Quick commerce, or Q-commerce, is rapidly changing how we shop, bringing everyday essentials like groceries and personal care items right to our doors within minutes.

This shift, supercharged by the pandemic, has made fast deliveries an essential part of our lives. If you want to understand this booming market and how it can benefit you, you’re in the right place.

We’ll dive deep into the latest quick commerce statistics for 2025, exploring market size, growth trends, consumer behavior, and the key players driving this exciting industry. Get ready to discover how quick commerce is not just a convenience, but a powerful opportunity.

The Phenomenal Rise of Quick Commerce: Market Size & Forecasts

The quick commerce market is experiencing explosive growth, significantly outpacing traditional e-commerce. It’s a clear indicator of our collective desire for instant gratification.

Key Quick Commerce Market Highlights:

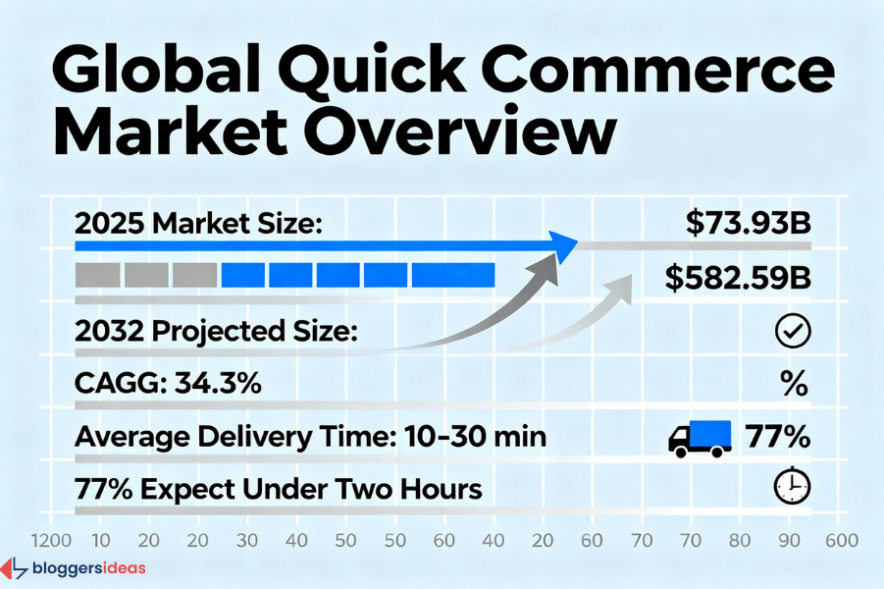

- The global quick commerce market is valued at a staggering $73.93 billion in 2025.

- Experts project this market to skyrocket to an incredible $582.59 billion by 2032, demonstrating an astonishing 7.8-fold growth in less than a decade.

- This rapid expansion translates to a Compound Annual Growth Rate (CAGR) of 34.3%, more than double the growth rate of traditional e-commerce.

- The average delivery time for quick commerce globally ranges from a swift 10 to 30 minutes.

- A remarkable 77% of customers now expect delivery within two hours, a benchmark that quick commerce platforms consistently meet.

Global Quick Commerce Market Projected Growth by Year:

Let’s look at the estimated growth of the global quick commerce market, showcasing its incredible trajectory:

| Year | Value (USD, Billions) |

| 2025 | $73.93 |

| 2026 | $105.02 |

| 2027 | $139.73 |

| 2028 | $185.91 |

| 2029 | $247.35 |

| 2030 | $329.10 |

| 2031 | $437.87 |

| 2032 | $582.59 |

Source: Statista

Demographics and User Penetration

Understanding the quick commerce user base is vital for businesses looking to enter or expand in this market. We see a clear picture of who embraces these ultra-fast delivery services.

