Since its launch in November 2019, Disney Plus has rapidly grown to become a dominant force in the streaming world.

With its expansive content library featuring everything from family-friendly classics to Marvel and Star Wars sagas, Disney Plus has attracted millions of subscribers across the globe.

In 2025, the streaming service is continuing to evolve, adapting to market changes and meeting subscribers’ growing expectations.

In this article, we will dive deep into the latest Disney Plus statistics for 2025, offering insights into subscriber growth, revenue, content strategies, and ways to maximize your streaming experience.

Disney Plus Subscriber Growth: A Rapid Ascent

Disney Plus has been on an exciting trajectory since its debut. As of mid-2025, the platform boasts an impressive 128 million core subscribers.

This number includes both domestic and international users, with Disney Plus maintaining a strong global presence in over 150 countries.

However, the platform has faced some ups and downs, including slight losses in certain segments, such as Disney+ Hotstar.

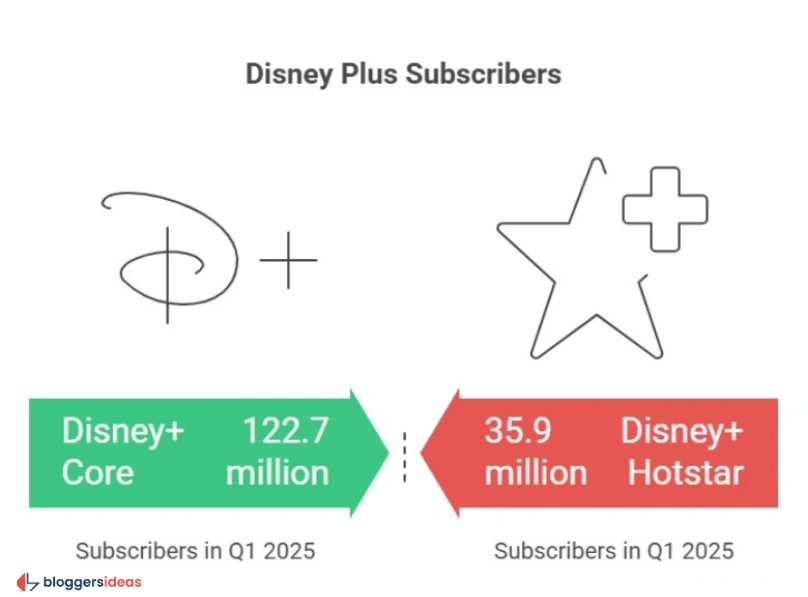

Key Subscriber Numbers (2025)

- Core Subscribers (Q1 2025): 124.6 million

- Disney+ Core Subscribers: 122.7 million (4% growth from Q3 2024)

- Disney+ Hotstar Subscribers: 35.9 million (1% growth from Q3 2024)

The Road to 128 Million Subscribers

The journey to 128 million subscribers is marked by rapid growth, especially during the pandemic when streaming services saw a huge spike in demand.

Disney Plus crossed the 50 million mark by April 2020, driven by content like The Mandalorian, which became a massive hit with audiences worldwide.

In early 2025, strategic releases such as Moana 2 and Mufasa: The Lion King provided further boosts to subscriber numbers.

Even as the platform faces challenges, including some price hikes and subscriber backlash, Disney Plus continues to build on its strong content base, offering more value to its viewers.

Quarterly Subscriber Growth (2021-2025)

Here’s a breakdown of Disney Plus’s subscriber numbers since its launch:

| Quarter | Core Subscribers (millions) | Total Including Hotstar (millions) | Growth Driver |

