TransferWiseLearn More |

PayoneerLearn More |

|---|---|

| $ Pricing | 0.6 to 1% Transfer Fees | Upto 2.5% Transfer Fees |

| Best for |

WIth TransferWise, you can send money anywhere in the world and with minimum transfer fees. |

Payoneer was founded in 2005 and is based in New York. The company strives to facilitate international transfers and cross-border payments to business |

| Features |

|

|

| Pros | |

|

|

| Cons | |

|

|

| Ease of Use | |

|

The user interface is simple and easy to navigate. You can sign up on TransferWise with a Facebook account or Google account which saves a lot of time. |

Payoneer has been in this business longer than TransferWise and it has a very intuiting user interface and with Payoneer, sending money is reallly easy. |

| Value For Money | |

|

TransferWise takes very nominal transfer charges which is 0.6 to 1% and that is really low in comparison to other platforms. |

Payoneer charges a little more than TransferWise but you can do transactions between Payoneer accounts for free. |

| Customer Support | |

|

The support you receive from TransferWise is very reliable. They provide a Frequently Asked Questions section, optimized with many sections for each type of transmission and TransferWise features. |

24*7 Customer Support |

In this article, we will discuss Transferwise Vs Payoneer 2024

With the announcement by WorldFirst in January 2019, to phase out US support. In the US, most FBA providers have Transferwise and Payoneer.

Let’s compare them more closely.

Truth: It’s very painful to send money across borders with a variety of currencies, exchange, and management fees.

You do not want to use your local banks too much as they charge exorbitant mid-market fees with a high minimum amount.

Do not get me in trouble and paperwork. So, the local bank is out, what’s left?

Although there are other payment options (Ahem, PayPal / Western Union) that I use every day, my stomach turns every time I see the fees charged to me.

Let’s try two very popular international money transfer giants.

