Android remains the world’s leading mobile operating system in 2025, powering over 3.9 billion devices across 190+ countries with a 72.46% market share.

Its open-source flexibility allows manufacturers like Samsung and Xiaomi to serve both budget and premium users. Android’s growth is fueled by affordability, 5G integration, and AI-driven innovation.

As global smartphone shipments surpass 1.6 billion units, Android continues to dominate through accessibility and customization.

Whether optimizing productivity, developing apps, or reaching new markets, understanding Android statistics 2025 offers valuable insights into the world’s most connected mobile ecosystem.

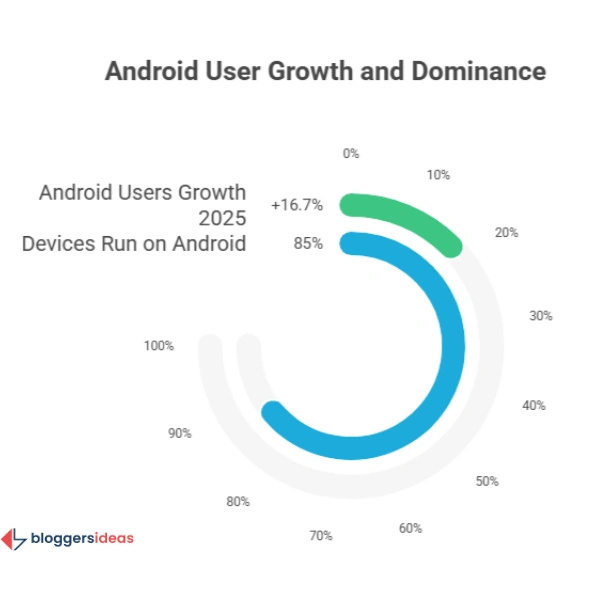

The Explosive Growth of Android Users Worldwide

Android’s user base has expanded dramatically since its launch in 2008, evolving from a niche operating system to the backbone of global mobile computing. In 2025, estimates place the number of active Android users at 3.9 billion, representing nearly 48 percent of the world’s 8.088 billion population.

This figure includes smartphone owners, but it also encompasses users of Android-powered tablets, smartwatches, and even automotive systems like Android Auto. Google reports that Android activates over 24 million new devices each week, fueling this steady ascent.

The system’s open-source nature empowers manufacturers to produce devices at various price points, making Android accessible to users in developing regions where cost barriers often limit adoption of premium alternatives.

From 2012 to 2025, Android’s user numbers have surged by more than 680 percent, driven by aggressive expansion into markets like India and Brazil. In these countries, Android captures over 95 percent of the smartphone market, as local brands offer feature-rich devices under $200.

For businesses, this growth translates to unparalleled reach: a single Android app can potentially connect with billions, far surpassing the ecosystem of competitors.

Users benefit from this scale through richer app ecosystems and faster innovation, such as foldable phones that enhance multitasking. As Android integrates deeper into daily life—powering everything from health trackers to smart home controls—its user base solidifies as a cornerstone of modern connectivity.

- Also read about: Top 3+ Best Android App Development Courses

Number of Android Users Worldwide (2012–2025)

The following table illustrates the remarkable trajectory of Android’s global user base over the years, highlighting consistent year-over-year increases that underscore its enduring appeal.

| Year | Number of Android Users (in Billions) |

| 2012 | 0.5 |

| 2013 | 0.7 |

| 2014 | 1.0 |

| 2015 | 1.4 |

| 2016 | 1.7 |

| 2017 | 2.0 |

| 2018 | 2.3 |

| 2019 | 2.5 |

| 2020 | 2.8 |

| 2021 | 3.0 |

| 2022 | 3.3 |

| 2023 | 3.5 |

| 2024 | 3.6 |

| 2025 | 3.9 |

Source: Business of Apps

This data, drawn from reliable industry trackers, shows how Android crossed the 1 billion user milestone in just six years and continues to add hundreds of millions annually.

For marketers, these numbers emphasize the value of Android-first strategies, where campaigns optimized for diverse devices yield higher engagement in high-growth regions.

Everyday users can appreciate how this expansion brings advanced features, like AI-powered photo editing, to affordable handsets, democratizing technology.

