The technology has enabled alternative lenders to quickly rate and approve small businesses looking for loans. Thanks to modern technology, it is possible to rent credit lines or operating credits after a few days.

Thanks to rapid approval technology, alternative Kabbage can offer transparent loan offerings and intuitive payment platforms.

Following in-depth research and analysis, we recommend that Kabbage select the best alternative lender for small business lines in 2019. To understand how we have selected our best options and a full list of alternative lenders, visit our Main Elections page.

In this post, we have featured Kabbage Review that includes detailed insights into its pricing, features, functionality, and more. Let’s get started here.

Kabbage Review 2024: How Does A Kabbage Loan Work?

Detailed about Kabbage Review

Kabbage automatic online approval process and easy payment terms distinguish the company from many competitors. It also provides an intuitive online loan platform that facilitates money management. Here is an overview of why Kabbage is our best option.

Application and approval procedure

While some alternative lenders go through a lengthy application and subscription process, you can complete the Kabbage application and approval almost immediately and completely online.

First, provide basic information about your business, including:

- Name and address of the company.

- Corporate Structure

- Type of industry

- Set month and year

Instead of sending statements such as tax returns and debt structures, link your application to a company’s checking account or another online service you use, such as QuickBooks or PayPal.

The Kabbage platform automatically and immediately checks the data on these websites to determine if they meet the Kabbage standards for a loan.

Many other lenders require borrowers to submit financial documents. By logging into your checking account or online banking service, Kabbage can analyze your finances without hindering you as a borrower.

The company reviews this information to determine, among other things, the average monthly revenue, the duration of its activity, and the volume of its transactions. Kabbage connects to thousands of banks and online services. You can search for your bank or service during the application process.

After a quick analysis of your data, including a check on your personal credit rating, Kabbage will quickly tell you if and to what extent a line of credit has been approved. The process usually takes only a few minutes. Once approved, you can get the loan immediately. You can also link additional services to your account to increase your credit line.

Kabbage application and approval process are one of the best we’ve ever seen. The company gives priority to the borrower, who does a lot of footwork. Many other companies we audit require much information from borrowers. Gathering all this important information can take a long time and be an obstacle for some small business owners.

Eligibility criteria

To apply for a Kabbage line of credit for small businesses, you must meet the following criteria:

- Annual minimum income: $ 50,000

- The minimum duration of activity: 1 year (3 years for lines up to 150,000 USD)

Kabbage will also consider your company’s bank accounts, accounts, social networks, and supplier accounts to approve or reject your business (and help you get more from your line amount).

The Application Process For Kabbage

The application process in Kabbage is completely online and usually takes less than 10 minutes (more information on the application process can be found here). You must enter basic information about your business, including the legal name, address, industry type, and federal tax code, or your company’s employee identification number.

After entering this information, you will be redirected to Instant Business Review, which will ask you to connect your online accounts to your Kabbage account. This includes bank accounts, accounting, suppliers, and payment processing.

After completing this step, you will need to enter your personal information, including your name, address, and social security number. You must also give your consent for a heavy burden on your credit report. Once Kabbage has evaluated the integrity of your business through an automated online process, it will approve or reject your request.

Once your application is approved, you can link your social media accounts, which can help you increase your credit line. If your Kabbage account is declined, you will continuously monitor your business information. Therefore, it can later be approved without having to be reapplied.

Kabbage Review | Who Is Qualified?

Since every company has a different financial condition, we can not say exactly what is required to approve a Kabbage line of credit.

Kabbage analyzes your financial data, such as your monthly income, transaction volume, and credit rating, to determine if and for what amount you are applying for a loan. To be considered, you must meet two minimum requirements:

You must have been in the business for at least 12 months.

Your company must have an annual minimum income of $ 50,000 or $ 4,200 per month for the past three months.

What distinguishes Kabbage from many other online lenders is the low minimum income. For many of the other lenders we examined, the minimum income requirement was at least twice that of Kabbage. Some lenders also require companies to be established for more than 12 months, sometimes up to two years.

Kabbage also checks your credit rating by deciding whether or not to grant a loan and determines the repayment rate you receive. Kabbage’s automated subscription model examines the credit report attributes (not the score itself) to determine if a small business is eligible for funding.

