- One of the most popular mortgage brokers and websites, Lending Tree offers a wide range of information to customers about mortgages, home loans, and other financial products. Each lead has the potential to earn you up to EPC $176.85.

- Users of the Motley Fool can access premium services, stock advice, and more. Their affiliate program has a wide variety of products that you may advertise and earn money from. The EPC is $3.08.

- An established insurance firm, Gabi Insurance offers a wide range of insurance products to its consumers. Affiliate programs are also available from the company. They also feature an easy-to-follow affiliate program. The EPC is $240.4.

Mortgage affiliate programs are a way for you to earn money by helping people find loans for buying homes. If you have a website or blog about finance or housing, you can join these programs.

They give you special links to mortgage services or lenders. When someone clicks on your link and applies for a loan or gets a mortgage, you get paid a fee as a thank you.

It’s a good method to make some extra cash while providing useful information to your readers about getting a home loan.

What Are Mortgage Affiliate Programs?

Top 9 Mortgage Affiliate Programs 2024

It’s important to remember that promoting mortgage firms should not be treated carelessly. If you support a shady business, you risk losing your credibility and tarnishing your reputation.

Some of the greatest mortgage firms to promote as an affiliate have been included here for your convenience.

1. Lending Tree

One of the most popular mortgage brokers and websites, Lending Tree offers a wide range of information to customers about mortgages, home loans, and other financial products.

On the site, there are also a lot of mortgage affiliates who help to enhance traffic and spread the word about their product offerings.

Since its inception in 1996, Lending Tree has built a solid reputation as one of the most trusted names in consumer lending. In addition to delivering some of the greatest mortgage offers, they have a stellar reputation for providing excellent customer service.

Affiliates in the Lending Tree program get access to some of the finest rates in the industry. A residual income can be a lifesaver for your firm, thanks to their generous commissions and residual revenue.

I like this firm because of the offers that are available on the website. Promoting a business that has it will encourage customers to make purchases from you. They’ll also be more likely to return as customers due to your good name.

Borrowers will appreciate the straightforward advice and easy access to your online business provided by Lending Tree.

They don’t just disseminate mortgage-related information via their affiliate network; they also feature a wealth of other financial services information.

Each lead has the potential to earn you up to EPC $176.85.

