Amazon continues to redefine the global e-commerce landscape in 2025, solidifying its position as a powerhouse in retail, cloud computing, and digital services.

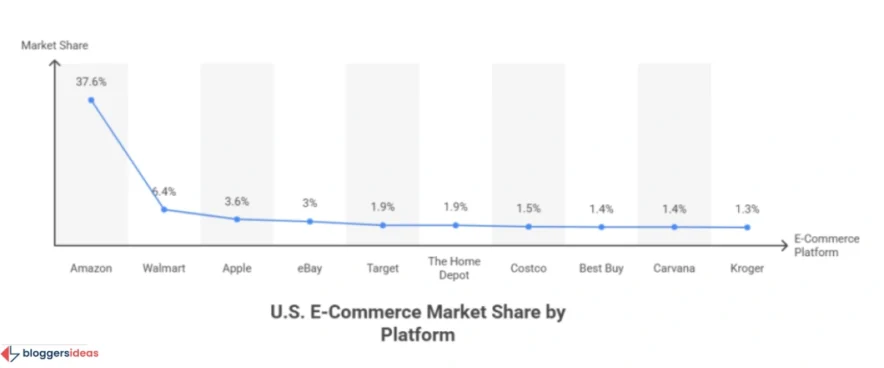

With a commanding 37.6% share of the U.S. e-commerce market and a staggering $167.7 billion in net revenue for Q2 2025, Amazon’s influence is undeniable.

This article explores the latest Amazon statistics for 2025, offering a comprehensive look at its market performance, user behavior, revenue streams, and innovative strategies.

Whether you’re a shopper looking to maximize savings or a seller aiming to tap into Amazon’s vast marketplace, this guide provides actionable insights to help you leverage the platform for your benefit.

Additionally, we address trending questions from platforms like Quora and Reddit to ensure you have the most up-to-date information.

Amazon’s Market Dominance in 2026

Amazon holds a 37.6% share of the U.S. e-commerce market, far surpassing competitors like Walmart (6.4%) and Apple (3.6%).

This dominance stems from its vast product selection, fast shipping, and innovative services like Amazon Prime and AWS.

Globally, Amazon ranks as the fourth most valuable brand, with a brand value of $577 billion in 2024, a 23% increase from the previous year.

The company’s ability to attract over 2.56 billion website visits in 2025 underscores its unmatched reach.

| E-Commerce Platform | Percentage of U.S. Market Share |

| Amazon | 37.6% |

| Walmart | 6.4% |

| Apple | 3.6% |

| eBay | 3.0% |

| Target | 1.9% |

| The Home Depot | 1.9% |

| Costco | 1.5% |

| Best Buy | 1.4% |

| Carvana | 1.4% |

| Kroger | 1.3% |

Source: Statista.

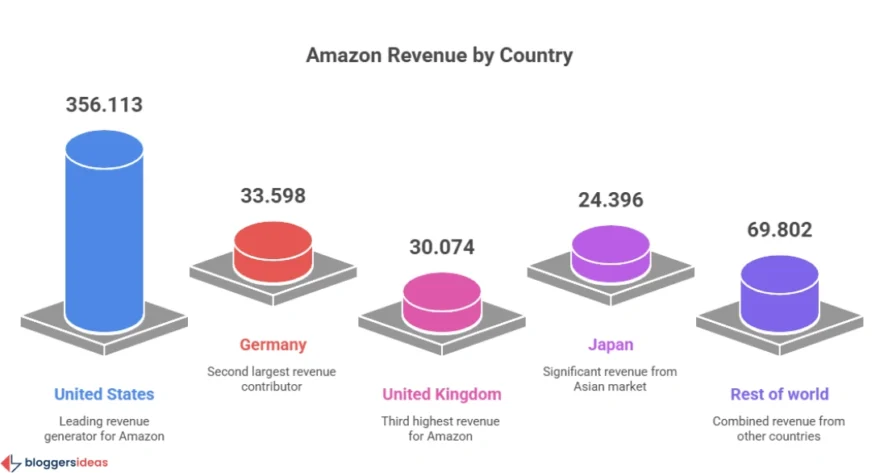

Amazon’s global presence continues to expand, with operations in over 100 countries and plans to launch a new marketplace in Ireland in 2025, bringing its total to 22 global stores.

