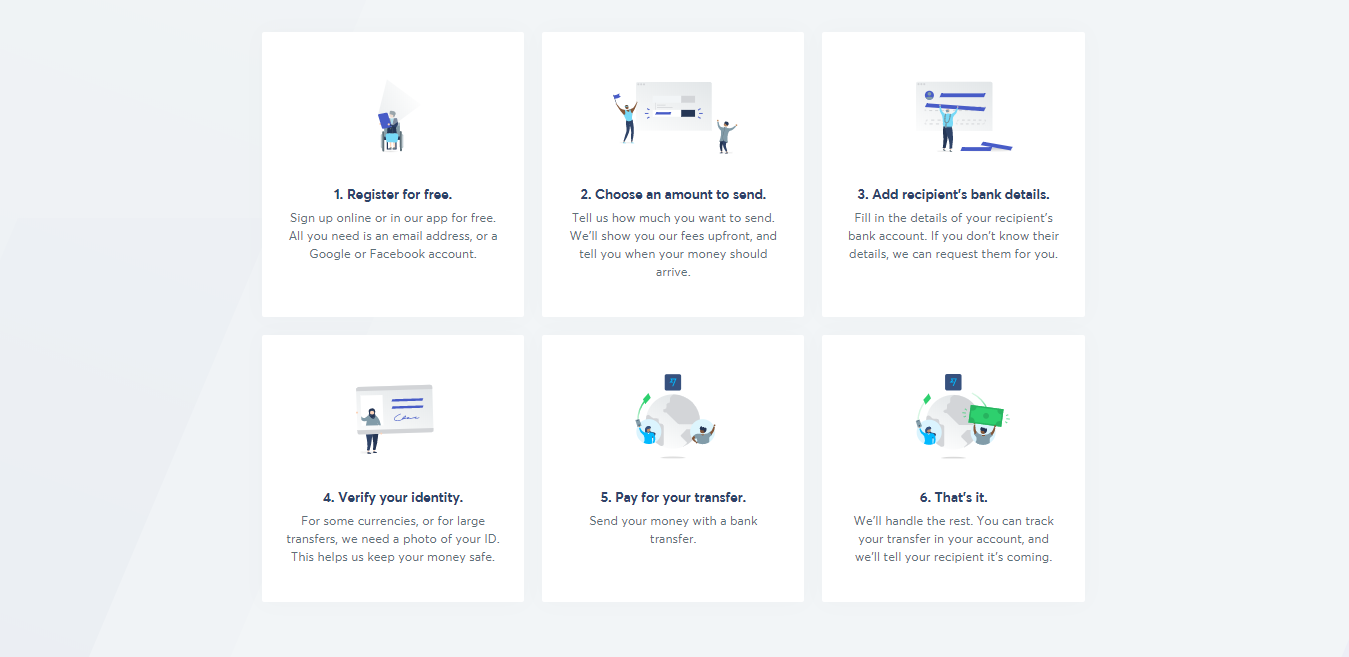

How TransferWise works:

Transfers are paid from your bank account, debit card or credit card. The money goes directly to the bank account of the recipient. The options vary depending on the combination of countries from which you are sending money.

For example, if you transfer money from the United Kingdom to India, you can pay using your debit or credit card, or directly from your bank account. However, if you send money from Germany to France, you can transfer IMMEDIATELY and the other party will receive money immediately .

Exchange rates and rates are displayed before the transfer. TransferWise also calculates the charges for you and notifies you of the charges of local banks (which you can not control).

How Western Union works:

Western Union is not just an online money transfer service. Customers can send and receive money, receive it on a bank account, a mobile wallet or a prepaid card.

You can always pay with your debit or credit card and, from some sites, transfer funds from our bank account by bank transfer through an online payment system (such as INSTANT, Trustly or Ideal). Western Union also offers a mobile application, available online through the Western Union mobile application. They also offer bill payments and money orders.

Fees

Transferwise calculates a percentage of the total amount of your transfer. This amount corresponds to approximately 0.6% to 1% of the transfer fee (depending on the currency combination). Transferwise fees vary If paying by bank transfer, no transaction fee will apply. Pay with ACH? There is a fee of 0.15% or by debit or credit card, usually from 0.3% to 2%.