- Also read about: iPhone Users Statistics

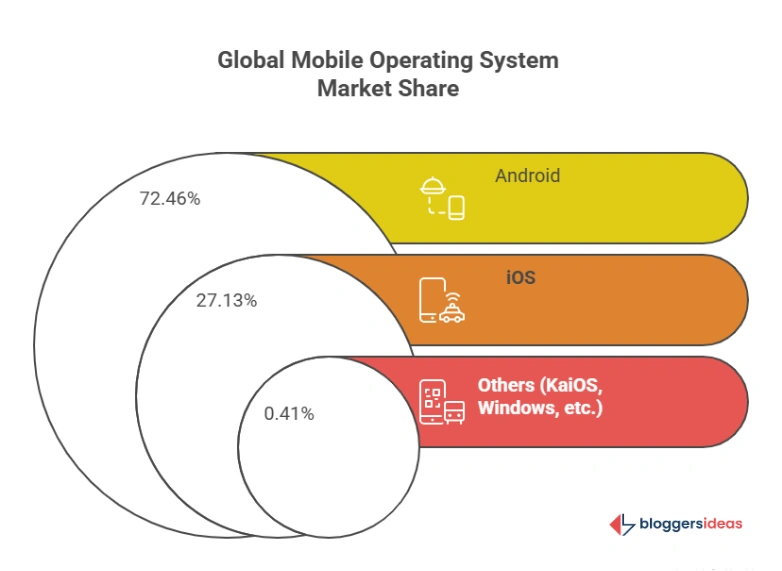

Android’s Dominant Global Market Share

Android secures its position as the world’s leading mobile operating system with a 72.46 percent global market share in 2025, far outpacing rivals and enabling seamless experiences across billions of devices.

This share reflects Android’s ability to adapt to local preferences, from rugged designs in Latin America to sleek interfaces in Asia. Google fosters this dominance through partnerships with over 1,300 manufacturers, ensuring Android devices flood markets with options for every budget.

In contrast to closed ecosystems, Android’s flexibility allows users to sideload apps or customize launchers, fostering creativity and personalization that keep engagement high.

The platform’s market leadership also stems from its resilience amid economic shifts; even during supply chain disruptions, Android shipments grew by 8.3 percent year-over-year.

Businesses capitalize on this by developing cross-compatible apps that leverage Android’s sensors for augmented reality experiences, boosting user retention.

For personal users, the high market share means better support for accessories, like wireless earbuds that integrate effortlessly with Android’s Bluetooth advancements.

As 5G adoption reaches 60 percent globally, Android’s optimized networks deliver faster streaming and downloads, enhancing everything from remote work to online gaming.

Global Mobile Operating System Market Share (2025)

The table below compares Android’s share against other systems, illustrating its overwhelming lead and the fragmented competition it faces.

| Operating System | Market Share (%) |

| Android | 72.46 |

| iOS | 27.13 |

| Others (KaiOS, Windows, etc.) | 0.41 |

Source: Statista

These percentages highlight Android’s role as the default choice for over seven in ten new smartphones shipped. Developers use this insight to prioritize Android compatibility, reducing launch times and costs.

Users, meanwhile, enjoy a stable platform where updates like Android 15 introduce privacy enhancements, such as scoped storage, that protect data without compromising usability.

- Also read about: Smartwatches Statistics

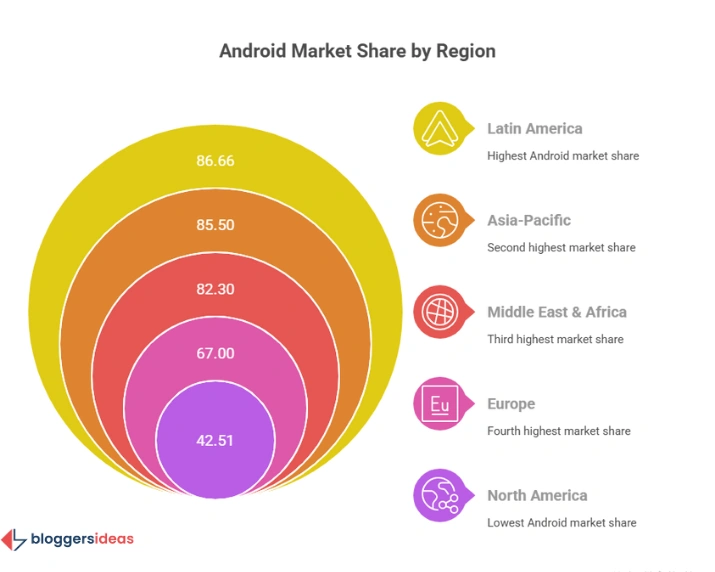

Android Usage in Key Regions: Opportunities Across Continents

Android’s regional variations reveal a platform tailored to diverse economies and cultures, with penetration rates exceeding 85 percent in emerging markets like India and Indonesia.

