Entrepreneurs, investors, and developers actively explore blockchain technology in 2025 because it delivers unmatched security, transparency, and efficiency across industries.

Over 560 million people worldwide—nearly 4% of the global population—use blockchain, while 659 million own cryptocurrencies, marking a 13% year-over-year increase.

The market surges from $41.15 billion today to a projected $1,879.30 billion by 2034 at a 52.90% CAGR, with U.S. contributions alone hitting $619.28 billion.

You gain direct advantages by implementing blockchain: enterprises cut costs through supply chain tracking, individuals secure assets via wallets, and startups launch DeFi apps earning yields up to 20%.

These blockchain statistics 2025 reveal adoption patterns, regional leaders, and emerging risks, empowering you to integrate the technology for competitive edges in finance, healthcare, gaming, and beyond.

This detailed guide combines verified data from global reports, analyzes transaction volumes exceeding $10 trillion, and incorporates fresh Quora and Reddit insights on AI-blockchain hybrids and post-quantum security, helping you apply strategies that boost ROI and mitigate threats.

Global User Adoption and Wallet Growth in Blockchain 2026

You witness explosive user growth as blockchain transitions from niche to mainstream. More than 560 million individuals engage with the technology, equating to 3.9% of the world’s population.

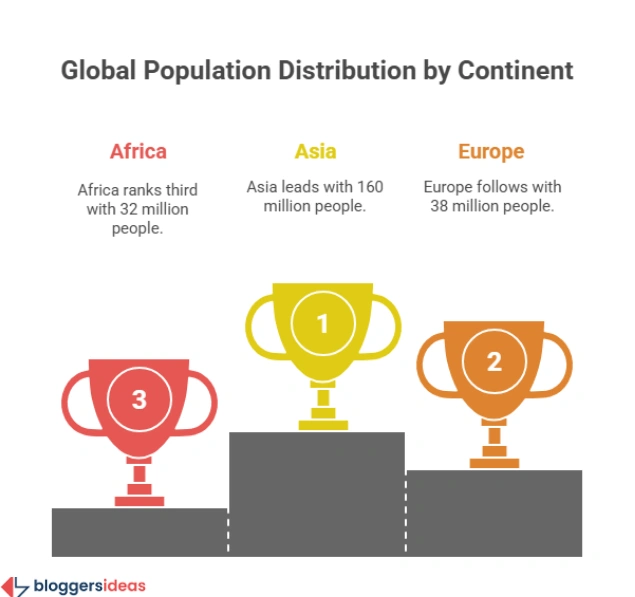

Asia dominates with 160 million users, driven by mobile-first economies and crypto-friendly policies in countries like India and Vietnam.

Europe follows with 38 million, Africa 32 million, North America 28 million, South America 24 million, and Oceania just 1 million.

Blockchain wallets, essential for storing digital assets, exceed 85 million globally, up from 10.69 million in 2016—a 700% surge. This growth accelerates: 2022 recorded 85.08 million wallets, 2021 hit 80.24 million, and projections for 2025 push beyond 100 million as Layer 2 solutions reduce fees.

| Region | Blockchain Users (Millions) |

| Asia | 160 |

| Europe | 38 |

| Africa | 32 |

| North America | 28 |

| South America | 24 |

| Oceania | 1 |

Cryptocurrency ownership reaches 659 million by late 2024, rising from 583 million in 2023 and 617 million mid-year. Bitcoin holders alone represent 4% of the global population—over 325 million people—solidifying its status as digital gold.

You benefit by starting with a non-custodial wallet like MetaMask, enabling seamless DeFi participation and earning passive income through staking.

| Year | Blockchain Wallet Users (Millions) |

| 2022 | 85.08 |

| 2021 | 80.24 |

| 2020 | 63.48 |

| 2019 | 44.51 |

| 2018 | 31.91 |

| 2017 | 19.34 |

| 2016 | 10.69 |

Source: Statista

Market Size Projections and Economic Impact

The blockchain market values at $41.15 billion in 2025, expanding to $32.69 billion in core technology and $55.54 billion by year-end under broader estimates.

Forecasts diverge but converge on trillion-dollar scales: one predicts $162.84 billion by 2027, another $1,879.30 billion by 2034 at 52.90% CAGR, and alternatives target $1.43 trillion or $1.24 trillion by 2030 via Blockchain 4.0 with AI interoperability.

Global spending on solutions hits $19 billion in 2024, up from $0.95 billion in 2017—a 20-fold increase. You invest wisely by focusing on high-growth segments like DeFi, where TVL rebounds 137% to $129 billion.

| Year | Market Size (Billion USD) |

| 2034 | 1,879.30 |

| 2030 | 1,431.54 |

| 2027 | 162.84 |

| 2025 | 55.54 |

| 2024 | 32.69 |

| 2023 | 19.36 |

| 2022 | 11.54 |

U.S. market alone grows from $8.7 billion in 2024 to $619.28 billion by 2034. North America generates 40%+ of global revenue, while Asia-Pacific expands at 61.8% CAGR.