TransferWise Vs Payoneer: The Ultimate Comparison

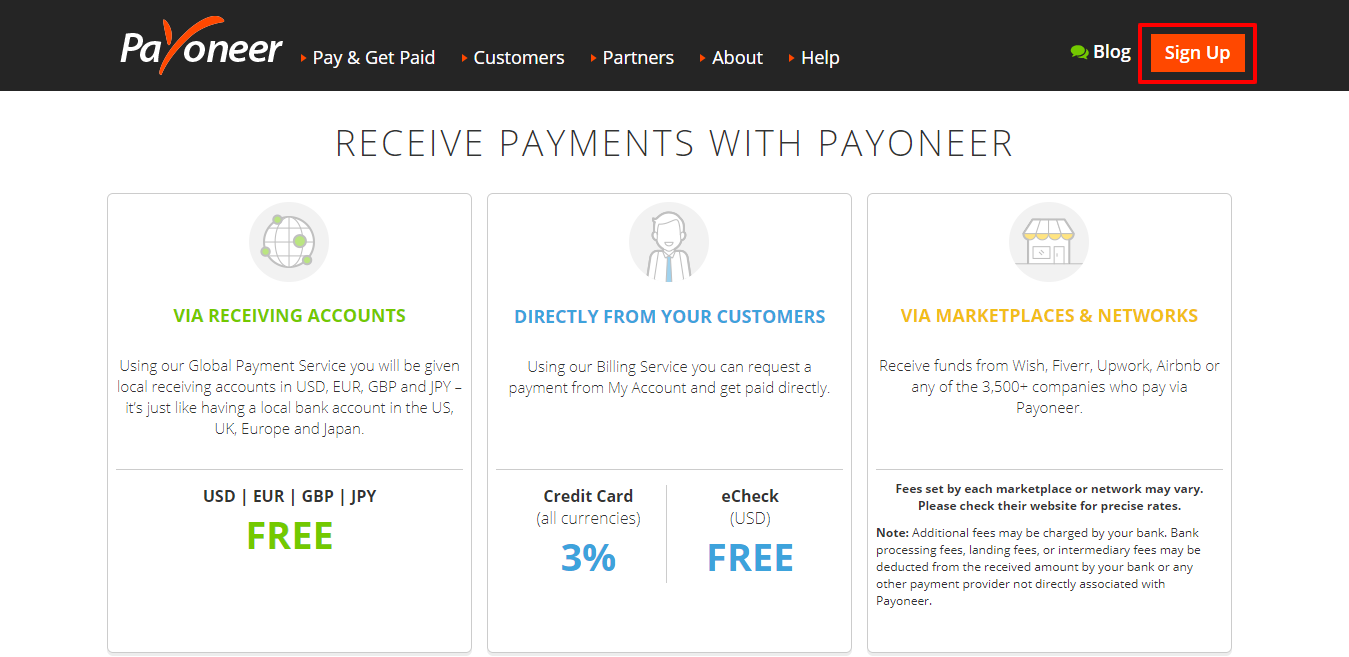

About Payoneer

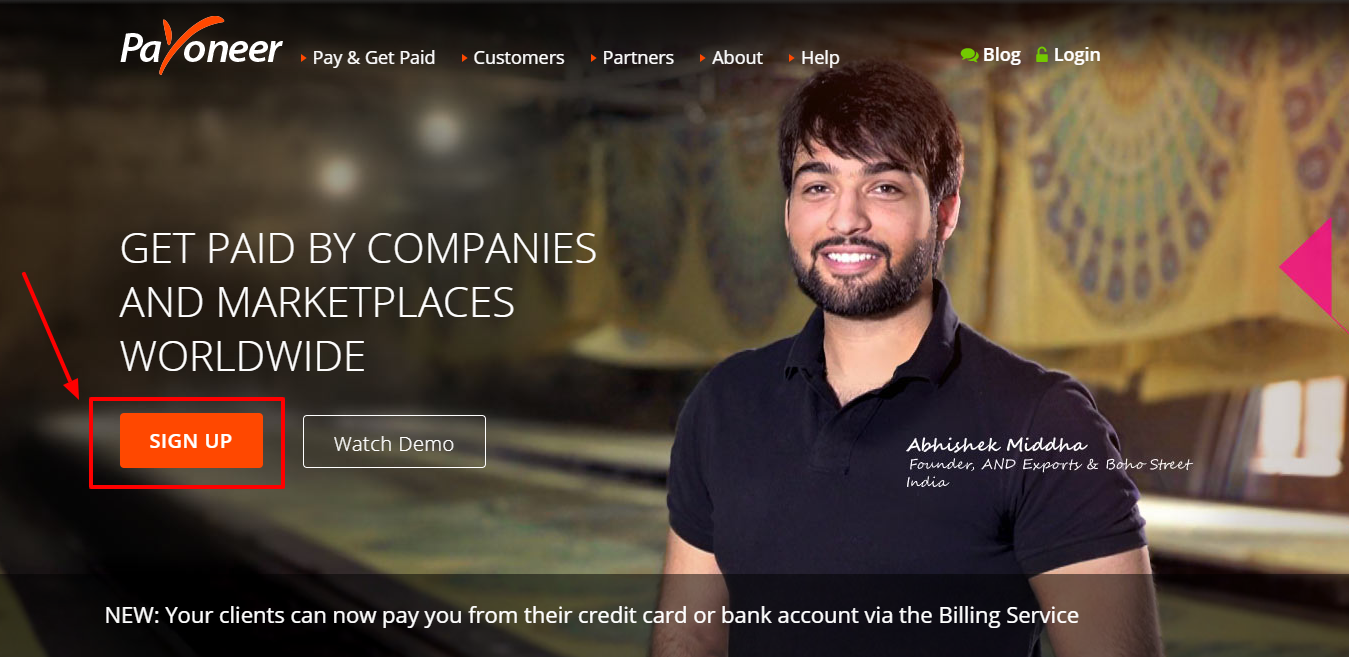

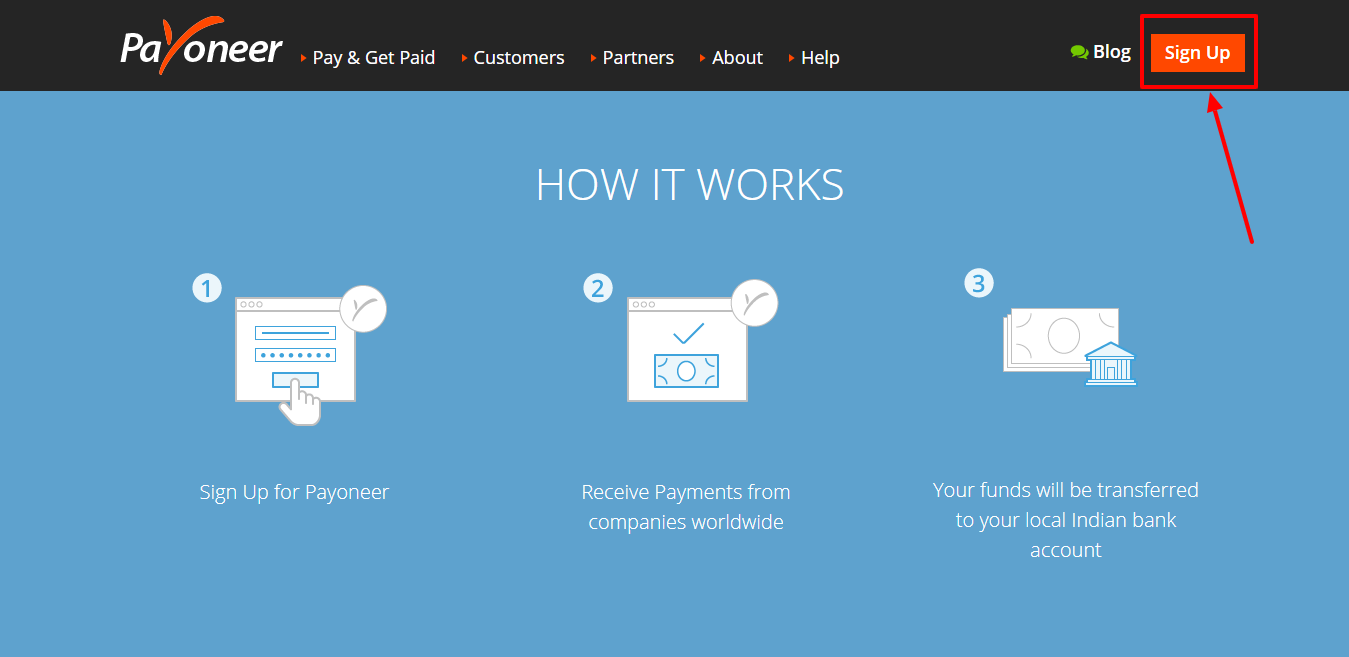

Payoneer was founded in 2005 and is based in New York. The company strives to facilitate international transfers and cross-border payments to businesses and to provide reliable service to people around the world. I have been using Payoneer for a long time now.