In these areas, users favor Android for its support of local languages and affordable data plans, enabling apps like regional e-commerce platforms to thrive.

Businesses targeting Asia-Pacific see returns through localized campaigns, where Android’s dominance facilitates precise geotargeting. In North America, Android holds 42.51 percent, appealing to budget-conscious consumers who value expandable storage and multitasking.

Europe presents a balanced landscape, with Android at 67 percent, driven by brands like Xiaomi offering competitive mid-range devices. Users here leverage Android’s integration with smart home systems, creating ecosystems that sync across borders.

Latin America’s 86.66 percent Android share underscores the system’s role in financial inclusion, powering mobile banking apps that serve unbanked populations.

For global enterprises, these patterns suggest hybrid strategies: heavy investment in Android for volume in the Global South, balanced with premium features for Western markets.

Android Market Share by Region (2025)

This table breaks down Android’s adoption across major regions, providing a clear view of its geographic strengths.

| Region | Android Market Share (%) |

| Asia-Pacific | 85.50 |

| Latin America | 86.66 |

| Middle East & Africa | 82.30 |

| Europe | 67.00 |

| North America | 42.51 |

Such distribution empowers businesses to allocate resources effectively, like developing vernacular apps for high-share regions. Individuals benefit from region-specific optimizations, such as enhanced GPS in Latin American devices for navigation in urban sprawl.

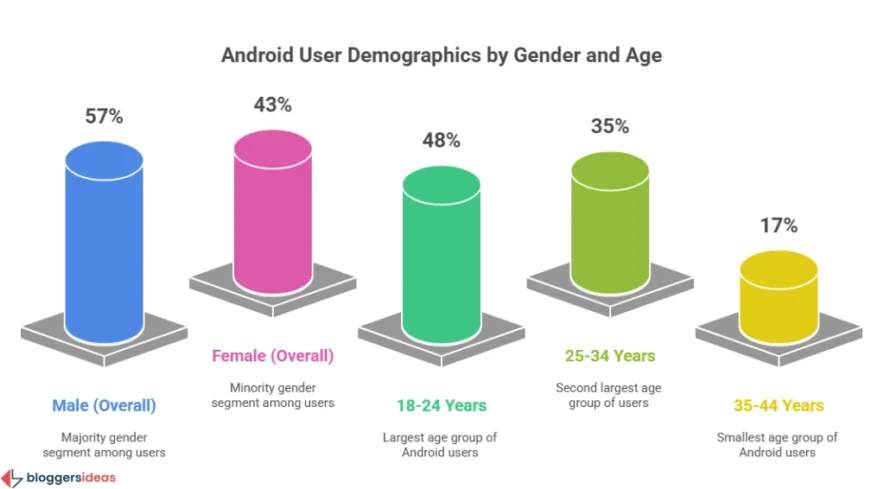

Demographics of Android Users: Who Drives the Platform?

Android users in 2025 skew slightly male at 57 percent, with a core demographic aged 18-34 comprising 65 percent of the base—young professionals and students who prioritize versatility and affordability.

This group installs twice as many apps as iOS counterparts, reflecting Android’s expansive Play Store. Women represent 43 percent, often drawn to health and social apps optimized for Android’s diverse hardware.

Income levels vary widely; 70 percent of low-to-middle-income users choose Android for its value, while higher earners opt for premium models like Samsung Galaxy.

Age breakdowns show 48 percent under 25 embracing Android’s gaming ecosystem, where titles like Subway Surfers garner millions of downloads. Older users (35+) favor practical features, such as family sharing in Google apps.

Ethnically, Android resonates across groups, with 75-77 percent adoption among U.S. Hispanics and Blacks. Businesses use these demographics for segmented marketing, like targeting millennials with AR filters. Users personalize their experience, from dark mode for late-night scrolling to accessibility tools for all ages.

