Spotify continues its reign as the undisputed leader in the music streaming industry, captivating hundreds of millions of users worldwide with its vast audio library and innovative features.

As of Q2 2025, the platform proudly announces an impressive 696 million monthly active users (MAUs), a testament to its continuous growth and expanding global footprint. This significant figure represents an increase of 18 million MAUs from Q1 2025 alone, underscoring Spotify’s dynamic expansion across diverse markets.

Understanding these Spotify users statistics 2025 is crucial for anyone seeking to leverage the platform, whether you are an artist, a podcaster, a marketer, or simply a curious listener.

This comprehensive article delves into Spotify’s latest user demographics, usage patterns, financial performance, and exciting new developments, providing valuable insights into how you can best utilize this audio giant.

A Deep Dive into Spotify’s User Base: Growth and Distribution

Spotify’s journey to becoming a global phenomenon began in 2006, when Daniel Ek and Martin Lorentzon founded the service in Stockholm, Sweden.

Their vision was to combat online music piracy by offering a legal and accessible digital music platform. After securing agreements with record labels, Spotify officially launched in 2008 and quickly gained traction, particularly through a pivotal partnership with Facebook.

The platform has since successfully navigated the shift to mobile and went public in April 2018, boasting a market capitalization of $26.5 billion on its first day of trading.

This historical context highlights Spotify’s resilience and strategic adaptations that have cemented its market leadership.

The Phenomenal Rise in Monthly Active Users

The growth in Spotify’s monthly active users has been nothing short of phenomenal. From 68 million MAUs in Q1 2015, the platform has surged to 696 million by Q2 2025.

This consistent quarter-on-quarter growth demonstrates Spotify’s ability to attract and retain a massive global audience.

Over the last two years alone (Q2 2023 – Q2 2025), Spotify has added a staggering 145 million monthly active users, solidifying its position as a household name in digital audio.

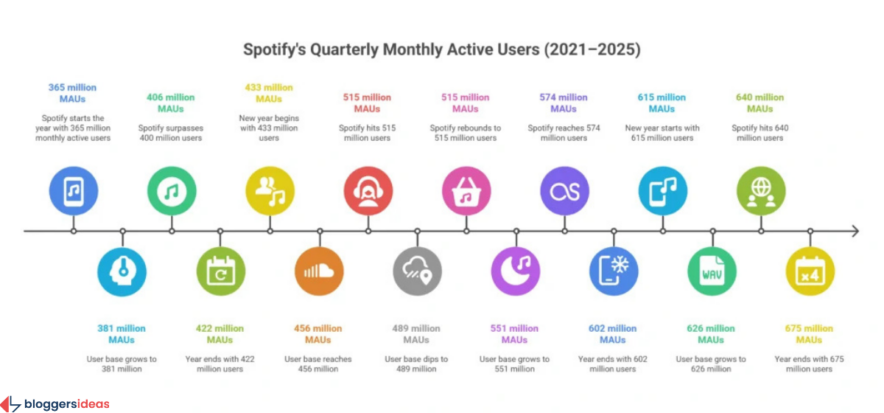

Here is a detailed breakdown of Spotify’s monthly active user growth over the past quarters, showcasing its remarkable expansion:

| Quarter – Year | Monthly Active Users (in millions) |

| Quarter 1 – 2021 | 365 |

| Quarter 2 – 2021 | 381 |

| Quarter 3 – 2021 | 406 |

| Quarter 4 – 2021 | 422 |

| Quarter 1 – 2022 | 433 |

| Quarter 2 – 2022 | 456 |

| Quarter 3 – 2022 | 515 |

| Quarter 4 – 2022 | 489 |

| Quarter 1 – 2023 | 515 |

| Quarter 2 – 2023 | 551 |

| Quarter 3 – 2023 | 574 |

| Quarter 4 – 2023 | 602 |

| Quarter 1 – 2024 | 615 |

| Quarter 2 – 2024 | 626 |

| Quarter 3 – 2024 | 640 |

| Quarter 4 – 2024 | 675 |

| Quarter 1 – 2025 | 678 |

| Quarter 2 – 2025 | 696 |

This table clearly illustrates the accelerating pace of Spotify’s user acquisition, making it a critical platform for content creators and advertisers alike.