Global Quick Commerce Users:

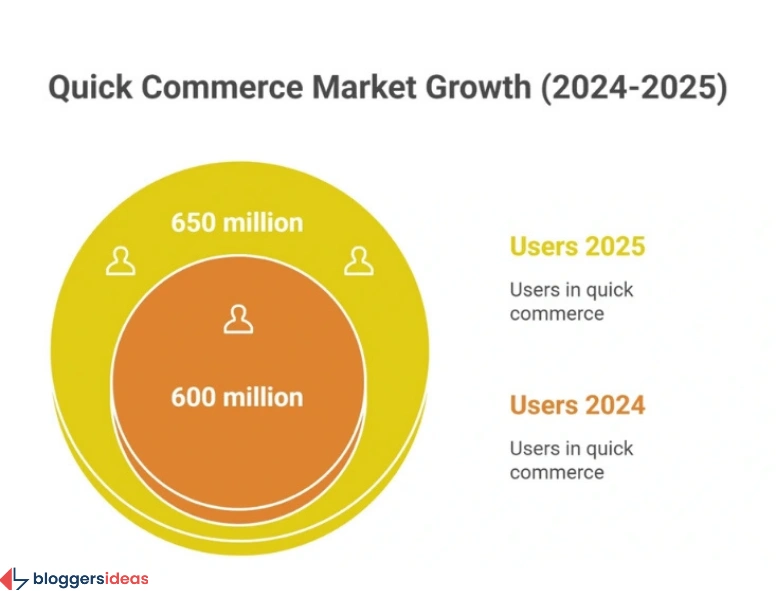

- Around 600 million people worldwide are using quick commerce services in 2024.

- This number is projected to surge to an estimated 900 million users by 2029.

- In 2025, about 8.6% of people globally are expected to use quick commerce services, climbing to 11.4% by 2030.

- On average, each global quick commerce user is expected to spend around $288.79 annually.

Quick Commerce Users in the US:

The United States also shows a significant and growing adoption of quick commerce services.

| Year | Quick Commerce Users in US (Millions) |

| 2017 | 12.2 |

| 2018 | 15.6 |

| 2019 | 20.4 |

| 2020 | 30.4 |

| 2021 | 41.5 |

| 2022 | 44.4 |

| 2023 | 50.3 |

| 2024 | 56.1 |

| 2025 | 60.1 |

| 2026 | 63.6 |

| 2027 | 66.3 |

| 2028 | 68.9 |

| 2029 | 71.5 |

Demographics by Age & Gender:

Online meal delivery services provide valuable insights into quick commerce demographics, as they share similar consumer behaviors and logistical models.

- Women consistently lead online meal delivery service usage across all age groups, peaking at 44.5% among ages 25-34.

- Usage drops sharply for ages 65+, falling to around 10% for both males and females.

Online Meal Delivery Usage by Age & Gender:

| Age Group | Male | Female |

| 16-24 | 37.9% | 41.1% |

| 25-34 | 42.3% | 44.5% |

| 35-44 | 39.7% | 42.8% |

| 45-54 | 34.2% | 37.0% |

| 55-64 | 28.2% | 28.3% |

| 65+ | 10.0% | 10.4% |

Source: Straits Research

Quick Commerce Around the Globe

The quick commerce landscape varies significantly by country, with some regions experiencing hyper-growth and intense competition.

India: The Global Leader in Growth

India stands out as the fastest-growing quick commerce market globally.

- India projects a remarkable 17% growth rate in 2025, making it the fastest globally.

- This sector will create an astounding 2.4 million blue-collar jobs by 2027.

- The demand for “dark retail space” in India will increase from 24 million square feet in 2023 to 37.6 million square feet in 2027.

- India’s quick commerce sales have skyrocketed by 280% over the past two years

- India’s quick commerce market is estimated to reach 11.08 billion by 2030.

- By 2030, around 65 million users are expected to use quick commerce services in India, with an average annual spend of about $137.20 per user.

Other Key Quick Commerce Growth Rates by Country (2025):

| No. | Country | Growth Rate |

| 1 | India | 17% |

| 2 | Japan | 9.30% |

| 3 | Germany | 8.60% |

| 4 | France | 8.50% |

| 5 | China | 8.30% |

| 6 | United Arab Emirates | 8.00% |

| 7 | United Kingdom | 7.30% |

| 8 | United States | 7.14% |

| 9 | Australia | 6.40% |

| 10 | South Korea | 6.30% |

China’s Dominance:

- China is set to generate the highest revenue globally, with about $92.68 billion in 2025 alone.

- It also leads in user penetration, with nearly a quarter (24.1%) of its population expected to use quick commerce services.

- China has approximately 2,000 dark stores, significantly more than the US.

The US Quick Commerce Market:

The US market also shows robust growth, albeit at a different pace than India.

- The US quick commerce market is expected to be worth $8.78 billion in 2025.

- It is projected to grow to $15.24 billion by 2032 with an 8.2% CAGR.

