In the bustling world of e-commerce, Amazon seller statistics for 2025 paint a vivid picture of opportunity and innovation, where over 9.7 million registered sellers worldwide compete and collaborate to tap into a marketplace generating projected revenues of $700 billion.

Aspiring entrepreneurs discover a platform that not only hosts 350 million unique products but also empowers small businesses to reach 310 million active customers, many of whom complete purchases in under 15 minutes thanks to seamless Prime perks.

Established sellers refine their approaches using data-driven insights, such as the 82% adoption of Fulfillment by Amazon (FBA), which boosts sales by 30-50% through reliable logistics.

This in-depth guide combines the latest trends and figures to help you navigate Amazon’s ecosystem, offering practical tips on product selection, fulfillment choices, and revenue optimization tailored for beginners and veterans alike.

Whether you aim to launch a side hustle generating $10,000 monthly or scale to seven figures, these statistics reveal how you can leverage Amazon’s tools—like AI-powered listings and Prime Day promotions—for sustainable growth.

Recent Quora discussions highlight sellers’ fascination with AI integration, with one thread from early 2025 questioning, “How do I use Amazon’s generative AI to optimize listings without losing authenticity?”

Responses emphasize testing tools like Rufus for personalized recommendations, which enhance conversion rates by 15-20% while maintaining brand voice.

Amazon, founded in 1995 as an online bookstore, has blossomed into the world’s largest e-commerce giant, operating in 20 marketplaces across 100+ countries and supporting 105 languages.

By 2025, it processes 12 million items daily in the U.S. alone, equating to 143 products per second, and commands 37.6% of U.S. e-commerce sales—far ahead of Walmart’s 6.4%. For you, this dominance means instant access to a loyal audience: 66% of U.S. consumers begin product hunts on Amazon, prioritizing its reviews (read by 75% before buying) and fast shipping.

Reddit’s r/AmazonSeller buzzes with 2025 queries like “Is FBA still viable amid rising fees?” where veterans share success stories of 20% net margins through niche wholesale, underscoring Amazon’s resilience despite challenges like inflation affecting 29% of sellers.

The Scale of Amazon’s Seller Ecosystem

Amazon’s seller base expands rapidly, with 9.7 million registered accounts globally in 2025, up from 9 million in 2024, as approximately 3,700 new sellers join daily.

Active participants number around 2.5 million, focusing on promotion and sales, while 1.9 million hail from the U.S., representing 60% of the total.

This growth stems from Amazon’s low barriers—anyone with a product and $39.99 monthly fee can start—yet only 58% achieve profitability in their first year, per Jungle Scout data.

Internationally, the UK boasts 281,257 sellers, Germany 244,425, and emerging markets like India surge with 200,000+, fueled by its status as Amazon’s fastest-growing marketplace.

For your benefit, this scale signals a vibrant community: join seller forums for peer advice, or use tools like Helium 10 to scout low-competition niches amid the influx.

Quora users in 2025 debate entry strategies, with one noting, “With 1.3 million projected newcomers, focus on underserved categories like sustainable home goods to avoid saturation.”

Reddit threads echo this, warning of fierce competition but praising diversification to Walmart or Shopify for 20-30% additional revenue streams.

The table below details Amazon sellers by key countries in 2025:

| Country | Number of Sellers | Share of Global Total (%) | Growth Tip for You |

| United States | 1.9 million | 60 | Leverage U.S.-centric ads for quick wins |

| United Kingdom | 281,257 | 5.3 | Optimize for local trends like eco-products |

| Germany | 244,425 | 4.6 | Prioritize multilingual listings |

| Italy | 216,690 | 4.1 | Target fashion niches with visuals |

| France | 211,859 | 4.0 | Use FBA for fast EU delivery |

| India | 200,000 | 3.8 | Capitalize on mobile shoppers |

Use this distribution to expand globally—start in the U.S. for volume, then localize for Europe to boost international sales by 25%.

