Artificial Intelligence (AI) has evolved from a futuristic concept to a cornerstone of global innovation, transforming industries including healthcare, finance, marketing, and manufacturing.

By automating complex processes and generating insights at scale, AI has become a driving force in business efficiency and technological advancement.

As 2025 unfolds, AI’s influence on global markets continues to accelerate, positioning it as one of the fastest-growing and most disruptive sectors of the modern economy.

This article explores the key AI market size statistics for 2025 and beyond, comparing its growth with other major industries, identifying leading companies, highlighting adoption patterns, and addressing workforce shifts.

It also covers emerging discussions on AI ethics, accessibility, and the human impact of automation—providing a complete picture of how this technology is reshaping the world.

The Unstoppable Ascent: AI Market Size in 2025–2034

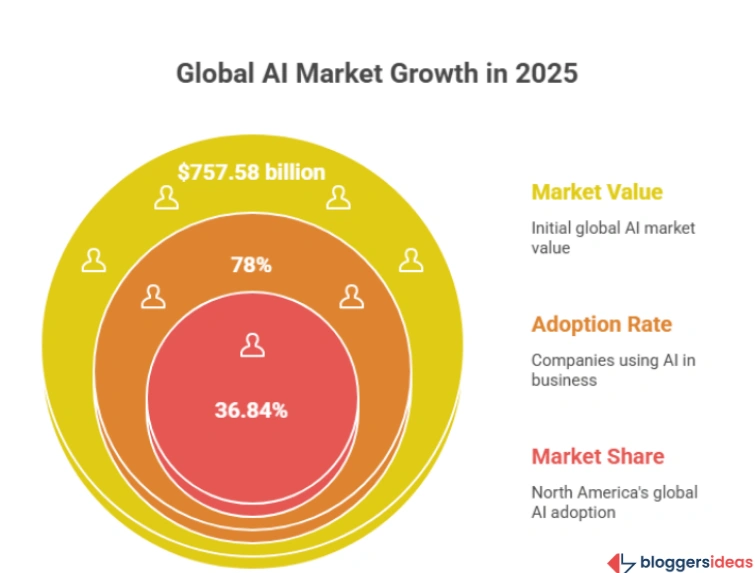

The global AI market is on an extraordinary upward trajectory. In 2025, it is valued at $757.58 billion, and it is projected to soar to $3.68 trillion by 2034, a 4.86× increase in less than a decade.

This rapid growth is driven by a 19.2% CAGR, fueled by enterprise adoption, government initiatives, and consumer-facing AI tools.

| Year | AI Market Size (USD) |

|---|---|

| 2024 | $638.23 billion |

| 2025 | $757.58 billion |

| 2026 | $900.00 billion |

| 2027 | $1,070.10 billion |

| 2028 | $1,273.42 billion |

| 2029 | $1,516.64 billion |

| 2030 | $1,807.84 billion |

| 2031 | $2,156.75 billion |

| 2032 | $2,575.16 billion |

| 2033 | $3,077.32 billion |

| 2034 | $3,680.47 billion |

Source: Precedence Research 2

Year-over-year growth illustrates this consistent acceleration—rising from $294.16 billion in 2025, up $60.7 billion from 2024, and reaching $1.37 trillion by 2031. By 2034, AI will be a multi-trillion-dollar powerhouse underpinning most digital industries.

Also read about: Meta AI Statistics

Comparing AI Market Growth to Other Major Sectors

When measured against established industries, AI’s growth rate stands out even if its size is smaller. In 2025, global e-commerce leads with a valuation of $21.62 trillion, far larger than AI’s $757.58 billion.

Yet by 2034, AI’s $3.68 trillion market will still represent one of the fastest-growing technology segments, while e-commerce expands to $75.12 trillion.

The IT market, worth $1.61 trillion in 2025, is projected to hit $2.98 trillion by 2034, a growth AI will surpass by that year.

