The digital asset landscape is continuously evolving, and while Bitcoin often captures the headlines, altcoins are increasingly carving out their own significant niche.

For those looking to understand the intricate dynamics of the cryptocurrency market, particularly how altcoins are shaping investment opportunities and real-world utility, a thorough examination of Altcoin Statistics 2025 provides crucial insights.

This comprehensive guide, leveraging the latest data and market trends, empowers both seasoned investors and curious newcomers to navigate the exciting world of alternative cryptocurrencies, helping them identify potential benefits and growth areas.

The Shifting Sands of Crypto Market Dominance

As of mid-2025, the cryptocurrency market presents a fascinating picture of diversification and shifting power dynamics. While Bitcoin (BTC) historically commands the largest share, altcoins are steadily increasing their footprint, illustrating a maturing ecosystem.

The total crypto market capitalization currently stands at an impressive 154.7 billion. Within this vast market, altcoins collectively account for approximately 43.7% of the global crypto market, a substantial portion that underscores their growing relevance.

Table 1: Global Crypto Market Overview (Mid-2025)

| Metric | Value |

| Total Crypto Market Cap | $3.942 Trillion |

| Total Trading Volume | $154.7 Billion |

| Altcoin Market Share | 43.7% |

| Bitcoin Dominance | 56.3% |

Examining the recent past, the altcoin market capitalization experienced fluctuations, demonstrating the inherent volatility of digital assets.

In July 2025, the altcoin market cap reached $1,610,722, which then saw a decline to $607,724 by August 21, 2025, representing a 62.3% decrease.

However, it is important to note that trading volume simultaneously nearly doubled during this period, surging by 96.7% from $676,239 to $1,330,585.

This surge in trading volume during a market cap decline often indicates heightened activity and price discovery, a characteristic trait of dynamic markets.

The Altcoin Season Index, as tracked by CoinMarketCap, currently sits at 43 out of 100.

A score below 50 generally indicates that Bitcoin is outperforming altcoins, suggesting that while altcoins are active, a full-blown “altcoin season” – characterized by widespread, aggressive altcoin rallies – has yet to definitively materialize.

This indicates a period where investors carefully consider their positions.

Also read abou: Blockchain Statistics

Key Players in the Altcoin Arena

Ethereum (ETH) firmly holds its position as the undisputed leader among altcoins. It serves as the backbone for numerous decentralized applications (dApps) and smart contracts, making it a critical infrastructure layer in the digital economy.

With a market capitalization of 33.98 billion, Ethereum’s influence is undeniable. The European Investment Bank’s creation of a €100 million digital bond on Ethereum’s public blockchain network further solidifies its institutional adoption and trust.

This demonstrates the growing confidence in its underlying technology.

Beyond Ethereum, a diverse array of altcoins commands significant market capitalization and trading volume, reflecting their utility, community support, and innovative features.

These top performers often represent different segments of the crypto ecosystem, from stablecoins to decentralized finance (DeFi) platforms and meme coins.

Table 2: Top Altcoins by Market Cap (Mid-2025)

| Sr. No. | Name | Symbol | Market Cap (Billion) | Trading Volume (Billion) |

| 1 | Ethereum | ETH | $517.52 | $33.98 |

| 2 | XRP | XRP | $170.59 | $6.73 |

| 3 | Tether | USDT | $167.00 | $97.42 |

| 4 | BNB | BNB | $115.47 | $1.16 |

| 5 | Solana | SOL | $96.88 | $5.78 |

| 6 | USDC | USDC | $67.81 | $13.29 |

| 7 | Lido Staked Ether | STETH | $36.75 | $0.063 |

| 8 | TRON | TRX | $33.07 | $1.18 |

| 9 | Dogecoin | DOGE | $31.95 | $3.11 |

| 10 | Cardano | ADA | $30.75 | $2.89 |

| 11 | Chainlink | LINK | $16.76 | $2.29 |

| 12 | Wrapped stETH | WSTETH | $16.06 | $0.069 |

| 13 | Wrapped Bitcoin | WBTC | $14.42 | $0.240 |

| 14 | Hyperliquid | HYPE | $13.82 | $0.311 |

| 15 | Wrapped Beacon ETH | WBETH | $13.28 | $0.039 |

| 16 | Stellar | XLM | $12.39 | $0.309 |

| 17 | Sui | SUI | $12.09 | $1.47 |

| 18 | Ethena USDe | USDE | $11.60 | $0.293 |

| 19 | Wrapped eETH | WEETH | $11.59 | $0.032 |

| 20 | Bitcoin Cash | BCH | $10.91 | $0.189 |

This table clearly shows the diversification within the altcoin market. Stablecoins like Tether (USDT) and USDC maintain high market caps due to their role in facilitating trading and providing stability.

