PayPal remains a leader in digital payments, with 432 to 434 million active users in 2025, processing over $1.68 trillion in payments.

This article explores key PayPal statistics, including user growth, revenue, and market share, providing valuable insights for both personal and business use.

PayPal’s platform handles 26.3 billion transactions annually, offering secure, efficient services for individuals and businesses.

With enhanced mobile apps and global accessibility, PayPal continues to expand, making it a trusted solution for secure payments and e-commerce growth.

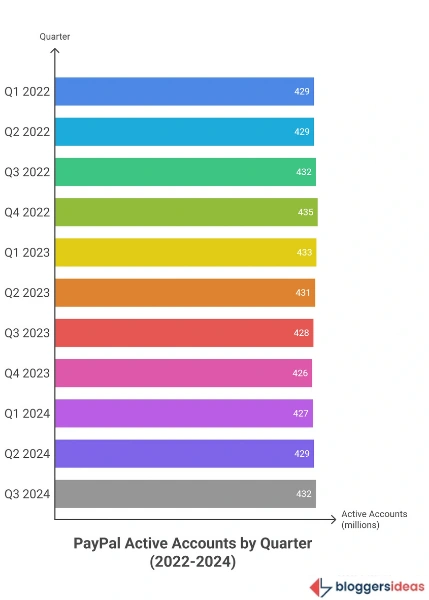

PayPal User Growth and Active Accounts

PayPal maintains a robust user base with gradual increases. The platform reports 432 million active users in Q3 2024, rising to 434 million by year-end, demonstrating resilience amid economic shifts.

Quarterly data shows fluctuations, with Q2 2024 at 429 million and Q1 at 427 million, but overall trends indicate recovery from 2023’s dips. This stability benefits users by ensuring reliable service, while businesses tap into a vast audience for sales.

The following table details PayPal’s active accounts by quarter since 2022:

| Quarter | Active Accounts (Millions) |

| Q3 2024 | 432 |

| Q2 2024 | 429 |

| Q1 2024 | 427 |

| Q4 2023 | 426 |

| Q3 2023 | 428 |

| Q2 2023 | 431 |

| Q1 2023 | 433 |

| Q4 2022 | 435 |

| Q3 2022 | 432 |

| Q2 2022 | 429 |

| Q1 2022 | 429 |

Source: Statista

This table highlights PayPal’s ability to retain users, encouraging readers to maintain active accounts for perks like cashback.

Regional adoption varies significantly. The United States leads with 278.1 million users, followed by Germany at 137.7 million and the United Kingdom at 56.2 million.

Italy and France round out the top five with 21.9 million and 20.5 million users, respectively. This distribution allows international users to send money home easily, while locals benefit from widespread merchant acceptance.

Reddit discussions in 2025 reveal users in Lebanon seeking alternatives due to restrictions, highlighting PayPal’s limitations in some regions but strengths in established markets.

PayPal Market Share and Competitive Position

PayPal commands a leading position in the payment processing market. The platform holds a 45.52% market share in 2025, surpassing competitors like Stripe at 17.15% and Shopify Pay Installments at 15.68%.

Amazon Pay follows at 2.62%, with SecurePay at 1.5%. This dominance stems from PayPal’s user-friendly interface and trust features, benefiting merchants with 25% higher conversion rates compared to other methods.

The table outlines market shares of top payment processors in 2025:

| Company Name | Market Share (%) |

| PayPal | 45.52 |

| Stripe | 17.15 |

| Shopify Pay Installments | 15.68 |

| Amazon Pay | 2.62 |

| SecurePay | 1.5 |

| PayPal Braintree | 1.2 |

| Stripe Checkout | 1.18 |

| Afterpay | 1.12 |

Businesses integrate PayPal to boost sales, as shoppers spend 12% more and purchase 60% more frequently. Readers set up merchant accounts to accept payments globally, enhancing e-commerce operations.

PayPal Revenue and Financial Performance

PayPal generates substantial revenue through transaction fees and services. In 2025, projections indicate continued growth, building on 2024’s $31.8 billion net revenue, an 8.19% increase from 2023.

Q3 2024 revenue reaches $7.84 billion, up 6% year-over-year, with Q2 at $7.9 billion (8% growth) and Q1 at $7.7 billion (9% growth). This upward trajectory reflects expanding user engagement and partnerships.

The table details PayPal’s quarterly revenue since 2022:

| Quarter | Revenue (Billions USD) | Year-on-Year Change (%) |

| Q3 2024 | 7.84 | 6 |

| Q2 2024 | 7.9 | 8 |

| Q1 2024 | 7.7 | 9 |

| Q4 2023 | 8.02 | 8.67 |

| Q3 2023 | 7.41 | 8.33 |

| Q2 2023 | 7.28 | 7.05 |

| Q1 2023 | 7.04 | 8.6 |

| Q4 2022 | 7.38 | 6.7 |

| Q3 2022 | 6.85 | 10.7 |

| Q2 2022 | 6.81 | 9.1 |

| Q1 2022 | 6.48 | 7.5 |

Source: World Population Review

Readers invest in PayPal stock or use services knowing its financial health supports innovation, like faster checkouts reducing latency by 40%.

