Do you wish to open a PayPal account in India and verify it?

Then believe me when I say that at the conclusion of this post, you will have a FULLY VERIFIED Paypal India account.

You must be able to send and receive payments if you want to make money online or start working online.

Most of us make payments with a credit or debit card.

But what about being paid.

PayPal and Google Wallet are just a few of the services you’ll need to accept payments from anywhere in the world.

Because,

If you are a blogger, you may be aware that the majority of advertising firms pay using PayPal. If you wish to receive payments from outside India, you must have a PayPal account.

What exactly is Paypal?

Paypal is a global online money transfer service that allows you to send and receive money from anywhere on the globe.

Paypal charges lower costs for its services to both consumers and businesses.

Most companies and customers choose to utilize it since it is secure and easy.

Here are a few of the benefits of having PayPal:

It is free, and you will not be charged any costs other than conversion fees.

It is quick and safe, and you will have your money in your bank account within a few days.

You may make overseas purchases without disclosing your credit card information, and you can handle all of your payments in one location.

Paypal is widely recognized, so you may use it everywhere you go online.

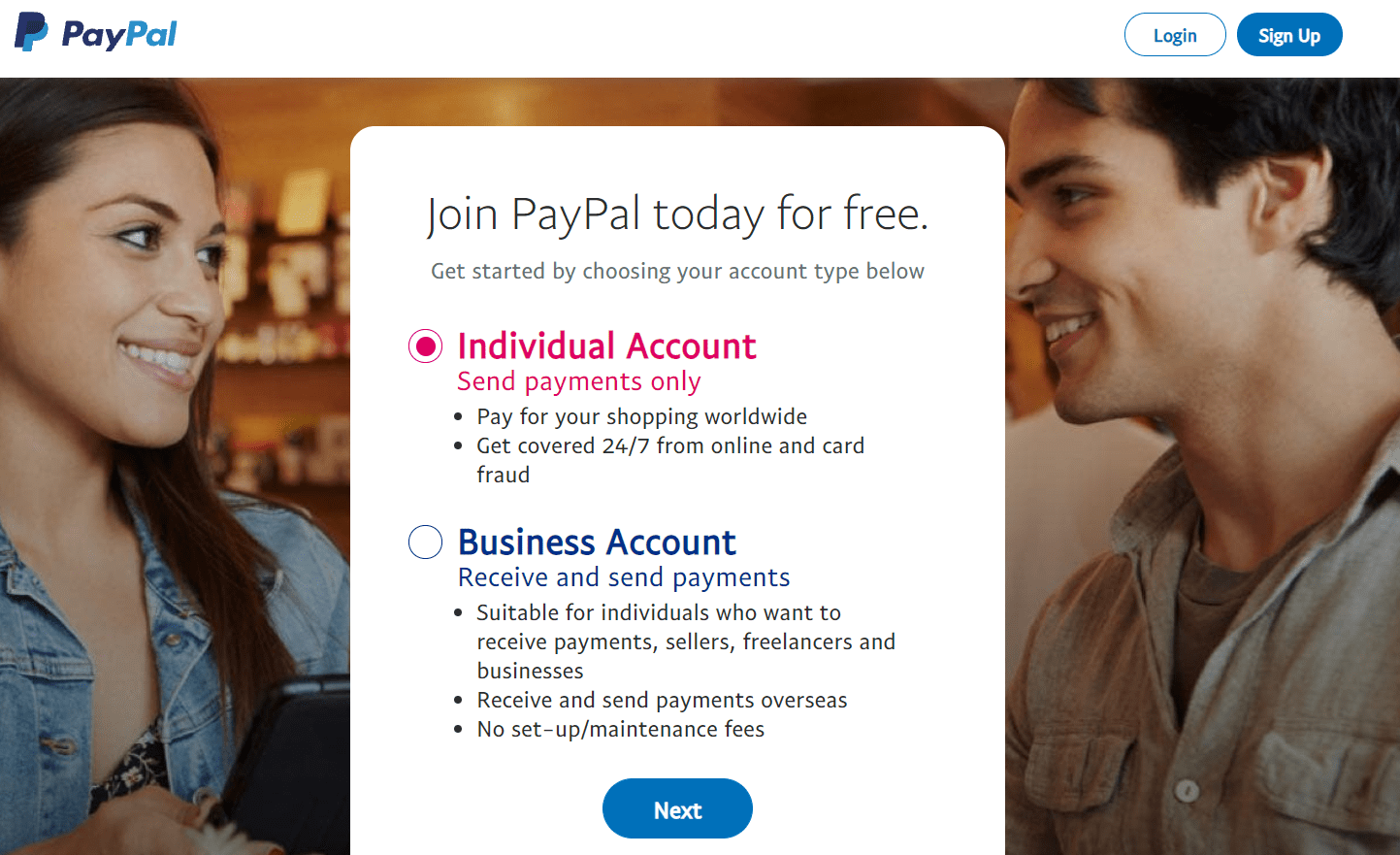

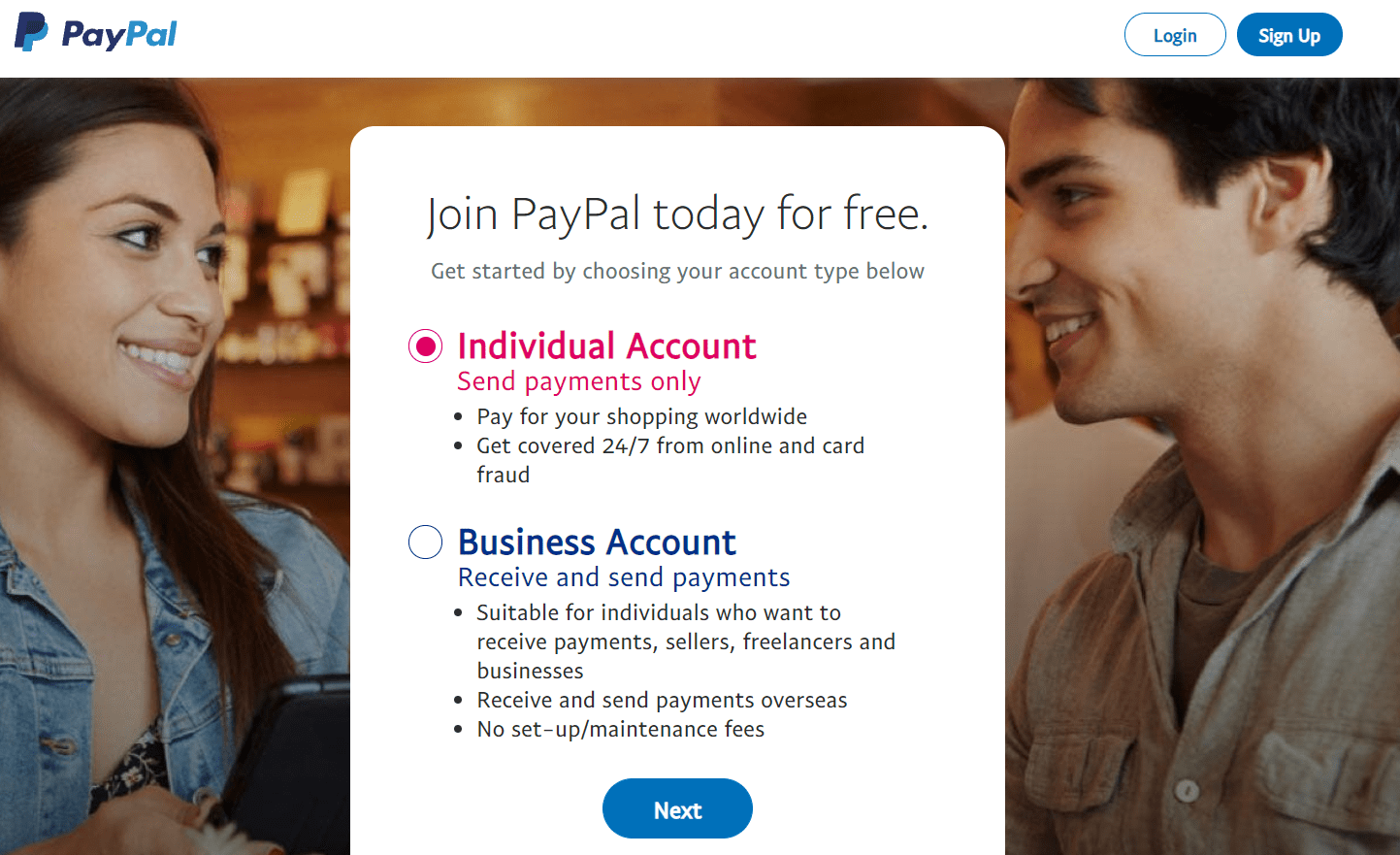

Types of PayPal Accounts and Their Uses

PayPal has two kinds of accounts. You can choose between an Individual and a Business account.

