Netflix, the undeniable titan of the streaming world, has continually reshaped how we consume entertainment.

As we navigate 2025, understanding the intricate details of Netflix statistics 2025 becomes crucial for industry observers, investors, and even casual viewers.

This in-depth article unpacks the latest data, revealing significant trends in subscriber growth, revenue generation, and user engagement, offering insights into how this global powerhouse continues to evolve.

Netflix Statistics: The Global Footprint 2026

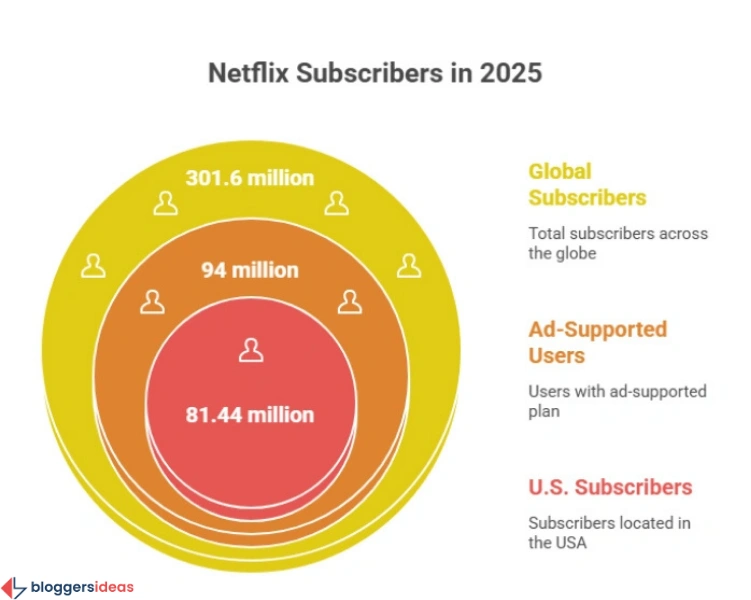

Netflix proudly announced reaching an impressive 301.6 million global subscribers as of August 2025, solidifying its position as the world’s premier streaming platform.

This significant milestone arrived after the company made a strategic shift in its reporting, choosing to focus on overall revenue and landmark achievements rather than quarterly subscriber figures.

This new approach underscores Netflix’s maturity in the market and its emphasis on sustainable financial health over raw subscriber numbers.

A Decade of Remarkable Growth: Netflix’s Subscriber Journey

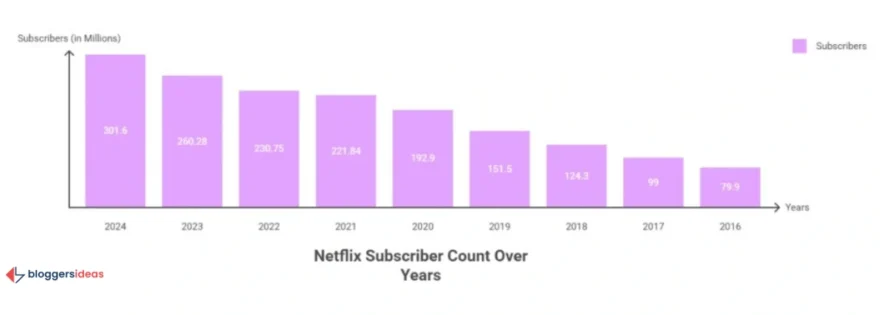

Examining Netflix’s subscriber growth over the past decade reveals a trajectory of consistent expansion, demonstrating its adaptability and enduring appeal.

The period between 2023 and 2024 witnessed a substantial increase, with Netflix attracting an additional 41.32 million subscribers, marking a 15.9% year-over-year growth.

This surge represented the highest annual increase since 2020, showcasing the platform’s robust performance just before its reporting strategy evolved.

Here is a comprehensive look at Netflix’s subscriber count through the years:

| Year | Netflix Subscribers (in millions) |

| 2024 | 301.6 |

| 2023 | 260.28 |

| 2022 | 230.7 |

| 2021 | 219.7 |

| 2020 | 192.9 |

| 2019 | 151.5 |

| 2018 | 124.3 |

| 2017 | 99 |

| 2016 | 79.9 |

| 2015 | 62.7 |

| 2014 | 47.9 |

| 2013 | 35.6 |

| 2012 | 25.7 |

| 2011 | 21.5 |

Source: Statista

In the first quarter of 2024 alone, Netflix added a remarkable 9.32 million subscribers, demonstrating strong momentum leading into its new reporting phase. This consistent growth highlights the platform’s ability to attract and retain a massive global audience.