An enviable collection of premium and multinational companies uses Payoneer as their standard payment options service, including Amazon, Google, and Airbnb.

A company can deposit into a Payoneer account in their own country and the recipient can receive payments locally with a Payoneer MasterCard or have it transferred directly to their bank account. There will be no charges for receiving money into a Payoneer account.

How It Works:

If you already have a Payoneer account with credit:

- The beneficiary must open a Payoneer account

- You or the beneficiary may convert the currency at the standard rate plus the Payoneer charges exchange rates into a Payoneer account.

- Money can be transferred to the recipient’s account if you wish to transfer money between Payoneer accounts with awesome transfer speed.

- Once the money has entered the recipient’s account, you can withdraw it from your local bank account in local currency.

- Mid-market fees may be charged for withdrawing money

If the recipient has a Payoneer account, but you do not:

- The recipient may use the Payoneer billing service to request funds from you

- You can pay the bill by credit card, debit card or bank account

- Payoneer charges a fee that depends on the type of payment you make

- The beneficiary may convert the currency at the standard rate plus the Payoneer rates into a Payoneer account.

- Once the money has entered the recipient’s account, you can withdraw it from your local bank account in local currency.

- Mid-market fees may be charged for withdrawing money

Customer Service and Technical Support:

Payoneer provides a very useful help desk on its website with a complete knowledge base and frequently asked questions to answer questions and solve problems. If you can not find an answer to your question here, you’ll need to sign in to your Payoneer account to access the live chat feature.

You can also contact Payoneer via email. Telephone support, however, seems limited to reporting a lost or stolen debit card. Live chat support is only available in English, Spanish or Russian.

If you do not speak any of these languages, the email option supports dozens of other languages. Unfortunately, we found many complaints that customer service is inadequate. We recommend that you test the knowledge base before using other support.

Also Read:

- Intuit QuickBooks Special Discount Coupon Save 50% (Upto 149$)

- Arcadier Review: Create Your Marketplace For Products and Services for Free

About TransferWise:

Transferwise, a peer money transfer service founded in 2011, was one of the most exciting new technology companies at the time of its launch.

The Estonian Transferwise founders were frustrated at losing so much money when sending money abroad and decided to take the matter into their own hands.

The idea of eliminating international bank charges in the world has allowed them to transfer more than £ 3 billion of their clients’ money since their inception and congratulate them on the simplicity of their business model and it has a better transfer speed than other platforms.

Related Read: Western Union Vs Transferwise

How Does TransferWise Work?

The currency exchange process Transferwise completely eliminated the intermediary. Best of all, they could charge according to their fee structure which is much less than other transfer service providers in the market.

Basically, TransferWise offers a peer-to-peer (P2P) service that really indicates that it generally corresponds to people who really want to transfer one currency to another. Sending money and receiving money abroad has never been easy till now.

As if we were setting an example here if we want to make transfers of up to £ 1000, you only need to add your £ 1000 to a GBP boat and it will automatically send the equivalent amount (£ 994.53) on the right of the receipt you have selected. This shows that you will not lose your money on a referral and their fee structure is also good.

TransferWise Security:

You should know that TransferWise offers like all other banks in the country, is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

Transferwise is an authorized, secure, and regulated law governed by the FCA. He will keep all his clients’ money separate from the money they use to manage their business.

The best thing about TransferWise is that you always know where your money is. Here you will be informed by e-mail every step of the transmission In addition, TransferWise offers you the opportunity to track your transmission with its amazing mobile application and website whenever it is convenient for you.

TransferWise Customer Support Service:

The support you receive from TransferWise is very reliable. They provide a Frequently Asked Questions section, optimized with many sections for each type of transmission and TransferWise features.

Here you can also get the average mid-market rate that not all providers offer. And here, if you need to ask a question, you can easily chat live with the customer service representative and get the fee structure too.

If you have any problems, you can also call Customer Support Service at 8am. at 20 o’clock ET on weekdays. In general, it provides excellent customer service that can help you in every possible way.

