Looking for an unbiased SafetyWing review, i’ve got you covered.

In this post, I have featured my trustworthy and honest SafetyWing Review 2024, which includes detailed insights into its pricing, features, terms covered, and more. Let’s get started here.

If you’re a digital nomad, you know the importance of insurance. But traditional travel insurance plans can be expensive and don’t always cover all your needs. That’s where SafetyWing comes in.

SafetyWing is a pay-as-you-go insurance policy designed specifically for digital nomads. It’s simple and straightforward, and you don’t have to know where you’re heading in advance or how long you will be gone. Plus, it’s affordable, so you can rest assured that you’re covered no matter what happens.

So, if you’re looking for reliable insurance coverage that won’t break the bank, SafetyWing is worth considering.

What Is SafetyWing Insurance?

Likely, you’ve never heard of SafetyWing because they’re still a relatively young company. SafetyWing is one of the newest travel insurance providers in the industry, having been launched in 2018 by Norwegians and situated in the United States.

If you’re worried about handing your health to a babysitter, don’t be. Tokio Marine, one of Japan’s largest and most established insurance companies, is SafetyWing’s insurance partner, and the insurance is underwritten by Lloyds. Furthermore, insurers must undergo extensive vetting and have insurance before they are permitted to trade.

Because SafetyWing is still a young firm, you’ve likely never heard of it. SafetyWing is one of the industry’s newest travel insurance carriers, founded by Norwegians in 2018 and based in the United States.

Don’t be concerned about entrusting your health to a babysitter. SafetyWing’s insurance is underwritten by Lloyds and is provided by Tokio Marine, one of Japan’s largest and most established insurance companies. Furthermore, before being allowed to trade, insurers must undergo intensive vetting and have insurance in place.

What Destinations Are Covered?

With SafetyWing, you can travel anywhere in the world outside of your home country. Iran, North Korea, and Cuba, except for U.S. citizens who have been granted permission by the U.S. government to visit Cuba.

What’s Covered In SafetyWing Insurance?

What Activities Are Covered with SafetyWing Insurance?

How Does SafetyWing Insurance Work?

This policy is pretty simple because there aren’t a lot of options. The same coverage applies to everyone, but age is the biggest thing that affects the cost.

For travelers aged 10 to 39, a Safety Wing insurance policy costs $36.96 for four weeks/28 days of coverage. Travelers 40 to 49 pay $59.92 for this same period, those 50 to 59 pay $94.08, and those between ages 60 and 69 pay $127.68.

If you’re over 70, no coverage is available through the website, but you may get coverage for a premium.