Loan Terms Process

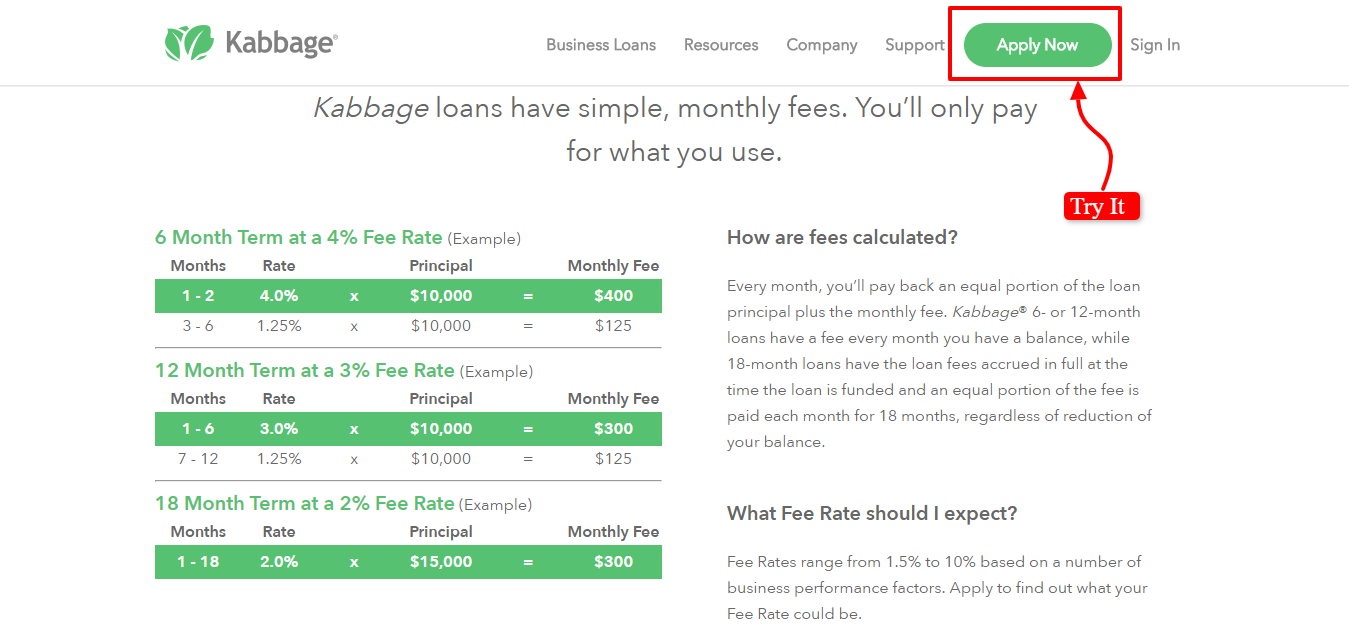

A Kabbage line of credit works more like a credit card than a traditional one: it only uses what it needs and only pays the amount actually used. For example, if you have a credit line of $ 20,000, but you only use $ 10,000, you only pay interest on that $ 10,000.

You can earn money with your line as often as once a day.