Also read about: YouTube Statistics

The Ad-Supported Revolution: Expanding Reach and Revenue

A pivotal factor in Netflix’s continued expansion and revenue generation is the success of its ad-supported plan. As of 2025, Netflix actively engages 94 million global monthly active users through its ad-supported tier, with an even greater concentration among the highly sought-after 18-34 age demographic.

This represents an extraordinary leap from May 2024, when the ad tier had reached 40 million monthly active users worldwide. In the countries where this plan is available, it now accounts for an impressive 40% of all new Netflix sign-ups.

Netflix strategically introduced its ad-supported plan in November 2022, initially rolling it out in Canada, Mexico, the United States, the United Kingdom, Australia, France, Brazil, Germany, Italy, Korea, and Japan. Looking ahead, Netflix plans to launch an in-house advertising technology platform by the end of 2025.

This innovative move aims to attract new advertisers, further integrating them with Netflix’s expansive user base and enhancing revenue streams.

The Impact of the Password-Sharing Crackdown

Netflix has effectively turned a challenge into an opportunity by cracking down on password sharing. The company has witnessed a significant uptick in new subscribers as individuals who previously shared accounts now create their own. This strategic enforcement has proven highly effective in boosting subscriber numbers

Netflix expanded its crackdown on password sharing to over 100 countries, and the immediate effects were striking. Following the announcement on May 23, 2023, Netflix experienced a remarkable surge, adding 100,000 subscribers on both May 26th and 27th, 2023.

During this period, the average daily sign-ups escalated to 73,000, representing a staggering 102% increase from the preceding 60-day average.

This performance even surpassed the subscriber spikes observed during the initial COVID-19 lockdowns, demonstrating the effectiveness of this strategic move.

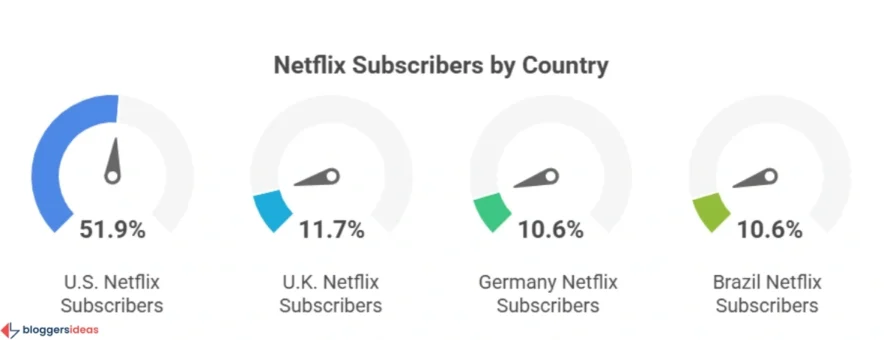

A Geographic Lens: Netflix Users by Country and Region

The global distribution of Netflix subscribers paints a clear picture of its varied market penetration and growth opportunities.

Dominant Markets: Where Netflix Reigns Supreme

As of 2025, the United States continues to be Netflix’s most substantial market by a significant margin, boasting 81.44 million subscribers.

This figure is more than four times greater than any other single country, highlighting the enduring importance of its home market.

The United Kingdom follows with 18.4 million subscribers, closely trailed by Germany and Brazil, both registering 16.59 million subscribers. Brazil matching Germany’s numbers indicates the impressive growth Netflix is experiencing across Latin America.

Here is a detailed breakdown of Netflix users by country:

| Country | Number of Netflix Subscribers (in millions) |

| United States | 81.44 |

| United Kingdom | 18.4 |

| Germany | 16.59 |

| Brazil | 16.59 |

| Mexico | 13.87 |

| France | 13.57 |

| India | 12.37 |

| Canada | 9.05 |

| Japan | 9.05 |

| South Korea | 8.36 |

Source: Netflix

Regional Powerhouses: EMEA Leads the Way

The regional distribution of Netflix subscribers further emphasizes its global growth strategy. The Europe, Middle East, and Africa (EMEA) region has emerged as Netflix’s largest market, with an impressive 101.13 million subscribers.