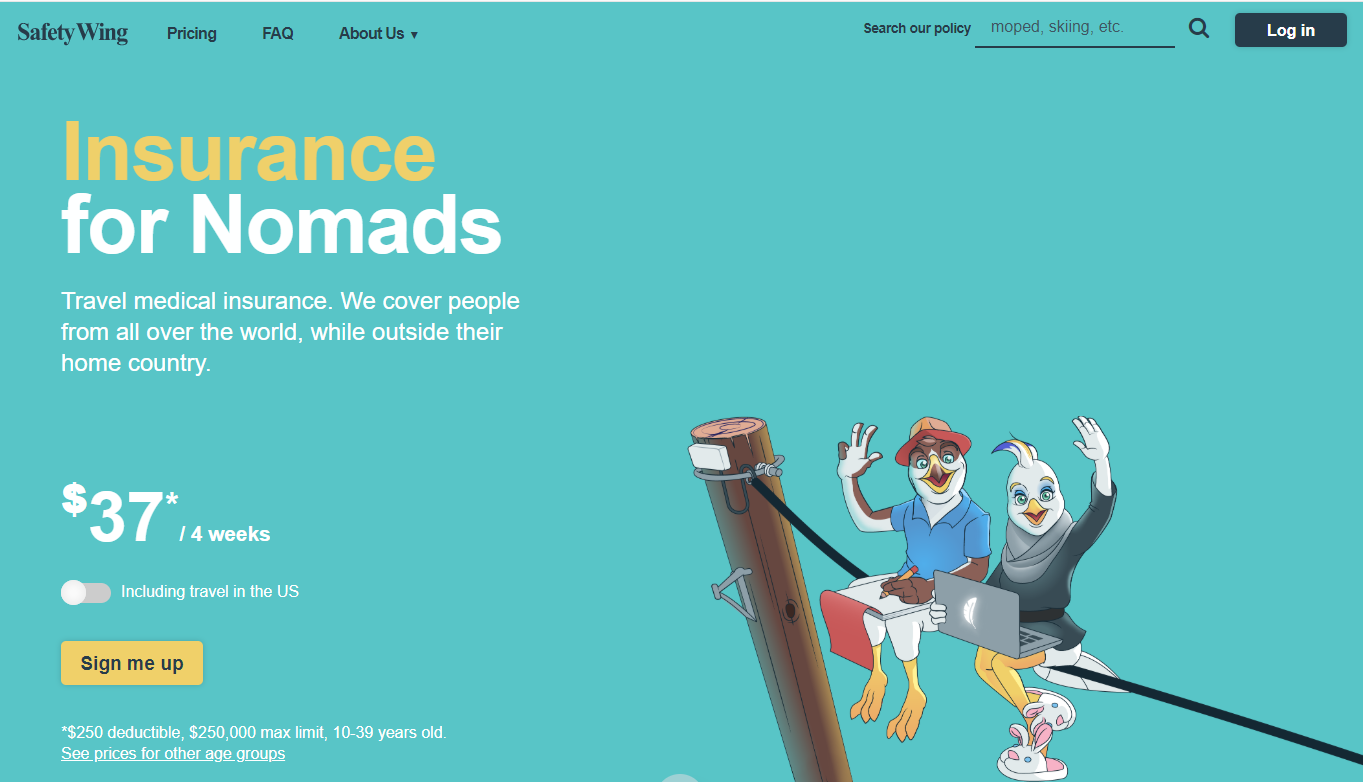

How Much Does SafetyWing Travel Insurance Cost?

Now for the ones and zeros. In fact, how did we make it this far into our review without mentioning the price? SafetyWing Travel Insurance is available for as little as $37 for 28 days. This is a terrific deal compared to other private medical insurance coverage, which can cost hundreds of dollars.

The monthly premium for SafetyWing varies depending on many factors, including the applicant’s age. If you want to go backpacking in the United States, you’ll have to pay a more excellent price (because of the expensive American healthcare system).

| Age | Price For 4 Weeks | Price For 4 Weeks (Inc USA) |

| 18 – 39 | $37 | $68 |

| 40 – 49 | $60 | $111 |

| 50 – 59 | $94 | $184 |

| 60 – 69 | $128 | $251 |

These rates are affordable and among the most competitive we’ve encountered – and we’ve looked at many travel insurance companies. Quotes are given on an individual basis. If interested, we recommend you go to the official SafetyWing website and create your own.

SafetyWing Remote Health Policy

SafetyWing just introduced a second policy, Remote Health, which is more expensive than the regular policy but may still be a reasonable investment for individuals seeking more comprehensive coverage. Remote Health was a pioneering form of occupational health insurance for the age of the Digi Nomad, developed initially to support remote working teams.

SafetyWing has refined the concept and made it available to individuals. Remote Health differs from traditional health insurance in several ways, providing more comprehensive coverage. Importantly, it may be able to cover pandemics such as the COVID-19 epidemic in 2020, which is attracting an increasing number of travelers.

How To Make A Claim?

You’ll unlikely ever need to make a claim on your travel insurance. If you do, you’ll be relieved to learn that if you’re working with a trustworthy company, the process is usually pretty simple and user-friendly. If you aren’t, may the gods assist you.

To start a claim, simply contact (phone) SafetyWing and speak with their multilingual team 24 hours a day, 7 days a week. You can also file a claim by logging into your account on their website.

You’ll need to write a formal sworn statement of events in the case of lost or stolen things, stating what transpired and what was lost. You will also require an official police record; you must obtain one, even if it involves paying a fee or bothering the police department.

You may be contacted by the insurer to discuss your claim further, and you may even be subjected to an interview. If your claim is valid, you have nothing to be concerned about.

It’s a good idea to gather your receipts and invoices first and submit all your expenses for your claim simultaneously. Keep copies of any fees, bills, invoices, and reports since you’ll need to send them to the claims team for them to evaluate your claim.

Answer all additional questions and list each expense for the amount stated on your receipt/invoice. You’ll receive an email with instructions on submitting the evidence you need to support your claim.

After completing that, you must upload your documents and information, evaluate the claim, and click submit. The SafetyWing team will get to work and keep you informed throughout the process. It’s worth noting that the time it takes to resolve a case differs from one to the next.

Who Is SafetyWing Travel Insurance Suitable For?

So what makes SafetyWing unique amongst other travel insurance providers, and who is their cover the perfect cover for? SafetyWing understands there is much more to travel than a 2-week vacation.