Here are the distinctions between the two.

-

Personal Account

- An individual account will only allow you to send payments.

- Pay for your purchases anywhere in the world.

- Online and card fraud is protected 24/7.

-

Business Account

- You may receive and send payments using a business account.

- Individuals, merchants, freelancers, and enterprises who wish to accept payments should use this service.

- Receive and transfer money both domestically and internationally.

- KYC will be required before you can begin receiving local INR payments.

- There are no setup or maintenance expenses.

Signing up for both accounts is completely free. As a result, you may select an account type that meets your requirements.

You may also downgrade (from business to individual) and upgrade (from individual to business) your account.

It is quite simple to convert your Individual account to a Business account.

- Open settings.

- Select the Upgrade to a Business Account option.

- Enter your company information and click the “Agree and Continue” button.

If you wish to convert your PayPal India Business account to an Individual account, you must contact the PayPal staff.

Just make sure you’re signed in to your account before making this request for the sake of your account’s security.

When contacting them, make sure to include all of the facts about the account type change. They will notify you once the account type has been updated.

Advantages of having a PayPal account:

- You will be able to make online payments without having to provide your credit card information.

- You may make a payment with your debit card. Many folks who do not have a credit card will benefit from this.

- You can receive funds from accounts in other countries. (For example, clients or advertising money.)

- Many internet services levy ongoing fees. When you pay using PayPal, you have the option to discontinue regular payments at any time.

- PayPal allows you to transfer payments in bulk.

- Invoices may be created and sent straight to your client.

Requirements for PayPal Registration

You’ll need three items to get started with PayPal.

- Email address

The first is your email address, which will be used to access your Paypal account.

- Bank Account

Following that, you will require an active bank account from which all cash will be taken.

- PAN Card

Finally, in order to be verified for receiving foreign payments, you must have a PAN card.

