In the world of online communication, one name stands out: Zoom. What started as a simple video conferencing tool has become a global powerhouse, changing how we work, learn, and connect.

Eric Yuan, the company’s founder, built Zoom after helping create the earlier video tool WebEx. He believed he could make a better, more user-friendly product, even in a crowded market with giants like Microsoft and Google.

His bet paid off spectacularly. During the 2020 global pandemic, millions of people turned to Zoom to stay in touch, transforming it from a business tool into a household name. While the world has largely returned to in-person activities, Zoom continues to be a central part of our digital lives.

This article provides a complete look at Zoom’s performance in 2025. We will explore its user numbers, financial health, market position, and much more. We’ve combined the best data from multiple sources to give you the most accurate and easy-to-understand picture of Zoom today.

Zoom in a Nutshell: Key Statistics for 2026

For those who need the facts quickly, here are the most important Zoom statistics right now.

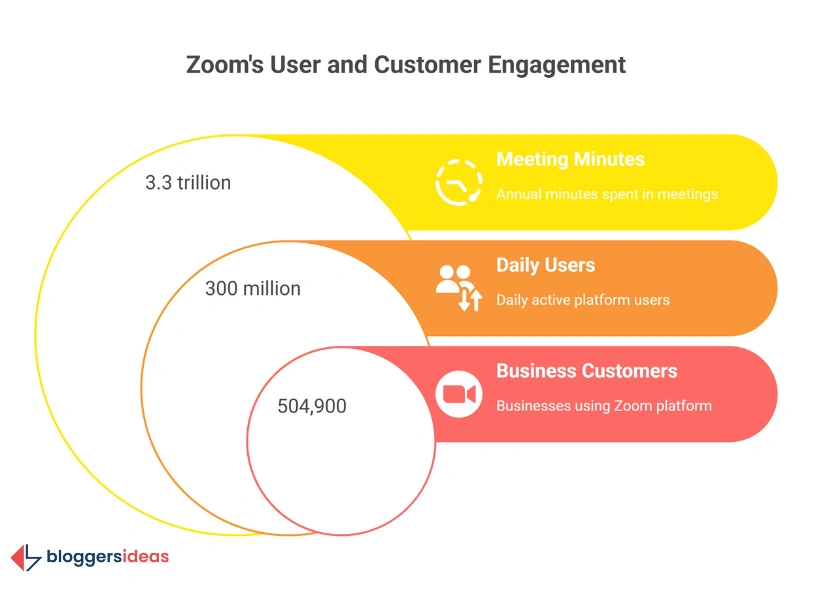

- Daily Users: Over 300 million people use Zoom every single day.

- Annual Revenue: Zoom earned $4.66 billion in its 2024 fiscal year.

- Market Share: Zoom dominates the video conferencing market, holding a 55.91% share.

- Business Customers: The platform serves over 504,900 business customers worldwide.

- Meeting Minutes: People spend an incredible 3.3 trillion minutes in Zoom meetings annually.

- Pandemic Growth: From 10 million daily participants in December 2019, Zoom exploded by 2900% to over 300 million by mid-2020.

- Profitability: The company reported over $1 billion in profit in its 2024 fiscal year, showing strong financial health.

The User Story: How Many People Use Zoom?

Zoom’s user base is the foundation of its success. The numbers show just how deeply it has become part of daily life for people around the globe.

Daily Active Users: A Staggering Number

Zoom hosts over 300 million daily active users. This figure includes people on both free and paid plans. An “active user” is a unique individual who joins at least one Zoom meeting on a given day.

To understand the scale of this growth, look at where Zoom started.

| Year | Daily Active Users |

| December 2019 | 10 million |

| March 2020 | 200 million |

| April 2020 | 300 million |

| January 2024 | 300 million+ |

This table shows the explosive growth during the early days of the pandemic. While the growth rate has stabilized, the platform has successfully retained a massive user base, proving it wasn’t just a temporary trend.

It’s also useful to know the term “daily meeting participants.” Zoom reported this number reached 350 million in December 2020. This metric is different from “active users” because it counts a person every time they join a meeting.

So, if you join three meetings in one day, you count as three “participants” but only one “active user.” This shows just how frequently people were using the service during its peak.

The Money Story: Zoom’s Revenue and Profitability

A large user base is great, but a company needs to make money to survive and thrive. Zoom has proven it can turn its popularity into impressive financial results.

