Welcome to my PocketSmith Review 2024, and why prefer it over any other Budgeting app.

PocketSmith might be the answer for you if you’ve suffered significant financial setbacks as a result of bad financial organization and planning.

Have you ever lacked organization and made expensive financial mistakes as a result?

Even if you had the money to pay a payment, you might have been hit with fines, interest, or penalties because you didn’t have “your ducks in order.” These things only helped to increase your sense of helplessness.

You can feel perpetually behind financially because you think you never have enough time or space in your calendar to manage your money.

The staff at PocketSmith are aware of your situation and have created a solution to help consumers comprehend and better manage their finances.

If you believe that your ongoing disorganization and lack of financial understanding are keeping you from reaching your objectives, the PocketSmith app might be exactly what you need.

What is PocketSmith?

PocketSmith is completely cloud-based and does not require the installation of special software, which means can be used from anywhere. The server offers very flexible import options and they can accept bank feeds from 36 countries.

The service is pretty similar to Mint.com, except for the fact that Mint is free, while PocketSmith involves monthly subscription fees, though there is a feature-limited free version available as well.

PocketSmith Features

Since its official launch, PocketSmith has slowly and steadily made its name among the top contenders in its class, thanks to some very useful and efficient finance management tools and features that help you keep a check on your money and manage the future of your finances.

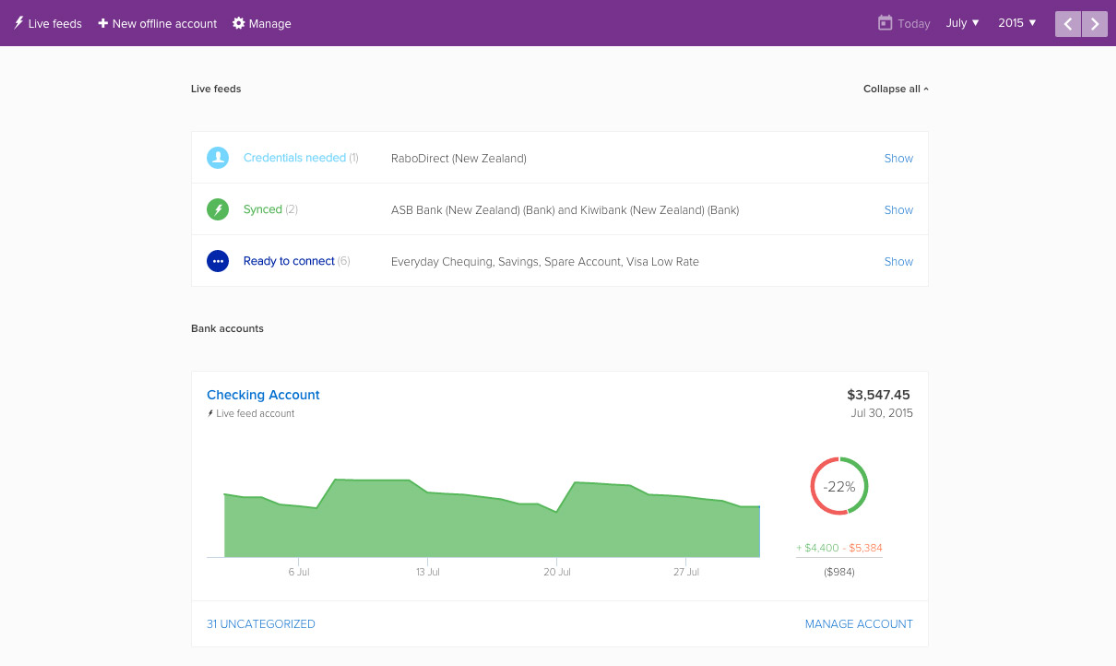

1) Automatic live bank feeds

PocketSmith has been designed to automatically import your transactions by connecting to over 12,000 globally recognized and reputed financial institutions.