Business value added reaches $360 billion by 2026 and $3.1 trillion by 2030. You capitalize by tokenizing assets—real estate or art—unlocking liquidity and fractional ownership.

Also read about: Total Number of Cryptocurrencies: 2025 Stats

Cryptocurrency Ecosystem and Active Tokens

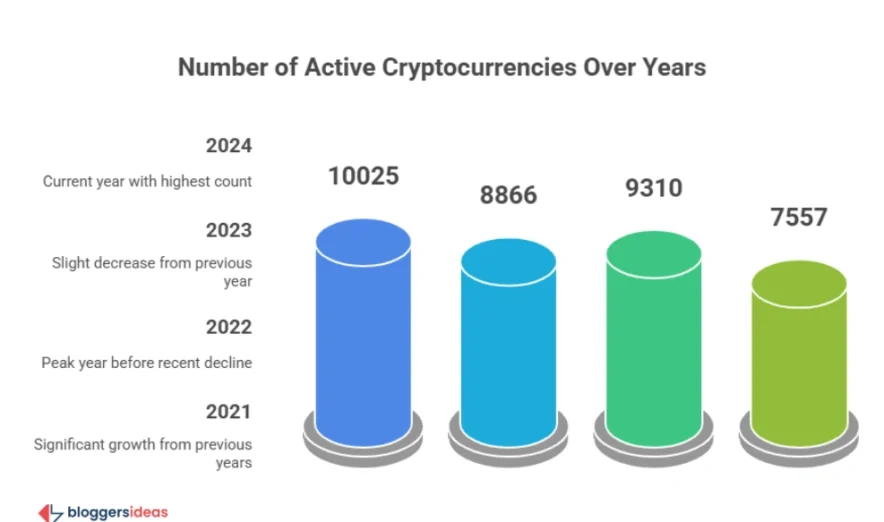

Over 20,000 cryptocurrencies launch historically, but 10,025 remain active in 2025, up from 8,866 in 2023. Bitcoin’s market cap hits $2.04 trillion—45% of the $4.5 trillion total crypto market—with prices surpassing $100,000 post-halving.

Ethereum circulates 129.17 million ETH at $2,249 per token, market cap $270.33 billion.

Daily Bitcoin transactions average 400,000+, peaking at 737,521 in June 2024; Ethereum processes 1,087,720 daily. Blockchain sizes grow: Bitcoin nears 500 GB, Ethereum expands via shards.

| Year | Active Cryptocurrencies |

| 2024 | 10,025 |

| 2023 | 8,866 |

| 2022 | 9,310 |

| 2021 | 7,557 |

Source: Fortune Business Insights

You diversify portfolios with Solana (7.3% DeFi TVL) for low-fee trades or stablecoins like Tether, backed by $600 million institutional funding.

User Demographics and Inclusion Trends

Males adopt twice as often: 22% use crypto versus 10% females; 16% men invest in blockchain tech versus 7% women. In the U.S., 62% owners are White, 24% Hispanic, 8% Black, 6% Asian.

Millennials dominate at 57%, Gen Z 13%, Gen X 20%, Boomers 10%—median age 45 debunks youth-only myths. 28% U.S. adults (66 million) own crypto, 67% male, two-thirds planning increases; 14% non-owners enter in 2025.

| Demographic | U.S. Crypto Ownership % |

| White | 62 |

| Hispanic | 24 |

| Black | 8 |

| Asian | 6 |

You target underserved groups—women via educational NFTs or emerging markets with mobile wallets—to expand reach.

Also read about: 10 Best Bitcoin and Crypto Affiliate Programs Of 2025

Enterprise Adoption and Industry Integration

Nearly 90% businesses deploy blockchain, 87% plan investments; 86% see touchless process enhancements, 91% expect verifiable ROI in five years. 80%+ Fortune 500 companies use it, 81 of top 100 public firms incorporate (65 fully).

77% executives view non-adoption as disadvantage; 56% predict industry disruption. Leading networks: Hyperledger Fabric (26 companies), Ethereum (18).

| Company | Blockchain Used |

| Adobe | Ethereum |

| Allianz | Hyperledger/Corda |

| Baidu | XuperChain |

| BHP | MineHub/Hyperledger |

Banking leads with 29.7% market share, followed by manufacturing (22.3% combined). 3 in 10 banks adopt; 90%+ U.S./Europe banks pilot.

Healthcare penetrates 15% by 2030 for secure records. You implement supply chain tracking—reducing fraud 42%—or smart contracts for automated payments.

Regional Leadership and Government Initiatives

India tops adoption (index 1), followed by Nigeria, Vietnam, U.S. (0.37), U.K. (0.12). Asia-Pacific startups grow 72% YoY; Dubai fully blockchains government transactions, saving millions. 20+ countries pilot: voting, IDs, land registries. You enter high-adoption markets like Philippines for remittance apps, cutting fees 90%.

| Rank | Country |

| 1 | India |

| 2 | Nigeria |

| 3 | Vietnam |

DeFi, NFTs, and Gaming Ecosystems

DeFi TVL hits $129 billion (137% YoY), peaking $200 billion early 2024; Ethereum 55%, Solana 7.3%. NFT sales reach $8.83 billion in 2024 (1.1% up), Ethereum all-time $44.9 billion.