It is variable; According to the TransferWise website, “most banks charge additional fees depending on the type of card used and the location of the exhibit.” The courses are always clearly displayed. If you can add local bank charges, you will be notified.

Western Union fees vary, depending on the amount you send, the countries you send money to, and the payment methods you choose. The payment of your bank transfer with a credit or debit card and the receipt of cash is sometimes the most expensive combination. In general, cash pickup from an agent is more expensive than sending funds online.

Exchange rate

The TransferWise exchange rate is set to the average standard rate. They do not increase this quota, which is unique compared to their competitors, by an additional margin.

As with other money transfer services, Western Union calculates a margin between the exchange rate offered to its customers and the average market exchange rate. Overall, we found in the tests that Western Union averaged 20% of its revenue in the currency ranges. Note that exchange rates vary depending on the payment and payment method. Exchange rates are sometimes better if you send larger quantities.

Who offers better exchange rates?

To understand who offers the best exchange rates, you must first look at the mid market rate.

This is the real exchange rate, which is the average of the buying and selling rates of a world currency, as well as the exchange rate used by banks and remittance services to conduct their transactions.

Let’s take a look at the prices proposed by Western Union and TransferWise compared to the average market price.

Western Union

Depending on the country you are sending money to, a typical Western Union exchange rate maybe 6% above the average market rate. Sending a large amount abroad means hundreds of dollars will go straight into the pockets of Western Union. But it is great for cash pickup option.

We use the example of a transfer in Euro (EUR):

- At an average market price of 1 USD = 0.96 EUR

- The Western Union exchange rate could be 1 USD = 0.88 EUR.

TransferWise

One of the main features of TransferWise compared to many other money transfer services is the exchange rate guarantee, which is exactly the average market rate, depending on the minute you make a transfer. As long as you send your money within 24 hours, you benefit from the same average market price as at the beginning of your transfer.

In other words, if you send euros to Spain and the average market price is $ 1 = $ 0.82, you will get that price.

Pros & Cons

The best money-back guarantee

Does Western Union offer a money-back guarantee?

According to our research, Western Union does not currently offer a money-back guarantee. For more information about Western Union’s money-back guarantee, visit the customer service page here. You can also check their homepage to see if Western Union has updated their money-back guarantee.

Does TransferWise offer a money-back guarantee?

Yes, Transferwise offers a money-back guarantee. For more information about the TransferWise Money Back Guarantee, visit the Customer Service page here. You can also visit the company’s home page to see if TransferWise has published additional information about its money-back guarantee.

Important points:

- With regard to fixed fees, depending on the payment method and country combination, Western Unions fluctuates so much that the fees for a transaction can sometimes be lower than for TransferWise. However, when we play with multiple combinations of countries, we find no case where Western Union fees were lower than those of TransferWise.

- In terms of the exchange rate , TransferWise is preferred.

- TransferWise is fantastic and the best option for online money transfers, but does not provide the opportunity to raise money (or pay in cash). If you need cash pickup options, Western Union is the only option.

Also Read:

- {Latest 2024} Best Referral Programs That Pay Real Cash Via PayPal or Payoneer

- Payoneer vs. Paypal | Payoneer India 2024 Review | Make 25$ FREE

- ePayments.Com: Can It Solve Online Payment Woes ?

- [Latest] 8 Best WooCommerce Payment Gateways For WordPress 2024

- Intuit QuickBooks Special Discount Coupon 2024 Save 50% (Upto 149$)

- Arcadier Review 2024: Create Your Marketplace For Products and Services for Free

FAQs: Transferwise Vs Western Union

👉How does TransferWise compare to PayPal and other money transfer services?

PayPal and other money transfer services are good for B2B and C2C transactions and Transferwise is better at sending money internationally and it is more innovative at execution.

👉How long does it take for TransferWise transactions?

It can take upto 1 to 4 business days to transfer money via TransferWise.

👉How reliable and trustworthy is TransferWise?

Its interface is really user interactive and easy to use. I have also send money via TransferWise and in my experience, it is lot more reliable and trustworthy than other money transfer services.

Conclusion: Transferwise Vs Western Union Comparison 2024

Depending on the method and transfer speed, WesternUnion may offer lower transmission rates. But the few extra dollars are worth the unbeatable currency exchange rates and fast transfer service. Send and receive money easily with Western Union.

In the end, you want to compare your options to find the service that best suits your needs.