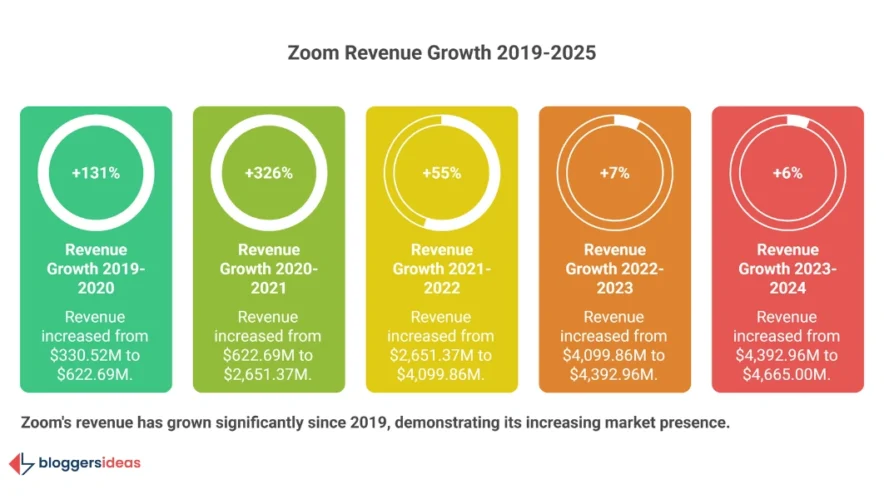

Zoom’s Growing Revenue

Zoom consistently grows its revenue year after year. For its fiscal year 2024, the company earned $4.66 billion. This shows a steady increase even after the peak of the pandemic.

In the first quarter of fiscal year 2025 alone, Zoom brought in $1.175 billion, putting it on track for another strong year.

The table below details Zoom’s remarkable revenue journey.

| Fiscal Year | Annual Revenue (in millions) |

| 2019 | $330.52 million |

| 2020 | $622.69 million |

| 2021 | $2,651.37 million |

| 2022 | $4,099.86 million |

| 2023 | $4,392.96 million |

| 2024 | $4,665.00 million |

| Q1 2025 | $1,175.00 million |

Zoom’s Impressive Profits

Making money is one thing, but keeping it as profit is another. After a dip in profitability post-pandemic as the company adjusted, Zoom has bounced back strongly. In its 2024 fiscal year, Zoom reported over $1 billion in profit.

| Fiscal Year | Annual Profit (in millions) |

| 2018 | $7 million |

| 2019 | $21 million |

| 2020 | $671 million |

| 2021 | $1,060 million |

| 2022 | $104 million |

| 2023 | $637 million |

| 2024 | $1,010 million |

This shows that Zoom runs a very efficient and profitable business, capable of navigating market changes while staying financially healthy.

The Market Dominance Story: Zoom vs. The Competition

Zoom doesn’t just participate in the video conferencing market; it leads it by a wide margin.

With 55.91% of the global market share, Zoom is the clear favorite for users around the world. Its closest competitor, Microsoft Teams, holds a significantly smaller portion of the market. This dominance speaks to the quality of Zoom’s product and the loyalty of its user base.

Here’s how the market breaks down among the major players as of 2023.

| Video Conferencing Software | Market Share |

| Zoom | 55.91% |

| Microsoft Teams | 32.29% |

| GoToMeeting | 8.81% |

| WebEx | 7.61% |

| Google Meet | 5.52% |

| RingCentral | 5.31% |

| FaceTime | 2.16% |

| Skype | 1.41% |

| Facebook Messenger | 0.75% |

| Bluejeans | 0.31% |

(Note: The total exceeds 100% as some surveys allow for multiple software choices.)

Zoom’s lead is substantial. Even with Microsoft bundling Teams for free with its popular Office 365 suite, more users actively choose Zoom for their communication needs. This is a powerful testament to the user experience Eric Yuan set out to create.

The Business Backbone: Who Are Zoom’s Customers?

While many people use Zoom for free to talk with friends and family, the company’s revenue primarily comes from its business customers. Zoom has successfully penetrated organizations of all sizes, from small startups to the world’s largest corporations.

A Deep Roster of Business Customers

- Zoom serves 504,900 business customers globally for their critical communications.

- 70% of the Fortune 100 companies use Zoom.

- Over half of the Fortune 500 companies rely on Zoom.

- 85% of the Forbes Cloud 100 (the world’s top private cloud companies) are Zoom customers.

Customers by Company Size

Zoom tracks its customers with more than 10 employees as a key metric for growth. This segment has seen incredible expansion over the years.

| Year | Customers with More Than 10 Employees |

| 2017 | 10,900 |

| 2018 | 25,800 |

| 2019 | 81,900 |

| 2020 | 467,100 |

| 2022 | 509,800 |

This customer segment is vital, as it accounts for 64% of Zoom’s total revenue.