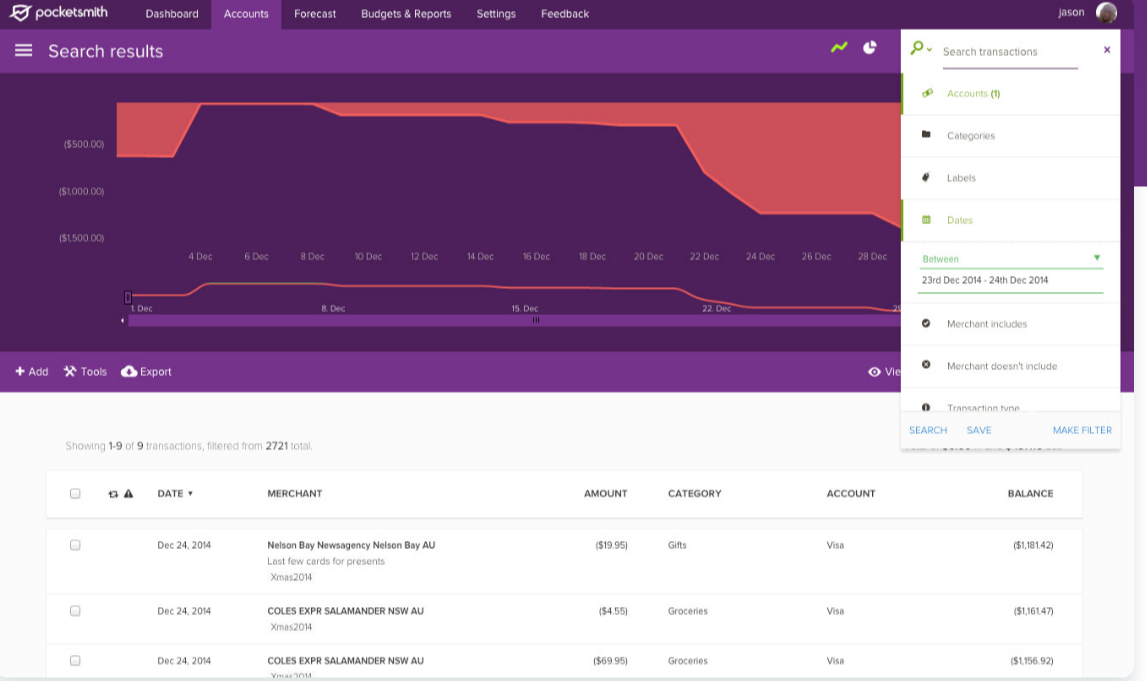

2) Find and organize transactions

The systematic interface of PocketSmith lets you categorize, label, and annotate spending, just the way you want it. You can also use their amazing native search engine to find transactions.

3) Multi-currency

Track and convert all accounts, assets, and liabilities from different countries as PocketSmith provides automatic currency conversion based on daily exchange rates. There is also exchange rate support for gold, silver, and Bitcoin.

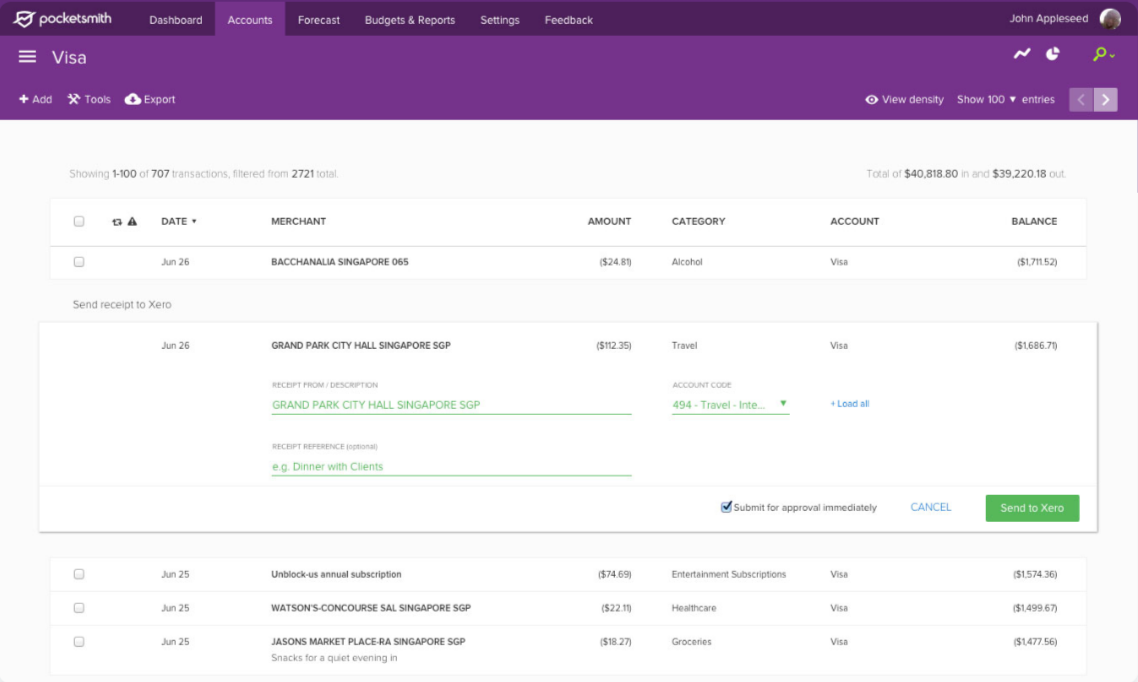

4) Send expenses to Xero

Users can instantly connect to a Xero account and send expenses over in a couple of clicks. There is no need to sign in or get into any manual entry hassles.