They appreciate that many of us set off with a one-way ticket, no itinerary, and no idea when we would be coming back. Therefore, SafetyWing may be suitable for;

- Long-Term Travellers: SafetyWing is unique in that it provides unlimited travel insurance. You can travel the world for years and still be insured if your premiums are paid.

- One-Way Travellers: As previously stated, your vacation does not need to end on a specific date for the insurance to be adequate!

- Digital Nomads: As a digital nomad, you travel from one location to another, working and hustling. With this policy, you can travel the world for years. If you’re a long-term digital nomad, there’s a good chance you’ll need to see a doctor about something.

- Travelers With Kids: This is yet another exciting feature. The coverage covers one small kid per adult, with a maximum of two children per family aged 14 days to 10 years old. So, if you and your partner buy the policy, you get two free children as long as they are under ten! You should inquire about separate or supplementary coverage if your child is older than ten.

What do you do with SafetyWing?

Thankfully, when this happened to SafetyWing team member Enelin Paas, she was insured.

While on her way home, she smashed her toe after falling through a rocky hole in the street. She thought little of it and decided to continue with life, expecting the pain and swelling to fade within a few days.

But the pain got worse, and the swelling got larger.

Five days after the incident, she decided it was time to go to the doctor due to an abnormal amount of pain and inflammation.

The doctor told her that the toe had become infected and immediately started her on antibiotics.

Enelin, being the intelligent digital nomad she is, was fully insured through SafetyWing’s digital nomad insurance plan.

After receiving the antibiotics from the pharmacy, she signed onto the online claim portal and downloaded a PDF of the medical claim form from the insurance provider. After filling it out, she sent it to the designated claim email address along with receipts from the hospital and pharmacy.

Within 24 hours, they sent her back an email saying that they received the claim,”

The email noted that they would evaluate the claim and send a letter detailing any potential next steps with the review results.

They also noted how Enelin could track each step of the claim process via their online portal, Client Zone.

Then, one month later, on June 19th, Enelin got a letter with the insurance review results.

They agreed with the claim and sent her a letter explaining her policy, benefits, and information on how to appeal the suit if she felt the decision was inappropriate.

Because her SafetyWing insurance plan had a $250 deductible, the money she paid to the doctor and pharmacy was subtracted from that deductible. If anything else happens in the next 11 months, her deductible drops to $141.20 (the medical bills cost $108.80).

That deductible resets to $250 after one year.

Overall, Enelin felt comfortable with the process and the coverage SafetyWing provides. She found that making a claim was super simple as she only had to send out one email and could continually check on the claim status as it was being processed.

So next time she trips and falls — anywhere in the world — she knows she’s covered.

Stories like Enelin’s are not uncommon.

Every day, digital nomads worldwide live and work abroad, and they must be protected from the potential hazards in each travel destination.

Whether relaxing on the beach in Bali, at home during the holidays or walking along a rocky road in Rio De Janeiro, you need insurance.

SafetyWing is currently the only insurance provider with insurance plans specifically designed to meet the growing needs of digital nomads.

Check out SafetyWing.com for a complete explanation of how each comprehensive insurance policy strives to fully cover the insurance demands of all the digital nomads in the world.

Why Do We Recommend SafetyWing Insurance?

There are some reasons why SafetyWing Insurance makes a compelling case as the best insurance for long-term travel and digital nomads around the world.

1. SafetyWing is very affordable

SafetyWing Insurance is unquestionably one of the most affordable alternatives on the market. It is an excellent choice for budget backpackers or digital nomads who are just starting and don’t want to spend much on insurance.

Their costs start at $40.04 for four weeks, which covers persons under 39 who are not traveling in the United States. If you fly to the United States, the price rises to $73.08 for four weeks (this option is only available to non-US citizens). With their cheapest plan costing only roughly $1.43 per day, you can practically get protected for the price of your daily coffee in many cities worldwide!

Prices for 40 to 49-year-olds climb to $64.68 for four weeks, $101.64 for four weeks for 50 to 59-year-olds, and $137.76 for 60 to 69-year-olds. All these costs are for insurance that does not cover travel to the United States. Click here for a Safetywing estimate, or fill out your information below to get an estimate tailored to your unique circumstances and travel dates.