Also read about: YouTube Statistics

The Power of Premium: Spotify’s Subscriber Base

Beyond its expansive free tier, Spotify thrives on its Premium subscription model. As of the end of Q2 2025, Spotify boasts 276 million premium subscribers globally.

This represents a robust 9.5% annual growth rate, with Spotify adding 24 million premium users year-over-year (from 252 million in Q3 2024 to 276 million in Q2 2025).

Between Q1 2024 and Q2 2025, Spotify welcomed an impressive 37 million new premium subscribers, highlighting the enduring appeal of its ad-free, high-quality audio experience.

The consistent growth in premium subscribers signifies the platform’s ability to convert free users into paying customers, a crucial aspect of its business model.

Here is a comprehensive breakdown of Spotify’s Premium subscriber growth over the past quarters:

| Quarter & Year | Subscribers (in millions) |

| Q1 – 2021 | 158 |

| Q2 – 2021 | 165 |

| Q3 – 2021 | 172 |

| Q4 – 2021 | 180 |

| Q1 – 2022 | 182 |

| Q2 – 2022 | 188 |

| Q3 – 2022 | 195 |

| Q4 – 2022 | 205 |

| Q1 – 2023 | 210 |

| Q2 – 2023 | 220 |

| Q3 – 2023 | 226 |

| Q4 – 2023 | 236 |

| Q1 – 2024 | 239 |

| Q2 – 2024 | 246 |

| Q3 – 2024 | 252 |

| Q4 – 2024 | 263 |

| Q1 – 2025 | 268 |

| Q2 – 2025 | 276 |

This data underscores the financial stability and user commitment that Spotify enjoys through its premium offerings.

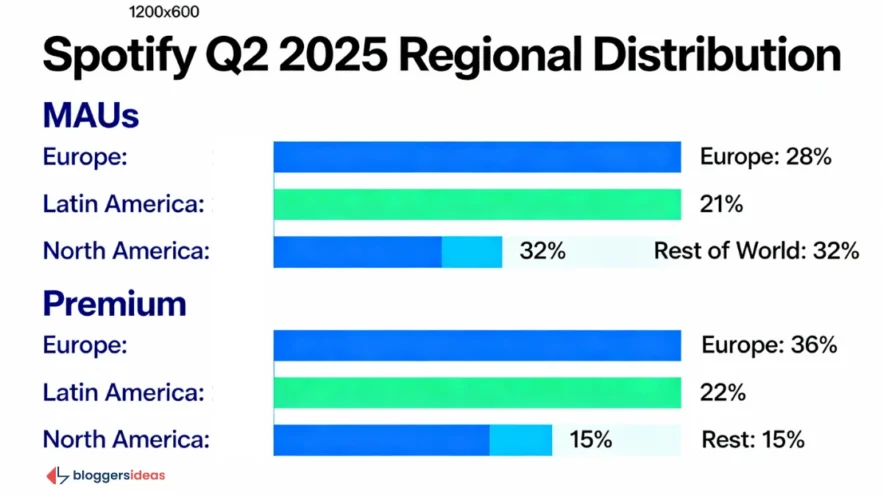

Geographic Distribution of Spotify Users and Subscribers

Spotify’s global reach is extensive, with users spanning across 237 countries and territories, and paying subscribers in 184 markets.

The distribution of its monthly active users and premium subscribers reveals interesting insights into its market penetration across different regions.

Europe consistently stands out as the largest Spotify demographic, accounting for 28% of its Monthly Active Users (MAUs). Latin America follows closely with 21%, while North America contributes 19%.

The remaining 32% comes from the “Rest of the World” category, a dynamic segment that reflects Spotify’s rapid expansion into emerging markets such as India, other parts of Asia, and Africa.

When specifically examining Premium subscribers, Europe’s dominance becomes even more pronounced, holding an impressive 36% of the total subscribers.

North America also contributes significantly with 27%, while Latin America accounts for 22%. The “Rest of the World” category holds 15% of Premium MAUs, indicating strong potential for subscriber growth in these developing regions.

Here is a comprehensive distribution of Spotify’s Monthly Active Users and Premium Subscribers by region as of Q2 2025:

| Region | Share of Spotify MAUs | Share of Spotify Premium MAUs |

| Europe | 28% | 36% |

| Latin America | 21% | 22% |

| North America | 19% | 27% |

| Rest of the World | 32% | 15% |

This regional breakdown provides valuable intelligence for tailoring content and marketing strategies to specific geographical audiences.