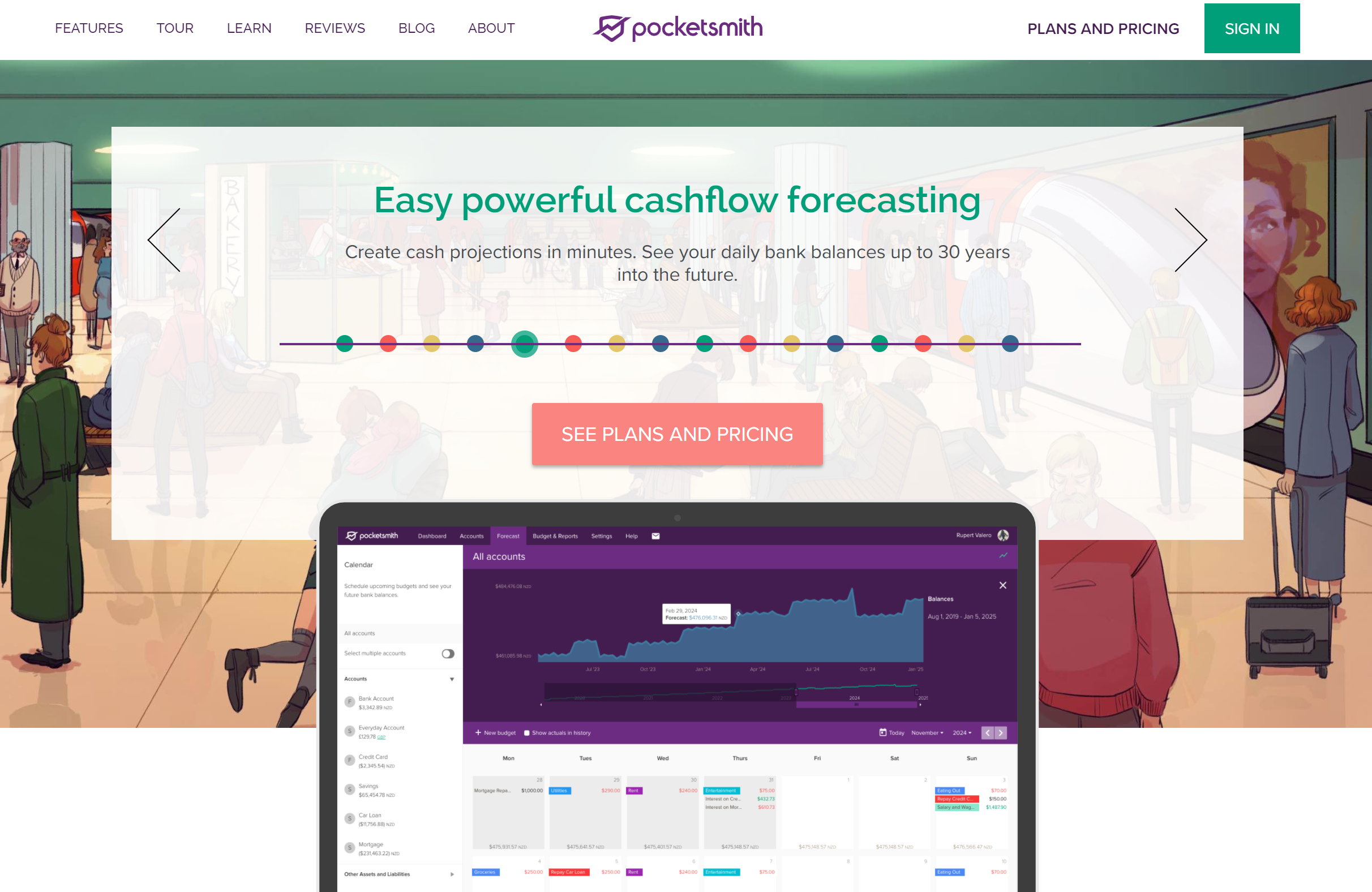

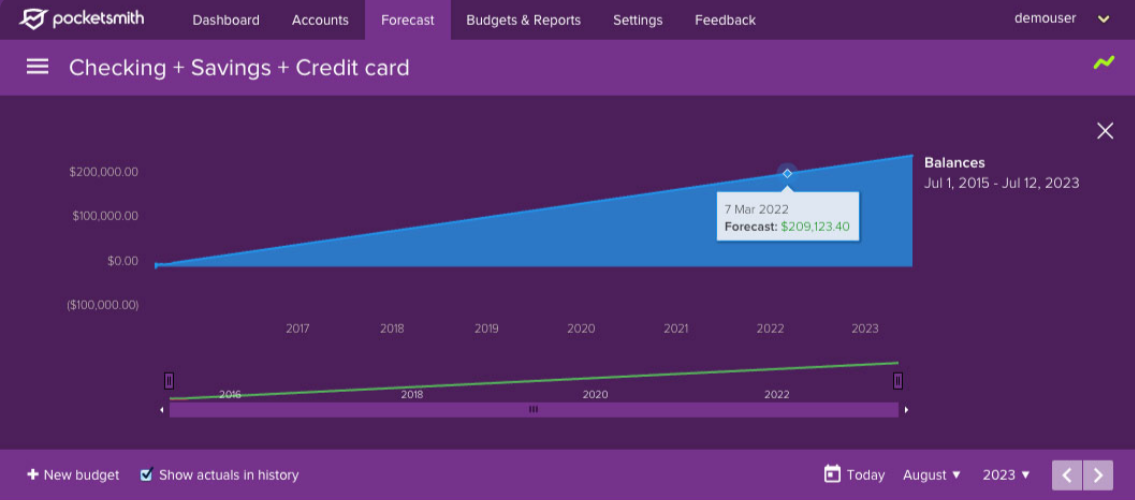

5) Easy, powerful forecasting

Users can create instant cash projections and see daily bank balances for up to 30 years.

6) Budget Calendar

Poecketsmith allows you to schedule your upcoming bills and budgets in a calendar so you can have a fruitful interaction with your money in a natural manner.

7) What-if scenarios

A unique and innovative outcome prediction mechanism lets you test your decisions to see future financial outcomes and take the uncertainty out of your planning.

8) Flexible budgeting

A flexible and user-friendly budgeting system lets you create daily, weekly, and monthly budgets, and more so that you can break your budget down into meaningful periods.

9) Live Bank Feeds

Though this feature is available only on the Premium and Super packages, you get to connect to more than 12,000 financial institutions worldwide and get automatic live bank feeds.

This includes all major banks in the US, UK, Canada, Australia, and New Zealand. Furthermore, you can import multiple accounts with the same institution and once that is done, your transactions will be automatically categorized.

10) Multi-currency capability

PocketSmith efficiently supports numerous recognized bank accounts, assets, and liabilities from different countries providing automatic currency conversion based on daily exchange rates. Another big plus is that there’s even exchange rate support for gold, silver, and Bitcoin.

Furthermore, your net worth will be recorded in your base currency while the app shows conversions to the country of your choice, both the native balance for the foreign-based accounts.