- Commission: $44.50

- Cookie duration: 14 days

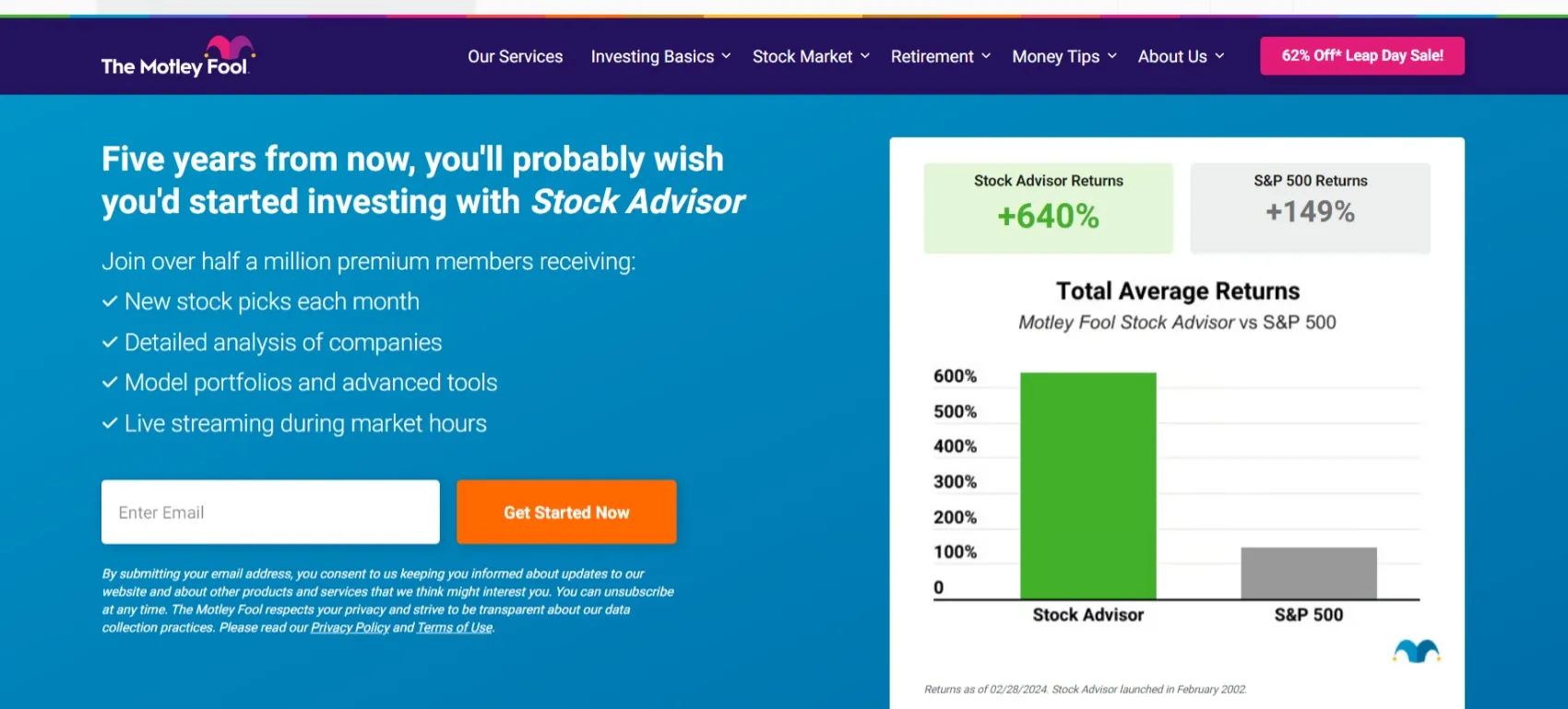

2. Motley Fool

Users of the Motley Fool can access premium services, stock advice, and more. Their affiliate program has a wide variety of products that you may advertise and earn money from.

Since its inception in 1993, Motley Fool has evolved to be one of the most respected names in the financial services business. Aside from generating excellent material, they are also known for their thorough stock analysis. The EPC is $3.08.

People all over the world admire the website because of its enormous popularity. As a result, you’ll be in a better position to offer sound financial guidance to your audience.

The Motley Fool is a great affiliate partner since they have a proven track record of success.

- Commission: $100 for each lead

- Cookie duration: 45 days

3. Gabi Insurance

An established insurance firm, Gabi Insurance offers a wide range of insurance products to its consumers. Affiliate programs are also available from the company.

With Gabi Insurance, you may expand your business while simultaneously earning a good amount of money as an associate.

You’ll get roughly $0.04 for each sale on Amazon when you advertise their services. If you’re looking for a way to make money online through your blog or website, this is a great affiliate program to have.

Because of the money-back guarantees on their policies and the chance to win cash prizes, the Gabi Insurance affiliate program is one of a kind. They also feature an easy-to-follow affiliate program. The EPC is $240.4.

There are forums on the website where you can exchange your insurance knowledge with other users, as well as wonderful resources on how to create financial independence. When it comes to insurance, you can also learn a great deal.

- Commission: $5 per lead

- Cookie duration: 90 days

4. Lexington Law

Legal services provided by Lexington Law include a wide range of practice areas and a global clientele. Using affiliate programs, you may help them expand by selling their items.

In the legal profession, Lexington Law was established in 2004 and has a solid reputation. Seven years in a row, they’ve been included in Inc.

5000’s ranking of the nation’s fastest-growing private enterprises. In addition to offering a wide range of legal services, the firm has paid out over $100 million in settlements to its clients throughout the years.

You can market them online because they offer so many services for their customers to choose from. Lexington Law’s affiliate program is well-designed, in my opinion.

This company’s approach is basic and straightforward, and it’s a pleasure to work with them. Having access to the best practices of the company’s affiliates will help them grow their business.

In addition, they offer an affiliate manager who can help you with any questions you may have. In addition to Lexington Law’s services, you can also promote your own items. The EPC is $35.98.

- Commission: $65

- Cookie duration: 30 days

5. MortgageAdvisor.com

In addition to offering comprehensive information about mortgages, home loans, equity lines of credit, and other financial products, MortgageAdvisor.com also serves as a prominent mortgage broker and online resource for consumers.

Many people call MortgageAdvisor.com “the most trusted name in the business” because of its exceptional industry reputation.

With a vast range of services, they’re also one of the major mortgage providers. Through your blog or website, you’ll be able to market MortgageAdvisor’s products and services.

No money is required upfront for the company’s affiliate program, which is one of a kind. As a result, you have complete authority over the website, blog, or another promotional medium you choose to use to advertise MortgageAdvisor’s goods and services.

Furthermore, there are no earnings restrictions for this business.

For your benefit, we’ll share our best practices and tips for building a successful business. The blog on the website also has some excellent tools that can help you increase the number of purchases you receive from your site’s visitors.

What I appreciate most about this organization is that there are no earnings caps and no commissions to worry about.

- Commission: up to $28 for each lead

- Cookie duration: TBD

6. Quicken Loans

One of the world’s largest online consumer lenders, Quicken Loans, specializes in mortgage lending.

More than a million people have financed their own houses with the help of Quicken loans since their inception in 1985.

They’re a reputable business that provides high-quality products and services at competitive prices. It’s a simple affiliate program that you can promote on your blog or website, and you’ll get paid if someone signs up for their services after seeing your ad.

Affiliates of Quicken Loans have access to marketing tools that help them promote the company’s services more successfully. Videos, FAQs, and more may be found on their website.

Enroll in the company’s referral program, and you’ll be eligible for additional compensation for referring new customers.

This company’s affiliate program is really well-structured. The company’s products are free of commission costs, and working with them is a breeze.

Additionally, you’ll be able to profit from any sales generated by promoting their products on your blog or website.