|---|---|---|---|

| Q1 2021 | 94.9 | N/A | Launch momentum |

| Q2 2021 | 103.6 | N/A | WandaVision debut |

| Q3 2021 | 116.0 | N/A | Loki series |

| Q4 2021 | 118.1 | N/A | Holiday bundling |

| Q1 2022 | 129.8 | N/A | Turning Red film |

| Q2 2022 | 137.7 | N/A | Obi-Wan Kenobi |

| Q3 2022 | 152.1 | N/A | Andor acclaim |

| Q4 2022 | 164.2 | N/A | Holiday specials |

| Q1 2023 | 161.8 | N/A | Price hikes |

| Q2 2023 | 157.8 | N/A | Ad-tier launch |

| Q3 2023 | 146.1 | N/A | Churn from hikes |

| Q4 2023 | 150.2 | N/A | Guardians special |

| Q1 2024 | 149.6 | 185.5 | Hotstar integration |

| Q2 2024 | 153.6 | 189.1 | Inside Out 2 |

| Q3 2024 | 153.8 | 189.3 | Deadpool & Wolverine |

| Q4 2024 | 158.6 | 194.5 | Holiday surge |

Subscriber Fluctuations in 2025

While Disney Plus’s growth remains impressive, the service has faced some challenges that have impacted its subscriber base. In Q1 2025, the platform lost approximately 700,000 subscribers, largely due to price hikes and backlash related to the suspension of Jimmy Kimmel Live! on ABC.

The backlash from viewers led to a #BoycottDisney movement, with over 1.7 million cancellations in September 2025.

However, the platform rebounded with significant content releases like Moana 2 and Mufasa: The Lion King in Q2, gaining 1.8 million subscribers.

In Q3, the surge continued with 1.4 million new subscribers, driven by major crossovers in Deadpool and Wolverine content.

Projected Subscriber Growth for 2025

By the end of 2025, Disney Plus is projected to reach 132.5 million core subscribers, with ad-tier adoption playing a crucial role in growth.

The ad-supported tiers are expected to reach 30% adoption globally, generating additional revenue for the platform. Password-sharing crackdowns are also expected to add 4.4 million subscribers by Q4.

| Quarter | Core Subscribers (millions) | Net Change (millions) | Influencing Events |

|---|---|---|---|

| Q1 2025 | 124.6 | -0.7 | Price hikes, Kimmel suspension |

| Q2 2025 | 126.2 | +1.8 | Moana 2, Mufasa premieres |

| Q3 2025 | 128.0 | +1.4 | Daredevil: Born Again; Boycott backlash |

| Q4 2025 | 132.2 | +4.4 | Holiday specials, password crackdowns |

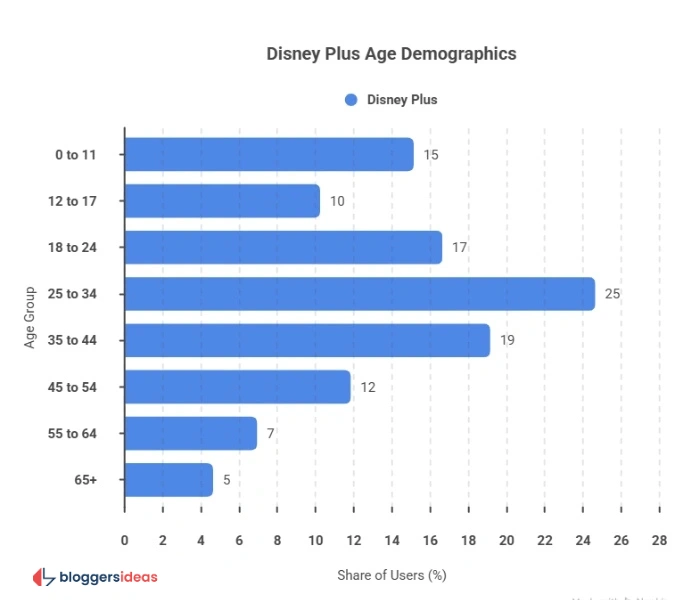

Subscriber Demographics: Who’s Watching Disney Plus?

Understanding Disney Plus’s user demographics is crucial to the platform’s content strategy.

The platform appeals to a wide audience, including families, young adults, and older viewers who enjoy nostalgic content.

Here’s a breakdown of the most prominent age groups among Disney Plus subscribers:

| Age Group | Share of Subscribers | Recommended Content |

|---|---|---|

| 0-11 years | 15.2% | Pixar shorts for kids’ playtime |

| 12-17 years | 10.3% | Teen dramas, like Zombies |

| 18-24 years | 16.7% | Marvel series and Star Wars |

| 25-34 years | 24.7% | Star Wars deep dives |

| 35-44 years | 19.2% | Family bundles, Pixar classics |

| 45-54 years | 11.9% | The Simpsons marathons |

| 55-64 years | 7.0% | National Geographic docs |

| 65+ years | 4.7% | Nostalgic Disney classics |

The platform also sees a fairly balanced gender distribution in the U.S., with 55% male and 45% female users, making Disney Plus appealing to a broad spectrum of tastes.