11) Budgeting

You can set up the app any way you desire to create custom flexible budgets for daily, weekly, and monthly time frames. The notifications and financial alerts by the system are also very good and will notify you when you are close to going over your budget.

12) Budget Calendar

PocketSmith makes sure you pay all your bills on time by allowing you to schedule upcoming bills. This feature enables users to prevent cash flow problems in the future.

However, this app doesn’t actually pay your bills for you. It is only a calendar to keep track of when your bills are due.

13) Projected daily balances

Forecasting your average balances up to 30 years out is an amazing feature for business owners and investors.

An additional feature of this is the “what-if” scenarios, which can be used to predict uncertainties such as a higher or lower income, or the outcome if you spend less money on goods and services.

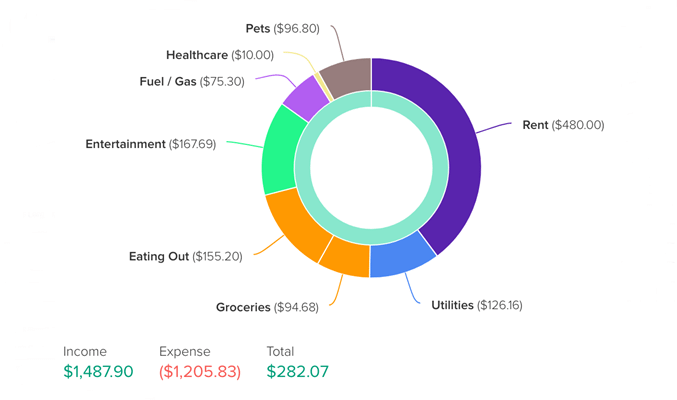

14) Income and Expense Statements

A digitized statement for your income and expenses is the most crucial feature of any finance management app. PocketSmith lets you customize your financial statements to show your income and expenses for any specified time frame.

This feature also has alerts to let you know when you’ve exceeded budgets for individual categories.

15) Net Worth

Knowing the difference between your assets and your liabilities is very important to calculate your net worth properly. PocketSmith shows you exactly that by enabling you to pull up that information in a matter of seconds.