Also read about: Facebook Users Statistics

Unpacking Spotify’s Financial Success: Revenue and Profitability

Spotify’s robust user growth translates directly into significant financial success, driven by its dual revenue model of premium subscriptions and ad-supported services.

As of Q2 2025, Spotify reported a substantial €4.1 billion in quarterly revenue, maintaining its strong growth trajectory.

The company projects continued success, forecasting €4.2 billion in revenue for Q3 2025, alongside an anticipated growth to 710 million monthly active users and 281 million premium subscribers.

This forward-looking projection reinforces confidence in Spotify’s continued financial performance.

Here is a detailed breakdown of Spotify’s annual revenue:

| Year | Revenue (€ billion) |

| 2014 | 1.08 |

| 2015 | 1.94 |

| 2016 | 2.95 |

| 2017 | 4.09 |

| 2018 | 5.26 |

| 2019 | 6.76 |

| 2020 | 7.88 |

| 2021 | 9.67 |

| 2022 | 11.72 |

| 2023 | 13.247 |

| 2024 | 16.96 |

| Q1 2025 | 4.2 |

| Q2 2025 | 4.2 |

Spotify also achieved a significant milestone in 2024 by reporting its first annual net profit of €1.1 billion, a strong indicator that its strategic diversification into other audio content, particularly podcasts and audiobooks, is yielding positive results.

This shift is proving successful in strengthening the company’s financial standing and broadening its appeal beyond just music streaming.

Also read about: Social Media Statistics

Premium Subscribers: The Main Revenue Engine

Spotify’s premium subscribers remain the primary revenue driver for the company. In Q4 2024, premium revenue reached €3.7 billion, followed by €3.6 billion in Q1 2025, and a further increase to €3.74 billion in Q2 2025.

This consistent quarter-over-quarter growth highlights the enduring strength of Spotify’s subscription business model, even amidst intensifying competition in the streaming landscape.

The commitment of paying users ensures a stable and predictable revenue stream that forms the backbone of Spotify’s financial health.

Here is a table displaying Spotify’s revenue generated through Premium subscribers by year:

| Year / Quarter | Premium Revenue (€ billion) |

| 2012 | 0.37 |

| 2013 | 0.68 |

| 2014 | 0.98 |

| 2015 | 1.74 |

| 2016 | 2.66 |

| 2017 | 3.67 |

| 2018 | 4.72 |

| 2019 | 6.09 |

| 2020 | 7.14 |

| 2021 | 8.46 |

| 2022 | 10.25 |

| 2023 | 11.566 |

| 2024 | 13.82 |

| 2025 (Q1) | 3.60 |

| 2025 (Q2) | 3.74 |

Ad-Supported Revenue: A Growing Contribution

While premium subscriptions drive the bulk of revenue, Spotify’s ad-supported users also contribute significantly to the company’s overall financial performance.

In Q4 2024, ad-supported revenue climbed to approximately €500 million, followed by €456 million in Q1 2025, and €453 million in Q2 2025. Although these figures represent minor quarterly fluctuations, potentially reflecting seasonality and broader market trends, they underscore the robust nature of Spotify’s advertising business.

Looking at previous years, ad-supported revenue has consistently showcased strong growth. For instance, Spotify generated €1.681 billion in 2023, an increase from €1.476 billion in 2022 and €1.208 billion in 2021.

This upward trajectory highlights the importance of Spotify’s dual model, which effectively monetizes both its premium subscribers and its vast ad-supported user base.

Here is a table displaying Spotify’s revenue generated through Ad-supported users by year:

| Year / Quarter | Revenue (€ million) |

| 2012 | 55.5 |

| 2013 | 68.16 |

| 2014 | 102 |

| 2015 | 196 |

| 2016 | 295 |

| 2017 | 416 |

| 2018 | 542 |

| 2019 | 678 |

| 2020 | 745 |

| 2021 | 1,208 |

| 2022 | 1,476 |

| 2023 | 1,681 |

| 2024 (Full Year) | 1,820 (approx.) |

| Q1 2025 | 456 (approx.) |

| Q2 2025 | 453 (approx.) |

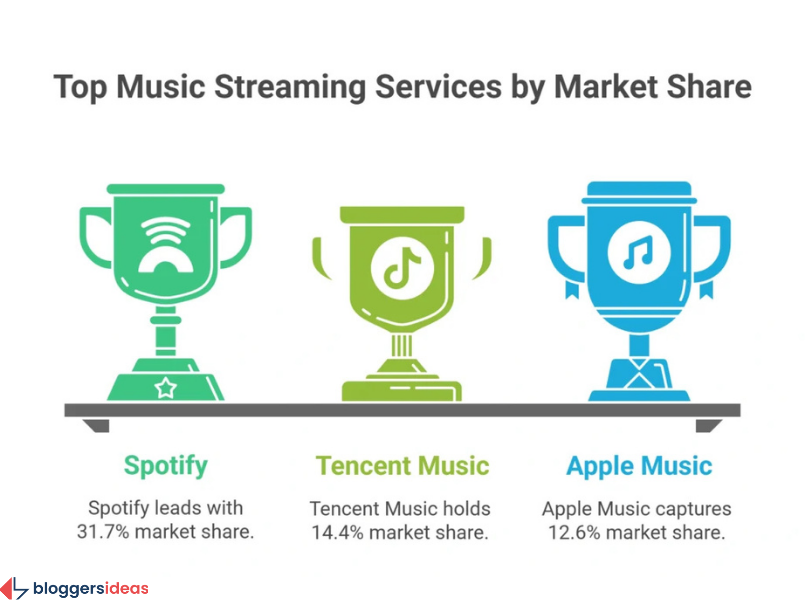

Spotify’s Market Dominance and Competitive Landscape

Spotify maintains a commanding lead in the global music streaming market, holding a substantial 31.7% share of subscribers.

This dominance is evident when comparing its subscriber base, which is more than double that of Tencent Music, its closest competitor, with a 14.4% share.

Spotify also significantly surpasses other major platforms like Apple Music (12.6%) and Amazon Music (11.1%), clearly highlighting its widespread popularity and user preference.

Here is a table displaying the market share of Spotify and other prominent music streaming services:

| Music Streaming Service | Share of Subscribers |

| Spotify | 31.7% |

| Tencent Music | 14.4% |

| Apple Music | 12.6% |

| Amazon Music | 11.1% |

| YouTube Music | 9.7% |

| NetEase | 6.7% |

| Yandex | 3.4% |

| Deezer | 1.3% |

| Other | 9.7% |

This data unequivocally positions Spotify as the market leader, a critical insight for anyone looking to reach a broad audience through music streaming.

Spotify vs. Apple Music: A Feature Comparison

While Spotify leads in subscriber numbers, Apple Music presents a formidable challenge, particularly with its superior audio quality.

Spotify’s freemium model makes streaming accessible to a wider audience, whereas Apple Music operates on a subscription-only basis, offering free trials but no permanent free tier.

Here is a statistical comparison highlighting key differences between Spotify and Apple Music:

| Feature | Spotify | Apple Music |

| Total Users | 696M MAUs (Q2 2025) | Not officially disclosed. Estimates 120–130M users |

| Premium Subscribers | 276M (Q2 2025) | Over 94M (Mid-2025) |

| Business Model | Freemium: free ad-supported + paid Premium tier | Subscription-only: no permanent free tier, only free trial for new users |

| Revenue (Q2 2025) | €4.2B | Not disclosed. Part of Apple’s Services revenue ($21B+ in Q2 2025) |

| Content Library | Over 100M tracks | Over 100M tracks |

| Podcasts & Audiobooks | 4.5M+ podcasts + growing audiobooks library | Growing podcast library, no audiobooks |

| Audio Quality | Up to 320 kbps (Ogg Vorbis). Promised HiFi tier not released | Lossless (up to 24-bit/192kHz) + Spatial Audio (Dolby Atmos) included |

| Social Features | Strong focus: Wrapped, collaborative playlists, social sharing | Limited: mainly “Replay” annual listening summary |

This comparison helps users decide which platform best suits their listening preferences and feature requirements.

Beyond Music: Podcasts, Audiobooks, and Content Expansion

Spotify’s strategic expansion beyond music into podcasts and audiobooks has been a significant factor in its sustained growth and increased user engagement.