- Another projection indicates the US market will hit

- 86.70 billion by 2030 with an annual growth rate of 6.72%.

- User penetration in the US quick commerce market is predicted to increase from 17.3% in 2025 to 20.9% by 2030, with each user spending about $1,040 annually.

- In the last two years, $800 million was poured into quick commerce companies in New York City alone, highlighting investor interest.

Also read about: Amazon Statistics

Top Companies and Funding

The quick commerce landscape is highly competitive, with established players and rapidly growing startups vying for market share.

Global Top Quick Commerce Companies by Downloads (2024):

- Zepto leads with 70.58 million downloads, making it the top app in the food and drinks category.

- Four out of the top five apps (Zepto, Zomato, Swiggy, & Blinkit) operate in India, showcasing India’s dominance.

| Sr. No. | Platform | Downloads (Millions) |

| 1 | Zepto: 10-Min Grocery Delivery | 70.58 |

| 2 | Uber Eats: Food & Groceries | 42.68 |

| 3 | Zomato: Food Delivery & Dining | 41.75 |

| 4 | Swiggy Food & Grocery Delivery | 39.18 |

| 5 | Blinkit: Grocery in 10 minutes | 36.17 |

| 6 | DoorDash – Food Delivery | 26.5 |

| 7 | Ele.me | 25.39 |

| 8 | bigbasket: 10 min Grocery app | 22.48 |

| 9 | foodpanda food & groceries | 21.56 |

| 10 | Zé Delivery de Bebidas | 17.74 |

| 11 | Rappi: Food Delivery, Grocery | 16.02 |

| 12 | iFood comida e mercado em casa | 15.46 |

Quick Commerce Startup Landscape:

- Globally, there are 210 quick commerce startups.

- Of these, 88 startups are funded, with 42 having received Series A+ funding.

Top 5 Quick Commerce Services Globally and Their Funding (Till 2025):

| Sr. No. | Quick Commerce Platform | Total Funding Received Till 2025 |

| 1 | Swiggy | $3.62 billion |

| 2 | DoorDash | $2.5 billion |

| 3 | Blinkit | $757 million |

| 4 | Glovo | $1.16 billion |

| 5 | Zepto | $1.95 billion |

Top Quick Commerce Companies in India:

- Blinkit dominates India’s quick commerce sector, holding a 45% market share.

- The company recorded a Gross Order Value (GOV) of ₹9,421 crore, a 134% year-on-year increase.

- Swiggy Instamart holds a 27% market share.

- Zepto accounts for 21% of the market in India, with its revenue growing by over 1,000% in 2023.

Top Players in India’s Quick Commerce by Market Share:

| Sr. No. | Platforms | Market Share |

| 1 | Blinkit | 45% |

| 2 | Swiggy Instamart | 27% |

| 3 | Zepto | 21% |

| 4 | BigBasket Now | 7% |

Latest Market Share in India (January 2024):

- Zomato-Blinkit leads with a 40% market share.

- Swiggy-Instamart saw a decline to 32%.

- Zepto showed remarkable growth, doubling its market share to 28%.

| Year | Zomato-Blinkit | Swiggy-Instamart | Zepto |

| January 2024 | 40% | 32% | 28% |

| March 2023 | 40% | 36% | 24% |

| March 2022 | 32% | 52% | 15% |

Most Used Quick Commerce Providers in the United States:

| Quick Commerce Provider | Share of US Consumers |

| Walmart | 53% |

| Amazon | 42% |

| Costco | 26% |

| Aldi | 21% |

| Instacart | 21% |

| Blue Apron | 15% |

| Burpy | 11% |

| HelloFresh | 11% |

| Deliv | 11% |

| EveryPlate | 11% |

The Backbone of Quick Commerce: Dark Stores and Logistics

Dark stores are crucial to the quick commerce model, enabling the ultra-fast delivery times that define the industry.

- There are currently 6,000 dark stores worldwide.

- About 200 of these are in the United States (as of 2022).

- In contrast, China has around 2,000 dark stores, showcasing a massive difference in scale.

Dark Stores in India:

India’s quick commerce providers are heavily investing in dark store networks.

- India currently has 1,290 dark stores in total.

- Swiggy Instamart leads with 500 stores.

- Blinkit comes in second with 450 dark stores.

- Zepto ranks third with 340 dark stores.