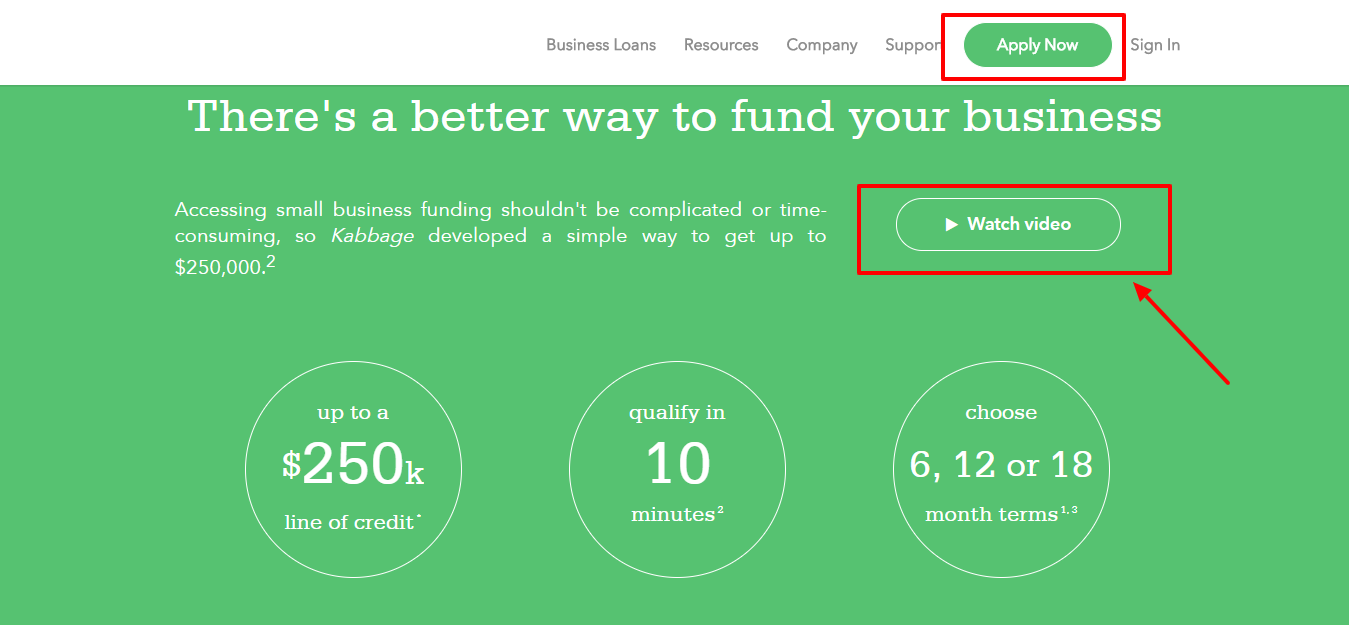

The company offers credit lines of up to $ 250,000. Each draft in your line of credit is considered a separate loan. Each time you borrow one of these loans, you have six or twelve months to repay it. For a period of 12 months, a minimum loan of $ 10,000 is required.

With Kabbage you pay part of your capital plus interest costs. Kabbage’s credit line changes over time as entrepreneurs pay more and end up paying less at the beginning of their term.

For a term of six months, which is a standard contract with Kabbage, entrepreneurs pay between 1.5 and 10 percent in the first two months of the loan. After that, you only have to pay 1 to 1.5% for the rest of the loan.

This is not an annualized rate, which means that it is a simple interest rate that can be applied to the total loan balance. This structure allows small business owners to pay most of the interest at the start of the loan, allowing greater financial flexibility at the end of the term. The Kabbage tariff structure is unique among the lenders we survey.

Kabbage loans are guaranteed by a personal guarantee. Although a formal guarantee, such as For example, if your personal or business assets are not required, the personal guarantee is a legally binding statement stating that you will personally pay the loan if your business fails to meet its obligations.

In addition to the monthly installment, no additional fee will be charged for a Kabbage line. For almost all other lenders, we have considered at least an additional original fee. Since Kabbage does not charge any prepayment fees, you can pay your loan in full at any time during the term.

To simplify the payment process, Kabbage combines all your payments into one payment per month. It also makes it much easier to withdraw money. You can use your lines of credit online, through the company’s mobile application, or by pulling a Kabbage card.

These three financing methods are only available for Kabbage. Other lenders rarely provide a mobile application, let alone a physical card, to withdraw money. You can also make loan payments and view the history of your transactions through the application.

Kabbage does not restrict the use of your credit line. The way he handles money is at his discretion. These short term credit lines are ideal for cash management and fast financing of projects such as marketing or advertising campaigns.

Short-Term Loan

Kabbage loans are perfect for companies that constantly need capital. The loan amounts are up to $ 250,000. Kabbage also has a unique credit model that allows borrowers to use only what they need. Even if a company is approved for a maximum of $ 250,000, the borrower pays only what he needs.

Kabbage loans are implemented in a manageable short-term payment platform.

They offer an eligible customers loan term of 6, 12, or 18 months.