The app can account for accounts held in foreign currencies thus, working as the best indication of your financial position at any given time.

16) Superfast Search Engine

You can quickly search and access all your transactions, whether old or new without scrolling through long lists of repetitive transactions using PocketSmith’s superfast native finance search engine.

How to Contact PocketSmith

Send an email to [email protected] to get in touch with PocketSmith customer service. Send an email to [email protected] with any bank feed concerns. Additionally, you can use the website’s contact page to file an assistance request.

How can I get started with PocketSmith?

To assist you in getting started with PocketSmith, I have put together a quick step-by-step guide.

Click here to see the PocketSmith homepage.

Visit the PocketSmith website and select the “SIGN UP” link. It is located in the top-right portion of the screen.

Select your plan: You must now select the plan you wish to purchase. Choose the basic package if you want to try out the platform initially. Once you’ve become used to all the features, upgrading is simple.

Select a username and a secure password: You must now select a username and a secure password.

Make sure your password is extremely safe because the accounts you’ll be importing to PocketSmith are sensitive. Along with entering your email address, you must also read and agree to the terms and conditions.

Create your dashboard: After creating your account, you must import your accounts. Remember that the basic plan only allows for the import of two accounts.

You may start categorizing your transactions, making budgets, and forecasting once you’ve uploaded your bank account(s). If this is your first time configuring anything, PocketSmith walks you step-by-step through the procedure.

They will demonstrate to you how to set up your dashboard when you choose “demo mode.”

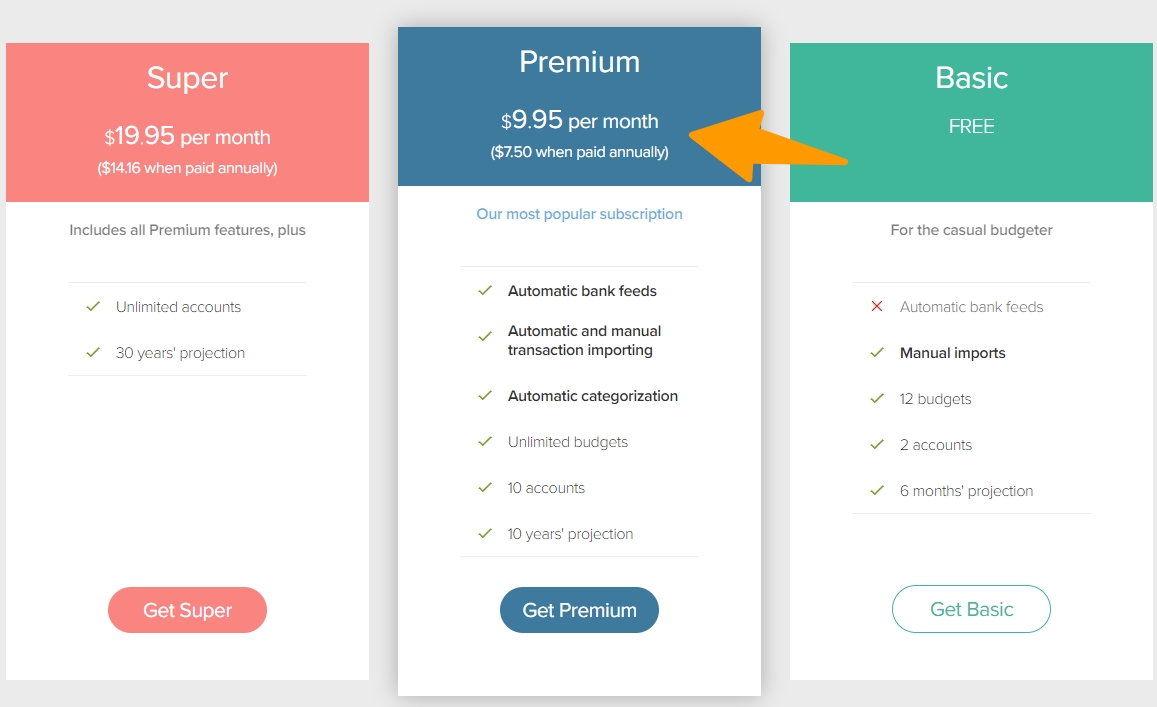

PocketSmith Pricing Plans

PocketSmith offers its customers to choose from three different packages. Each of these packages is priced differently and delivers a unique service.

1) PocketSmith Basic (PocketSmith Trial)

Price: FREE

This is a feature-limited version in which you can add up to two bank accounts. However, this process is not automatic like the other packages.

You will also need to manually import your bank account information into the app. Since this is a basic package, users can only access up to 12 budgets and six months of budget projections.