Also read about: 10 Best Amazon Proxy Providers

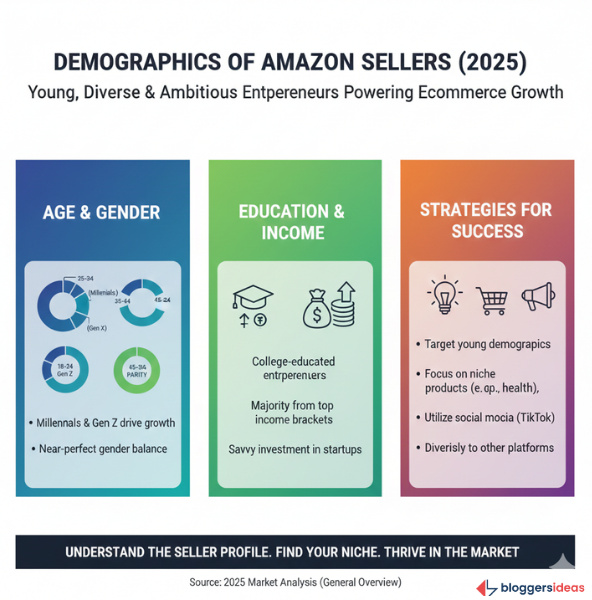

Demographics of Amazon Sellers

Amazon sellers in 2025 skew young and balanced by gender, with 33% aged 25-34, followed by 31% in 35-44, reflecting a wave of millennial and Gen Z hustlers drawn to flexible income.

The 18-24 group claims 11%, while older brackets taper: 15% (45-54), 7% (55-64), and 3% (65+). Gender parity nears perfection at 53% male and 47% female, up from 2023’s slight male tilt, as women-led brands thrive in beauty and wellness.

Educationally, 34% hold college degrees, and 48% hail from top U.S. income quartiles, enabling savvy investments like $1,000 starters (25% of launches).

This profile empowers you: if you’re a 30-something professional, mirror peers by bootstrapping with savings (77% do), targeting niches like health products where young demographics drive 17% of sales.

Reddit’s r/FulfillmentByAmazon in March 2025 asked, “How do demographics affect product choice?” Top replies urged Gen Z-focused items like tech gadgets, yielding 20% higher engagement via TikTok integrations.

Examine seller age distribution in the table:

| Age Group | Percentage (%) | Common Strategies for Success |

| 18-24 years | 11 | Low-inventory dropshipping |

| 25-34 years | 33 | AI-optimized listings |

| 35-44 years | 31 | FBA for scaling |

| 45-54 years | 15 | Wholesale for stability |

| 55-64 years | 7 | Niche consulting add-ons |

| 65+ years | 3 | Passive income via bundles |

Align your approach—younger sellers excel in trends, so use Amazon’s AI tools for 34% faster listing creation.

Also read about: Amazon Statistics

Top Product Categories:

Sellers gravitate toward evergreen categories in 2025, with Home and Kitchen dominating at 35% of small-to-medium businesses, followed by Beauty and Personal Care (26%), Clothing, Shoes, and Jewelry (20%), Toys and Games (18%), and Health, Household, and Baby Care (17%).

These choices reflect consumer priorities: 71% source from China for cost efficiency, but U.S. tariffs push 38.4% toward domestic suppliers, reducing duties. Emerging trends favor sustainability—eco-kitchenware sees 15% YoY growth—while AI aids 34% in listing optimization.

You benefit immensely: scout Home and Kitchen via Jungle Scout for $100K+ potential, bundling items to lift average order value by 25%.

Quora’s 2025 query, “Profitable FBA products amid tariffs?” recommends beauty niches, where 26% share yields 11-25% success rates. Reddit sellers tout toys for Prime Day spikes, with one post claiming 50% revenue jumps from seasonal bundles.

Top categories table for SMB sellers:

| Product Category | Share (%) | Sourcing Tip for Profitability |

| Home and Kitchen | 35 | Bundle with eco-materials |

| Beauty and Personal Care | 26 | Use AI for personalized recs |

| Clothing, Shoes, and Jewelry | 20 | Focus on U.S. manufacturing |

| Toys and Games | 18 | Time for holiday surges |

| Health, Household, Baby Care | 17 | Emphasize reviews for trust |

Prioritize these for 30% sales uplift via FBA eligibility.

Also read about: Shopify Statistics

Fulfillment Models

FBA reigns supreme in 2025, adopted by 82% of sellers for its Prime badge, which sways 90% of buys, versus 34% sticking with FBM for control. FBA cuts shipping costs 70% per unit, enabling global reach in 20 marketplaces, and 64% of users turn profitable in year one with 11-25% success rates.

Challenges persist—29% cite inflation, 23% recession fears—but AI tools mitigate via 14% social content efficiency.

Opt for FBA to scale: it handles 4.5 billion U.S. items yearly (8,600/minute), freeing you for marketing. Reddit’s r/AmazonFBATips in May 2025 debated, “FBA fees worth it?” Consensus: yes for 20% margins post-50% deductions, especially in India’s booming market.