Cloud computing, at $912.77 billion in 2025, is expected to grow to $5.15 trillion by 2034, slightly outpacing AI but maintaining a strong interdependence with it.

In contrast, the global software market ($659.17 billion in 2023) will reach $2.24 trillion by 2034, remaining below AI’s projected value.

Meanwhile, massive industries like health and wellness ($6.87 trillion) and oil and gas ($6.10 trillion) continue to dominate in total value but grow at much slower rates than AI.

| Sector | 2025/2024 Market Size | 2034 Market Size | Relative to AI (2025) | Relative to AI (2034) |

|---|---|---|---|---|

| AI | $757.58B | $3.68T | – | – |

| E-commerce | $21.62T | $75.12T | Vastly larger | Still larger |

| IT | $1.61T | $2.98T | Larger | Surpassed by AI |

| Cloud Computing | $912.77B | $5.15T | Slightly larger | Leads AI |

| Software | $659.17B | $2.24T | Smaller | Smaller |

| Health & Wellness | $6.87T | $11T | 9× larger | Much larger |

| Oil & Gas | $6.10T | $8.79T | Far larger | 2× AI |

Source: Statista

Leading Players in the AI Ecosystem

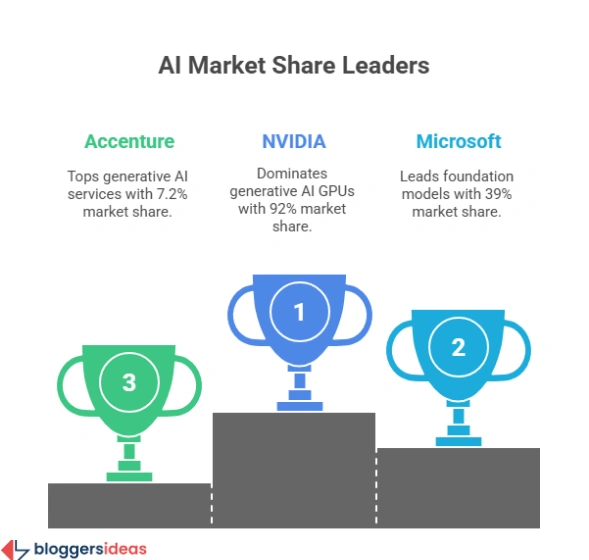

The AI market’s structure varies by segment, with a few companies dominating each major domain.

Generative AI GPUs:

- NVIDIA leads the GPU market with a commanding 92% share, powering most large-scale AI models.

- AMD follows with 4%, growing rapidly from 3% in 2023 (a 179% YoY increase).

- Huawei holds 2.2%, while others share the remaining 1.8%.

Foundational Models and Platforms:

- Microsoft dominates with 39% market share, driven by its OpenAI partnership.

- AWS follows with 19%, and Google holds 15%.

- OpenAI maintains 9%, with Anthropic at 4%, and other players combining for 14%.

AI Services Market:

- Accenture leads with 7.2%, following a $3B investment and a 390% rise in generative AI service revenue.

- Deloitte holds 3.4%, supported by a $4B AI investment, while IBM and McKinsey each control around 2.2%.

- Smaller consultancies and IT firms make up the remaining 81.3%.

Other key contributors to the broader ecosystem include Intel, Baidu, AWS, Arm, IBM, OpenAI, Google, Midjourney, Sensely, Atomwise, and Zebra Medical Vision, spanning chips, software, and applied AI solutions.

Also read about: DeepSeek AI Statistics

AI Adoption Demographics

AI adoption trends vary across demographics, influenced by age, gender, and geography.

- Among adults 65+, men show 35.4% interest in AI compared to 22% of women, the widest gender gap across all groups.

- For ages 35–44, the difference narrows to just 5.4 points (52.3% men vs. 46.9% women).