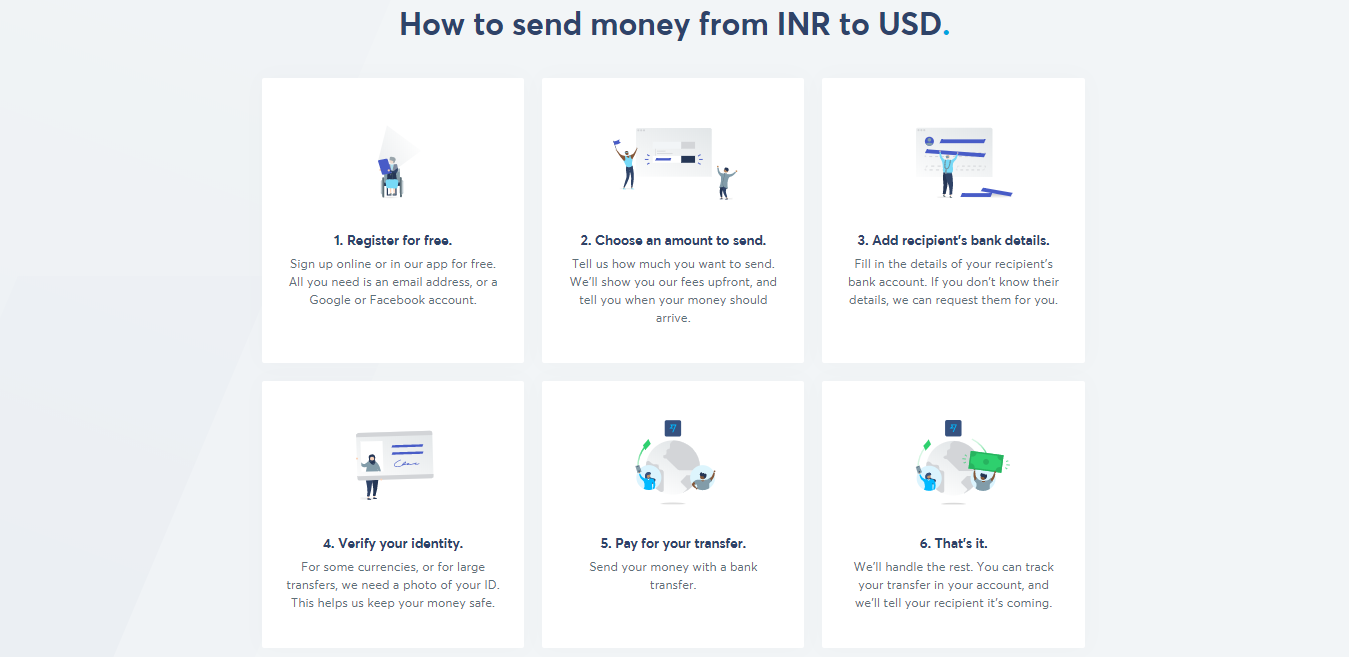

How do I register with TransferWise to make and receive payments?

The registration process is very simple and fast. To simplify the initial registration process, you can register with a Google or Facebook account.

Just before the launch, you must carry out a very rigorous process of verifying your identity and compliance with money laundering regulations. To get started, you need to provide the following documents.

Proof of address: You must present a power bill (telephone, electricity, gas), a credit card bill, tax statements, and much more.

Identity papers: National ID, driver’s license, passport.

In addition to these authentication procedures, TransferWise also sends you text messages with a security code and an e-mail. Once you have completed this process, you can make your first transfer and the money will be transferred with a transfer speed of 1-4 business days.

Quick Links:

How long does a transfer take? (Check Comparison Transferwise Vs Payoneer Here)

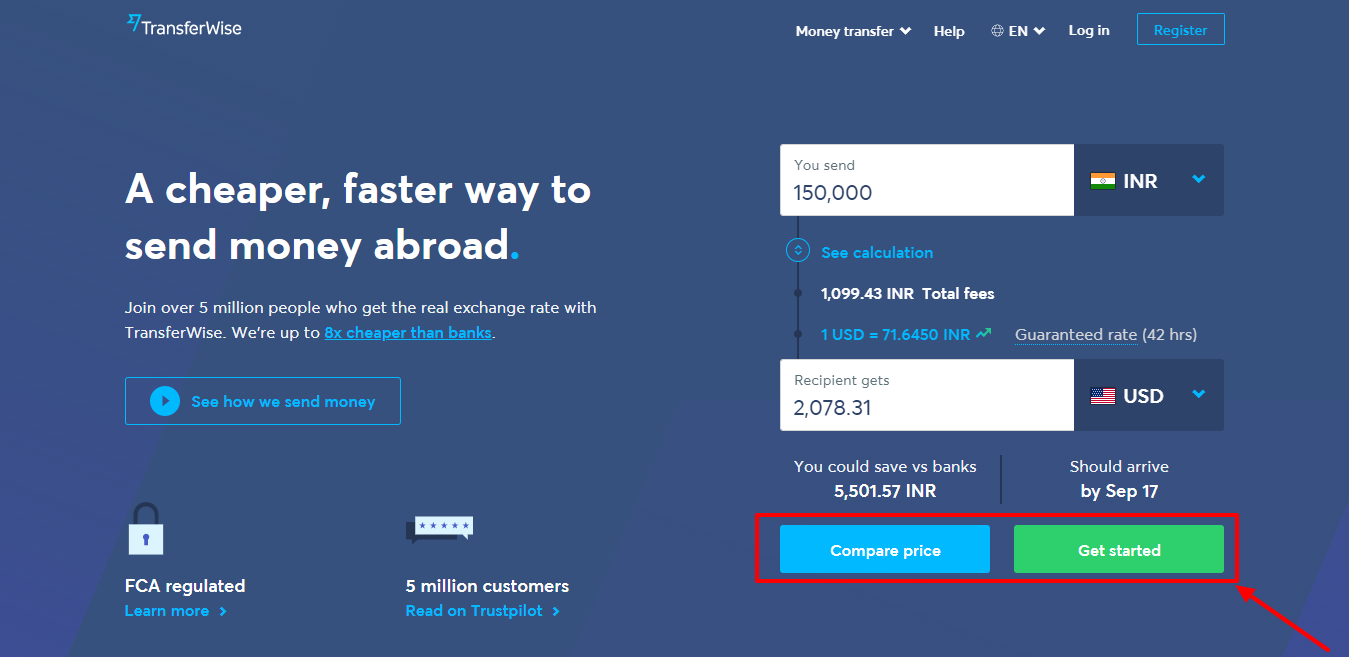

First, you must complete the amount to be transferred. As a bonus, you will then see the expected time of arrival of the amount and a few more details.