Platforms like Solana (SOL) and Cardano (ADA) continue to attract significant investment through their innovative blockchain architectures and expanding ecosystems.

The enduring presence of Dogecoin (DOGE) also highlights the significant influence of community and social sentiment on altcoin valuations, showcasing that beyond pure utility, cultural impact matters.

Also read about: 10 Best Bitcoin and Crypto Affiliate Programs Of 2025

Trending Altcoin Categories: Where Innovation Meets Investment

The altcoin market is not a monolithic entity; it comprises various categories, each driven by distinct technologies, use cases, and market narratives.

Understanding these categories is essential for investors seeking to diversify their portfolios and capitalize on emerging trends.

Stablecoins lead the charge, boasting a combined market cap of $279.8 billion, representing 7.83% of the total crypto dominance.

These assets, pegged to fiat currencies, provide a crucial bridge between traditional finance and the volatile crypto market, enabling traders to secure profits and enter/exit positions without converting back to fiat.

Exchange-based tokens, which offer various benefits like reduced trading fees or governance rights on centralized exchanges, hold the second position with $165.1 billion across 128 different tokens.

This category demonstrates the inherent value created by platforms that facilitate crypto trading.

Decentralized Finance (DeFi) remains a powerhouse, with 1,395 different coins totaling $163.5 billion in market capitalization.

DeFi protocols are revolutionizing traditional financial services, offering lending, borrowing, and trading without intermediaries, attracting significant capital due to their innovative approach.

Meme coins, surprisingly, represent the largest category by count with 5,310 tokens worth $72.7 billion combined.

While often driven by social media trends and community engagement, their collective market cap highlights their speculative appeal and growing influence, evolving from pure novelty to significant market players.

Emerging categories such as Real World Assets (RWA) and Artificial Intelligence (AI) are rapidly gaining traction, reflecting the broader technological advancements and their integration with blockchain. RWAs, with a market cap of

29.4 billion, are leveraging blockchain for data management, secure transactions, and decentralized AI applications, tapping into the growing interest in artificial intelligence.

Table 3: Top Altcoin Categories by Market Cap (Mid-2025)

| Top Altcoin Categories | Market Cap (Billion) | Dominance (%) | Coins Count |

| Stablecoins | $279.8 | 7.83 | 350 |

| Exchange-based Tokens | $165.1 | 4.86 | 128 |

| Decentralized Finance (DeFi) | $163.5 | 4.44 | 1,395 |

| Meme | $72.7 | 4.21 | 5,310 |

| Real World Assets (RWA) | $55.3 | 4.50 | 540 |

| Artificial Intelligence (AI) | $29.4 | 2.54 | 1,189 |

| Layer 2 (L2) | $18.4 | 1.12 | 125 |

| Gaming (GameFi) | $12.6 | 2.14 | 909 |

These categories demonstrate the diverse landscape of altcoin innovation, offering investors a wide spectrum of opportunities based on their risk appetite and investment goals.

From stable, utility-driven assets to speculative, community-led projects, the altcoin market offers something for everyone.

Demographics and Adoption: Who is Investing in Altcoins?

Understanding the demographics of cryptocurrency investors provides valuable insights into market trends and future growth potential.

The adoption of altcoins is increasingly widespread, reaching various age groups and income levels globally.