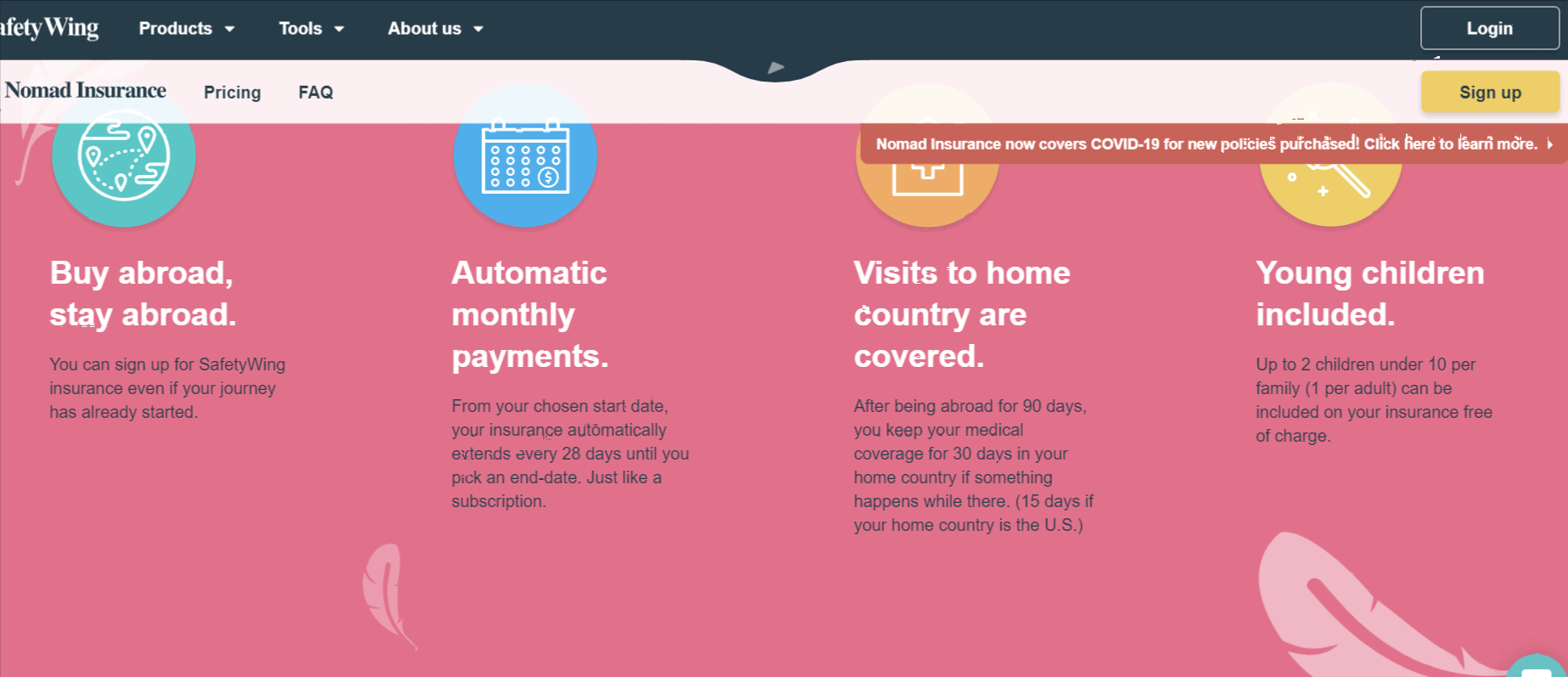

2. Flexible Policies

One of the best things about SafetyWing is its flexibility when acquiring a policy. Many long-term travelers and digital nomads don’t know how long they’ll be on the road. Thus, SafetyWing ensures you don’t overpay for coverage you don’t require.

You’ll be charged every four weeks for their standard policy, and you can cancel at any moment if you don’t need coverage for the next four weeks. You will be requested to renew when a 364-day term has passed.

SafetyWing also allows you to purchase a fixed-length policy, similar to a regular travel insurance policy, and unlike many other firms, you can purchase coverage while on the road. The former is extremely useful if you need health insurance proof for visa applications.

3. Worldwide Coverage

Your SafetyWing Insurance policy covers you if you do not travel to North Korea, Cuba, or Iran. Benefits like kidnapping in high-risk nations are also subject to some restrictions. However, for the most part, you can travel anywhere and be confident that you are protected.

4. Lots of Activities Covered

SafetyWing’s rules cover a wide range of sporting activities, allowing you to enjoy the places you visit! SafetyWing covers you for activities such as scuba diving, joining a local gym, taking yoga courses, and climbing popular hiking paths. When purchasing insurance, read the complete list of activities covered in the Terms and conditions to avoid any unpleasant surprises if you need to file a claim.