If you select the money you wish to transfer, Transferwise will display the rates from the beginning and subtract them immediately before conversion. Afterward mainly the middle market margin without profit margin is used. And the best part is that the exchange is guaranteed as long as TransferWise receives your money within 24 hours.

Both services are good at what they do.

Everyone is destined for different things.

With TransferWise:

- You can sign up in North America, the United Kingdom, Australia, Europe, and some places in Asia.

- You have access to an online money transfer platform to transfer money to a bank account abroad.

- You will enjoy excellent prices and the interbank exchange rates. This costs you on average 0.5% of each transaction, compared to 3% for a bank.

- There is no minimum or maximum transfer amount and send multi-currency.

- Registration is quick and easy (there are still many downloadable documents).

With Payoneer:

- You can register as an independent or small business from anywhere in the world.

- As a freelancer: You can collect payments from foreign employers in your own bank account in local currency. You can transfer the money to your national bank account or withdraw it in cash using a MasterCard provided by Payoneer. You pay about 1% of the transaction as a conversion fee.

- As a company: You can pay employees and freelancers worldwide, you can also pay to other companies or receive money on your sub-bank accounts abroad.

- The registration process can take days. The delivery of your MasterCard may take more than a month depending on where you live.

- As an individual, unlike TransferWise, you can not pay anyone.

- Therefore it is a completely different service. Very good on the way.

Transferwise Vs Payoneer: Two Different Services

Unlike other international payment comparisons, the Cash Transfer Settlement and Settlement page, which Payoneer compares to Transferwise, explains how these two services differ in their approach, audience, and functions.

If we are in WorldFirst Vs. HiFX, we try to give two very similar services with specific advantages and disadvantages. This is not the case.

Let’s first explain who can use Payoneer or Transferwise for what purpose. Subsequently, we carefully describe the comparison of the exchange rate structures and integration processes proposed by these two online money transfer providers.

Transferwise is

- Designed for private individuals and individuals.

- For customers with bank accounts in the UK, Europe, the USA, or Australia in multi-currency.

- A simple solution that allows you to send money in multi-currency abroad for any purpose.

- Learn more about our Transferwise Review.

Payoneer is

- Only for small businesses and individuals receiving payments from foreign companies in multi-currency. Private customers can not transfer money to the Payoneer platform but only withdraw.

- For customers around the world, regardless of whether they have a bank account or not. You can order your own Payoneer Mastercard.

- A simple solution for freelancers and small businesses hiring freelancers. Nothing outside this range.

- Read more about our Payoneer Test.

Transferwise Vs Payoneer | Transfer Fee, and Reception Fee.

Transferwise exchange rates are much better in terms of rates, but structures are very different.

TransferWise

- Pay a percentage (usually between 0.5% and 1%) of the amount you transfer as a fee

- Where is it transferred and how much are the costs?

- The TrasnferWise Borderless account does not incur any fees for adding and receiving credit. However, the exchange rates and withdrawal of funds entail costs

Payoneer

- Pay a percentage (usually 0.5%) if you withdraw Payoneer funds from your local bank account