Disney Plus’s Financial Performance

Disney Plus’s financial trajectory continues to improve as the platform strengthens its foothold in the streaming market.

For the fiscal year 2024, Disney Plus generated $10.4 billion in revenue, which was a 21.6% increase compared to 2023’s $8.4 billion.

This growth was fueled by higher average revenue per user (ARPU) and increased ad-supported subscriptions. In 2025, Disney Plus is projected to exceed $11.2 billion in revenue.

| Year | Revenue ($ Billions) | ARPU | Growth (%) |

|---|---|---|---|

| 2020 | 2.8 | 5.50 | N/A |

| 2021 | 5.3 | 6.20 | 89.3 |

| 2022 | 7.4 | 6.50 | 39.6 |

| 2023 | 8.4 | 6.70 | 13.5 |

| 2024 | 10.4 | 7.20 | 23.8 |

| 2025 (proj.) | 11.2 | 7.55 | 7.7 |

The platform’s revenue mix includes 30% from ad-supported tiers, with U.S. revenue rising due to the increased demand for these affordable options.

Retention rates also improved, with 68% of subscribers staying with Disney Plus after six months, especially those who bundled Disney Plus with other services like Hulu and ESPN+.

Disney Plus’s Market Share and Competition

Disney Plus remains one of the top contenders in the streaming market, though it faces intense competition. In the U.S., it holds 12% of the subscription video-on-demand (SVOD) market.

While it lags behind Amazon Prime Video (22%) and Netflix (21%), it remains ahead of Max (13%) and Hulu (10%).

| Platform | Market Share | Subscribers (Millions) | Strengths for Users |

|---|---|---|---|

| Amazon Prime Video | 22% | 200+ | Bundled with shopping perks |

| Netflix | 21% | 280 | Original content variety |

| Max | 13% | 100 | HBO prestige |

| Disney Plus | 12% | 128 core | Family, MCU exclusives |

| Hulu | 10% | 55.5 | Live TV, current shows |

| Paramount+ | 9% | 71 | CBS News & Sports |

| Apple TV+ | 8% | 25 | High-production originals |

| Peacock | 1% | 34 | NBC live events |

Making the Most of Disney Plus

If you want to make the most of your Disney Plus subscription in 2025, here are some tips:

- Leverage bundles: Bundling Disney Plus with Hulu or ESPN+ offers savings of up to 40%. The ad-supported tiers are great for budget-conscious viewers.

- Subscribe during content releases: Sign up during major content drops like Daredevil: Born Again or the latest Marvel series to get the most out of your subscription.

- Download for offline use: Use Disney Plus’s download feature to take your favorite movies and shows on the go, especially useful for family trips or long commutes.

FAQs About Diney Plus Statistics

1. How many Disney Plus subscribers are there in 2025?

As of mid-2025, Disney Plus has 128 million core subscribers, with a total of 163.9 million including Hotstar.

2. What is Disney Plus’s revenue for 2024?

Disney Plus generated $10.4 billion in revenue in 2024, showing a 21.6% growth year-over-year.

3. What age group dominates Disney Plus viewership?

The largest group of viewers is aged 25-44, making up 43.9% of the subscriber base.

4. What is Disney Plus’s market share in the U.S.?

Disney Plus holds a 12% market share in the U.S., ranking fourth behind Amazon Prime Video, Netflix, and Max.

5. How can users maximize their Disney Plus subscription?

Users can maximize their subscription by bundling with Hulu or ESPN+, timing subscriptions with new content releases, and using offline downloads.

Also Read:

- Facebook Users Statistics 2026

- Digital PR Statistics 2026

- TikTok User Statistics 2026

- Screen Time Statistics 2026

- Link Building Statistics 2026

Conclusion

Disney Plus continues to evolve, balancing rapid growth with occasional setbacks like price hikes and subscriber churn.

Despite these challenges, the platform remains a leading force in the streaming world, attracting millions of subscribers worldwide with its family-friendly content, iconic franchises, and ever-expanding library.

Whether you’re a casual viewer or a die-hard Disney fan, these statistics provide valuable insights into how Disney Plus continues to thrive in the competitive streaming landscape.