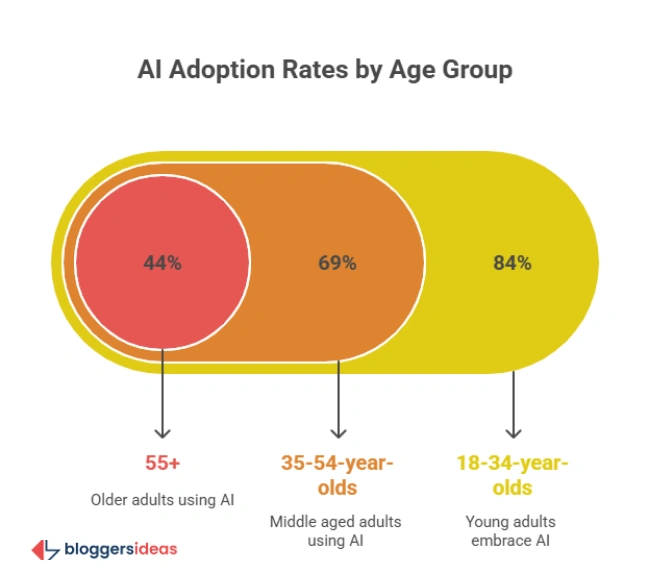

- 84% of adults aged 18–34 report using AI, compared to 44% of those over 55.

- Formal AI training follows the same pattern: 56% of young adults vs. 20% of seniors.

| Age Group | % AI Use | % AI Training |

|---|---|---|

| 18–34 | 84% | 56% |

| 35–54 | 69% | 41% |

| 55+ | 44% | 20% |

Men consistently express more enthusiasm for AI, peaking among 16–24-year-olds (57.3%), while female enthusiasm in the same range sits at 48.5%. Interest declines sharply after 65.

| Age Group | Female Interest | Male Interest |

|---|---|---|

| 16–24 | 48.5% | 57.3% |

| 25–34 | 46.4% | 53.9% |

| 35–44 | 46.9% | 52.3% |

| 45–54 | 43.7% | 51.5% |

| 55–64 | 37.8% | 49.2% |

| 65+ | 22% | 35.4% |

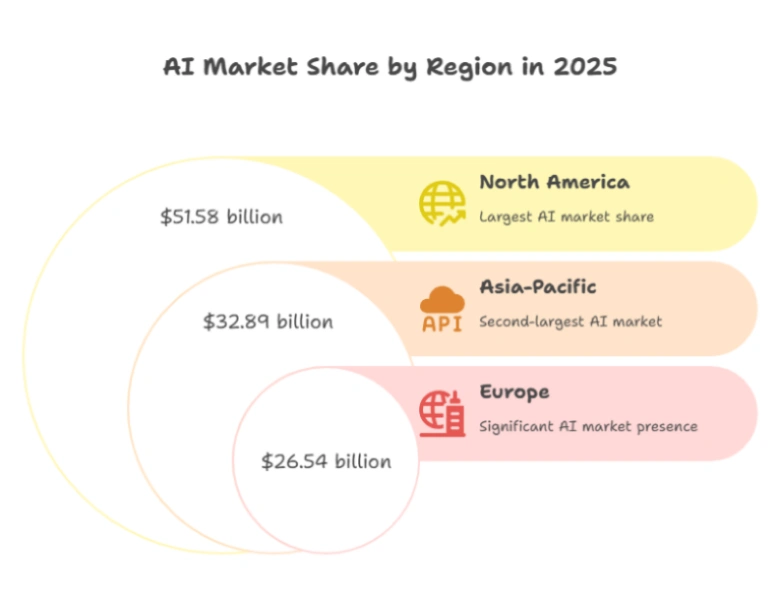

Geographically, North America leads AI adoption with 36.84%, followed by Europe (24.97%), Asia-Pacific (23.93%), and LAMEA (14.26%).

| Region | % Share of Global AI Adoption |

|---|---|

| North America | 36.84% |

| Europe | 24.97% |

| Asia-Pacific | 23.93% |

| LAMEA | 14.26% |

In 2025, regional AI market valuations are:

- North America: $51.58B

- Asia-Pacific: $32.89B

- Europe: $26.54B

Also read about: Google Ads Statistics

The AI Job Market: Roles, Demand, and Salaries

The AI boom is transforming global employment. In Q1 2025, the U.S. listed 35,445 AI-related job openings, up 25.2% from 2024. The median AI job salary hit $156,998, reflecting the high value of technical skills.