Quick Commerce vs. E-Commerce: A Statistical Comparison

While both are online retail, quick commerce distinguishes itself through its speed and localized fulfillment.

| Sr. No. | Category | Quick Commerce | E-Commerce |

| 1 | Global Market Size (2025) | $73.93 billion (or $195.01 billion by 2025) | $18.77 trillion (2024 global online consumer goods revenue) |

| 2 | Global Market Size Projection | $582.59 billion (by 2032) | $75.12 trillion (by 2034) |

| 3 | CAGR | 34.3% | 14.88% |

| 4 | Delivery Speed | 10-30 minutes | 3.7 days (average) |

| 5 | Market Segment Focus | 70% concentrated in ultra-fast segment | 70% (B2B is a significant portion) |

| 6 | Customer Expectations | Matches demand for <2 hours delivery | 44% of customers willing to wait ≤2 days |

| 7 | Average Order Value / ARPU (2025) | $288.79/user (global) or $1,040/user (US) | $1.13k/user |

| 8 | Return Rates | 1-2% | 15-20% |

| 9 | Warehouse / Fulfillment | Dark stores: 1,500-2,500 sq. ft., 1,500-2,500 SKUs | Warehouses: 40,000 sq. ft., 50,000-100,000 SKUs |

| 10 | Fulfillment Cycle | 20-45 min | 1-3 days |

| 11 | Order Processing | Must be completed within ≤5 minutes for delivery readiness | Flexible order batching within fulfillment cycle |

| 12 | Geographic Concentration | 50% market in metro areas with high density | Broader regional and rural penetration |

Consumer Behavior and Preferences: Why Speed Matters

Consumers are increasingly prioritizing speed and convenience, driving the quick commerce boom.

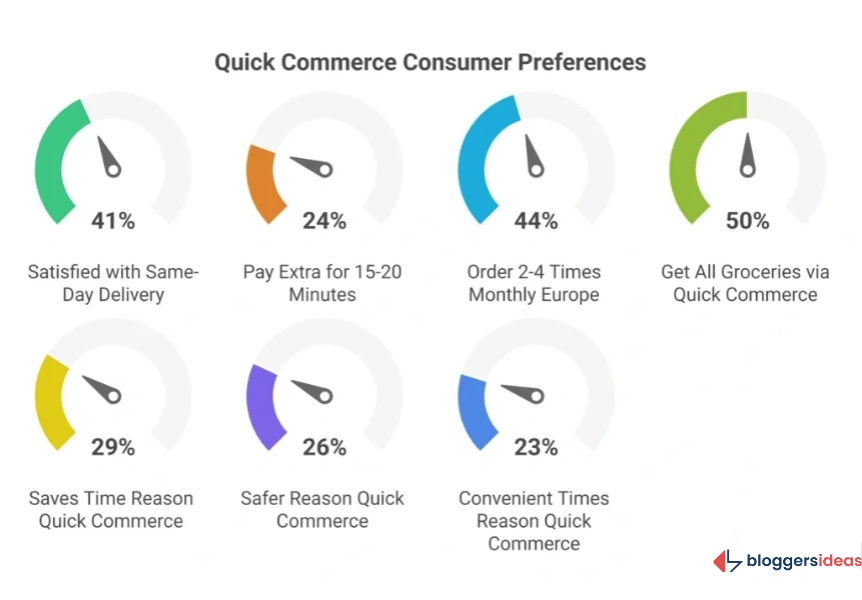

- 41% of consumers are satisfied with same-day delivery, but a significant 24% are willing to pay extra for faster service, preferring orders within an hour or two.

- 46% of consumers prioritize speed when shopping online.

- 74% emphasize convenience, and 48% focus on ease of use.

- These shifting priorities mean more consumers expect grocery orders within 30 minutes.

Reasons Consumers Prefer Quick Commerce (Online Grocery Shopping, US, 2022):

| Reason to Buy Groceries Online | Share of Consumers |

| Saves time/effort | 29% |

| Safer to shop during COVID | 26% |

| Convenient times (e.g., 24/7) | 23% |

| Delivery of products | 19% |

| Convenience of delivery | 18% |

| Easier to compare products | 17% |

| I prefer online shopping | 13% |

| Cheaper prices | 13% |

| Easier to find items I need | 13% |

| Products are always in stock | 12% |

The Evolving Landscape: Challenges and Adaptations

While quick commerce offers immense opportunities, the post-pandemic environment has presented challenges, leading to consolidation and adaptation among players.