- Manual imports

- 12 budgets

- 2 accounts

- 6 months projection

2) PocketSmith Premium

Price: $9.95 per month ($7.49 when paid annually)

This package gives you the automatic bank feed updates feature, along with automatic transaction importing and categorization. This package allows users to add up to 10 accounts to the app and access up to 10 years of budget projections and unlimited budgets.

- Automatic bank feeds

- Automatic and manual transaction importing

- Automatic categorization

- Unlimited budgets

- 10 accounts

- 10 years projection

3) PocketSmith Super

Price: $19.95 per month ($14.16 when paid annually)

As a highlight, this version offers the capability to add and handle unlimited accounts along with the ability to make projections and forecasts of up to 30 years, plus everything available with the Premium service.

- Unlimited accounts

- 30 years projection

Visit the PocketSmith Official Website to learn more about their plans, pricing, features, overview, and customizations.

How Does PocketSmith Work?

This all-inclusive budgeting application offers an abundance of options to aid you in tracking and organizing your finances. Despite its complexity, you can begin using it in much less than a minute.

The Procedure for Registration

There are five stages needed in creating a PocketSmith account, but the entire procedure takes only a few seconds (in all seriousness, it took us only about 25 seconds).

You will not be required to disclose any personal information when you sign up for the service, and you will always be free to change your plan, upgrade, downgrade, or cancel the service at any time.

Following the setup of your account, you will be offered three options: importing your information from another site (such as Mint.com), manually adding your bank information and transactions, or taking the tour to gain an idea of how everything works.

I tested by importing data from my Mint.com account in my particular case. I was instructed to export the essential information from my Mint account in accordance with the basic instructions supplied by PocketSmith. After that, I simply uploaded the Excel file to the PocketSmith website.

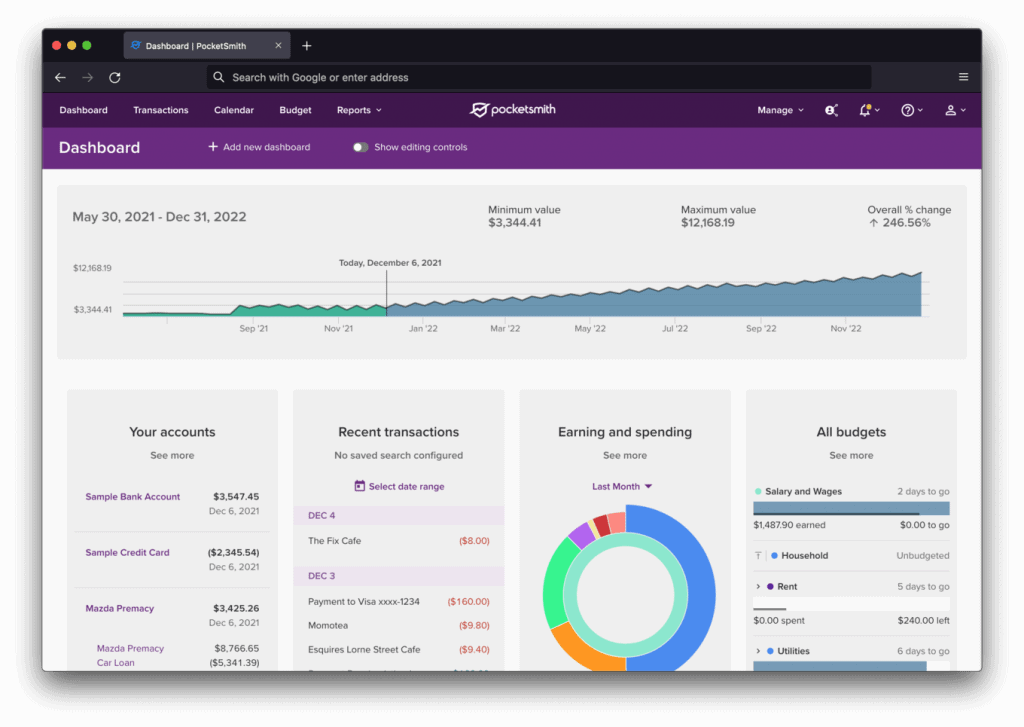

Pocketsmith Dashboard

When your account is ready, you will be taken to the dashboard, where you may view your earnings and expenditures. You can view your earlier spending history for up to six months by clicking the corresponding icons (for the free version).

The dashboard also provides an overview of your budget and financial prospects. In a moment, I’ll elaborate a bit more on these.

Administration and Documentation of Financial Transactions

Examine each of your transactions using the chosen technique for transaction management, and then assign each to the proper category and label.

There is no pressure from PocketSmith to conform to categories that are meant for everyone. Additionally, you can add notes to transactions. The search parameters for transactions include an amount, category, tag, and text notation.