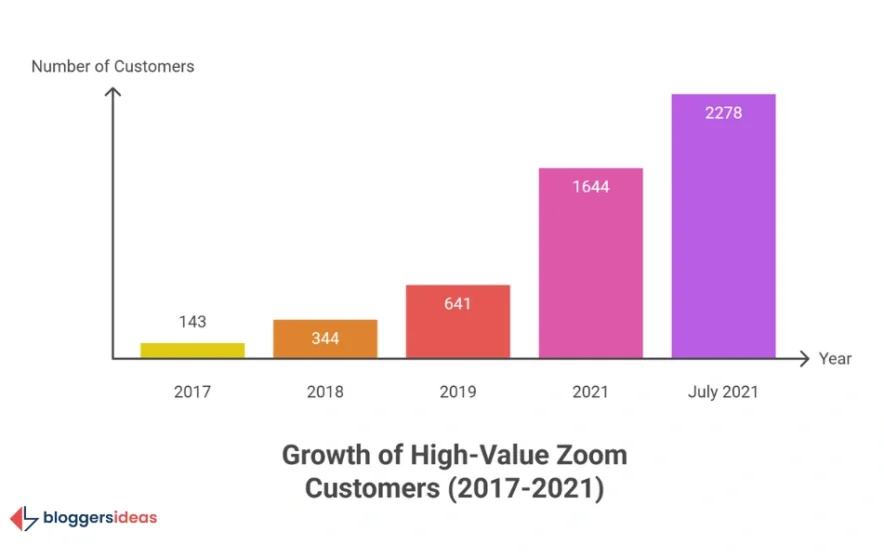

High-Value Enterprise Customers

The most valuable clients are large enterprises. Zoom defines its core “enterprise customers” as large organizations, and in 2024, it reported having 192,600 of them.

Even more impressively, Zoom tracks the number of customers who contribute over $100,000 in revenue each year. This group represents the company’s deepest and most profitable relationships.

| Year | Customers Contributing $100k+ Annually |

| 2017 | 143 |

| 2018 | 344 |

| 2019 | 641 |

| 2021 | 1,644 |

| July 2021 | 2,278 |

As of 2021, these high-value clients already accounted for 22% of Zoom’s quarterly revenue. This focus on landing and expanding large enterprise accounts is a core part of Zoom’s strategy for stable, long-term growth.

The Engagement Story: How Much is Zoom Actually Used?

The scale of interaction on Zoom is almost hard to comprehend. The company measures usage in “meeting minutes” and “webinar minutes” to quantify just how much communication happens on its platform.

Trillions of Meeting Minutes

Zoom hosts over 3.3 trillion meeting minutes each year. This number is calculated by taking the total meeting minutes from the final month of a quarter and multiplying it by 12. It represents the combined duration of all Zoom meetings held in a year.

The growth has been astronomical.

| Time Period | Annualized Meeting Minutes |

| December 2013 | 200 million |

| June 2016 | 6 billion |

| January 2020 | 101 billion |

| October 2020 | 3.3 trillion |

Billions of Webinar Minutes

Webinars are another key feature of Zoom, and their usage has also soared. The platform hosts over 45 billion annual webinar minutes. This was a 7.14% increase from the previous year, showing continued growth in online events, training sessions, and large-scale presentations.

The Global Reach: Zoom Downloads Around the World

App downloads are a great indicator of a platform’s popularity and brand recognition. In 2020, Zoom broke records, becoming one of the most downloaded apps in history. While the download rate has slowed, it remains a top choice worldwide.

Zoom Downloads by Year

The pandemic year of 2020 was an anomaly, with nearly three-quarters of a billion downloads. The numbers have since normalized to a more sustainable, yet still impressive, level.

| Year | Worldwide App Downloads |

| 2020 | 740.26 million |

| 2021 | 324.47 million |

| 2022 | 187.23 million |

| 2023 (first half) | 81.48 million |

Zoom Downloads by Region (2023, First Half)

Zoom has a strong presence across the globe.

Here’s a look at where people downloaded the app in the first half of 2023.

| Region | App Downloads |

| Asia-Pacific (APAC) | 37.14 million |

| North & Latin America (NALA) | 23.34 million |

| Europe, Middle East & Africa (EMEA) | 21.00 million |

The Asia-Pacific region continues to be a major growth area for Zoom, leading in downloads. In the United States, Zoom remains the most downloaded video conferencing app, with 37 million downloads in 2022, well ahead of Microsoft Teams (25 million).

[Something Extra] How to Use These Zoom Statistics

This data is more than just a collection of numbers. Different professionals can use these insights to make smarter decisions.

For Marketers and Sales Professionals:

- Targeting: The huge market share (55.91%) means your target audience is almost certainly using Zoom. Use this to justify integrating Zoom into your sales demos and client onboarding.

- Content Strategy: Knowing that 89% of users use Zoom for work helps you create business-focused content (e.g., “Tips for Better Zoom Presentations”).

- Regional Focus: The high download numbers in the APAC region suggest it is a ripe market for expansion and localized marketing campaigns.