5. Some Home Coverage Included

One of the drawbacks of traditional travel insurance policies is that they frequently exclude coverage for trips to your country. By giving some coverage in the policyholder’s home country, SafetyWing once again establishes itself as one of the top insurance solutions for long-term travel.

If your home nation is the United States, you are protected for up to 15 days every 90 days or up to 30 days if your home nation is anywhere else. Remember that you are only insured for occurrences that occur while you are in your home country, so you can’t go back home for treatment and expect to be covered under their coverage. Nonetheless, this function is a significant advance above what other insurance companies provide.

6. 24/7 Support Provided

If something goes wrong while you’re on the road, you can be assured that SafetyWing provides 24/7 help to its policyholders. They feature an online directory of hospitals and medical providers and a hotline you may contact 24 hours a day, 7 days a week, to speak with a staff member.

7. It Covers COVID-19 & Quarantine

COVID-19 is now covered by SafetyWing’s nomad insurance as of August 2020. This means that if you get the virus while traveling overseas after the start of your coverage, you will be covered! Because the scope functions similarly to that for other conditions, it will be subject to the same policy limitations and exclusions. This covers the scope for testing if a medical professional orders it but not for antibody testing. More information on this can be found here.

Safetywing also enhanced its coverage to include COVID-19 quarantine fees in May 2021. They will pay up to $50 per day for up to ten days if you are required to quarantine by the government or a doctor because of testing positive or if you are experiencing symptoms while waiting for your test results.

This policy only covers quarantine outside your country and excludes any scheduled quarantine in a hotel.

8. Family Friendly

If you’re traveling with your family, SafetyWing allows you to include up to two children under ten in your policy for free. There is a restriction of one child per adult, but if you’re traveling with your partner, you can cover two children for free!

Why Don’t I Choose SafetyWing Insurance?

A Quick Overview of SafetyWing

- Amounts up to $250,000 may be covered in a medical emergency. This also includes $1,000 in emergency dental care, which is ideal if you want to go gutterboxing at 2 a.m.

- Up to $100,000 in medical evacuation coverage may be available. It’s important to note that medical evacuation refers to being taken to a hospital in your country, not being rescued from a mountain after breaking your leg while hiking.\

- Up to $10,000.00 in emergency evacuation coverage in the event of civil disturbance or something similar. So, if London devolves into riotous, deadly chaos due to Brexit, you may book a journey home or simply to safety in Paris!

- In a natural disaster, hotel costs could be covered by up to $100 a day for up to five days.

- While cancellation is not covered, trip interruption costs up to $5,000.00. This means that if you have to cut your trip short, you could be eligible for up to $5,000 in reimbursement to assist you in getting home.

- Luggage can be replaced for up to $3,000 if it is lost. However, remember that each item’s maximum value is $500. As a result, if you intend to check that diamond necklace, you might want to get a different cover.

FAQs On SafetyWing Review:

💥Do SafetyWing Insure Electronic Devices?

Electronic devices are not covered by SafetyWing. This is because most Digital Nomads have specialist gadget insurance. I recommend acquiring adequate protection for your expensive electrical items.

👍What Countries Are Covered by SafetyWing?

Over 100 nations are covered by SafetyWing. They cannot provide coverage for visits to North Korea, Iran, or Cuba. Kidnap and crisis coverage is not available in Iraq, Afghanistan, Somalia, Nigeria, Pakistan, or Venezuela, or in any other country where U.S. financial sanctions prevent them from doing so.

✔ Is SafetyWing the Best Travel Insurance for Digital Nomads?

It's impossible to declare which provider or insurance plan is the finest. SafetyWing's mission is to offer cover for nomads by nomads. At a great price, they provide specialized, powerful coverage for Digital Nomads.

✔ Is SafetyWing the Cheapest Travel Insurance on the Market?

SafetyWing is without a doubt one of the most affordable dedicated travel insurance providers we've come across.

✔Does SafetyWing have fixed terms & conditions?

Please keep in mind that insurance terms and conditions vary and might change at any time. The material presented here is solely for educational purposes. Before embarking on your vacation, we recommend checking with your insurance provider to confirm your protection. Please read the terms and conditions of your policy very carefully.