- Payoneer to Payoneer account transfer for free

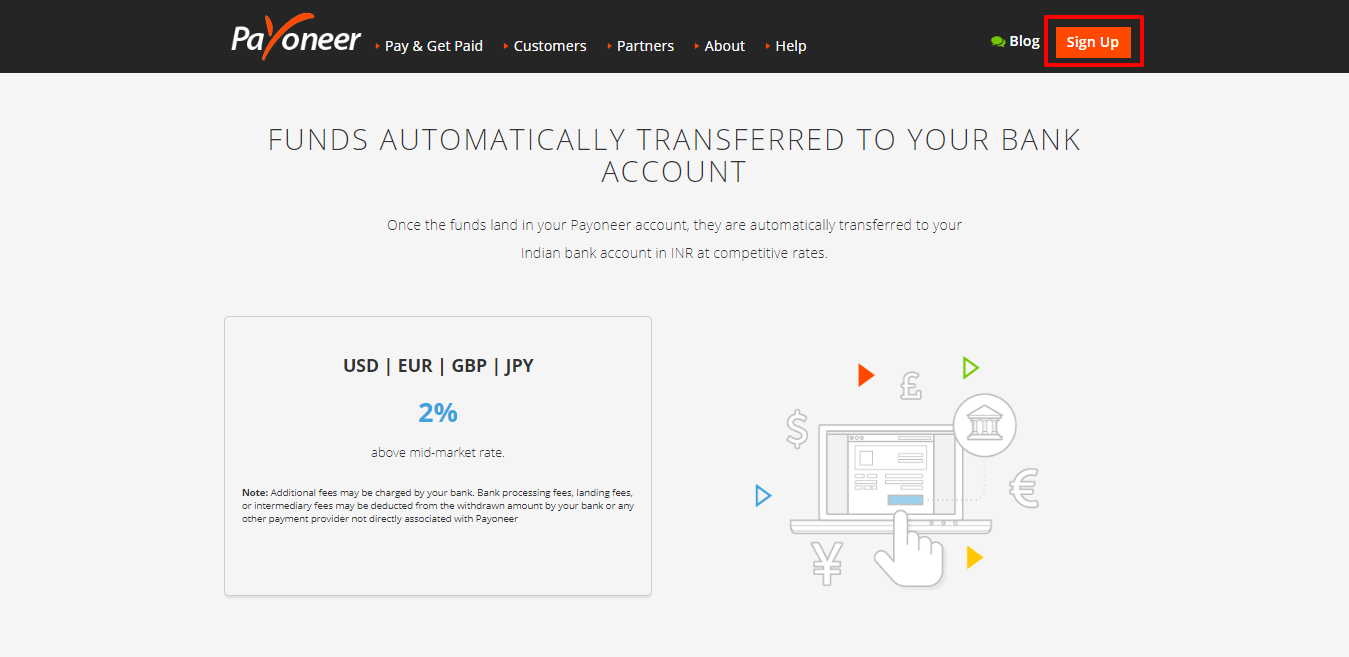

- Payoneer charges for currency conversion rates can be up to 2.5%

- If you receive money through the Global Payment Service (for example, paid by Amazon), you will receive a rate of 1%.

- The remuneration structure of the company can be found here

Exchange Rate:

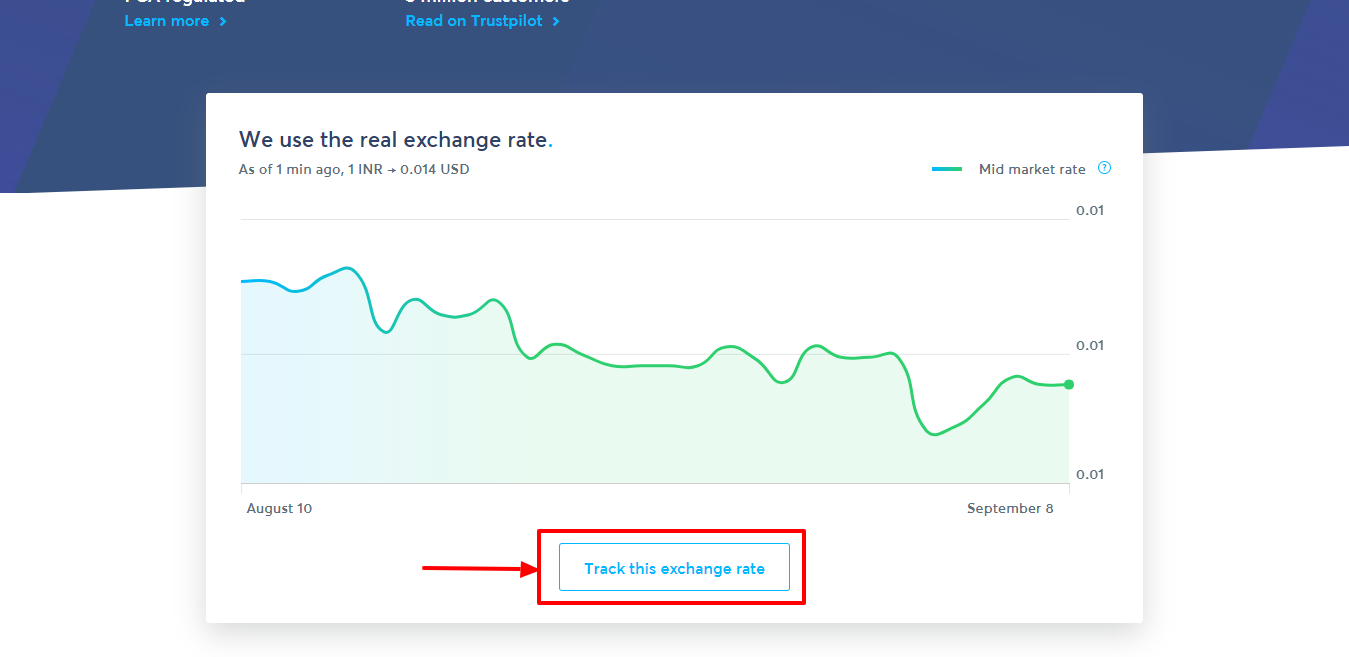

With regard to the superiority of exchange rates in doing international payments, both countries have no advantage, as both are affected by daily market fluctuations. Compare Transferwise Vs Payoneer exchange rates before transfer.

TransferWise

- Easy to use a currency converter to determine the existing exchange rates

- The average mid-market rate of the company is not significantly different from the market rates

- You can enable the notification of exchange rate alarms and see exchange rates fluctuations

Payoneer

- Use average market rates for exchange rates

- Currency conversion in some countries leads to conversion rates of 2% to 2.75%

- You can check the calculated exchange rate before you complete your transfer.

Supported Countries:

With regard to the number of approved countries and currencies, Payoneer has an advantage in this area.