The company has proactively acquired leading podcasters and podcast networks, such as The Joe Rogan Experience, The Ringer, and Gimlet Media, aiming to keep users engaged for longer periods on its platform.

Spotify’s Thriving Podcast Ecosystem

As of early to mid-2025, the number of podcasts on Spotify is estimated to be around 4.5 to 4.6 million titles. This vast library offers listeners an incredibly diverse range of audio content, from news and true crime to comedy and educational programs.

The number of video podcasts has also seen substantial growth, with over 300,000 video podcast shows available on Spotify as of late 2024. The number of creators publishing videos monthly grew by an impressive 50% year-over-year, indicating a rising trend in visual audio content.

In the US, an estimated 42.4 million users listen to podcasts at least once a month on Spotify, significantly outpacing Apple Podcasts, which serves 29 million US listeners.

Among weekly podcast consumers in the US, Spotify ranks as the second most-used platform (27% market share), only behind YouTube (34%).

The most popular podcasts on Spotify include global phenomena like The Joe Rogan Experience, Call Her Daddy, and Huberman Lab. In terms of genres, Society & Culture remains the most listened-to, followed by Comedy, Lifestyle & Health, Arts & Entertainment, and Education.

Here is a list of the top 10 most popular podcasts on Spotify globally:

- The Joe Rogan Experience

- Call Her Daddy

- Huberman Lab

- Anything Goes With Emma Chamberlain

- On Purpose With Jay Shetty

- Crime Junkie

- This Past Weekend w/ Theo Von

- Serial Killers

- The Diary of a CEO With Steven Bartlett

- TED Talks Daily

Venturing into Audiobooks

Spotify has also entered the audiobook market, offering an impressive 350,000 audiobooks to its users. Premium subscribers even receive 15 hours of free listening, further enhancing the value proposition of the platform.

This expansion into audiobooks demonstrates Spotify’s commitment to becoming a comprehensive audio destination, catering to a wider array of listening preferences.

The acquisition of Findaway, a platform that serves writers, publishers, and consumers across the audiobook ecosystem, played a crucial role in Spotify’s strategic entry into this segment.

The Music Library: Tracks, Playlists, and Payouts

Spotify’s core offering remains its massive music library, which continues to expand rapidly. The platform boasts over 100 million tracks, with an average of 60,000 new tracks added every single day. This translates to almost 22 million new songs annually, ensuring a constantly fresh and diverse listening experience for its users.

The platform is also home to an astounding 8 billion playlists across all genres, with over 700 million new playlists created in the first six months of the year alone. In 2020, Spotify added over 1 billion new playlists, showcasing the highly interactive and personalized nature of user engagement.

Artist Payouts: Understanding the Economics of Streaming

A frequently discussed topic is how much Spotify pays artists per stream. Generally, Spotify pays artists between $0.003 and

10 billion to the music industry, an increase from $9 billion in 2023. This highlights the substantial financial impact the platform has on the global music ecosystem.

Here are rough estimates of Spotify’s streaming payouts to artists:

| Number of Streams | Estimated Payout |

| Per Stream | $0.003 to $0.005 |

| 100 Streams | $0.3 to $0.5 |

| 1,000 Streams | $3 to $5 |

| 1 million Streams | $300 to $500 |

| 10 million streams | $30,000 to $50,000 |

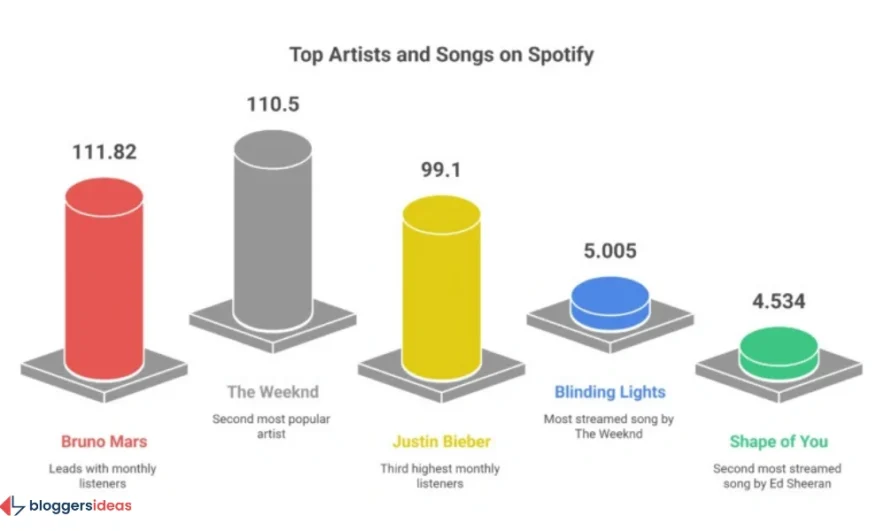

Most Popular Artists and Songs

As of September 2025, Bruno Mars holds the title of the most listened-to artist on Spotify with 111.82 million monthly listeners, closely followed by The Weeknd with 110.5 million.

Justin Bieber, with 99.1 million monthly listeners, surged to third place following the surprise drop of his album “Swag,” gaining mass listeners globally.

Blinding Lights by The Weeknd stands as the most streamed song of all time with over 5 billion streams, followed by Ed Sheeran’s “Shape of You” with 4.5 billion streams. These figures demonstrate the immense power of viral hits and established artists on the platform.

Age and Gender Demographics

Understanding user demographics is crucial for content creators and marketers. In the US, a majority of Spotify users are under 35 years old, with the 25-34 age group representing 29% and the 18-24 age group making up 26%.

However, the average age of Spotify users has been steadily increasing, indicating that music streaming is becoming the dominant listening format across all age groups.

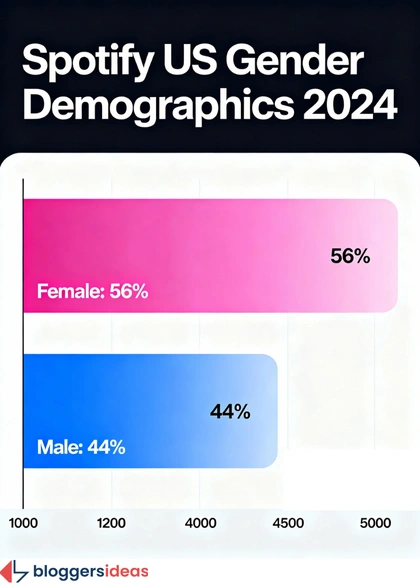

In terms of gender, women comprise 56% of Spotify’s usage, consistent with surveys conducted on Apple Music users, highlighting a slightly female-leaning user base.

Here is a breakdown of Spotify’s age demographics in the US as of 2024:

| Age | Percentage of Users |

| 18-24 | 26% |

| 25-34 | 29% |

| 35-44 | 16% |

| 45-54 | 11% |

| 55+ | 19% |

Here is a breakdown of Spotify’s gender demographics in the US as of 2024:

| Gender | Percentage of Users |

| Female | 56% |

| Male | 44% |

Daily Usage Time

North American users exhibit the highest engagement, spending an average of 140 minutes on Spotify every day. In contrast, European users spend the least amount of time, with an average of 99 minutes daily. These regional differences in usage patterns can influence content scheduling and advertising campaigns.

Here is a breakdown of Spotify’s daily usage time by region in 2024:

| Region | Average Daily Usage (minutes) |

| North America | 140 |

| Middle East & Africa | 124 |

| Latin America | 117 |

| Asia Pacific | 110 |

| Europe | 99 |

Latest Innovations and User Experiences

Spotify continuously innovates to enhance the user experience and maintain its competitive edge. Recent developments reflect a focus on personalization, interactivity, and expanding content formats.

The platform has significantly expanded its music video features, making them available in 97 markets, allowing users to watch alongside their favorite tracks.

Spotify has also rolled out AI-powered playlists in new regions, leveraging artificial intelligence to create highly personalized listening experiences. A notable introduction is the AI DJ for Spanish-speaking users, offering a curated audio journey with conversational commentary.

Daylist, a popular feature that creates dynamic playlists reflecting a user’s changing moods throughout the day, is now accessible in 14 additional languages, further improving personalization for a global audience.

For enhanced interactivity, Spotify has introduced podcast comments, fostering greater community engagement around audio content.

Additionally, the unique vodcast series “Countdown to” provides fans with exclusive behind-the-scenes insights into album creation, blurring the lines between audio and visual content.

These innovations demonstrate Spotify’s commitment to evolving its platform and offering cutting-edge features that cater to the diverse preferences of its massive user base.