The United States remains Amazon’s largest market, generating $356.113 billion in net sales in 2022, followed by Germany ($33.598 billion) and the United Kingdom ($30.074 billion).

- Also read about: 10 Best Amazon Proxy Providers

Revenue Breakdown: How Amazon Makes Money

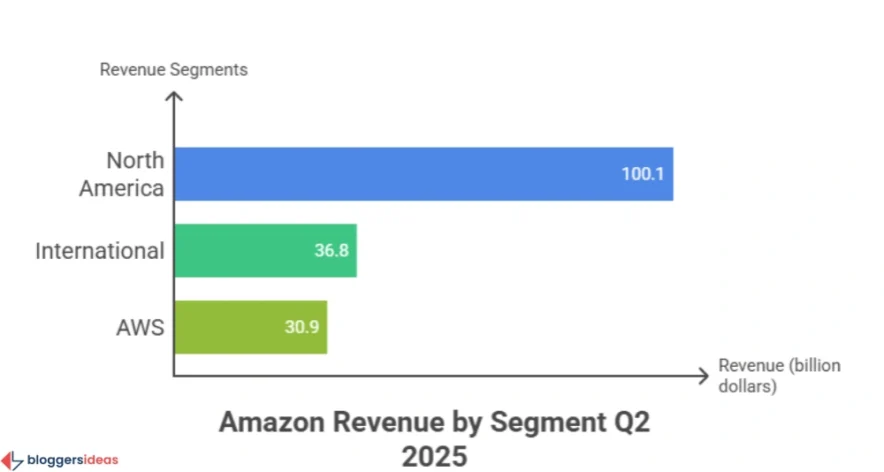

Amazon’s financial performance in 2025 showcases its ability to generate substantial revenue across multiple segments. In Q2 2025, the company reported net sales of $167.7 billion, reflecting a 13% year-over-year (YoY) growth.

The trailing twelve months (TTM) revenue reached $670 billion, an 11% increase from the previous year. Amazon’s revenue streams are diverse, with North America, International, and AWS being the primary contributors.

| Segment | Q2 2025 Sales ($B) | Q2 2024 Sales ($B) | YoY Growth | Share of Total Revenue |

| North America | 100.1 | 90.0 | 11% | 60% |

| International | 36.8 | 31.7 | 16% | 22% |

| AWS | 30.9 | 26.3 | 17.5% | 18% |

Amazon’s online store sales grew to $61.5 billion in Q2 2025, while advertising services saw the strongest YoY growth at 23%, reaching $15.7 billion.

Third-party seller services contributed $40.3 billion, and subscription services, primarily Amazon Prime, generated $12.2 billion. Physical stores, while less significant, added $5.6 billion to the revenue pool.

| Business Line | Q2 2025 ($B) | Q2 2024 ($B) | YoY Growth |

| Online Stores | 61.5 | 55.4 | 11% |

| Third-party Seller Services | 40.3 | 36.2 | 11% |

| AWS | 30.9 | 26.3 | 17% |

| Advertising Services | 15.7 | 12.8 | 23% |

| Subscription Services | 12.2 | 10.9 | 12% |

| Physical Stores | 5.6 | 5.2 | 7% |

| Other | 1.5 | 1.3 | 19% |

Amazon’s net income for Q2 2025 reached $18.2 billion, a 35% increase from the previous year, despite heavy capital investments of over $103 billion in infrastructure and equipment.

The company’s operating cash flow grew by 57% to $112.7 billion in Q3 2024, and free cash flow rose to $47.7 billion, reflecting Amazon’s financial resilience.

Also read about: Marketing Automation Statistics

Amazon’s User Base and Traffic Insights

Amazon attracts a massive audience, with 2.56 billion global website visits in 2025, ranking it as the 12th most visited website globally and 5th in the United States.