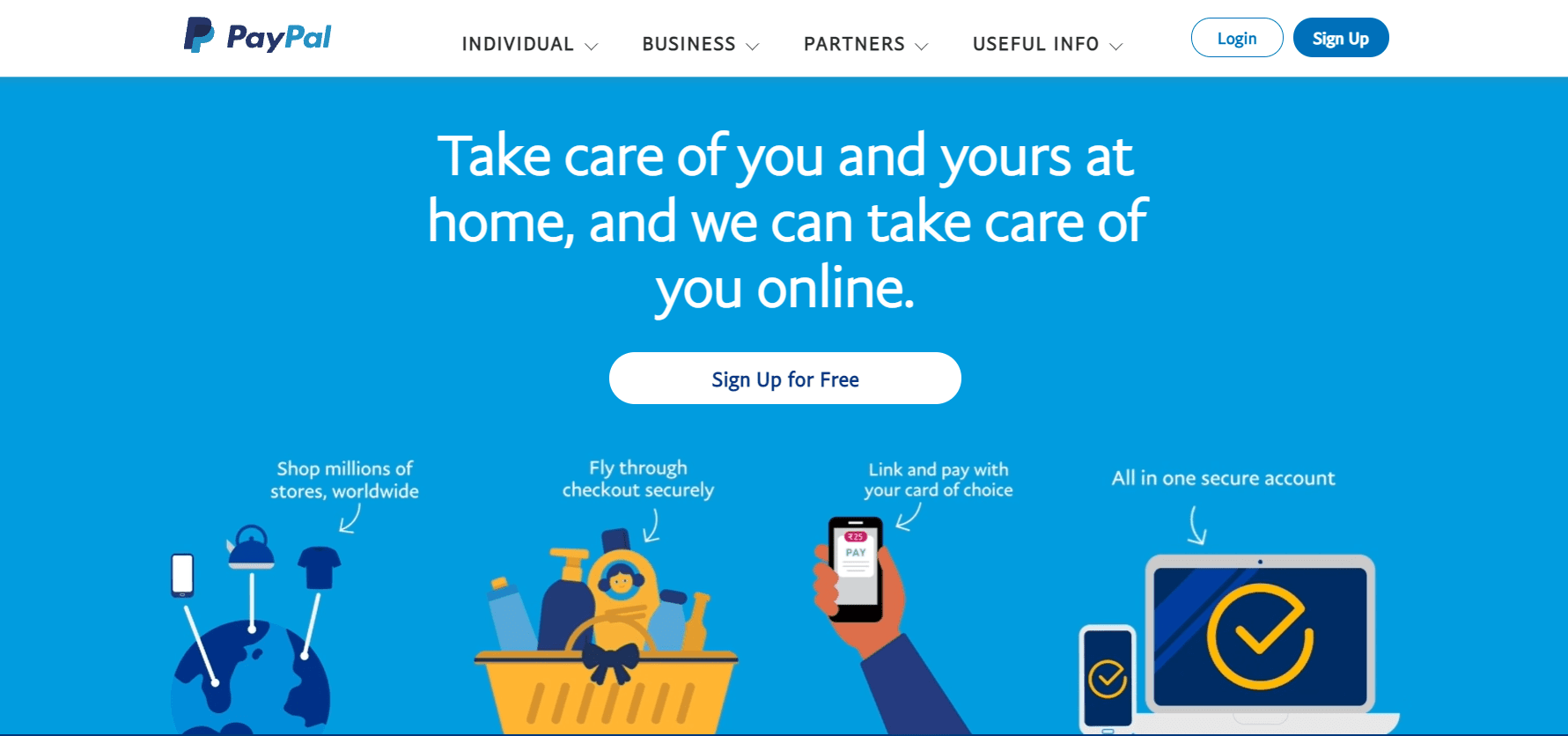

How Do I Open a PayPal Account?

Creating a PayPal account is a simple process that can be completed in a matter of minutes. Here’s a step-by-step guide to setting up a PayPal account.

Step 1: Go to the PayPal website and select the signup option.

Step 2: Next, you must choose an account type (Individual account or Business account).

Select the Business account, which will allow you to receive and send payments, and then click the Next button.

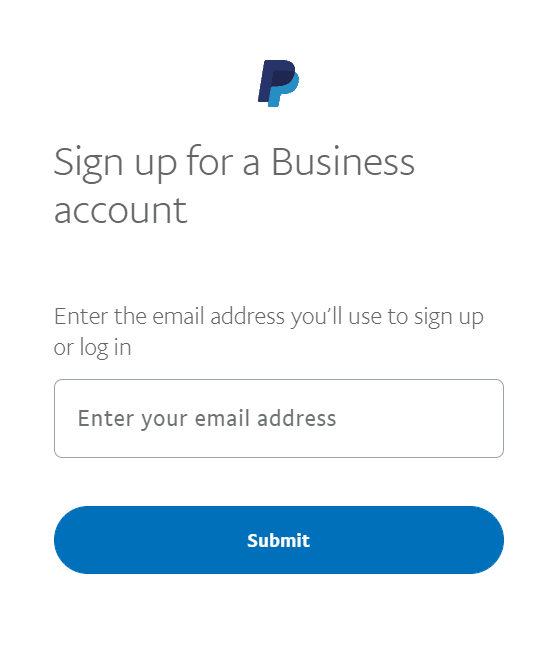

Step 3: Fill up your email address and password. This email address will be used to log into your PayPal account.

Step 4: Describe your company, choose an appropriate purpose code, input your PAN card number, and other information.

Step 5: You will then be required to give more information about yourself and your business, such as your name, address, and phone number.

Finally, click the Agree and Proceed button.

So that’s how you establish a PayPal account.

But it isn’t all. You must finish your business setup before you can begin collecting payments and watching your business develop.

Let’s look at how to achieve it now.

How Do You Verify Your PayPal Account?

After completing the signup procedure, you will be sent to a screen for further verification.

Verification of Email Address

So, the first step in verifying your PayPal account is to validate your email address, which is required as part of the registration procedure to prove that you are the legitimate owner to accept payments.