Quick Links:

- Best Travelinsurance.com Review

- best travel Insurance for Digital Nomads

- Honest Lambda Test Review

- Best World Nomads Review

Conclusion: SafetyWing Review 2024

If you want a simple, straightforward policy designed for digital nomads, SafetyWing was made with you in mind. One of the most incredible things about it is you don’t have to know where you’re heading in advance or how long you will be gone. This pay-as-you-go policy is simple and straightforward.

This policy is also unique because it offers some coverage when you return home for incidental reasons. For those digital nomads who travel endlessly and aren’t home enough to carry an insurance policy in their native country, an approach from SafetyWing provides the right amount of coverage.

SafetyWing was designed for digital nomads by digital nomads, which is why it offers things that no other travel insurance company does. Unlike other policies designed to protect a single trip or a few vacations a year, this policy is meant to cover you as you travel the world.

I can’t tell you how many times I was stuck in some tiny African hospital with no resources because my health insurance didn’t cover this new country. Thanks to SafetyWing, I know that if something happens, I am covered and will be able to get the help I need without worrying about what it might cost me.

“I cannot recommend this product enough. I used to think my medical insurance was fine but this has given me peace of mind.”

I HAVE FILED A CLAIM with SAFETY WING/ WORLD TRIPS/TOKIO MARINE (all the same company) and what they did – they only found unreasonable excuses not to pay me! I got hospitalised in Thailand with Spontaneous Pneumothorax, the doctors told me its regular INSURED EMERGENCY CASE! MAP from Safety Wings tried to BARGAIN the hospital for too long NOT TO PAY THE FULL PRICE OF MY TREATMENT, so I had to pay all bills beforehand by myself because all their bargaining postponed my urgent treatment while I WAS IN A SEVERE PAIN!! The Pakistani guy is their so-called Medical Audit Professional, after my doctor talked to him he said “He is not a doctor, he has no medical knowledge!”

By now I still didn’t get payed! They offer money to my hospital directly (half price) and now rejecting to pay me anything??? Easy target! Just find a stupid excuses, no need to pay!

PLEASE NEVER TRYST THIS COMPANY! THET ARE FRAUDS NOT THE INSURANCE COMPANY!

SafetyWing is one of those “Why didn’t I think of that?” products. Started by a dude who took time off from being a lawyer to backpack around the world, now he offers his insurance policy exclusively to people like you and me: the nomadic human beings. Once we complete our big plans and purchase this plan, we no longer have to worry about travelling with inadequate coverage; we can explore life without boundaries!

I’ve used SafetyWing now on about a dozen trips since I first learned about it and I continue to be impressed. (This) product is well-designed, easy to use, and affordable — not to mention insanely comprehensive — all of which make me feel confident when I’m exploring the world with my nomadic lifestyle

Seriously guys, it’s like every traveler’s dream. I hate surprises while abroad and this plan eliminates that worry because if something happens to me while travelling, SafetyWing will take care of the expenses until my medical evacuation is complete. The one time they haven’t saved my life yet but they’re still cool as hell.”

I have been traveling the world for more than two years and I’ve seen firsthand how scary, expensive and uncertain it can be to be an expat. As one of the first nomads to develop a travel medical insurance plan specifically for nomads like me, SafetyWing is built with many insights and considerations taken from my own journey as well as the feedback we’ve received from thousands of people who already use our product. The entire team at SafetyWing believes that health care should not depend on retirement plans or employment status; everyone deserves international coverage regardless of their location – whether they’re born abroad or born in U.S., Europe, Asia, Africa, South America etc.

I was skeptical at first, but the $75 per year is well worth peace of mind. My friends with house insurance agree that it’s not just for nomads! I’m never coming back to an old-fashioned home insurer again.

“I just got back from 18 months traveling around the world, and SafetyWing was great! It gave me peace of mind that I would be taken care of if there was ever an emergency. The cost is low considering what it covers you for – your health expenses outside your home country will be covered no matter where or why. I’d recommend it to any traveler, whether they are staying abroad for 1 month or 5 years.”

I’ve been wearing my SafetyWing for three months now and I feel better about it every day. It’s like wearing a suit of armor around your face. You still get to be as adventurous as you want to, but any disaster will only shatter the coating instead of ripping little pieces off to injure you inside. I haven’t traveled without it since!

A must-have travel accessory for those who enjoy getting lost in foreign cities just a little too much. Trust me, I know what you’re going through – last year during Lost & Found Fest NYC, I almost made an attempt on the catwalk! Doesn’t everyone have that one friend that likes take risks? Well don’t let them go backpacking alone.