Additional Benefits of Kabbage Small Business Loans:

- Loans are scalable and manageable

- Fast approval and quick access to funds

- Simple monthly fee

Kabbage Card | Read Full Instruction Of Kabbage review

Kabbage offers a new exclusive Kabbage card that customers can store in their wallets and access their funds anytime, anywhere. Customers can request the Kabbage card on the Kabbage website via a short form.

The card will be delivered within 7 to 10 working days. When they receive it, customers can activate the credit card online through their Kabbage account. The advantages of the Kabbage Card are:

- Access to funds available at the point of sale.

- Remote access to the Kabbage account

- Buy and invest wherever Visa is accepted

- There is no minimum purchase quantity or limit for the number of purchases that can be made in one day (restrictions are 25,000 cards per day, 50,000 per month and 600,000 per year).

- No additional hidden monthly costs

- Easy Conditions: Each Kabbage Card transaction creates a new six-month loan on the same terms and conditions as other commercial loans with six-month customers.

Transparent Application Conditions

In comparison to other lenders, Kabbage provides a lot of information online without having to apply. Your website contains the following useful information:

- Companies have to be in business for a year before they apply

- Companies must earn at least $ 50,000 a year or $ 4,200 a month over the past three months.

- No penalties for advance payment after 6 and 12 months.

- No closing costs.

- No origination fees

- The interest rate of 1.5 to 10%

- Good resources

- No minimum score required

Customer Service and Reputation

We are satisfied with the customer service we receive from Kabbage. To test the kind of support you can expect, we call the lender several times and pretend to be the owner of a company that is interested in a line of credit.

Every time we contacted the lender, helpful representatives were immediately available to answer all our questions. Several other lenders we called have taken us directly to voicemail several times. Instead of telling us what kind of business we had or what amount we needed, the Kabbage representatives made sure that all our questions were answered first.

The support staff we talked to answered all our questions about lines of credit, how the refund process works, and qualified people. At the end of our talks, we understood how Kabbage loans work.

We were also impressed with the Kabbage online help. It contains the most comprehensive Frequently Asked Questions section on nearly all of the lenders we surveyed and answers questions about payments, fees, loans, applications, and security. In general, Kabbage is very transparent about its loan offer. Many other lenders try to hide information.

Therefore, business owners should call to know their qualifications and the details of a loan. Kabbage provides a large portion of the relevant credit information on its website so that the services offered are easy to find.

Kabbage has a rating of A + and a rating of 4.5 out of 5 stars based on reviews published on the website. There are about 50 customer complaints, which is low for a lender; Some have about 2,000 complaints.

Limitations

Kabbage is that you have little time to repay your loans. Although the company has recently offered a 12-month recovery period, not all borrowers are eligible for this option. Those who have not only six months to pay their loans.

According to the Office’s website, 42 complaints against Kabbage have been received in the last three years until August 2017. While a much larger number of complaints are typical for a lender, Kabbage has only settled six of these 42 complaints to the satisfaction of the plaintiffs.

Although Kabbage answered the other 36 questions, the consumer did not accept the answer, or the BBB did not receive any consumer response in terms of satisfaction.

Company Features

Other features make Kabbage a good option for small businesses. Thanks to the online loan platform, you can access the funds wherever you have an internet connection.

It also makes it easier to manage your credit line and understand your financial situation. Kabbage can also provide you with a Kabbage card, which allows you to withdraw money.

Collateral

Loans with Kabbage are not guaranteed, meaning that you do not have to deposit assets as collateral. However, cabbage requires a personal guarantee.

Time to deposit

Once Kabbage has approved it, the money can be deposited into your account the same day. The official deposit is expected to be one to three days after the end of the loan agreement.

Only a handful of companies we reviewed offered funds on the same day. This is an important distinguishing feature for Kabbage: As it is a credit line, you can retrieve it on the Kabbage online platform on the day you authorize it.

Online platform

The Kabbage platform and application work almost like an online banking program. You can easily withdraw money, check the payment plan, the “interest rates” (or interest rates) associated with the transaction, and your loan history. You can withdraw money every 24 hours.

Special documentation

If you work with Kabbage, Kabbage representatives say you do not have to produce many financial documents. Kabbage only needs bank statements to verify the financial stability of your business.