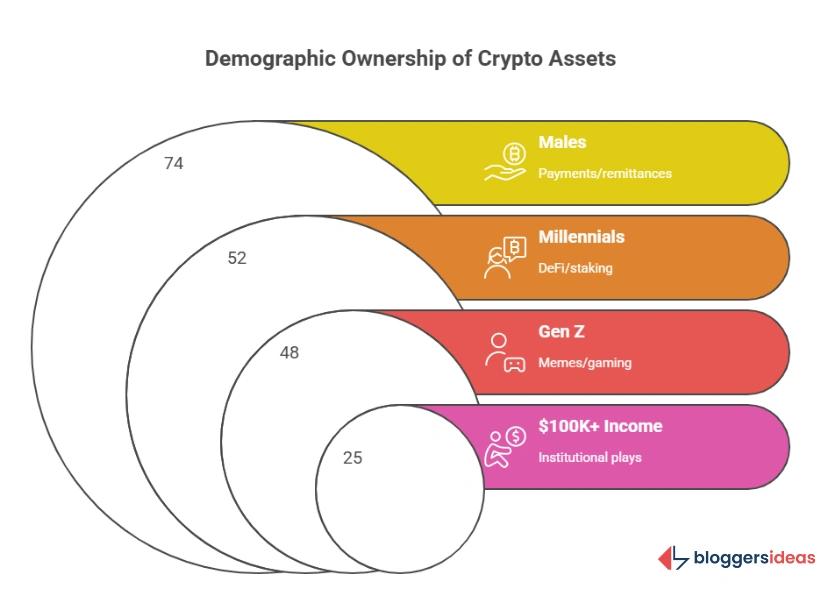

In the United States, a significant portion of the younger generation is actively engaged in crypto investing. Approximately 57% of Millennials and 48% of Gen Z have traded or invested in cryptocurrency at least once in their lifetime.

This indicates a strong generational shift towards digital assets, suggesting continued growth as these generations accumulate wealth.

Globally, a notable gender disparity exists in crypto ownership. Around 74% of males own cryptocurrency, compared to 26% of females.

However, regional differences exist, with 31% of crypto holders in Asia-Pacific countries being women, and female Millennials and Gen Z in these regions owning more cryptocurrency than their male counterparts. This highlights the importance of localized market analysis.

Table 4: Crypto Ownership by Gender (%)

| Gender | Crypto Ownership |

| Male | 74% |

| Female | 26% |

Income levels also play a significant role in crypto adoption. Individuals earning over $100,000 per year own 25% of all crypto investments, while only 18.6% of Americans earning less than

111,000 each year, suggesting that higher disposable income correlates with greater participation in the crypto market. This highlights a potential area for future growth as accessibility and education improve for lower-income brackets.

Table 5: Crypto Ownership by Income Level

| Income Level | Ownership Rate |

| $100,000+ annually | 25% of crypto owners |

| Under $50,000 annually | 18.6% ownership |

| Average crypto investor | $111,000 annual income |

The United States leads the cryptocurrency market in 2025 in terms of overall trading volume and adoption.

However, countries like Bulgaria show significant search interest in altcoins, indicating a strong global curiosity and engagement with these alternative assets.

Altcoin Market Risks and Investment Considerations

While the potential for high returns in the altcoin market is enticing, investors must approach it with a clear understanding of the inherent risks.

The cryptocurrency market is notoriously volatile, and altcoins, in particular, can experience drastic price fluctuations within hours. This makes them highly unpredictable investments, requiring careful research and risk management.

A critical aspect to consider is the irreversibility of cryptocurrency transactions. Once completed, these transactions cannot be reversed, leaving users unprotected in cases of error or fraud.

Unlike traditional banking systems with fraud protection, crypto transactions are final, emphasizing the need for meticulous double-checking before confirming any transfer.

Investor sentiment also plays a crucial role. A significant portion of the general public, specifically 82% of people, are not confident about investing in cryptocurrency, with individuals aged 50+ showing less inclination to trade in cryptos compared to younger generations.

This indicates a lingering perception of risk and a need for greater education and regulatory clarity to instill broader confidence.

Furthermore, cryptocurrency investments are not protected by government insurance, unlike traditional bank deposits and savings accounts.

This lack of a safety net means investors bear the full risk of their holdings, highlighting the importance of not investing more than one can afford to lose.

Altcoin Future Market Projections

Despite the inherent risks, the future market projections for altcoins remain optimistic, with significant growth anticipated in the coming years. The global cryptocurrency market is projected to expand at a Compound Annual Growth Rate (CAGR) of 14.19% from 2025 to 2030. This robust growth forecast signals continued innovation and adoption across various sectors.

Optimism among current crypto owners is also high, with approximately 63% expecting to purchase more cryptocurrency in 2025. This sustained interest from existing holders provides a strong foundation for continued market growth.

Coinbase projects a potential shift towards altcoins in the third quarter of 2025, particularly highlighting Ethereum (ETH), which experienced over 50% growth in market cap from July 2025. This indicates a potential “altcoin season” where capital rotates from Bitcoin into promising alternative assets. Forecasts suggest the altcoin market cap might even cross $1.4 trillion by September 2025.

However, it is crucial to reiterate that these projections are subject to the inherent volatility of the digital asset market. Investors must remain vigilant, conduct thorough due diligence, and invest wisely to capitalize on potential returns while mitigating risks.

Quora and Reddit Insights: Addressing User Concerns

Beyond the statistics, understanding what real users are discussing on platforms like Quora and Reddit provides invaluable qualitative insights into the evolving concerns and interests surrounding altcoins.