TransferWise

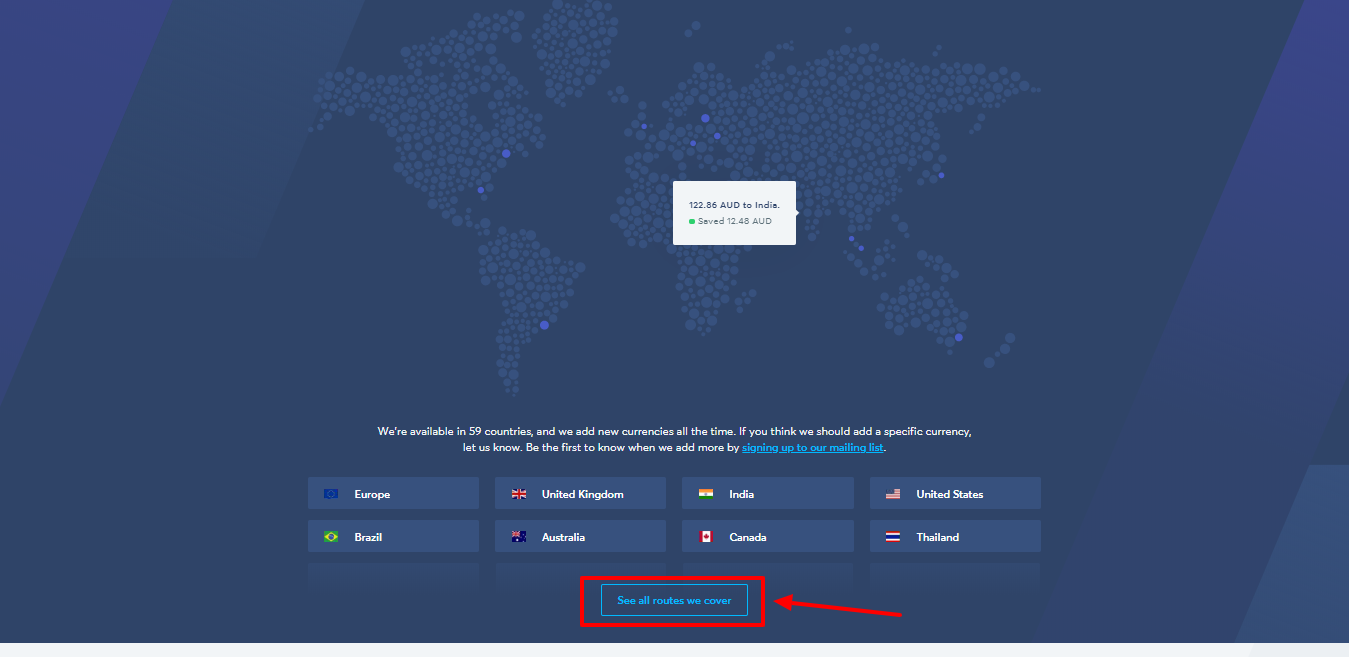

- Supports up to 41 countries in February 2019

- Click here to view the list of supported countries.

Payoneer

- Payoneer is compatible with more than 200 countries.

- Payoneer trades in more than 150 currencies.

User-friendliness:

Both are fully committed to providing their customers with the excellence they expect. From registration to shipping international transfers, the whole process is intuitive and easy.

TransferWise

- The registration can be done individually or as a business unit.

- Multilingual website in English, Spanish, German, French, Hungarian, Russian, Portuguese, Italian, and Japanese

- It offers an application for devices with iOS and Android.

Payoneer

- Registration is open to individuals and businesses. But nobody can receive this payment

- Multilingual website in English, Spanish, Korean, Russian, Japanese, and Korean.

- It offers an application for devices with iOS and Android.

Available Coupons:

Do not we all love so much? Let’s see what a better deal offers. Both have their own promotional offers.

TransferWise:

- When you register with TransferWise through SpriceWorld, you can make a free transfer of up to £ 3,000.

- This amount, together with the usual tax percentage, is estimated at $ 25.

Payoneer:

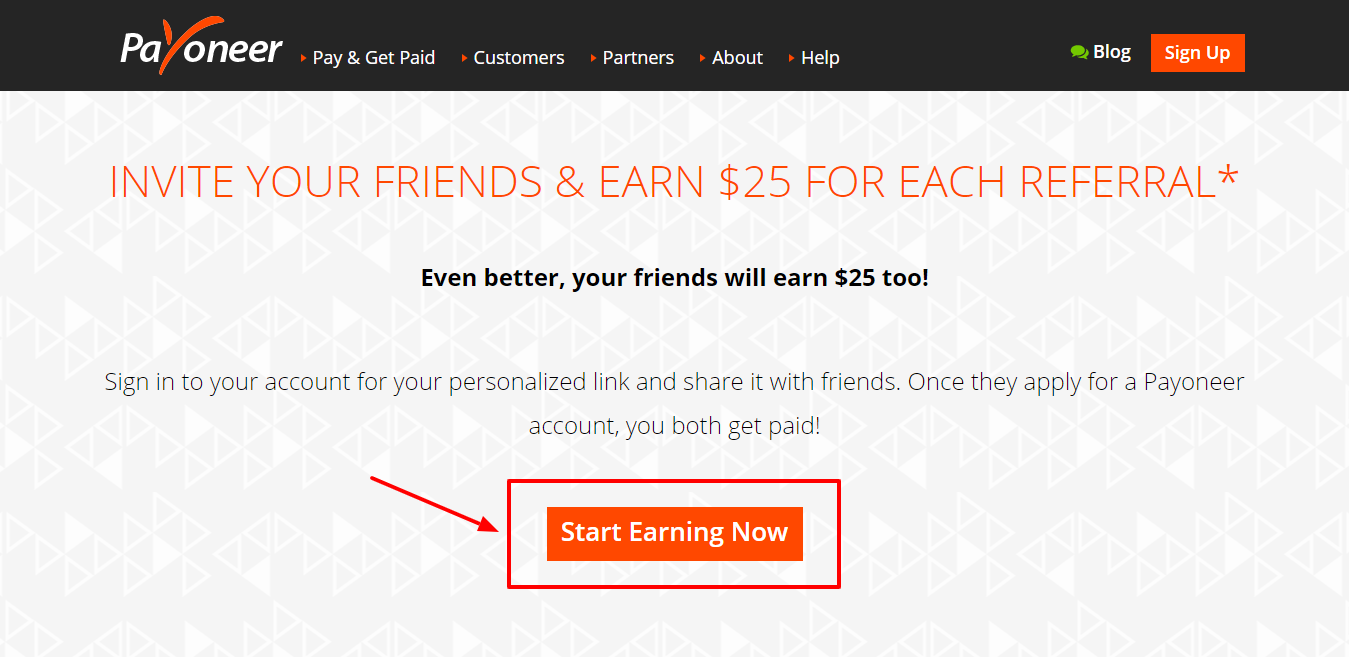

- If you sign up to Payoneer through SpriceWorld, you will receive $ 50 from your account when your balance reaches $ 1,000.

However, the general veto factor for the comparison still depends on the long-term costs that one of them requires.

Since the two are almost equal, the consumer is reaching for a more attractive price and a more attractive price structure.

Now it’s Transferwise and we recommend it.

Transferwise vs Payoneer Features:

Payoneer Features:

- Small businesses and private accounts

- Personal accounts can only receive transfers

- Open an account in four currencies: EUR, GBP, USD, and YEN

- It can be used as a bank account

- Buy card online

- Maximum daily payout limit of $ 2,500

- Take off ATMs worldwide

TransferWise Features:

- Peer-to-peer platform

- Nominal transfer fees

- Transfers within 1 to 4 days.

- Accounts without borders without residence abroad

- Four currencies are offered: AUD, EUR, GBP, or USD

- One-time payment or repeated payment

- Find out about fees and tariffs before you make a transfer through an online calculator

- Payments with a debit card, Apple Pay, SWIFT transfers, and bank transfers

- Secure payment feature available via the TransferWise feature in Facebook Messenger

- 5 star Trustpilot rating of more than 40,000 ratings

- Use the average rate provided by Reuters

Price comparison: Transferwise Vs Payoneer

Payoneer promises minimum rates with no hidden costs and keeps its word. The receipt of other Payoneer customers is free and only 2% if you receive money in a bank account in a different currency. If the coins are the same, fees will be charged.

Because of the way they facilitate money transfers, Transferwise works on a case-by-case basis and all details can be determined using the conversion tool available on the website. TransferWise users can avoid overhearing hidden bank charges due to the average market price.

The company also displays the charges initially and withdraws them before the changeover so customers know exactly what to expect.

International Presence:

The fact that Payoneer can count as partners or customers on Google, Upwork, Airbnb, Amazon and Getty Images shows the global reach and trust they have.

With 14 offices around the world, including China, the United States, Spain, and Hong Kong, they can manage 150 currencies in more than 200 countries. The global presence has been expanded in recent years by the opening of offices in the Philippines and in Japan.

With a Transferwise Borderless account, customers can send money to more than 50 countries and manage approximately 40 different currencies.

His online service extends his worldwide activities and completes the reach of his offices, especially in Tallinn, the country of origin of its founders.

User-friendliness:

Payoneer is especially popular with the self-employed in developing countries like India, where the banking system may not be as strong as in traditional financial centers.

Their global reach gives them a clear advantage in this regard, but annual ticket fees can scare off some potential customers. The fact that only VIP customers can organize outgoing payments is a minor inconvenience to an otherwise impressive service.

This can be expected from a technology startup, but the fully automated TransferWise process is particularly appealing to many customers. Low rates are an obvious benefit, but the friendliness of their customer service team has helped them become a leader in money transfer, which is remarkable given the history of some of their more established competitors.

Also Read:

- Best Referral Programs That Pay Real Cash Via PayPal or Payoneer

- Payoneer vs. Paypal | Payoneer India Review | Make 25$ FREE

Conclusion: Transferwise Vs Payoneer 2024

If you want to send money as cheaply as possible, Transferwise is generally cheaper than Payoneer. They do not earn money with the exchange rate and only take a small percentage of the total transfer of course. Transferwise and Payoneer are free to join.

It is easy to register and send money and in many situations should be even faster than Payoneer. However, this does not mean that Payoneer is not taking place.

Payoneer is well known and can, therefore, be a practical option. It is especially useful for small amounts where you do not lose so much by taking a percentage.

For amounts over $ 300, we strongly recommend choosing Transferwise as a solution to save a lot of money.

If you would like to take a closer look at Transferwise and similar services, you may like our comparison with Transferwise and Payoneer.

In essence, enable one option or another and see how much it costs to send money with each service. Then you can make a good decision about the best transfer option for you!

recently payoneer is asking a lot for verifications , so its also big problem with payoneer specially from aisa if you cant provide them proper verification in english docs then it will be problem