This surpasses the combined total of the U.S. and Canada, which collectively account for 89.63 million subscribers. This shift clearly indicates that international growth is now the primary driver for Netflix’s expanding subscriber base.

The Asia Pacific region demonstrates significant potential with 57.54 million subscribers, fueled by the soaring popularity of localized content, including K-dramas, anime, and Bollywood-style originals.

Latin America also remains a robust and consistent market, contributing 53.33 million subscribers to Netflix’s global total.

Here is a summary of Netflix subscribers by world region:

| World Region | Netflix Subscribers (in millions) |

| Europe, the Middle East, and Africa | 101.13 |

| U.S.A. and Canada | 89.63 |

| Latin America | 53.33 |

| Asia Pacific | 57.54 |

Understanding the Netflix User: Demographics and Engagement

Understanding who uses Netflix and how they engage with the platform provides invaluable insights into its appeal and future strategies.

Demographic Snapshot: Who is Watching Netflix?

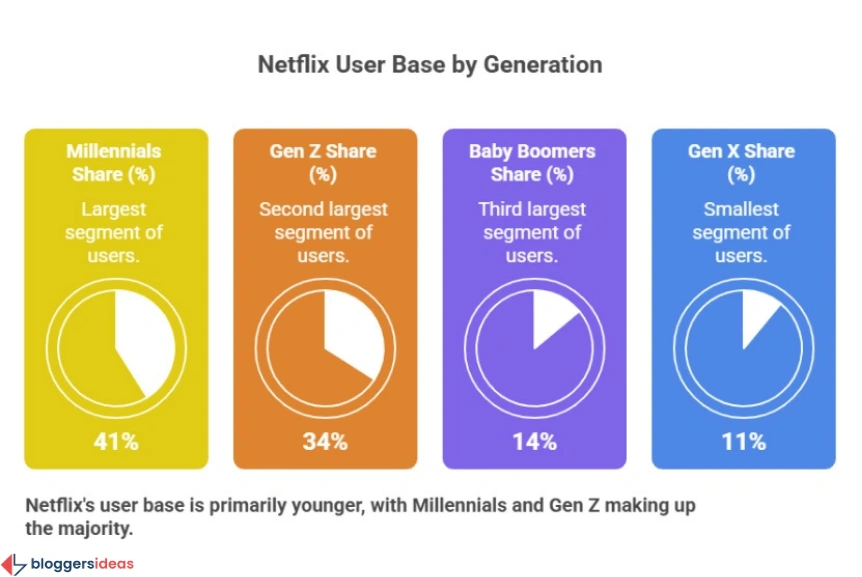

A slight majority of Netflix users are female, comprising 51% of all subscribers, while males account for 49%. The average Netflix subscriber generally falls within the millennial generation and typically earns less than $50,000 annually.

Education-wise, approximately 68% of Netflix members have some college education or less, while around 33% hold a bachelor’s degree or higher.

The platform’s content strategy caters to a broad audience, ensuring its appeal across various age groups.

| Generation | Share of Users |

| Millennials | 41% |

| Generation Z | 34% |

| Baby Boomers | 14% |

| Generation X | 11% |

Millennials represent the largest share of Netflix users, closely followed by Generation Z, indicating the platform’s strong connection with younger audiences.

Unparalleled Engagement: Time Spent on Netflix

Netflix consistently outperforms competitors in terms of daily user engagement. In 2025, Netflix users spend an average of 1 hour and 3 minutes per day on the platform.

This figure surpasses Hulu (56 minutes) and even popular social media giants like TikTok (54 minutes), YouTube (51 minutes), Spotify (51 minutes), Instagram (35 minutes), X/Twitter (33 minutes), and Facebook (32 minutes).

This high level of engagement underscores Netflix’s ability to captivate its audience with its extensive and diverse content library, encouraging habitual viewing and binge-watching behavior.

The Power of Recommendation: Algorithm-Driven Viewing

An astonishing 80% of Netflix subscribers rely on the platform’s recommendation algorithm to discover new content.

While viewers frequently gravitate towards popular titles, the vast majority also actively choose shows and movies suggested by Netflix, proving the immense influence of its personalized recommendation system in driving viewership and keeping users engaged.

This data highlights the sophisticated AI and machine learning that power Netflix’s user experience.

Financial Fortitude: Netflix Revenue Statistics 2025

Netflix’s financial performance continues to impress, reflecting the success of its strategic initiatives and market dominance.