Blockchain gaming markets to $65 billion by 2025 via P2E. Public chains host 60% dApps; hybrid 42% enterprise market. You earn via liquidity pools (5-20% APY) or NFT flips on OpenSea.

Also read about: 17+ Best Crypto Ad Networks 2025: Where Should You Invest?

Investment and Funding Landscape

VC pours $11.5 billion into 2,150+ deals in 2024, 60% early-stage. You attract funding by building on Solana for scalability or integrating AI for predictive analytics.

Security Risks and Fraud Mitigation

Losses drop 54% to $1.8 billion in 2023 from $3.8 billion 2022, but incidents rise 90% to 319. Ronin heist: $620 million. U.S. scams: $5.6 billion. You protect with hardware wallets, multi-sig, and audits—recoveries hit $231.7 million.

| Heist | Loss (Million USD) | Date |

| Ronin | 620 | Mar 2022 |

| Poly | 610 | Aug 2021 |

Bitcoin and Ethereum Performance Metrics

Bitcoin processes 400K+ daily transactions, blockchain ~500 GB. Ethereum: 1M+ daily, infinite supply. Halving pushes BTC to $400K predictions. You mine or stake for rewards.

Emerging Trends from Quora and Reddit 2025

Reddit r/blockchain debates post-quantum cryptography—users ask migrating ETH to lattice-based algos; implement via zk-proof upgrades for 2030 threats.

Quora queries AI-blockchain oracles: Chainlink integrations predict markets 95% accurately—deploy for DeFi lending. Community seeks sustainable mining: proof-of-stake cuts energy 99%; switch Solana.

Web3 identity: DID standards rise—use for KYC-free access. Tokenization of real-world assets (RWAs): $10T potential by 2030—fractionalize property via Centrifuge.

You future-proof with hybrid chains, consent-based data sharing amid privacy laws.

Practical Strategies to Leverage Blockchain for Your Benefit

You start small: create an Ethereum wallet, buy $100 BTC for long-term hold (historical 200%+ annual returns). Businesses deploy Hyperledger for procurement—42% cite security gains.

Developers build dApps on Solana—transactions under $0.01. Investors stake ETH for 5-8% yields. Mitigate risks: enable 2FA, diversify 10% portfolio. Scale with RWAs or CBDC pilots.

| Strategy | Benefit |

| Wallet Setup | Secure Asset Control |

| Staking | Passive Income |

| Smart Contracts | Automated Efficiency |

94% executives plan increases—adopt now for first-mover advantages.

FAQs About Blockchain Statistics

1. What key global adoption metrics highlight blockchain's reach in 2025, and how can individuals start benefiting immediately?

Over 560 million people use blockchain (3.9% population), with 659 million owning crypto; individuals benefit by downloading a wallet like Trust Wallet, purchasing Bitcoin via exchanges, and staking for 5-10% annual yields while securing assets against inflation.

2. How do market size projections vary for blockchain in 2025 and beyond, and what investment strategies align with this growth?

Markets range $41.15 billion now to $1,879 billion by 2034 (52.90% CAGR) or $1.43 trillion by 2030; align by allocating 5-15% portfolios to BTC/ETH ETFs, tokenizing assets for liquidity, or funding DeFi protocols yielding double-digit returns.

3. Which industries lead blockchain enterprise adoption in 2025, and how do businesses implement it for competitive advantages?

Banking holds 29.7% share, 90% firms deploy; businesses implement Hyperledger for supply chains (42% fraud reduction) or Ethereum smart contracts for automated payments, cutting intermediaries and boosting efficiency 30%.

4. What security risks persist in blockchain 2025 despite declining losses, and what practical steps protect users and enterprises?

Losses fell 54% to $1.8 billion but incidents rose 90%; protect with hardware wallets, multi-signature approvals, regular audits, and quantum-resistant upgrades to recover funds and prevent breaches like Ronin’s $620 million heist.

5. How do emerging community trends from Quora and Reddit influence blockchain applications in 2025, and how can you apply them?

Trends include AI oracles for 95% accurate predictions and RWA tokenization ($10T potential); apply by integrating Chainlink for DeFi lending or platforms like RealT for fractional real estate, unlocking new revenue in predictive markets and illiquid assets.

Also Read:

- Android Usage Statistics

- Facebook Users Statistics

- Mobile Internet Traffic Statistics

- AI Recruitment Statistics

- Google Chrome Statistics

Conclusion

These 100+ blockchain statistics 2025 demonstrate irreversible momentum: 659 million crypto owners, $10 trillion transactions, 80% Fortune 500 adoption, and markets nearing $2 trillion by 2034.

You transform operations—slash costs 30% in supply chains, secure data immutably, or generate yields in DeFi. Asia leads users, banking deployments; mitigate $1.8 billion frauds with best practices.

Integrate AI, quantum-resistant tech, and RWAs to stay ahead. Early adopters capture $3.1 trillion value by 2030—launch your blockchain journey today for sustained prosperity in a decentralized world.