Fulfillment comparison table:

| Model | Adoption (%) | Key Benefit | Drawback |

| FBA | 82 | 30-50% sales increase | Higher fees (15-20%) |

| FBM | 34 | Full control over shipping | No Prime eligibility |

Switch to FBA for 46% faster profitability.

Sales and Revenue Insights

Third-party sellers drive 60% of Amazon’s 2025 sales, up from 57% in 2022, generating $480 billion in 2023 and projecting $500 billion amid 7-11% Q2 growth.

U.S. sellers average $250,000-$290,000 annually, with 50% hitting $10,000-$250,000 monthly; over 55,000 exceed $1M, employing 2 million. Daily revenue averages $1.75 billion, with Prime Day 2025 smashing $24.1 billion across 26 countries.

Maximize yours: 66% search starts on Amazon yield quick wins—optimize for 28% under-3-minute buys. Quora warns of 2025 challenges like competition (top issue for 40%), advising PPC for 19% ad revenue jumps to $56.2 billion.

Revenue trends table:

| Year | Third-Party Share (%) | Avg. U.S. Seller Sales ($K) | Prime Day Sales ($B) |

| 2021 | 55 | 200 | 11.2 |

| 2023 | 60 | 250 | 12.7 |

| 2024 | 61 | 290 | 14.2 |

| 2025 | 60 | 300 (proj.) | 24.1 |

Target $1M club via data analytics.

Challenges and Opportunities

Sellers face heightened rivalry (40% cite as top hurdle), fees (rising 5-10%), and suspensions (20% affected), but opportunities abound: AI listings for 100,000+ users, partnerships like Pinterest ads for visibility.

Reddit’s r/AmazonSeller in January 2025 queried competitor sales visibility, revealing tools like Keepa demystify volumes for strategic pricing.

Overcome via niches: wholesale yields 10-30% ROI on volume, per Quora. Diversify to reduce risks—40% use multiple platforms.

Challenges table:

| Challenge | % Affected | Mitigation Strategy |

| Competition | 40 | Niche focus + PPC |

| Fees/Inflation | 29 | Domestic sourcing |

| Recession Fears | 23 | Bundle for value |

| Suspensions | 20 | Compliance audits |

Embrace for 15% margin resilience.

Community Wisdom: Insights from Quora and Reddit

Quora’s 2025 threads probe FBA profitability, affirming wholesale’s viability despite fees, with tips on Jungle Scout for trends.

Reddit’s r/FulfillmentByAmazon AMAs from veterans ($100M+ revenue) stress high-margin products against Chinese dominance, recommending U.S. branding for 20% premiums.

Users ask about tariffs’ “bloodbath”—experts foresee 15% small-business exits but niches thriving.

Apply: test AI for 34% efficiency, per discussions.

FAQs About Amazon Seller Statistics

1. How many Amazon sellers exist in 2025, and what does this mean for new sellers?

Amazon has 9.7M sellers and 2.5M active in 2025. Competition is high, but niches still open daily. With smart research tools and focused categories, new sellers can still succeed.

2. What are the top product categories in 2025, and how do I choose one?

Top categories include Home & Kitchen (35%), Beauty (26%), and Clothing (20%). Pick one with strong demand, manageable competition, and good margins—tools like Jungle Scout help validate profitable niches.

3. Is Amazon FBA still profitable in 2025?

Yes. FBA boosts sales 30–50% thanks to Prime and fast shipping. Despite fees, most sellers using FBA still see solid margins when sourcing efficiently and optimizing listings.

4. What challenges do Amazon sellers face in 2025, and how can I overcome them?

Sellers face more competition, higher costs, and stricter policies. You can win by diversifying to other marketplaces, improving operations, and using AI tools to optimize listings and ads.

5. How much revenue can the average seller expect in 2025, and what drives it?

Average U.S. sellers earn $250K–$300K yearly. Success comes from strong PPC, FBA usage, optimized listings, and visibility boosts through influencers and seasonal events like Prime Day.

Also Read:

- YouTube Creator Statistics

- Email Marketing Statistics

- Content Marketing Statistics

- CRM Statistics

- Metaverse Statistics

Conclusion: Seize Amazon’s 2025 Momentum for Your Success

Amazon seller statistics for 2025 illuminate a thriving arena where 9.7 million voices converge for $700 billion in action, offering you pathways to $250K averages through FBA and AI savvy.

Dive in with data as your guide—your e-commerce empire awaits.