I always buy travel insurance, but I never used it until now. Just as soon as I’d started my home-free journey across the US, disaster struck. Not only did my car break down and strand me in a small town for days with no job prospects, but then just before getting on my way again, I fell and broke my ankle. With SafetyWing insurance protecting me from unforeseen circumstances like these – can you imagine what adventure would have been stopping me if not for $200 worth of this?

Traveling abroad is a relaxing yet frightening time for many people. Health insurance safety nets are not only expensive, but put an unnecessary burden on the traveler while they’re trying to have a good time exploring their new world. SafetyWing was devised by travelers for travelers, so you can take a trip without having to worry about your health and safety while away from home.

I’ve never met anyone who enjoys the process of trying to understand travel insurance. It’s not that it is hard; it just makes no sense at all. Why should I pay for something if I’m unlikely to be using it? And if I am using it, then what happens when one of my friends (who didn’t purchase the same expensive nonsense) needs help with coverage while somewhere else in the world?

Sounds like something only an inept bureaucrat could love, so this mattered once or twice until my cousin got waylaid by bad luck on his side-jaunt through Zambia. Safewing had him covered so well he might as well have been sitting next to me at home drinking beer and taking care of business.

The best product I’ve found for safety on the road. Bravo! Can’t recommend this enough, especially for anyone freelancing or unable to get work sponsored health care while they’re abroad. SafetyWing has made it so that no matter how long you are traveling or where your next destination you can feel safe. Do yourself a favour and make sure you have peace of mind when away from home with this one.

I was looking into getting travel insurance for a year or so before going abroad. I found SafetyWing and researched it a bit. It seemed fine to me, but I wanted other people’s opinions too, so I did a google search for reviews on the topic of “long-term travel medical insurance.” The overwhelming amount of good reviews from nomads made the choice clear, and there were enough comments about their policies being super helpful if they needed visits home while traveling to seal the deal. So far everything has been great – I don’t think there’s any way anyone can not recommend SafetyWing!

“I can never tell how long I’ll be traveling for, and any extended time out of my home country really makes me nervous. SafetyWing provides coverage no matter where you are in the world–even if you’re just visiting a second-hand car!–and it’s affordable too. It only costs about $12 USD per day to purchase. I think they’ve thought of everything: emergency medical care abroad, evacuation, repatriation*, lost luggage*, travel delays* – all included! Check them out.”

I’m a nomad and joined SafetyWing two days after I arrived! My travel medical insurance is now my favorite item in my bag.

SafetyWing was the big game changer. Basically, you pay a small monthly fee for this travel insurance and it takes care of everything so you don’t have to worry about having coverage in another country or anything because they have doctors everywhere. It’s really worth it if you’re only traveling around one city for a couple months, but if you’re not sure how long your six-month Eurotrip is gonna be, then I would recommend getting an annual policy with them too!”

I was looking for international health insurance and Safety Wing Insurance caught my eye. It provides coverage globally at a very reasonable price! Bonus: they can be tailored to suit your needs and lifestyle – boating enthusiasts, bikers, trekkers, beach lovers! Keep reading for more reasons why you should choose SafetyWing Insurance.

International travel is an exciting adventure that everyone deserves to experience in their life time. However like any extraordinary travel plan, there will likely come times when you’ll need some help from professionals not affiliated with your usual doctors or hospitals; this is where SafetyWing has got you covered. They offer affordable worldwide medical insurance helps people to prepare ASAP if the unexpected occurs anywhere outside of home country

What if I’m visiting a country and need emergency medical help, and they don’t take my insurance? This the question that SafetyWing fiercely aimed to answer. Co-founders Chris Baldwin and Zee Vardas met while traveling in India and became friends while sharing life stories on their backpacking trips together. They both ran into problems with using their North American health coverage when they RETURNED to India, but it didn’t cover them for issues that arose outside of India; basically, every good thing about world travel is cut short by the fact there’s “no such thing as international healthcare.”

This company makes sure people like me (the notoriously independent traveler) can get emergency medical treatment anywhere in the world.

When I first moved to Paris for a few months, SafetyWing was such a relief. The plan was easy and affordable (less than $10/mo). Never again will I find myself in that situation where you search for hours trying to find the right medical provider and the best deal, because it’s all taken care of with this app-to-app service. It’s so wallet friendly too: your deductible is only 10% of your total bill but always less than €400 or its equivalent in USD, which is easily covered by most travel insurance plans. If you’re looking for reliable safety features for any length of stay abroad, SafetyWing Insurance could be just what you need!