Soaring Revenue and Profitability

In the second quarter of 2025, Netflix generated an impressive $11.08 billion in revenue, surpassing the expected value of $11.04 billion and demonstrating a robust 16% year-over-year growth.

This marks a significant increase from $10.54 billion in Q1 2025. The company anticipates even greater success, projecting $11.53 billion in Q3 2025.

For the full year 2024, Netflix achieved a total revenue of $39.00 billion, showcasing healthy growth. The quarterly breakdown for 2024 further illustrates this upward trend:

- Q1 2024: $9.37 billion

- Q2 2024: $9.56 billion

- Q3 2024: $9.83 billion

- Q4 2024: $10.25 billion

These consistent gains underscore Netflix’s enhanced business performance, driven by new features like ad-supported plans, effective password-sharing crackdowns, and a growing slate of live event content.

The company’s operating income also reached $3.77 billion in Q2 2025, representing a substantial 45% increase compared to the same period last year. For the full year 2024, Netflix set an operating income margin target of 26%, further indicating its focus on profitability.

Here is a historical overview of Netflix’s revenue:

| Year | Revenue (in billions) |

| 2025 (Q2) | $11.08 |

| 2024 (Full Year) | $39.00 |

| 2023 | $33.724 |

| 2022 | $31.61 |

| 2021 | $29.698 |

| 2020 | $24.99 |

| 2019 | $20.15 |

| 2018 | $15.79 |

| 2017 | $11.69 |

| 2016 | $8.83 |

Maximizing Value: Revenue Per User (ARPU)

Netflix’s Average Revenue Per User (ARPU) serves as a key indicator of its monetization efficiency. In 2024, Netflix’s global ARPU increased to $11.70, a notable improvement from $10.82 in 2023.

This rebound, after a slight dip in 2023, suggests that initiatives like the password-sharing crackdown and the expansion of the ad-supported tier are successfully enhancing per-user revenue.

Here is a breakdown of Netflix’s average monthly revenue per membership:

| Year | Netflix’s Global ARPU |

| 2024 | $11.7 |

| 2023 | $10.82 |

| 2022 | $11.76 |

| 2021 | $11.67 |

| 2020 | $10.91 |

| 2019 | $10.82 |

| 2018 | $10.31 |

| 2017 | $9.43 |

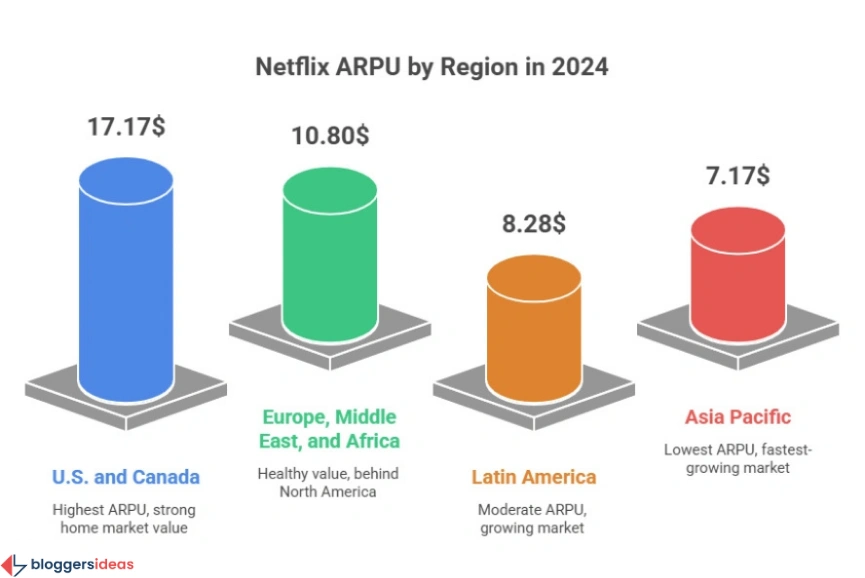

Regional ARPU: A Tale of Disparity

The ARPU varies significantly across regions, reflecting different market dynamics and pricing strategies. In 2024, the U.S. and Canada boasted the highest ARPU at $17.17, underscoring the strong spending power in these markets.

Europe, the Middle East, and Africa followed with an ARPU of $10.80. Latin America generated $8.28 per user, while the Asia Pacific region, despite being a fast-growing market, registered the lowest ARPU at $7.17.