Approximately 83% of this traffic originates from the U.S., translating to over 2.13 billion visits. Mobile devices drive 59.52% of traffic, while desktops account for 40.48%. Users spend an average of 11 minutes and 33 seconds per session, visiting 6.59 pages per visit.

| Country | Share (%) | Visits | Desktop (%) | Mobile (%) |

| United States | 83.12% | 2.13B | 38.68% | 61.32% |

| India | 1.91% | 48.83M | 30.36% | 69.64% |

| Canada | 0.86% | 21.94M | 48.52% | 51.48% |

| Brazil | 0.79% | 20.10M | 36.44% | 63.56% |

| Mexico | 0.75% | 19.15M | 30.24% | 69.76% |

Amazon’s user base is estimated at 300 to 600 million monthly active users globally, with 48 to 107 million daily active users.

The Amazon Prime program boasts over 250 million members worldwide, a fivefold increase from 46 million in 2016. In the U.S., Prime membership is projected to reach 185 million by the end of 2025, with a 99% two-year renewal rate.

Why Shoppers Choose Amazon

Amazon’s appeal lies in its convenience, speed, and variety. A staggering 80% of shoppers prefer Amazon for its fast and free shipping, while 69% value its wide product selection.

Additionally, 66% of consumers start their product searches on Amazon, outpacing search engines (20%) and other platforms.

| Reason for Shopping on Amazon | Percentage of Shoppers |

| Fast and Free Shipping | 80% |

| Wide Selection of Products | 69% |

| Desire to Use Prime Membership | 66% |

| Best Prices on Products | 49% |

| Easy Returns | 44% |

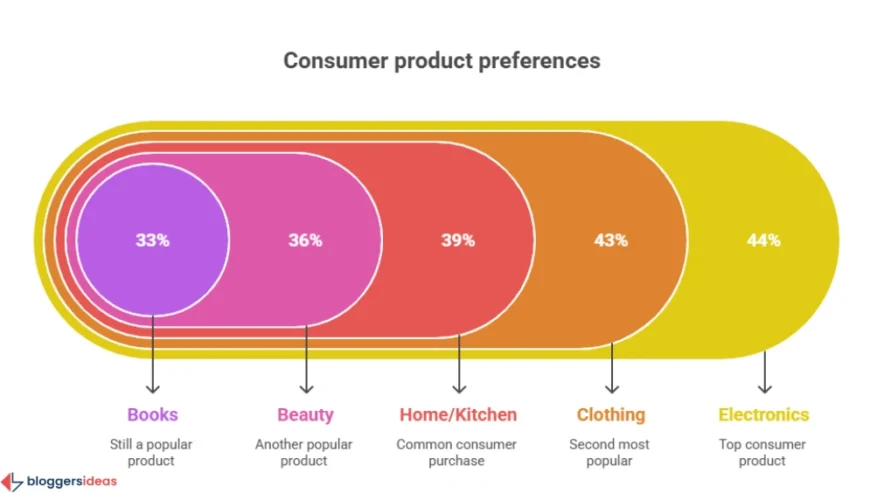

Electronics top the list of frequently purchased products, with 44% of shoppers buying items in this category, followed closely by clothing, shoes, and jewelry (43%). Home and kitchen products (39%), beauty and personal care (36%), and books (33%) are also popular.

| Product Category | Percentage of Consumers |

| Electronics | 44% |

| Clothing, Shoes, and Jewelry | 43% |

| Home and Kitchen | 39% |

| Beauty and Personal Care | 36% |

| Books | 33% |

Opportunities for Sellers: Tapping into Amazon’s Marketplace

Amazon’s marketplace offers immense opportunities for third-party sellers, who account for 60% of all sales on the platform.

Over 1.9 million sellers operate worldwide, with nearly 1.1 million based in the U.S.

In 2023, over 10,000 independent sellers surpassed $1 million in sales for the first time, highlighting the platform’s potential for profitability.

Fulfillment by Amazon (FBA)

Fulfillment by Amazon (FBA) is a game-changer for sellers, reducing shipping costs by 70% per unit compared to other fulfillment options.