- Commission: $15 per referral maximum

- Cookie duration: 90 days

7. Better.Com

As a mortgage industry innovator, Better.com acknowledges the need for change. The financial crisis of 2007-2008 clearly demonstrates that the system is broken.

Visionary CEO Vishal Garg envisioned a direct mortgaging method that would make it easy for customers to acquire the greatest deals at the cheapest pricing. The company’s founder and CEO, With Better.Com, made this dream a reality.

It’s a company that simplifies the mortgage and refinancing process by removing unnecessary fees and reducing the number of complications. An easy method to cut costs is to stop charging consumers for meetings that they don’t need.

Better.com also intends to minimize the overall costs of the mortgaging operation in addition to speeding up the process. A cheap interest rate is a result of this, and Better.com is one of the first companies to offer it.

Better.Com has a big customer base because of its reputation as one of the most cost-effective and fastest mortgage and refinancing providers in the industry.

Better.Com Popularity Com’s and business methods can be used by affiliate marketers to promote the brand and create cash through their affiliate program.

As a mortgage affiliate, Better.com has one of the strongest programs currently available. Affiliate marketers can earn up to $200 for each customer they refer to the program. It’s a no-brainer for affiliate marketers.

This exceptionally well-paying scheme will net you a tidy sum. However, there’s more to it than that. Increased sales volume can be achieved by enhancing your marketing techniques.

- Cookie Duration: n/a

- Commission Rate: $200 per lead

8. Mortgage Training Centre

The mortgage industry is vast and can include companies that are not directly involved in the mortgage process but still play a part in it.

An example is the Mortgage Training Center, which is a well-known training and licensing institute for mortgage agents. Founded in 1994, the Mortgage Training Center has helped countless individuals become licensed mortgage brokers since its inception.

They offer courses on the Secure And Fair Enforcement of mortgaging licensing (SAFE) for brokers who want to learn more about it.

Furthermore, the National Mortgage Licensing System and Registry have recognized these courses as being of the highest quality, making them widely accepted across the country.

The Mortgage Training Center also offers an affiliate program, where marketers can earn up to a 50% commission for each referral they make to the center, with liberal payout policies.

The commission rates for affiliate marketing may vary based on the service or product being promoted. Overall, the company’s prices are in line with the market. Although their affiliate program offers a cookie life that’s not the longest, it’s still sufficient.

- Cookie Duration: 30 Days

- Commission Rate: 50%

9. BBVA Bank

BBVA Bank has been serving customers in the United States since 1964. However, the bank’s history can be traced back to 1857 in Bilbao, Spain.

With 19 branches spread across the country, BBVA Bank provides a diverse range of banking services, including mortgage loans.

BBVA Bank provides various types of mortgage loans, including fixed-rate, jumbo, and adjustable-rate mortgages.

They also offer no/low down payment options, as well as government-backed loan products and HOME (Home Ownership Made Easy) mortgages.

If you refer someone to BBVA Bank for a mortgage loan, you will receive a fixed payment of $85 per lead.

- Commission Rate: $85 per lead

- Cookie duration: Session-based

FAQs

💼 How can I join a mortgage affiliate program?

To join, find a mortgage company with an affiliate program that suits your audience, apply on their website, and start sharing your unique affiliate links once approved.

💰 How much money can I make?

Earnings vary by program. You might earn a fixed fee for each application or a percentage of the loan amount, depending on the program's structure.

📣 How should I promote my affiliate links?

Promote your links through blog posts, social media, email newsletters, or any platform where you engage with people interested in real estate and finance.

🔍 What makes a good mortgage affiliate program?

Look for programs with competitive commission rates, reputable lending partners, timely payments, and support for affiliates, including access to promotional materials.

👥 Who can benefit from joining a mortgage affiliate program?

Content creators, bloggers, or anyone with an audience interested in real estate, home buying, or personal finance can benefit from joining.

📈 Can I track my referrals and earnings?

Yes, most mortgage affiliate programs provide a dashboard where you can track clicks, referrals, and earnings to monitor your performance and optimize your strategies.

🌍 Are mortgage affiliate programs available internationally?

While many mortgage affiliate programs are country-specific due to differing mortgage laws and regulations, there are programs available in multiple countries. Always check the geographic focus of a program before joining.

Quick Links:

- Top Keto Affiliate Programs

- Top Vape Affiliate Programs

- Top Book Affiliate Programs

- List of Best Jewelry Affiliate Programs

- Best Travel Affiliate Programs

- Best Solar Affiliate Programs

- Top Luxury Affiliate Programs

Conclusion: Is Joining a Mortgage Affiliate Program a Good Move?

Joining a mortgage affiliate program can be a smart choice if you have a platform that talks about housing or finances.

It lets you make some extra money by connecting your readers with mortgage services they might need.

By choosing the right program, you can offer valuable help to those looking to buy a home or refinance their mortgage, all while earning a commission for your referrals.

It’s a great way to use your influence to assist others in making big financial decisions and benefit from it at the same time.