Many users frequently ask about the sustainability of altcoin projects, particularly meme coins, and the real-world utility of emerging tokens.

A recurring theme revolves around the “liquidity bottleneck” and “token supply explosion.” Users are asking why, despite a growing overall crypto market cap, many altcoins remain significantly below their all-time highs.

The answer lies in the mismatch between capital inflow and the sheer number of new tokens entering the market.

With more tokens than ever before, liquidity is spread thin, preventing broad-based rallies. Instead, capital rotates selectively into highly visible narratives or projects with strong fundamentals.

Another prevalent question concerns the impact of institutional interest. While institutions are increasingly entering the crypto space, their focus remains predominantly on Bitcoin and, to a lesser extent, Ethereum.

Users are keen to know when this institutional capital will flow into a broader range of altcoins. This hinges on greater regulatory clarity for altcoins and the ability of these assets to offer comparable use cases or risk-adjusted returns that appeal to traditional financial players.

The “musical chairs” analogy frequently appears in discussions, emphasizing the risk of holding underperforming assets.

Users are grappling with how to identify projects with product-market fit, sustainable economics, and user adoption, as opposed to those that may not recover from market downturns. This highlights a shift towards fundamental analysis over purely speculative trading.

Furthermore, discussions often highlight the importance of “token burn and scarcity” mechanisms. In a low-liquidity environment, projects that actively reduce their supply through burns or buybacks are seen as potentially outperforming others, as this creates a deflationary pressure that can drive up value.

Finally, users are deeply interested in the next “narrative shifts” that could trigger altcoin rallies.

Whether it’s new technological breakthroughs, mass adoption events in specific sectors like gaming (GameFi), or real-world asset (RWA) tokenization, the community is always searching for the next big trend to drive altcoin performance.

This proactive engagement from users underscores the dynamic and forward-looking nature of the altcoin community.

FAQs About Altcoin Statistics

1. What is an altcoin, and how does it differ from Bitcoin?

An altcoin is any cryptocurrency that isn’t Bitcoin. Bitcoin acts as the market benchmark, while altcoins offer different technologies, features, and use cases such as smart contracts, faster transactions, or stable value.

2. Why consider investing in altcoins if Bitcoin is more established?

Altcoins can offer higher growth potential, new technologies, and exposure to specific sectors like DeFi, gaming, and smart contracts. They also allow better diversification beyond Bitcoin.

3. What are the biggest risks of altcoin investing?

Altcoins are extremely volatile, often have lower liquidity, and many projects fail due to weak adoption or funding. No protections exist if funds are lost, making risk management essential.

4. How do institutional investors view altcoins?

Institutions focus mainly on Bitcoin and selectively on Ethereum. They invest in other altcoins only when there’s strong utility, liquidity, and regulatory clarity. Their involvement can boost prices significantly.

5. What should I consider before investing in an altcoin?

Review the project’s use case, team, roadmap, market cap, liquidity, and community activity. Look for real utility, active development, and strong long-term potential before investing.

Also Read:

- YouTube Creator Statistics

- LinkedIn Statistics

- Content Marketing Statistics

- Google Ads Statistics

- Telegram Statistics

Conclusion: Navigating a Maturing Altcoin Landscape

The altcoin market in 2025 presents a complex yet exciting landscape for investors. While Bitcoin maintains its dominance, altcoins are demonstrating significant growth, diversification, and innovation across various categories.

Ethereum continues to lead, while other projects like Solana, XRP, and Cardano are solidifying their positions through technological advancements and expanding ecosystems.

The rise of new categories like RWA and AI-integrated tokens signals a maturation of the market, moving beyond pure speculation towards tangible utility.

However, investors must remain acutely aware of the inherent risks, including market volatility, irreversible transactions, and the lack of traditional financial protections.

The influx of numerous new tokens means that selective investment based on strong fundamentals, real-world usage, and demonstrable growth is paramount.

The insights from platforms like Quora and Reddit underscore a growing sophistication among retail investors, who are increasingly focusing on liquidity, institutional adoption, and project sustainability.

As the Altcoin Season Index hovers around early momentum levels, and with projections pointing towards continued market expansion, a cautious yet optimistic approach is warranted.

By diligently tracking fundamentals, monitoring market trends, and adapting investment frameworks to this evolving reality, investors can position themselves to potentially benefit from the next wave of altcoin innovation and growth.

The future of digital assets is not solely Bitcoin; it is a vibrant tapestry woven with the threads of countless altcoins, each offering a unique proposition in the decentralized future.

Source: Coingecko, CoinMarketCap