It is always good to have other information at hand, eg. For example, tax returns or other financial documents. However, because of the nature of Kabbage loans, you do not need to provide complete documentation.

Offered services

Kabbage offers commercial lines of credit.

To qualify for a Kabbage loan, you need the following:

- Time in the business: 12 months

- Personal credit score: N / A

- Income: $ 50,000 a year (or at least $ 4,200 in the last 3 months)

Kabbage does not require a minimum FICO score. However, you give your consent for a credit check during the application process. This is a unique survey that allows Kabbage to review the information in its report when considering approval. Candidates in passable to excellent categories are more likely to qualify.

Conditions and Prices

These are the terms and conditions listed on the Kabbage website:

- Loan amount: Up to $ 250,000

- Duration of the raffle: 6, 12, or 18 months

- Loan costs: 1.5% – 10% of the monthly borrowed amount

- Drawing rate: No

- Effective APR: 24% – 99%

Kabbage loans have a term of six, 12, or 18 months. Every month pay 1/6, 1/12, or 1/18 of the capital plus a fee.

This lender does not impose a penalty on prepayment, however, considering that Kabbage operates on a fee structure originally calculated for the first two months of a six-month loan and the first six months of a loan. After 12 months, your interest rates range between 1.5% and 10% of the initial capital per month.

For the remaining months, the fees amount to 1% of the capital. Confused? Kabbage has a very good loan calculator on its website that can be helpful in understanding how interest rates work.

Note that Kabbage loans do not have an APR due to the way they are issued. However, the estimated APRs vary between approximately 24% and 99%.

In addition to the monthly loan fees, Kabbage does not charge any additional fees. For example, you will not be charged any processing fees, maintenance or service fees, unused line charges or prepayment charges.

Before you receive your loan, Kabbage will send you a SMART chart with all the information you need to make an informed decision about the loan, including the total loan rates and the APR.

Prices and Conditions | Kabbage Review

When you partner with Kabbage, you can use your credit limit on virtually all small business purchases, including inventory purchases, equipment financing, payroll, cash flow enhancement, activity expansion, and investment in marketing strategies, recruiting new employees, or covering other costs.

Companies can receive funding of up to $ 250,000 with a maturity of six to 18 months.

The Kabbage line of credit does not work like a traditional credit card with APR funding. It is financing that companies can use up to a certain amount.

The interest rate for each monthly payment is not fixed. When we talked to a Kabbage representative, he told us that companies usually pay between 1.5 and 10% for a six-month loan in the first two months and between 1 and 1.5% in the last four months.

The specific rates depend on the financial situation of your company. They pay the most interest at the beginning of the loan and gradually decline towards the end.

If you settle the entire loan in one single payment before the expiration date, Kabbage will not charge you a prepayment penalty. Some lenders offer interest discounts to companies that prepay their loans. It is not clear if Kabbage offers this advantage.

Kabbage loans are structured in monthly payments. Other lenders offer weekly or daily payment plans, but monthly payments are standard in the industry.

Kabbage also does not charge any application, origin, or termination fees.

READ ALSO

- SimpleTuition Review: Does It Really Help With Students Loans?

- [Updated ]Top Small Business Loans Platform: With Pros & Cons

- SimpleTuition Coupons & Discounts: Get Up To 50% Off

- [Latest] Everything Breaks Review {Discount Coupon:

Conclusion: Is This Lender Right For You? | Kabbage Review 2024

Kabbage provides borrowers who need quick access to money or have difficulty getting approval from other lenders, convenience and flexibility.

Kabbage loans are expensive, but they can be a reasonable option for borrowers with low or fair credit. And since Kabbage can quickly deposit money into a PayPal account, this can be a good product for companies that need a financial safety net to cover their emergency costs.

However, if you have the means to buy, you should evaluate other lenders to see if you can benefit from a lower interest rate. Kabbage is also not suitable for companies seeking a term loan or financing of more than $ 150,000.

I hope this post suits your purpose well and helped you in getting a detailed insight of Kabbage Review. And if you liked the post then you can easily share it on various social media platforms like Facebook, Twitter, and LinkedIn.