Approximately 50% of U.S. sellers use FBA, and 300,000+ sellers have utilized Multi-Channel Fulfillment (MCF) since its launch.

FBA allows sellers to store products in Amazon’s fulfillment centers, where Amazon handles packing, shipping, and customer service, enabling sellers to focus on scaling their businesses.

Private Label and AI Tools

Over 60% of Amazon sellers now run private label brands, which offer 30–50% profit margins compared to 5–15% for dropshipping.

AI tools are transforming the selling process, with 34% of sellers using AI to create product listings and 14% leveraging it for social media content.

Tools like the AMZScout PRO AI Extension help sellers identify profitable products, track price changes, and optimize listings for better visibility.

Top Product Categories for Sellers

The top-performing product categories in 2024 include Beauty & Personal Care (30%), Home & Kitchen (30%), and Fashion & Accessories (27%).

Specific products like gel vegan eye patches (71,000 sales/month, $1.5 million revenue) and portable travel fans (83,775 sales/month, $1.36 million revenue) demonstrate the earning potential in these niches.

| Category | Top Product | Monthly Sales | Monthly Revenue |

| Beauty & Personal Care | Gel Vegan Eye Patches | 71,000 | $1,500,000 |

| Home & Kitchen | Blender with Portable Cup | 74,050 | $2,281,040 |

| Fashion & Accessories | Portable Travel Fan | 83,775 | $1,365,643 |

Amazon Prime Day and Special Sales Events

Amazon Prime Day 2025 (July 8–11) generated $24.1 billion in U.S. online sales, a 30.3% YoY increase, outpacing Black Friday 2024 ($10.8 billion).

Mobile shopping dominated, accounting for 53.2% of sales, and AI-powered tools saw a 3,300% surge in traffic as consumers used chatbots to find deals.

Influencer marketing drove 19.9% of sales, with influencers generating 10 times more sales than traditional social media marketing.

Amazon Web Services (AWS): The Cloud Powerhouse

AWS remains Amazon’s fastest-growing segment, generating $30.9 billion in Q2 2025 with a 17.5% YoY growth.

In 2022, AWS contributed $79.9 billion annually, up from $62.1 billion in 2021. AWS serves 10–15 million accounts, powering businesses worldwide with its scalable cloud solutions.

| Year | AWS Net Sales Revenue ($B) |

| 2022 | 79.9 |

| 2021 | 62.1 |

| 2020 | 45.3 |

| 2019 | 35.0 |

| 2018 | 25.6 |

Advertising: A Growing Revenue Stream

Amazon’s advertising business is projected to reach $94 billion globally by 2026, up from $47 billion in 2023. In Q2 2025, advertising services generated $15.7 billion, a 23% YoY increase.

The average cost-per-click (CPC) is $0.98, with an advertising cost of sales (ACoS) of 28.97%. Nearly half of Amazon customers report purchasing products through ads, underscoring their effectiveness.

Amazon’s Innovations and Sustainability Efforts

Amazon invests heavily in innovation, particularly in AI and sustainability. In 2024, the company allocated $25 million for a 10-year AI research collaboration.

Over 750,000 robots operate in Amazon’s fulfillment centers, boosting efficiency by 75% and enabling same-day delivery for over half of Prime orders.

Rufus, Amazon’s AI-powered shopping assistant, enhances the customer experience by offering personalized recommendations.

On the sustainability front, Amazon matched 100% of its energy consumption with renewable sources in 2023. The company aims to achieve zero carbon emissions by 2040, with over 500 companies participating in this initiative.

Trending Questions from Quora and Reddit

Recent discussions on Quora and Reddit reveal user interest in Amazon’s latest features and seller opportunities. Shoppers frequently ask about maximizing Prime benefits, such as accessing exclusive deals and utilizing same-day delivery.

Sellers are curious about leveraging Amazon’s new AI tools, like Rufus, to optimize listings and increase sales.

Additionally, users on Reddit have highlighted the growing influence of TikTok, with 72% of Gen Z starting their shopping journeys on the platform, often leading to purchases on Amazon.