- In the US, some quick commerce companies like Fridge No More, Buyk, and Jokr have ceased operations or exited the market due to intense competition and unsustainable unit economics.

- Established players are adjusting:

- Instacart has entered rapid delivery (15 minutes) but saw its valuation cut by 40%.

- Gopuff experienced valuation fluctuations and workforce reductions, now focusing on revenue-generating initiatives like commerce integrations and ads.

- Uber Eats and Deliveroo remain active, partnering with retailers and expanding advertising platforms to sustain their positions.

- Flink, a rapid-grocery startup, raised $150 million but its valuation is significantly lower than previous rumors.

Something New: What Users Are Asking on Quora and Reddit

Beyond the statistics, real-world user discussions on platforms like Quora and Reddit offer fresh insights into the quick commerce experience. Users are often discussing:

- “Is quick commerce really sustainable in the long run?” This speaks to the financial viability and unit economics of ultra-fast delivery, especially regarding delivery rider wages, dark store operating costs, and the true cost of convenience.

- “What are the environmental impacts of so many small, fast deliveries?” Concerns about increased traffic congestion, packaging waste, and carbon emissions from fleets of delivery vehicles are rising. Users are looking for more sustainable options.

- “How does quick commerce affect local businesses?” This is a hot topic, with debates about whether quick commerce platforms enable small businesses to reach wider audiences or if they undercut traditional local stores by offering lower prices and faster delivery.

- “What new categories will quick commerce conquer next?” Beyond groceries and essentials, users are speculating about fast delivery for pharmaceuticals, specialty foods, electronics, or even pet supplies, pushing the boundaries of what can be delivered quickly.

- “Are quick commerce algorithms becoming too good at predicting what I need?” This touches on privacy concerns and the power of data, as these platforms use AI to optimize inventory and delivery routes, leading to highly personalized (and sometimes unsettlingly accurate) recommendations.

- “What about the quality and freshness of produce from dark stores?” Users often compare the quality of items received from quick commerce (stored in dark stores) versus traditional supermarkets where they can hand-pick items. This is a critical factor for perishable goods.

- “How do quick commerce platforms handle customer service when something goes wrong with a super-fast order?” The expectation of instant resolution for instant delivery issues is high, and users share both positive and negative experiences with support teams.

These discussions highlight that while the speed and convenience of quick commerce are highly valued, users are also critically examining its broader implications on the economy, environment, and personal experience.

Businesses that address these concerns will likely build stronger, more loyal customer bases.

FAQs About Quick Commerce Statistics

1. What is quick commerce, and how is it different from traditional e-commerce?

Quick commerce delivers essentials in 10–30 minutes using nearby dark stores, while traditional e-commerce offers broader products with delivery times of several days.

2. What drives the growth of quick commerce?

Growth comes from rising demand for instant delivery, pandemic-driven habits, dense urban populations, and advances in logistics and AI.

3. Which countries lead the quick commerce market?

India leads in growth at 17% in 2025, while China leads in revenue at $92.68 billion. Japan, Germany, and France also show strong expansion.

4. How can businesses benefit from quick commerce?

Businesses can partner with platforms or build dark stores to offer fast delivery, boost customer satisfaction, and increase impulse-driven sales.

5. What are dark stores, and why are they essential?

Dark stores are small fulfillment hubs near customers that enable fast picking and delivery, making ultra-fast 10–30 minute service possible.

Also Read:

- Android Usage Statistics

- Mobile Internet Traffic Statistics

- WordPress Statistics

- AI Recruitment Statistics

- Uber Statistics

Conclusion: The Future is Fast, Smart, and Sustainable

The quick commerce market is undergoing a profound transformation, moving beyond a pandemic-driven surge to become a permanent fixture in global retail. The incredible projected growth to $582.59 billion by 2032 underscores the rising demand for instant deliveries.

With most deliveries completed in 10-30 minutes and a vast majority of customers expecting fulfillment within two hours, quick commerce is not just outpacing traditional e-commerce but reshaping consumer expectations entirely.

By 2032, we anticipate that AI-driven logistics, strategically located dark stores, and increasingly green delivery methods will make quick commerce a core pillar of how we shop and consume. This isn’t just about speed; it’s about intelligent, efficient, and ultimately, sustainable convenience.