Here is a table displaying the average revenue per user of Netflix by region as of 2024:

| Region | ARPU |

| U.S. and Canada | $17.17 |

| Europe, Middle East, and Africa | $10.80 |

| Latin America | $8.28 |

| Asia Pacific | $7.17 |

Netflix’s Market Value and Strategic Investments

As of September 2025, Netflix commands a remarkable market capitalization of $528.53 billion USD, positioning it as the 18th most valuable company globally.

This valuation represents a substantial 36.24% increase in 2025 alone, building on a massive 82.05% surge in 2024. This consistent growth, rebounding strongly from a dip in 2022, highlights investor confidence in Netflix’s long-term strategy and profitability.

Here is a table displaying Netflix’s Market Cap by year:

| Year | Netflix Market Cap (in billions) |

| 2025 | $528.53 |

| 2024 | $387.93 |

| 2023 | $213.09 |

| 2022 | $131.22 |

| 2021 | $267.46 |

| 2020 | $238.89 |

| 2019 | $141.98 |

Netflix is also making significant investments in its content. The company’s content spend target for 2024 is set at $17 billion, demonstrating its commitment to producing high-quality original shows and movies to attract and retain subscribers. This substantial investment ensures a continuous flow of compelling content, a key differentiator in the competitive streaming landscape.

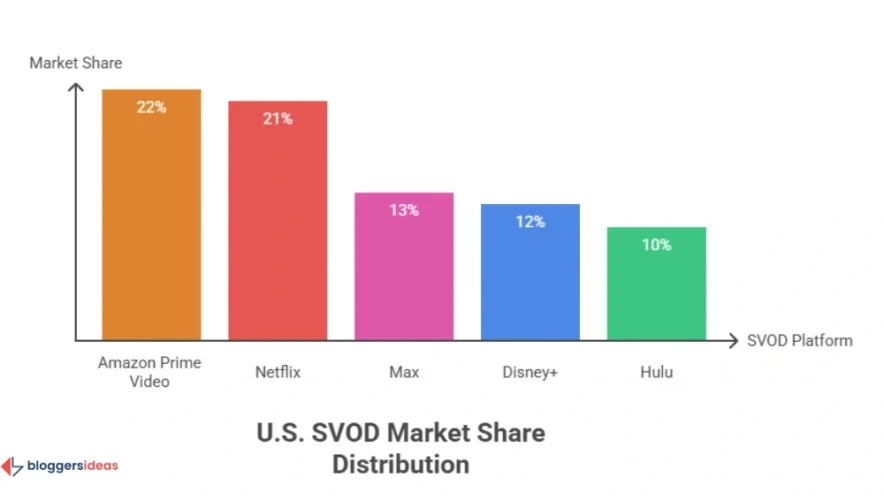

Netflix in the Broader Streaming Landscape: Market Share and Preference

Even with the rise of numerous streaming services, Netflix maintains a formidable presence in the SVOD (Subscription Video On Demand) market.

Standing Strong: Market Share in the United States

In the United States, Netflix holds the second-highest market share, capturing 21% of the SVOD market. While Amazon Prime Video leads with 22%, Netflix’s strong position underscores its enduring popularity and crucial role in the American streaming ecosystem.

Here is a table displaying the distribution of the SVOD market share in the United States:

| SVOD Platform | Market Share |

| Amazon Prime Video | 22% |

| Netflix | 21% |

| Max | 13% |

| Disney+ | 12% |

| Hulu | 10% |

| Paramount+ | 9% |

| Apple TV+ | 8% |

| Peacock | 1% |

| Other | 3% |

Preferred Platform: Americans Choose Netflix

A significant 47% of American citizens express a preference for Netflix over other web streaming platforms. Amazon Prime Video comes in second with 14%, followed by Hulu with 13.6% and Disney+ with 13%.

This strong preference highlights Netflix’s success in cultivating a loyal subscriber base and consistently delivering content that resonates with American audiences.

Beyond the Numbers: Emerging Trends and User Concerns

Beyond the reported statistics, understanding what users discuss on platforms like Quora and Reddit provides valuable qualitative insights into Netflix’s evolving landscape and future direction.

1. The Rise of Live Content and Interactive Experiences

Users frequently discuss Netflix’s increasing foray into live content, such as comedy specials and sporting events. The potential for more interactive experiences, similar to “Bandersnatch,” also generates considerable buzz.