Products like the Stanley Cup, which went viral on TikTok, generated $6.3 million in revenue in June 2025.

How Shoppers Can Benefit from Amazon

For shoppers, Amazon offers unmatched convenience and value. Here are practical ways to maximize your experience:

- Join Amazon Prime: With over 250 million members, Prime provides free two-day shipping, access to Prime Video, and exclusive deals. The 99% renewal rate in the U.S. reflects its value.

- Use AI Tools: Tools like Rufus help you find tailored products and deals quickly. Voice search via Alexa remains popular, with 27% of global online users leveraging it.

- Shop During Prime Day: Prime Day 2025 saw $24.1 billion in sales, offering significant discounts. Plan purchases around major sales events like Black Friday and Cyber Monday.

- Compare Prices: 90% of shoppers compare prices on Amazon. Use tools like the AMZScout PRO AI Extension to track price changes and find the best deals.

How Sellers Can Succeed on Amazon

Sellers can capitalize on Amazon’s vast audience and robust infrastructure. Here are key strategies:

- Leverage FBA: FBA reduces shipping costs by 70% and streamlines logistics, allowing you to focus on product development and marketing.

- Focus on High-Demand Categories: Categories like Beauty & Personal Care and Fashion & Accessories are growing rapidly. Use product research tools to identify trending items.

- Optimize Listings with AI: AI tools can create SEO-optimized listings, increasing visibility. 34% of sellers already use AI for this purpose.

- Engage with Influencers: Influencer marketing drives 10x more sales than traditional methods. Partner with TikTok influencers to reach Gen Z shoppers.

Amazon’s Workforce and Logistics

Amazon employs approximately 1.56 million full- and part-time workers as of Q1 2025, down slightly from a peak of 1.62 million in 2022.

The company operates over 185 fulfillment centers globally, with 100 in the U.S. alone. These centers enable Amazon to ship 1.6 million packages daily, processing 20 orders per second.

Fun Facts About Amazon

- Largest Item Sold: A 400-square-foot mobile house with a bathroom, kitchen, and automatic gate system is among the largest items available.

- Most Expensive Item: A baseball signed by Josh Gibson, priced at $1.6 million, is one of the priciest listings in 2025.

- Most Searched Item: The Nintendo Switch leads with over 1.3 million monthly searches in the U.S.

FAQs About Amazon Statistics

1. How can I maximize savings during Amazon Prime Day?

Join Prime for exclusive deals, plan purchases early, and use tools like Rufus or AMZScout PRO AI to track discounts and shop top categories early (July 8–11, 2025).

2. What are the benefits of using Amazon FBA for sellers?

FBA cuts shipping costs by 70%, handles logistics, boosts visibility, and offers Prime-eligible shipping, helping sellers increase trust and sales.

3. How does Amazon’s AI improve shopping?

Amazon’s AI, like Rufus and Alexa, personalizes recommendations and speeds up shopping. AI tools saw a 3,300% traffic surge during Prime Day 2025.

4. Why is Amazon preferred over other platforms?

Amazon wins on fast shipping (80%), wide selection (69%), Prime perks (66%), and easy returns, with 66% of shoppers starting searches there.

5. How can sellers use influencer marketing on Amazon?

Partner with TikTok influencers, where 72% of Gen Z shop. Influencer campaigns drove 19.9% of Prime Day sales, outperforming traditional ads.

Also Read:

- Android Usage Statistics

- Facebook Users Statistics

- Marketing Automation Statistics

- Zoom Statistics

- TikTok User Statistics

Conclusion

Amazon’s dominance in 2025 is a testament to its innovative approach, expansive reach, and customer-centric model.

With $167.7 billion in Q2 revenue, 250 million Prime members, and a 37.6% U.S. e-commerce market share, the company continues to set the standard for online retail.

Shoppers benefit from fast shipping, a vast product selection, and AI-driven personalization, while sellers can tap into a lucrative marketplace with tools like FBA and AI optimization.

By staying informed about Amazon’s trends and leveraging its features, both shoppers and sellers can unlock significant opportunities.