How Users Can Leverage Spotify for Their Benefit

For users, understanding Spotify’s features and statistics can unlock new avenues for discovery and engagement.

- For Music Enthusiasts: Explore the vast library of over 100 million tracks and billions of user-created playlists. Utilize features like Daylist and AI-powered playlists to discover new artists and genres tailored to your taste. Follow your favorite artists to stay updated on new releases and behind-the-scenes content.

- For Podcast Lovers: Dive into the extensive catalog of 4.5 million podcasts, including video podcasts, covering every imaginable topic. Engage with creators and other listeners through podcast comments, joining a growing community of audio enthusiasts.

- For Audiobook Listeners: Explore the 350,000 audiobooks available, with Premium subscribers enjoying 15 hours of free listening per month, making it easier to consume books on the go.

- For Social Engagement: Leverage Spotify Wrapped at the end of each year to review your listening habits and share them with friends. Create collaborative playlists to curate music with others for parties or shared experiences.

What Users are Asking: Insights from Quora and Reddit

Beyond official statistics, online communities like Quora and Reddit offer a glimpse into the real-time concerns and curiosities of Spotify users. Recent discussions highlight several key themes:

- HiFi Audio Tier: Many users continue to express eagerness and frustration regarding the long-promised Spotify HiFi audio tier. While Apple Music and Amazon Music offer lossless audio, Spotify’s HiFi remains unreleased, leading to questions about its launch date and potential impact on sound quality.

- Podcast Discoverability: Users frequently ask for better ways to discover new podcasts, indicating a desire for more refined search and recommendation tools within the vast podcast library.

- Regional Content Discrepancies: Some users in specific regions inquire about the availability of certain songs, artists, or podcasts, highlighting regional licensing differences and the desire for a universally accessible content library.

- Artist Support and Payouts: There’s an ongoing conversation, particularly among independent artists and their fans, about the fairness of artist payouts and how to best support creators on the platform.

- Integration with Other Devices and Services: Users often seek seamless integration with smart home devices, car systems, and other platforms, looking for a truly interconnected listening experience.

Addressing these user concerns and adapting to evolving preferences will be crucial for Spotify’s continued success and user satisfaction in the coming years.

FAQs About Spotify Statistics

1: How many people actively use Spotify globally in 2025?

As of Q2 2025, Spotify has a massive user base of 696 million monthly active users globally, demonstrating its widespread appeal and continuous growth across various regions.

2: What is the total number of Spotify Premium subscribers in 2025?

By Q2 2025, Spotify proudly reports 276 million premium subscribers worldwide, showcasing a significant portion of its user base opting for the ad-free, enhanced listening experience.

3: Which region contributes the most to Spotify's user base and premium subscribers?

Europe consistently leads as the largest demographic for Spotify, accounting for 28% of its monthly active users and an even larger 36% of its premium subscribers, highlighting its strong market penetration in the region.

4: How many songs and podcasts are available on Spotify in 2025?

Spotify’s extensive content library in 2025 includes over 100 million tracks, with approximately 60,000 new songs added daily, alongside an impressive 4.5 million podcast titles.

5: What are some of the latest innovations Spotify has introduced to enhance user experience?

Spotify has recently expanded music videos to 97 markets, rolled out AI-powered playlists, launched an AI DJ for Spanish-speaking users, made Daylist available in 14 more languages, and introduced podcast comments for increased interactivity.

Also Read:

- Mobile Internet Traffic Statistics

- Quick Commerce Statistics

- Canva Statistics

- Google Ads Statistics

- Pinterest Statistics

Conclusion: Spotify’s Enduring Influence in 2026

Spotify’s dominance in the audio streaming world remains clear in 2025, with 696 million monthly users and 276 million premium subscribers.

Its growing catalog of music, podcasts, and audiobooks, paired with powerful AI personalization, keeps engagement high and attracts new listeners across the globe.

After achieving its first annual net profit in 2024, Spotify continues to show strong revenue growth from both premium plans and ad-supported users.

Even as competition rises, Spotify’s steady feature upgrades, strategic acquisitions, and global reach help it stay ahead. Its ability to evolve with user needs and lead in audio innovation cements its role as one of the most influential platforms shaping how people discover and enjoy sound today.