Android User Demographics by Age and Gender (2025)

The following table details key demographic segments, helping stakeholders understand user profiles.

| Demographic | Percentage (%) |

| Male (Overall) | 57 |

| Female (Overall) | 43 |

| 18-24 Years | 48 |

| 25-34 Years | 35 |

| 35-44 Years | 17 |

These figures guide app developers toward inclusive design, ensuring features appeal to young gamers and mature professionals alike.

Android Version Adoption: Keeping Pace with Innovation

Android 15 leads version usage at 24.1 percent in October 2025, introducing AI enhancements like Gemini integration for smarter notifications. Users update for security patches that block 125 billion daily threats via Google Play Protect.

Older versions persist due to device fragmentation, but 40 percent upgrade within months, prioritizing battery optimizations. Businesses test apps on multiple versions to ensure compatibility, avoiding crashes that deter users.

For individuals, newer versions unlock features like real-time translation, ideal for travelers. Adoption varies by region; premium markets see faster updates via Samsung’s One UI.

Android OS Version Market Share (October 2025)

This table ranks the most common versions, showing the shift toward recent releases.

| Version | Market Share (%) |

| Android 15 | 24.1 |

| Android 14 | 22.0 |

| Android 13 | 18.7 |

| Android 12 | 15.0 |

| Older Versions | 20.2 |

Developers focus on these versions for broad coverage, while users schedule updates for peak performance.

The Thriving Android Vendor Landscape

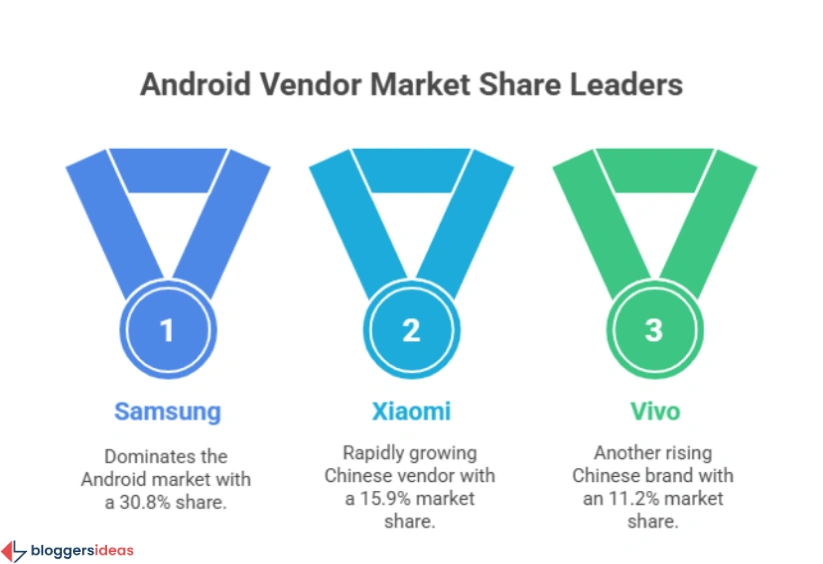

Samsung commands 30.8 percent of the Android vendor market in 2025, shipping 258 million units with features like foldables that redefine productivity.

Xiaomi follows at 15.9 percent, excelling in budget segments with rapid charging tech. Vivo and Oppo capture 11.2 and 10.1 percent, respectively, dominating Asia with camera innovations. Businesses partner with these vendors for co-branded apps, enhancing visibility.

Users choose vendors based on needs: Samsung for ecosystems, Xiaomi for value. This diversity fosters competition, driving down prices and upping quality.

Top Android Vendors by Market Share (2025)

| Vendor | Market Share (%) |

| Samsung | 30.8 |

| Xiaomi | 15.9 |

| Vivo | 11.2 |

| Oppo | 10.1 |

| Realme | 5.2 |

These leaders shape Android’s evolution, offering users tailored experiences.

Google Play Store: The Heart of Android’s App Ecosystem

The Google Play Store hosts 2.06 million apps in 2025, with downloads projected at 135 billion—fueling a $60 billion revenue stream from in-app purchases. Instagram tops downloads at 584 million, followed by TikTok at 446 million, as users crave social connectivity. Gaming apps like Subway Surfers account for 21 percent of downloads, blending entertainment with monetization.