We all know that traveling can be one of the best adventures in life, but it also comes with a lot of risk exposure. Even if you’re always careful to plan ahead for your time abroad, sometimes accidents happen. Fortunately, there are ways to protect yourself when they do – like SafetyWing Insurance!

It provides worldwide coverage against major medical expenses – it is designed specifically for nomadic lifestyles and is perfect for anyone who doesn’t know how long they’ll be exploring the world yet. With this insurance coverage in place, anytime an accident happens abroad (and remember accidents can happen anywhere!) you won’t have to worry about paying high prices at hospitals everywhere you go because your money will be covered by SafetyWing

I would like to give SafetyWing a 5 star review because they’re an all-inclusive and trustworthy company. As a nomad with no fixed address, it’s impossible for me to get traditional travel insurance – until I found SafetyWing. The best part about this company is that your coverage starts as soon as you pay for it without any exclusions! They make everything simple by taking care of the documentation and application process on your behalf, so if anything happens before or during your trip, you can rest assured knowing that SafetyWing has got it covered!

When you’re travelling abroad without coverage, you never know if an accident or injury will happen- so why take the chance? That’s where SafetyWing comes in! Must try

A few months ago, I spent a month in Angola with some friends. We all had different travel insurance policies and the more we talked about it on our trip, the more we realized how different they were for each of us personally. After coming back from Africa and getting way more questions than usual around what kind of travel medical insurance we had while there (what did you do!), we realized that SafetyWing is something that would be great for anyone looking to self-insure and not worry about their health when traveling outside their home country.

I got my SafetyWing insurance at the beginning of my 5-month trip, and it made me feel much more confident. The thing about traveling abroad for extended periods is that you never really know when your adventure will end – I found myself finishing up my last country but feeling like there was still so much to explore just around the corner.

An important part of the experience is trying different foods, exploring new cultures and seeing different landscapes…unfortunately injuries can also come with these adventures! As a student saving every penny to save money on flights, I couldn’t afford travel medical insurance beforehand. So if anything happened while I was away, all my savings would be gone instantly (and let’s not forget expensive hospital bills).

“We had a long layover in Thailand and realized we might need some travel insurance, but not just any old policy. We discovered SafetyWing which covers our whole entire trip no matter where we are! No more stress about getting sick while you’re gone.”

Picking an insurance plan all the way out here in the third world proved difficult, so Happiness Abounds came through with a perfect solution. You can also get help from one of their experts if you are unsure about what needs coverage or not, which is always better than assuming too much.”

“They offer friendly customer service and customs on top of all that great stuff! Definitely go with SafetyWing Insurance

-I was immediately attracted to SafetyWing. In many places around the world, you never know when a natural disaster or injury will strike, but as an expat living in Bali I also felt worried being far from home for so long – not to mention those who have been injured. Security is important now more than ever and safety is even more so! I was impressed that they expanded their coverage outside of North America into Asia and parts of Europe because there are a lot people traveling internationally this year. I’m going to feel better knowing that should anything happen while abroad, my loved one would automatically be taken care of without having to worry about what insurance company they have at home.”

SafetyWing is perfect for people who love to travel and explore new places. This insurance gives me peace of mind knowing that if something happens while I’m abroad, I’ll always have my health covered! You can pick up SafetyWing anywhere in the world so no matter where you are or how long you’ve been gone, your coverage is waiting. So spread your wings and fly because now you can wander with confidence knowing SafetyWing will be there when things go wrong.”

SafetyWing is genius. I felt so much safer when travelling abroad with my family knowing that they would be covered if anything happened to us while out in the world. Everyone should have this! It’s not too expensive but it’s worth every penny.

No matter where you go, SafetyWing has got your back…literally! With safety in mind, theirs an app for receiving medical attention anonymously and making sure wherever you are-you’re always protected by their 24/7 emergency response services from dispatching a helicopter or private medical team anywhere on the globe within three hours of request.

I’ve never felt more covered before.

Whenever I travel, I use SafetyWing Insurance to make sure my family can always help me out if something happens. It costs a small fee each year but the peace of mind is worth it! You can also tailor what types of coverage you want, which is amazing because not everyone needs every plan. They have good review rates which means that people are happy with their service and it’s easy to get in touch with someone who will actually answer your questions—I know this for myself because I had some pretty complicated issues! Plus, they have competitive pricing so you won’t break the bank.

Nice review on Safetywing, good stuff. I have researched them too and consider them a great insurer overall, though far from perfect still. We’re collecting and have collected a ton of user reviews for them and most are positive.