Mentions of AI in U.S. job listings jumped 114.8% (2023), 120.6% (2024), and 56.1% (2025).

Top-growing roles include:

| Job Role | YoY Growth (%) |

|---|---|

| AI Engineer | 143.2% |

| AI Content Creator | 134.5% |

| AI Solutions Architect | 109.3% |

| Prompt Engineer | 95.5% |

| AI Systems Designer | 92.6% |

| AI Product Manager | 89.7% |

Regionally, Asia leads AI job growth at 94.2%, followed by North America (88.9%) and South America (63.4%).

Business Adoption and Economic Impact

AI is now embedded in mainstream business operations. As of 2025, 78% of companies use AI in at least one function, up from 50% in 2022. Generative AI alone is used by 71% of firms, a dramatic rise from 33% in 2023.

| Year | AI Use in Companies | Generative AI Use |

|---|---|---|

| 2025 | 78% | 71% |

| 2024 | 72% | 65% |

| 2023 | 55% | 33% |

| 2022 | 50% | – |

The professional services sector leads measurable AI results at 48.4%, followed by manufacturing, information services, and healthcare (each around 12%).

The AI healthcare market, worth $38.66B in 2025, is projected to reach $187B by 2035, a 17× increase from 2021. The AI chip market has risen from $10.5B in 2021 to $44.3B in 2025, and will hit $127.8B by 2028.

In finance, 34% of firms reported over 20% revenue growth due to AI, and 88% experienced at least some gains.

| Revenue Increase | % of Firms |

|---|---|

| >20% | 34% |

| 10–20% | 17% |

| 5–10% | 20% |

| <5% | 16% |

| No Impact | 12% |

Globally, China and North America are set to see the biggest GDP boosts from AI—26% and 14%, respectively, by 2030.

Challenges in AI Implementation

Despite widespread adoption, companies still face key barriers.

- Data accessibility is the top issue for 34% of firms.

- Lack of AI expertise and high costs affect 29% each.

- Insufficient tools or infrastructure hinder 25%.

Still, 90% of organizations have already deployed generative AI tools, with 44% in full-scale production.

Workforce Transformation and Skills Development

AI is reshaping labor markets and skill demands. Workers with AI expertise earn 25% higher wages on average. Jobs requiring AI skills evolve 66% faster than traditional roles.

By 2025, AI may eliminate 92 million jobs but create 170 million new ones, yielding a net gain of 78 million jobs. This shift underscores the need for lifelong learning and reskilling programs.

Insights from Quora and Reddit

Online discussions reveal that users are increasingly focused on accessible AI tools for individuals and small businesses. Many seek low-code platforms or affordable AI integrations to improve productivity.

Ethical concerns are also rising—topics like job loss, AI bias, and regulation dominate conversations. Meanwhile, users explore new career niches in areas like AI education, sustainable farming, and mental health technology, reflecting an eagerness to find human-centered applications of AI.

Also Read:

- Android Usage Statistics

- Facebook Users Statistics

- AI Recruitment Statistics

- Blockchain Statistics

- Netflix Subscriber Statistics

Conclusion: Navigating the AI Frontier

The AI market’s growth to $757.58 billion in 2025 and its projected $3.68 trillion by 2034 mark a new era of technological transformation.

As AI becomes integrated across every major industry, its impact extends far beyond automation—it is redefining how economies function, how businesses compete, and how individuals work and learn.

However, rapid progress brings challenges in data management, ethics, and workforce adaptation.

Success in this evolving landscape depends on continuous education, responsible AI development, and strategic investment. Those who embrace these shifts will not just witness the AI revolution—they will shape it.