For Investors and Financial Analysts:

- Key Health Metrics: Track the growth of “customers contributing $100k+” and “enterprise customers.” These are leading indicators of Zoom’s financial stability and future revenue.

- Competitive Analysis: While Zoom’s market share is dominant, keep a close watch on Microsoft Teams. Microsoft’s ability to bundle Teams with Office 365 is its biggest competitive advantage.

- Profitability: Zoom’s return to over $1 billion in annual profit is a strong bullish signal, showing the company can operate efficiently at scale.

For Business Leaders and IT Managers:

- Tool Selection: The data confirms that Zoom is the market standard. Choosing Zoom means you are adopting a tool that your employees, clients, and partners are already familiar with.

- Negotiation Power: If you are a large enterprise, knowing that Zoom has over 2,000 customers paying $100k+ gives you context for negotiating enterprise-level pricing and support.

- Future-Proofing: Zoom’s acquisitions (like Solvvy for AI) and expansion into a broader communications platform signal it’s a long-term partner, not just a meeting tool.

For Job Seekers:

- Company Stability: Strong revenue and profit figures indicate that Zoom is a stable company with resources to invest in its employees and products.

- Growth Areas: The company’s focus on enterprise customers and new services like AI-powered customer support point to growing departments and potential job opportunities in those areas.

Looking Ahead: The Future of Zoom

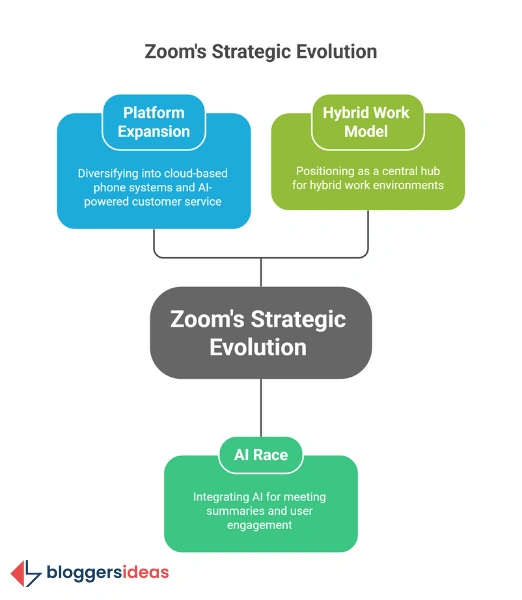

Zoom’s journey is far from over. The company faces the challenge of maintaining growth in a post-pandemic world where competition is fierce. Its strategy is clear: evolve from a video meeting app into an all-in-one communication platform.

- Platform Expansion: Zoom is no longer just about video. It has expanded its offerings to include Zoom Phone (a cloud-based phone system), Zoom Contact Center (for customer support), and Zoom IQ (an AI-powered conversation intelligence tool). The acquisition of Solvvy, an AI company, strengthens its push into automated customer service. This diversification creates new revenue streams and makes the platform stickier for business customers.

- The AI Race: Artificial intelligence is the next battleground. Zoom is integrating AI to provide meeting summaries, analyze sales calls, and improve user engagement. Its ability to innovate here will be critical in its fight against Microsoft and Google, who are also investing heavily in AI.

- The Hybrid Work Model: The future of work is hybrid, and Zoom is positioning itself as the central hub for connecting remote and in-office employees. Features designed for “Zoom Rooms” in physical offices aim to bridge the gap between virtual and physical collaboration.

FAQs About Zoom Statistics

1. How many people use Zoom daily in 2025?

Over 300 million people use Zoom every day in 2025, making it one of the most popular video conferencing platforms worldwide.

2. What is Zoom’s market share in 2025?

Zoom holds a dominant 55.91% market share in the global video conferencing market, leading competitors like Microsoft Teams and Google Meet.

3. What are Zoom’s annual revenue and profitability in 2025?

Zoom generated $4.66 billion in revenue in fiscal year 2024 and reported a profit of over $1 billion, showcasing strong financial health.

4. Who are Zoom’s business customers?

Zoom serves over 504,900 business customers globally, including 70% of Fortune 100 companies and more than half of Fortune 500 companies.

5. How much time do people spend on Zoom meetings annually?

Users spend a staggering 3.3 trillion minutes in Zoom meetings every year, highlighting the platform’s extensive usage for communication and collaboration.

Also Read:

- Tinder Statistics

- WhatsApp Statistics

- Email Marketing Statistics

- Google Gemini Statistics

- CRM Statistics

Conclusion

Zoom has cemented its place as the undisputed leader in the video conferencing market.

With a commanding 55.91% market share, over 300 million daily users, and a robust financial profile, the company has successfully transitioned from a pandemic phenomenon to an enduring digital utility.