This is as simple as clicking the “Get Started Now” button in the PayPal team’s welcome email.

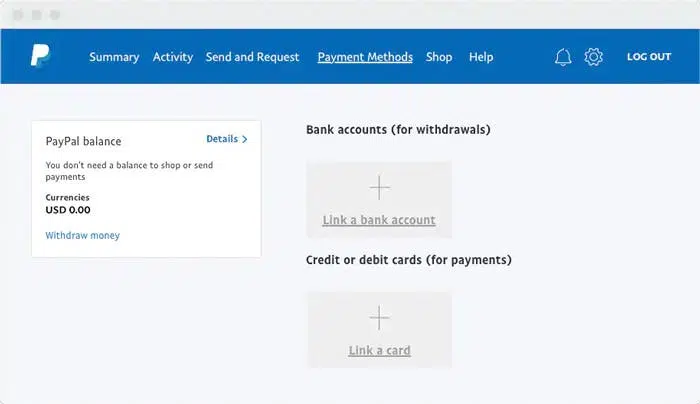

Adding and Verifying a Bank Account

The following critical step is to link and verify your bank account so that you may withdraw cash from PayPal to your associated bank account.

To link your bank account, navigate to the top menu and click “link a new bank account.” or browse your PayPal account’s Financial Information section.

Enter your bank information and click the “Link Your Bank” button.

You will need to authenticate your bank account after linking it to your PayPal account.

After you finish connecting your bank account, you will receive two modest payments (each between 1.01 and 1.50 INR) to your bank account within six business days. So, to verify your bank account, choose it and click Confirm.

Enter the exact amounts you received and press the Confirm button.

Complete the online verification process

Following that, you must give or confirm your identification in order to begin receiving foreign payments instantly.

Simply input your PAN number and click submit.

Upload your identification documents

Finally, in order to begin collecting local payments, you must upload your identity credentials for verification.

You must submit your PAN card and one government-issued supporting document here.

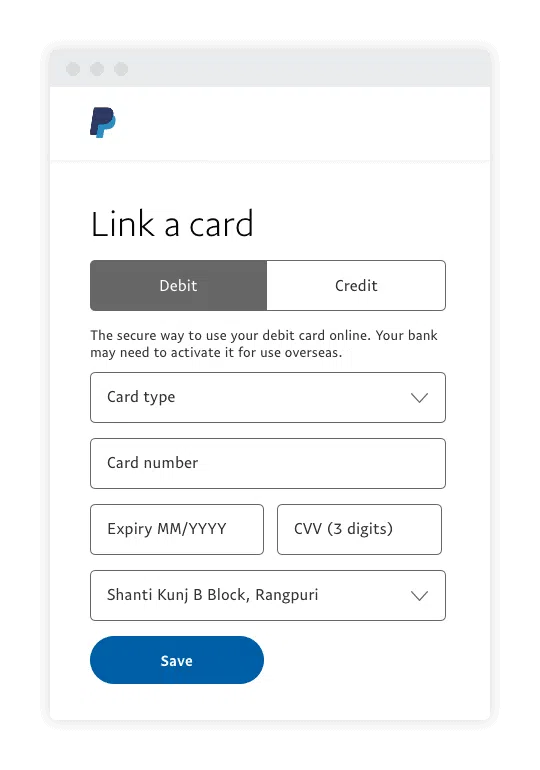

How To Add Your Debit/Credit Card to Paypal?

Linking a debit or credit card to your PayPal account allows you to play faster while protecting your financial information.

To link a debit/credit card with PayPal, navigate to the Money area in the top menu and click “link a new card.”

Additionally go to your PayPal account’s Financial Information area, select “Link a new card,” then input your card number, card type, expiration date, security code, and click the “Link Card” button.

That’s just how it is.

Quick Links

- Best Referral Programs That Pay Real Cash Via PayPal or Payoneer

- Earn $100 By Inviting Others Users to PayPal & PayPal Affiliate

- PayKickstart Discount Coupon

Conclusion |How To Open A PayPal Account In India And Verify It 2024

I hope this post answered any of your questions about opening and confirming a PayPal account.

So, register a free PayPal account now and promote your company to the rest of the globe.

If you have any other queries about PayPal, please leave them in the comments below.

And, if you found this information useful, please share it on social media.