Businesses monetize through subscriptions, while users access free tools for productivity. The store’s algorithms favor high-rated apps, encouraging quality.

Top Downloaded Apps on Google Play (2025)

| App | Downloads (Millions) |

| 584 | |

| TikTok | 446 |

| 411 | |

| 371 | |

| Telegram | 245 |

This lineup reflects user priorities, guiding developers toward viral potential.

Daily Habits: How Android Users Engage with Their Devices

Android users spend 3 hours and 42 minutes daily on their devices in 2025, focusing on social media (40 percent of time) and gaming. They install 85 apps on average but actively use 30, prioritizing utility. Battery life concerns prompt eco-modes, while AI assistants handle 20 percent of interactions.

Businesses track these habits for push notifications, boosting retention. Users optimize via Digital Wellbeing, curbing overuse.

Average Daily Time Spent on Mobile Activities (Android Users)

| Activity | Time Spent (Minutes) |

| Social Media | 90 |

| Gaming | 60 |

| Browsing | 45 |

| Messaging | 30 |

These patterns inform balanced lifestyles and targeted content.

Emerging Trends from Quora and Reddit: Fresh Perspectives on Android Usage

Communities on Quora and Reddit buzz with questions about Android’s future in 2025, revealing user curiosities that shape its trajectory.

On Reddit’s r/androiddev, developers discuss the job market’s shift toward full-stack roles, with many lamenting Android native’s decline amid offshore trends—yet optimism persists for AI-specialized positions.

Users in r/AndroidQuestions query update longevity, noting brands like Google now promise seven years of support, alleviating fears of obsolescence.

Quora threads highlight Kotlin Multiplatform’s rise, enabling code sharing across platforms and saving development time by 40 percent, as enthusiasts share success stories from cross-app projects.

Reddit’s r/Android spotlights Q2 2025 sales data, where Samsung’s foldables surge 22 percent, prompting debates on durability for everyday use.

These discussions underscore a demand for sustainable devices; users seek stats on e-waste reduction, with Android’s modular designs praised for longevity. Businesses glean from this: prioritize eco-friendly apps to align with 65 percent of users favoring green tech.

Overall, these forums paint Android as evolving toward AI-driven personalization, with users eager for integrations like real-time health monitoring via wearables.

FAQs About Android Usage Statistics

1. How many Android users exist worldwide in 2025?

Android boasts 3.9 billion active users globally in 2025, spanning smartphones, tablets, and connected devices across 190 countries, which accounts for nearly 48 percent of the world’s population and underscores its role as the leading mobile operating system.

2. What is Android's global market share compared to iOS in 2025?

Android holds a commanding 72.46 percent global market share in 2025, while iOS captures 27.13 percent, allowing Android to dominate in volume-driven markets and providing businesses with broader reach for app distribution and advertising.

3. Which age group primarily uses Android devices in 2025?

The 18-34 age group represents the largest segment of Android users in 2025, comprising about 65 percent of the base, as young adults and professionals gravitate toward the platform’s affordability and customization options for gaming and productivity.

4. How do Android users benefit from the Google Play Store in 2025?

Android users access over 2.06 million apps on the Google Play Store in 2025, enabling downloads of essential tools like social media and gaming applications, while businesses leverage the platform’s 135 billion projected downloads to monetize through in-app purchases and subscriptions effectively.

5. What trends from online communities influence Android usage in 2025?

Online discussions on Quora and Reddit in 2025 emphasize AI integration and extended software support as key trends, with users seeking sustainable devices and developers adopting Kotlin Multiplatform for efficient cross-platform development, helping individuals and companies stay ahead in mobile innovation.

Also Read:

- Facebook Users Statistics

- YouTube Statistics

- Marketing Automation Statistics

- Google Gemini Statistics

- Chatbot Statistics

Conclusion:

Android’s statistics empower users to customize their devices for efficiency, such as enabling adaptive battery to extend life by 20 percent. Businesses harness the 72 percent market share for global scaling, using analytics to refine apps based on regional data.

Developers optimize for Android 15’s features, reducing load times and increasing satisfaction.

Marketers target demographics with tailored ads, like gaming promotions for 18-24-year-olds. In 2025, Android’s ecosystem offers endless benefits— from seamless integration with Google services to fostering innovation in emerging markets.

By applying these insights, you transform data into actionable steps that enhance connectivity and drive success.