Net income for Q3 2024 stands at $1.01 billion, down 1% year-over-year, but overall 2024 shows resilience with $6.8 billion in free cash flow.

Transaction revenue comprises 90.7% at $7.588 billion, while value-added services add $778 million. US revenue totals $4.518 billion (57%), international $3.634 billion (43%). This balance allows users in high-growth areas like Germany to enjoy robust features.

PayPal Transaction Volume and Efficiency

PayPal processes massive transaction volumes. In 2024, it handles 26.3 billion transactions, up 5% from 2023, with Q4 at 6.619 billion (down 3% year-over-year).

Total payment volume reaches $1.68 trillion in 2024, a 10% increase. Average transactions per account hit 60.6, up 3%, surpassing estimates of 56. This efficiency benefits users by enabling quick, secure payments.

The table shows annual transaction volumes since 2018:

| Year | Transactions (Billions) |

| 2024 (up to Q3) | 19.72 |

| 2023 | 24.98 |

| 2022 | 22.3 |

| 2021 | 19.3 |

| 2020 | 15.4 |

| 2019 | 12.4 |

| 2018 | 9.9 |

Merchants see 33% more completed checkouts with PayPal, while consumers trust its 24/7 fraud monitoring. Readers use PayPal for e-commerce to increase sales frequency by 60%.

PayPal User Demographics and Preferences

PayPal attracts diverse users. Millennials comprise 97%, with 25% aged 25-34 and 19% 35-44. In the US, 56% have accounts, including 9% children and 85% Gen X online shoppers.

Europeans favor PayPal, with 75% trusting it more than others. Germany leads usage for in-store (nearly half) and online (90%) payments.

The table details age demographics among PayPal users:

| Age Group | Share (%) |

| Under 24 | 14 |

| 25-34 | 25 |

| 35-44 | 19 |

| 45+ | Remaining |

Readers under 34 use PayPal for BNPL, saving on purchases, while older users appreciate security.

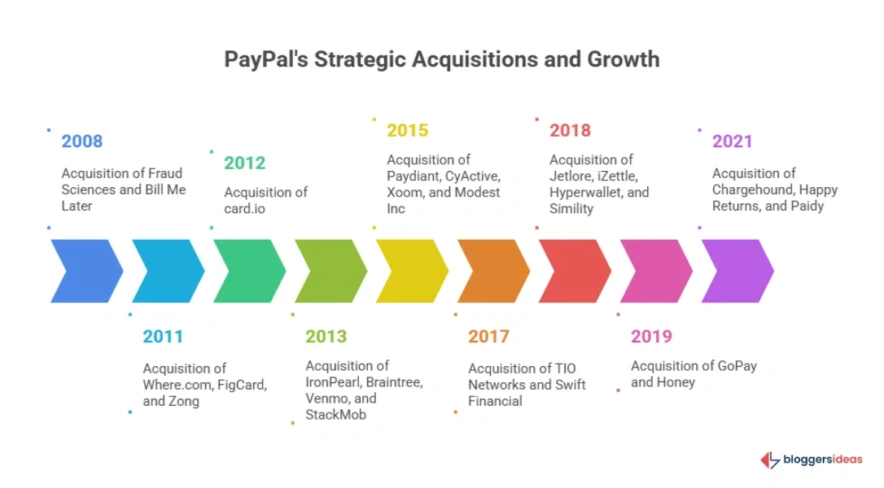

PayPal Acquisitions and Expansions

PayPal acquires strategically to enhance services. Key buys include Honey ($4 billion in 2019) for deals, Braintree ($800 million), and iZettle ($2.2 billion).

Recent additions like Chargehound and Paidy expand fraud protection and BNPL. These integrations benefit users with cashback and flexible payments.

The table lists major acquisitions:

| Year | Acquisitions |

| 2008 | Fraud Sciences, Bill Me Later |

| 2011 | Where.com, FigCard, Zong |

| 2012 | card.io |

| 2013 | IronPearl, Braintree, Venmo, StackMob |

| 2015 | Paydiant, CyActive, Xoom, Modest Inc |

| 2017 | TIO Networks, Swift Financial |

| 2018 | Jetlore, iZettle, Hyperwallet, Simility |

| 2019 | GoPay, Honey |

| 2021 | Chargehound, Happy Returns, Paidy |

Venmo, with 90 million users, grows 4% annually, projecting $2 billion revenue by 2027. Readers use Venmo for P2P, earning cashback.

PayPal Fraud and Security Measures

PayPal faces fraud costing over $1 billion annually, or 0.17-0.18% of revenue. Common scams include phishing and overpayments.

Businesses lose $3.7 million yearly, handling 679 chargebacks monthly. PayPal offers coverage at 0.4-0.6% per transaction.

Quora users in 2025 ask about account holds, advising verification to release funds. Reddit threads warn of credential dumps, recommending two-factor authentication.

Readers enable security features like encryption for protection, reporting suspicious activity promptly.

PayPal in eCommerce and Digital Payments

PayPal boosts e-commerce with 25% better conversions and 33% more checkouts for enterprises. Shoppers spend 12% more, purchasing 60% frequently.