After reviewing your total expenditure information, the next step is to create a budget. This might help you uncover problem areas where you may be overspending or underspending.

PocketSmith Alternatives

1) Trim

Trim is a Free Personal Finance Management app, in case if Trim negotiates your bills successfully, Trim will take a huge chunk that is 25% off your first month’s savings, with 256-bit SSL encryption they offer good bank security level and security features including read-only access and two-factor authentication. one just needs to text Trim to get started with their services.

Trim automated the process of finding coupons and applying them directly when you make purchases, they also have a Bill negotiator option that helps automatically negotiates users’ bills like the internet, Cable, etc.

2) CountAbout

CountAbout comes with easily customizable budget features, available on both iOS and Android, CountAbout can be linked with 12,500+ financial institutions, Including Mint.com and Quicken, to provide timely updated financial reports, the pricing range starts at $9.99/year which goes up to $39.99/year.

CountAbout also claims all your data stored with them is encrypted and ensures, no data sharing with external operators or advertisers.

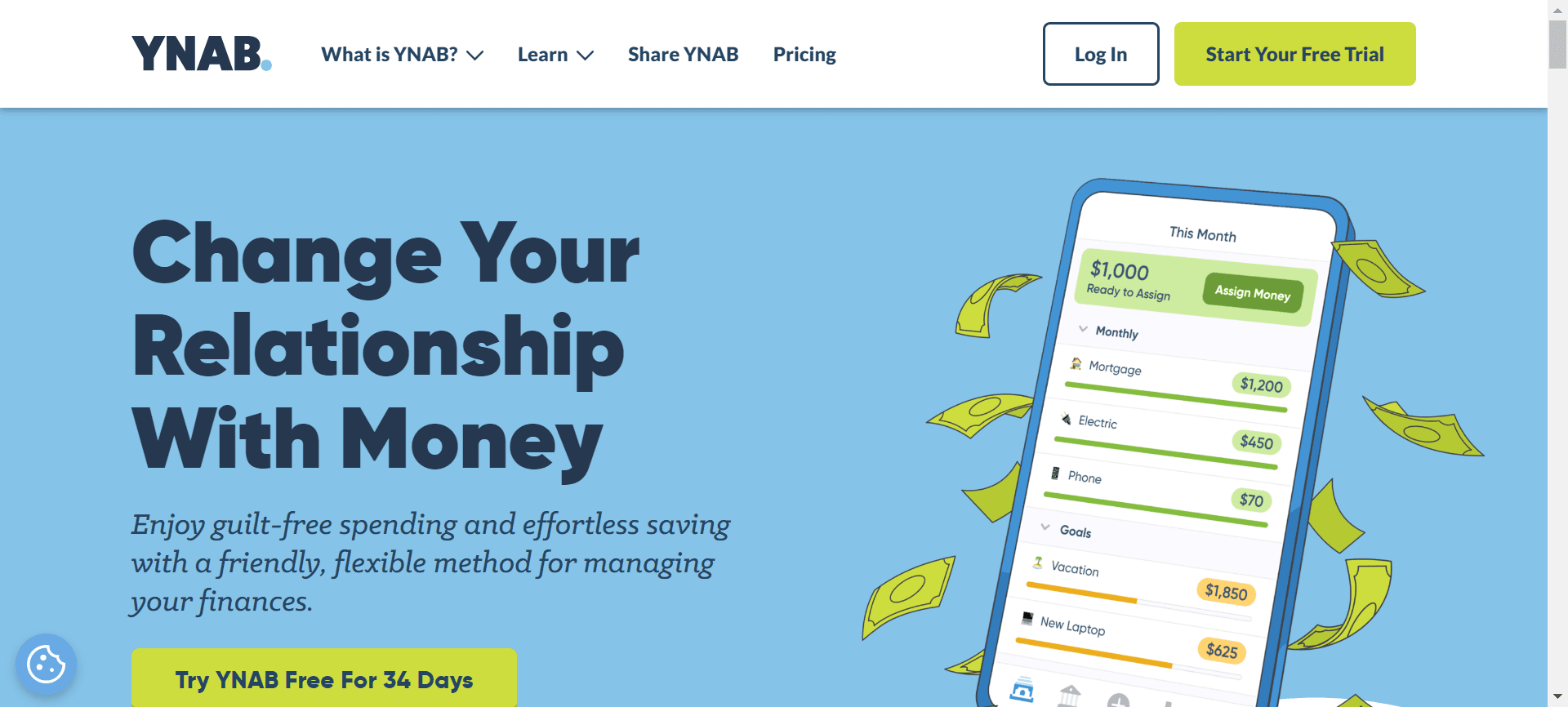

3) YNAB

One of the most popular PocketSmith alternatives is You Need A Budget (YNAB). Since the software is so goal-focused, it is very helpful for paying off debt. Like PocketSmith, it also consolidates your financial data so you can keep track of expenses and keep tabs on your net worth from a single dashboard.