This suggests that subscribers are looking for new and dynamic ways to engage with the platform beyond traditional on-demand viewing. Netflix’s move into gaming, with engagement tripling over the past year, is a clear response to this desire for diverse entertainment options.

2. Navigating Content Quality and Quantity

While Netflix invests heavily in content, discussions often revolve around the perceived quality versus quantity of its offerings. Users sometimes express frustration over the removal of beloved titles or the cancellation of shows after a few seasons.

However, the consistent release of diverse international content, especially K-dramas and anime, frequently receives high praise, demonstrating Netflix’s success in catering to niche interests and global tastes.

3. The Balancing Act: Ad-Tier Experience and Price Sensitivity

The ad-supported tier is a recurring topic. While many appreciate the lower price point, concerns about ad frequency, relevance, and the overall viewing experience sometimes surface.

Users frequently discuss whether the savings are worth the interruption, suggesting Netflix needs to carefully optimize its ad strategy to maintain subscriber satisfaction. This feedback is critical for Netflix as it further develops its in-house advertising technology.

4. The Search for Hidden Gems: Overcoming Content Overload

With a vast library of over 8,000 titles in some regions, users often discuss strategies for discovering “hidden gems” beyond the most promoted shows.

Community forums on Reddit and Quora become valuable spaces where subscribers share recommendations, discuss effective use of the algorithm, and explore ways to personalize their viewing experience, highlighting the challenge and opportunity of content discoverability on such a massive platform.

The Future of Netflix: Key Initiatives and Outlook

Netflix’s strategic initiatives, including the ad-supported tier, password-sharing crackdown, and investments in content and gaming, clearly position the company for continued growth and profitability.

The focus on strong regional content, coupled with a robust global presence, allows Netflix to cater to diverse audiences while maintaining its competitive edge.

The company’s projected 2025 revenue between $43 billion and $44 billion, reflecting an 11% to 13% increase, paints a very optimistic financial picture. With a forecast of approximately $6 billion in free cash flow for 2024, Netflix possesses strong liquidity to fuel further investments and expansion.

The launch of an in-house advertising technology platform by the end of 2025 further underscores its commitment to diversifying revenue streams and enhancing its advertising capabilities.

FAQs About Netflix Subscriber Statistics

1. How many subscribers does Netflix currently have in 2025?

As of August 2025, Netflix has reached a significant milestone of 301.6 million global subscribers, maintaining its position as the world’s leading streaming platform, although the company has shifted its reporting focus to overall revenue rather than quarterly subscriber counts.

2. What impact has the ad-supported plan had on Netflix's subscriber growth and revenue?

Netflix’s ad-supported plan has proven highly successful, attracting over 94 million global monthly active users by 2025 and accounting for 40% of new sign-ups in available countries, contributing significantly to a 16% year-over-year revenue growth in Q2 2025 and paving the way for further monetization through an in-house advertising technology platform.

3. How has Netflix's crackdown on password sharing affected its subscriber numbers?

Netflix’s password-sharing crackdown has notably boosted its subscriber count, leading to a substantial increase in daily sign-ups, with surges of 100,000 new subscribers on specific days and a 102% increase in average daily sign-ups after the policy was announced.

4. Which region contributes the most to Netflix's subscriber base?

The Europe, Middle East, and Africa (EMEA) region has emerged as Netflix’s largest market, boasting 101.13 million subscribers, surpassing the combined total of the U.S. and Canada, which collectively account for 89.63 million subscribers.

5. What are some of the key financial projections for Netflix in 2025?

Netflix projects its 2025 revenue to fall between $43 billion and $44 billion, indicating an 11% to 13% increase, with an operating income margin target of 26% for the full year 2024, reflecting strong financial health and confidence in its strategic initiatives.

Also Read:

- Infographics Statistics

- Marketing Automation Statistics

- YouTube Statistics

- Tinder Statistics

- Google Gemini Statistics

Conclusion

The Netflix subscriber statistics 2025 reveal a company that is not merely resting on its laurels but actively innovating and adapting to a dynamic streaming landscape.

From its impressive global subscriber base and surging revenue to its strategic adoption of ad-supported plans and effective password-sharing policies, Netflix continues to demonstrate remarkable resilience and growth.

Understanding these trends provides valuable insights for anyone interested in the future of entertainment and the strategies of a true industry leader.