Over 10 million websites accept PayPal, with 9.73% of top 1 million sites. US sites lead at 15.67%, followed by UK.

PayPal Open integrates tools for SMBs, reducing latency 40% and boosting conversions 100 basis points. Reddit users discuss PayPal’s 2025 investor plans for growth, noting high single-digit margins.

The table shows merchant accounts growth:

| Year | Merchant Accounts (Millions) |

| 2023 | 35 |

| 2022 | 35 |

| 2021 | 33 |

| 2020 | 30 |

| 2019 | 24 |

| 2018 | 21 |

| 2017 | 18 |

| 2016 | 15 |

| 2015 | 13 |

Merchants use Complete Payments for 45% TPV, enhancing sales.

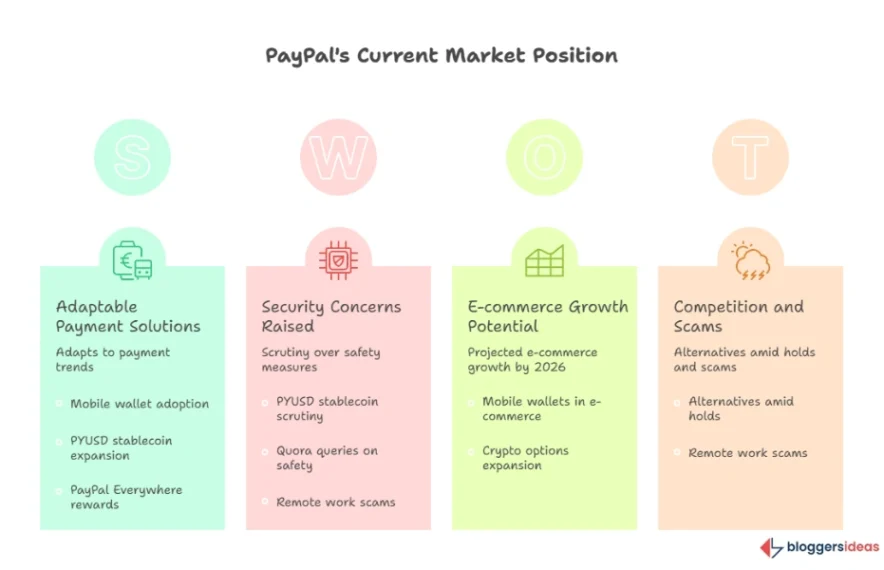

Emerging Trends in PayPal for 2026

PayPal adapts to trends like mobile wallets, projected at 50% e-commerce by 2026. PYUSD stablecoin faces scrutiny but expands crypto options.

Quora queries on safety in 2025 emphasize alternatives amid holds, while Reddit discusses investor presentations for profitable growth. Users ask about remote work scams, advising never share passwords.

Readers stay informed on updates like PayPal Everywhere for rewards.

How to Use PayPal for Personal and Business Benefits

Individuals send money securely, enjoying buyer protection for disputes. Link cards for cashback, using apps for quick transfers.

Businesses integrate for higher conversions, accepting 25 currencies. Quora tips include verifying accounts to avoid holds, while Reddit suggests enabling 2FA against dumps. Start with personal accounts for P2P, upgrade to business for invoices.

In 2025, PayPal’s 27,200 employees support innovations, ensuring reliability.

FAQs About PayPal Statistics 2026

1. What do PayPal statistics 2025 reveal about user growth?

PayPal statistics 2025 show 434 million active users, a 2.1% increase from 2024, driven by mobile enhancements and partnerships expanding accessibility in over 200 markets.

2. How can individuals benefit from using PayPal in 2025?

Individuals benefit from using PayPal in 2025 by enjoying secure transactions, buyer protection for disputes, and cashback rewards through features like PayPal Everywhere, making everyday payments efficient.

3. What are the emerging trends in PayPal for 2025?

Emerging trends in PayPal for 2025 include expanded BNPL options, AI-driven fraud detection, and integrations like PayPal Open for SMBs, enhancing transaction speed and security.

4. Is PayPal safe to use amid 2025 fraud concerns?

PayPal is safe to use in 2025 when users enable two-factor authentication, avoid sharing passwords, and report suspicious activity, leveraging its 24/7 monitoring to minimize risks.

5. How does PayPal support businesses in 2025?

PayPal supports businesses in 2025 by offering higher conversion rates, global payment acceptance in 25 currencies, and tools like Complete Payments that reduce latency and boost sales.

Also Read:

- WhatsApp Statistics

- Zoom Statistics

- Meta AI Statistics

- Video Marketing Statistics

- Apple Music Statistics

Conclusion:

In conclusion, PayPal continues to dominate the digital payment space in 2025, with 434 million active users and a market share of 45.52%.

The platform’s steady growth, strong revenue, and global reach make it an essential tool for individuals and businesses alike.

With a focus on security, ease of use, and expanding features like mobile wallets and BNPL options, PayPal remains a top choice for seamless transactions.

As the platform adapts to emerging trends and improves its services, users and businesses can leverage PayPal for secure, efficient, and profitable transactions.