Furthermore, YNAB has a 34-day free trial period. Following that, it costs $14.99 monthly or $98.99 annually.

FAQs Related PocketSmith Review

👉 Does PocketSmith sell data?

The majority of PocketSmith's features are only available to paying customers. They don't use any tricks, get kickbacks, or sell user data to earn money; the only way they make money is when people like you pay a reasonable fee for an excellent product.

👉 Can I trust PocketSmith?

The budgeting app known as PocketSmith is reliable and risk-free to use. Despite this, you are responsible for safeguarding your own password and should never reveal any of your confidential information to anyone.

👉 Who is the owner of PocketSmith?

PocketSmith's Current Chief Executive Officer and Co-Founder is Jason Leong.

👉 Is PocketSmith web-based?

A desktop personal finance app with a web interface is PocketSmith. As a companion budgeting tool, our mobile app for iOS and Android puts some of the most important features of PocketSmith right in your pocket. In order to attain your financial goals while still doing what you do best, which is to live your life!

👉 Does PocketSmith use open banking?

The fact that PocketSmith operates on a global scale provides us with a distinct viewpoint on open banking. They have been on the front lines of providing bank feeds to customers all across the world for more than a decade at this point.

Final Thought: PocketSmith Review 2024

PocketSmith is a 5-star app that comes with a price. PocketSmith would be a great financial budgeting app if you couldn’t get equivalent features with other platforms or apps for free. However, PocketSmith’s prices may look higher than those of its competitors.

The calendar is its best feature for managing accounts like checking, credit cards, student loans, and more. The free version apps come with two schedules for checking and credit card accounts aren’t great.

Users need Premium or Super accounts to track and report on several accounts. PocketSmith calls the Premium account the “best value subscription” at $9.95 per month. If you want complete account information and financial predictions, PocketSmith may be an excellent investment.

PocketSmith includes many features to assist you manage your money, but your choice will depend on your needs and finances. Select PocketSmith wisely to improve your finances.

Further Read:

I love having all my numbers in one place. The interface is super slick and simple to use. I can see how much money goes in and out every day! It even notifies me when it’s time to pay bills or make purchases. Thank you – PocketSmith

Pocketsmith has been an essential part of my finances since the day I downloaded it. The lessons are immersive and informative, but also fun to explore. Once you get going, there’s no going back–Pocketsmith will be a trusted companion in your life as long as you save just a little bit here and there.

Pocketsmith is the best for organising your finances. It helps you stay sane by letting you see all of your spending in one place, so it’s easy to figure out what items need more attention and which ones are getting a little too much money spent on them. Plus, they have lots of helpful articles with budgeting tips and other financial experts telling about how to get themselves together before every selfie!

Like many elderly people, I’ve been using Quicken for years. But new products come out every year! Pocketsmith is a powerful new competitor to Quicken with awesome budgeting tools – though it takes some time to get the hang of. It’s worth checking out, as Pocketsmith has one of the best financial projection features around.

I can’t say enough good things about this software. The part that I love is the deep level of detail in the budgeting section. They have a pre-set agenda, but you are able to change it as needed for your business or personal life. It’s super helpful in keeping on track and getting stuff done! The financial projection starts out with some basics, but then becomes incredibly sophisticated and robust after a while of using it. The time spent spreading my work across different budgets has been great for both our business and personal lives, so thank you!

Personally, I like the fact that it’s always there with me. I check my email, lock my phone and things could be out of control but PocketSmith will teach me to save financially.

I also won’t have to worry about forgetting to pay bills or being late when money gets tight. It’s all right there in one place!

For a company that’s serious about their budgeting and financial projections, Pocketsmith is the way to go. I know how daunting it can be at first, but you get used to its in-depth interface pretty quickly. You spend more time managing your finances with this software than you would if you didn’t have an organizational system, for sure. But once I started getting into the groove of things, things went much smoother. And all without worrying about forgetting anything! It sucks not having any clue what we spent our money on months ago or where it came from originally…I was all over the place before Pocketsmith saved my life

PocketSmith is the solution to your chronic disorganization and lack of financial understanding. If you feel like these two factors are holding you back from reaching your goals, then PocketSmith might be exactly what you need.

PocketSmith is an amazing financial tool with one-star pricing. If you couldn’t get most of what PocketSmith does for free elsewhere, it would stand out as a 5-star product. However, its less desirable than other competitors because of the low price point.